[ad_1]

Investing within the inventory market is without doubt one of the most well-known methods to develop your wealth, but it surely isn’t the one funding alternative obtainable.

Actual property investing is one other wealth-building alternative that’s rising in reputation. Nonetheless, many individuals draw back from it as a result of they assume it requires some huge cash to get began.

Fortuitously, that’s not the case. You can begin investing in actual property with $1,000 or much less.

5 Methods to Put money into Actual Property with $1,000 or Much less

It’s potential to get into actual property with restricted funds. If you wish to diversify your funding portfolio, listed below are some glorious methods to build wealth outside the stock market.

1. Put money into eREITs

It as soon as took a large sum of money to start out investing in actual property. Crowdfunded actual property alleviates that downside for a lot of traders.

With crowdfunding, you pool cash with different individuals to spend money on particular person properties. This implies you possibly can spend money on actual property with minimal funds.

Oftentimes, this takes the type of a Actual Property Funding Belief (REIT). REITs are specifically designed corporations that spend money on actual property properties.

An eREIT is a kind of belief that holds actual property belongings for individuals to privately spend money on with minimal charges.

Crowdfunding platforms, like Fundrise, decide particular person funding properties then let you choose those that pique your curiosity.

One superior good thing about eREITs is that they permit individuals so as to add actual property to their funding portfolio with little cash. For instance, Fundrise permits traders to start out with as little as $10.

Different crowdfunding platforms, like DiversyFund and Streitwise, function equally.

Listed below are some property varieties you possibly can anticipate to spend money on by means of most of these platforms:

- Buying facilities

- Combined-use properties (contains each residential and business properties)

- Multi-family flats or homes

Should you solely need to spend money on business actual property, RealtyMogul is a terrific various.

Annual returns often common at the very least eight or 9 % with most on-line funding companies.

The one vital draw back is that investments are illiquid and usually take a number of years for traders to redeem with none charges.

This makes eREITs a long-term strategy to diversify your investments.

2. Put money into REITs with SoFi Make investments

Entering into actual property by means of crowdfunding is a improbable strategy to develop your wealth. Nonetheless, investments are sometimes illiquid and aren’t publicly traded.

If that may be a detractor for you, you possibly can nonetheless make the most of REITs to spend money on actual property on-line by means of a brokerage like SoFi Invest.

Publicly-traded REITs commerce like shares, so traders should purchase and promote actual property firm shares like another funding.

You’ll be able to spend money on quite a lot of actual property offers with REITs, resembling:

- Workplace buildings

- Inns

- Healthcare

- Knowledge facilities

- House buildings

- Storage items

REITs should make investments at the very least 75 % of their belongings in actual property. In addition they have to pay at the very least 90 % of their taxable revenue to shareholders.

This allows you to make the most of investing in actual property whereas avoiding coping with liquidity points.

Take into account that it’s potential to see swings, and a few brokerages could cost charges for buying and selling.

If they’re appropriate on your wants, REITs supply a big alternative to develop your portfolio. You solely want $1 to open an account and begin investing in actual property with SoFi.

*Proper now Frugal Guidelines readers who join an Energetic Make investments brokerage account for the primary time are eligible to play “The Claw” interactive sport. Play, and you might win a random greenback quantity of inventory starting from $5 to $1,000!

3. Listing a Spare Room on Airbnb

If you wish to spend money on actual property with little cash however don’t have the will to tie up your funds, renting out a spare room is a wonderful various.

Itemizing a room or spare home could sound like a aspect hustle. In some cases, it’s. You record the property, guarantee it’s clear, and take care of friends.

Fortuitously, this doesn’t take as a lot time as you’d anticipate.

A platform like Airbnb manages all the rental course of for you. The positioning enables you to talk with friends and manages funds. You’ll be able to even outsource cleansing to attenuate your involvement.

