[ad_1]

Newest information on ETFs

Go to our ETF Hub to seek out out extra and to discover our in-depth knowledge and comparability instruments

India and synthetic intelligence fuelled demand for trade traded funds in July, whilst Europe fell out of favour.

The flows knowledge recommend buyers look like specializing in what are broadly perceived to be two long-term engines of the worldwide economic system: AI is seen by many as a breakthrough know-how destined to percolate throughout sectors, whereas India is hotly tipped to take the baton from China because the world’s fastest-growing giant economic system within the many years to come back.

“India is turning into a extra sizeable development engine for rising markets,” stated Karim Chedid, head of funding technique for BlackRock’s iShares arm within the Europe, Center East and Africa area.

“There’s additionally the demographic angle. It’s one of many few nations on the planet the place the demographics are very beneficial. They’ve a big and rising workforce and client base,” Chedid added, with India’s inhabitants having this 12 months overtaken China because the world’s largest.

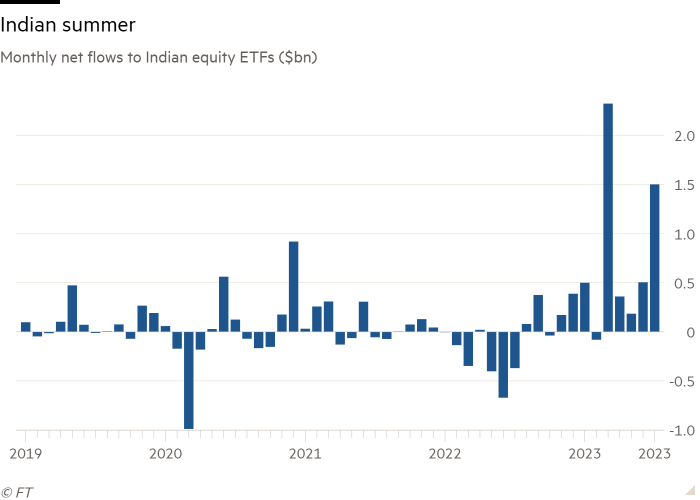

Indian fairness ETFs took in a web $1.5bn in July, in line with BlackRock’s knowledge, the second-highest month-to-month determine for India on file, crushed solely by the $2.3bn witnessed in March of this 12 months.

In distinction with March, nevertheless, the majority of the shopping for this time got here from overseas buyers, with US-listed Indian fairness ETFs accounting for 80 per cent of the cash. Emea-based buyers have been accountable for the majority of the rest, with flows into Emea-listed Indian fairness ETFs now having been optimistic for 9 straight months, BlackRock’s knowledge exhibits.

Except for the longer-term story, Chedid believed enthusiasm for India may additionally be being pushed by the pullback in oil costs from final 12 months’s highs, provided that it’s a giant web vitality importer.

AI is much more the craze, powering $5bn of month-to-month inflows into know-how ETFs. This took the year-to-date tally to $20.8bn as demand for tech funds, which had began to plateau, has reaccelerated for the reason that begin of Could.

“We have now seen extra give attention to AI and the tech mega caps,” stated Chedid, who believed the zeal for AI has been sturdy sufficient to assist propel a broader change in ETF buyers’ urge for food from the outdated world to the brand new.

“The US indices are typically extra weighted in direction of AI and tech than European indices so I believe that has most likely pushed a few of that change in focus,” he stated.

Matthew Bartolini, head of SPDR Americas analysis at State Avenue International Advisors, stated the AI shopping for spree had been potent sufficient to reverse waning enthusiasm for “thematics” ETFs, within the US a minimum of.

“Fuelled by funds centered on AI, thematic ETFs have witnessed a little bit of a renaissance posting back-to-back months of inflows,” he stated. “Thematics now have web inflows on the 12 months. Nevertheless, greater than 100 per cent of these flows are pushed by the robotics and AI sectors, and solely 5 of the 13 sectors have inflows on the 12 months.”

Chedid famous a level of warning, although: On condition that this 12 months’s US inventory market rally has been powered by a handful of tech giants, he stated buyers have been more and more favouring equal-weighted funds that restrict publicity to those behemoths. BlackRock’s home view runs counter to this warning, nevertheless.

“We do just like the AI theme, even the shares the place development has been concentrated,” Chedid added. “Their worth doesn’t look stretched as a result of their earnings development has been sturdy. Their fundamentals are OK.”

Total, international web ETF inflows hit $88.1bn in July, down from $99.1bn in June. The dip was pushed by weaker flows to fairness ETFs, from $76.9bn to $59.7bn, though this was nonetheless the second-highest studying this 12 months.

US fairness funds took the lion’s share, $38.6bn, with non-European buyers beginning “to meaningfully promote European fairness ETFs over the summer season”, Chedid stated.

“US fairness flows have picked up in comparison with earlier within the 12 months. It was worldwide [ie non-US] equities that have been holding up earlier than. Now it’s extra US equities holding that up,” he added.

Scott Chronert, international head of ETF analysis at Citigroup, stated this demand for US shares gave the impression to be largely homegrown, with US fairness ETF flows “minimal outdoors of the US”.

Chedid anticipated this to alter, nevertheless, with the financial backdrop within the US extra propitious.

“The macro image in Europe has been deteriorating. [Purchasing managers’ index] releases have proven a major deceleration. Providers have began to stage off, manufacturing stays very weak and core [inflation] stunned on the upside within the eurozone. That could be why we’re seeing some sluggish flows in Europe,” he stated.

On the sector stage, financials ($2.4bn) and vitality ($1.2bn) each noticed optimistic flows in July. Chedid stated this made sense, with these sectors being buoyed by increasing web curiosity margins and a bottoming in oil costs, respectively. This was the primary optimistic month for vitality ETFs since November, with $12.2bn being excised within the interim.

What could also be extra noteworthy, nevertheless, was shopping for in different cyclical