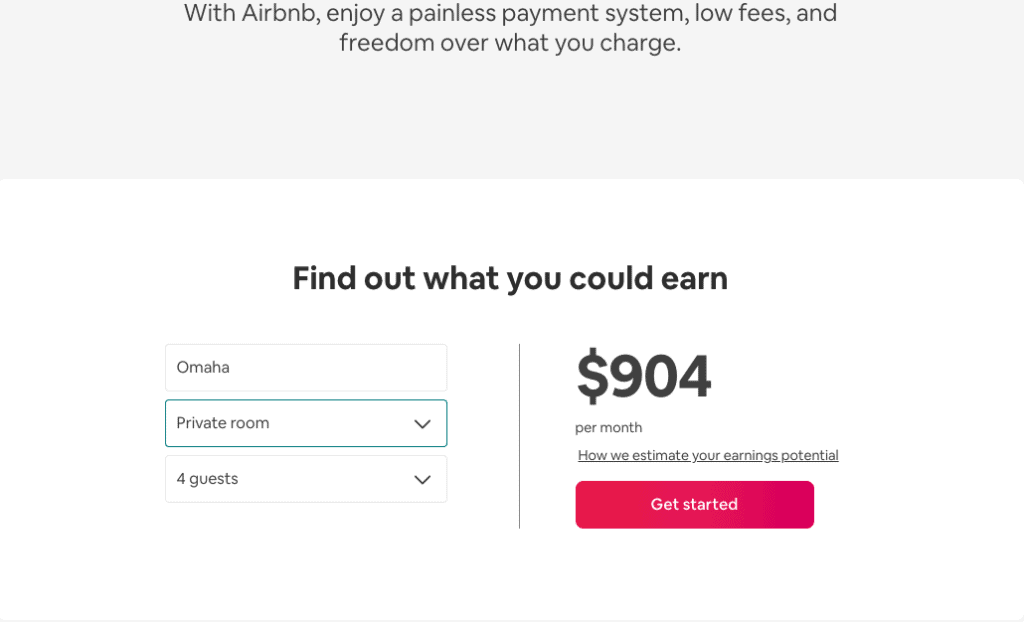

Operating a easy search on Airbnb reveals that I might make as much as $904 a month itemizing a room in our residence in Omaha.

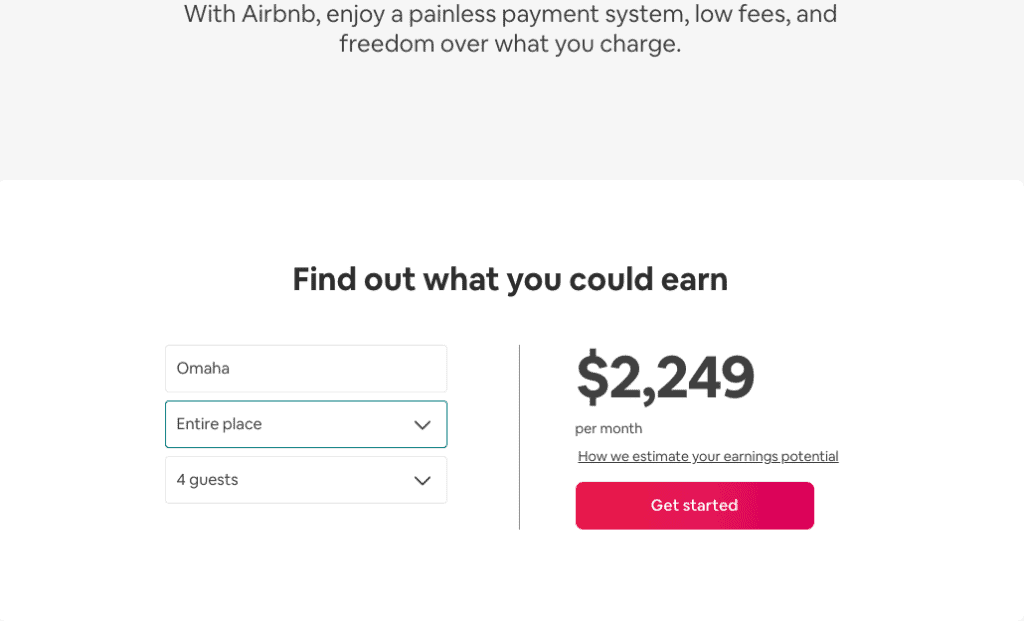

If we have been to record a whole home, we might earn as much as $2,249 per thirty days.

The Airbnb web site states the above charges assume a full property for 15 nights per thirty days. Relying on the place you reside, you might earn extra.

Itemizing your property is free, and the corporate takes simply three % of what you earn per rental.

We’ve got relations who record their properties usually after they journey and use the funds they earn as additional funds in direction of their mortgage.

Learn our host checklist to discover ways to maximize earnings with this chance.

4. Put money into Loans

Fixing and flipping properties is usually cost-prohibitive for many individuals who need to begin investing in actual property. It requires vital expertise and assets.

Peer-to-peer (P2P) lending is an answer that lets individuals prolong loans to debtors. Debtors then use the funds to restore and flip properties.

This permits individuals to spend money on residential actual property, however on the debt aspect.

Groundfloor is a P2P crowdfunding web site and probably the greatest Fundrise alternatives for those who don’t thoughts extending loans.

You don’t present the entire funds by yourself. As a substitute, your cash will get pooled with different actual property traders.

Returns have averaged roughly ten % for the reason that firm launched. Traders can get began with simply $10.

There are minimal charges, and loans vary between six and 12 months.

Lending isn’t for novices. You act on the knowledge obtainable to you, and revenue funds solely pay out on the finish of the time period.

Should you’re snug with the danger, this is usually a legit strategy to diversify your actual property investing portfolio.

Alternatively, you too can spend money on native brick-and-mortar enterprise by means of Mainvest. They permit individuals to spend money on native companies with as little as $100.

The corporate claims returns of ten to 25 %. Should you’re in search of different diversification alternatives, Mainvest could possibly be resolution.

Learn our overview of Mainvest to be taught extra.

5. Tax Liens

Most owners will let you know how costly it’s to pay property taxes. Right here in Nebraska, we’ve a sky-high tax price.

We’d like to not pay the invoice, however that might end in a tax lien. When you have a tax lien and don’t pay it off in time, the federal government can foreclose and seize your property.

These properties are then bought at public sale to actual property traders. Because the investor, you could usually repay the lien inside a selected timeframe.

There’s lots of alternative with investing in tax liens. Nonetheless, it’s not for novices and requires vital due diligence earlier than buying.

Moreover, there may be lots of competitors for property liens. This makes it tougher to seek out worthwhile alternatives.

Generally Requested Questions

If you wish to spend money on actual property, you’ll have questions earlier than you get began. Listed below are some frequent questions we obtain from readers.

How a lot cash do it is advisable to begin investing in actual property?

There is no such thing as a longer a excessive barrier to entry if you wish to spend money on actual property.

Crowdfunding platforms make it potential to start out with as little as $500.

These web sites do a lot of the due diligence on properties for you, so that you solely want to decide on a platform that matches your wants.

You will discover choices to spend money on business actual property, residential properties, or each to diversify your investments.

Is proudly owning rental property value it?

Sure, proudly owning rental properties could be well worth the funding. Should you afford a down fee and the required expertise to handle it, it may be a wonderful strategy to develop your wealth.

A platform like Roofstock is a superb various if in case you have funds however don’t need to handle a property.The positioning finds turnkey properties so that you can spend money on and handles all the maintenance for you.

Are returns taxable?

Sure. Should you obtain dividends in your actual property investments, they’re taxable. An effective way to keep away from that is to spend money on actual property by means of a self-directed IRA.

This shelters revenue from taxes. It’s greatest to seek the advice of a tax skilled to be taught the way it will influence your tax scenario.

Is actual property funding?

Sure, actual property is a terrific funding selection for many individuals. It’s a wonderful strategy to diversify your inventory investments and might present return.

Like every funding alternative, it’s important to do your analysis to make sure actual property investing is a match on your scenario.

Backside Line

Actual property is an typically ignored strategy to develop your wealth since many individuals imagine you want some huge cash to get began. Fortunately, that’s not the case.

There are a number of methods to start out investing in actual property with $1,000 or much less. With a bit homework, you could find an choice that works on your wants.

What’s holding you again from investing in actual property? How are you working to extend your internet value?

SoFi Make investments refers back to the three funding and buying and selling platforms operated by Social Finance, Inc. and its associates (described beneath). Particular person buyer accounts could also be topic to the phrases relevant to a number of of the platforms beneath.

1) Automated Investing and advisory companies are supplied by SoFi Wealth LLC, an SEC-registered funding adviser (“Sofi Wealth“). Brokerage companies are supplied to SoFi Wealth LLC by SoFi Securities LLC.

2) Energetic Investing and brokerage companies are supplied by SoFi Securities LLC, Member FINRA/SIPC, (“Sofi Securities”). Clearing and custody of all securities are supplied by APEX Clearing Company.

3) SoFi Crypto is obtainable by SoFi Digital Belongings, LLC, a FinCEN registered Cash Service Enterprise.

For extra disclosures associated to the SoFi Make investments platforms described above, together with state licensure of SoFi Digital Belongings, LLC, please go to SoFi.com/legal.

Neither the Funding Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any services or products bought by means of any SoFi Make investments platform. Info associated to lending merchandise contained herein shouldn’t be construed as a suggestion or pre-qualification for any mortgage product supplied by SoFi Financial institution, N.A.

Associated Posts

[ad_2]

Source link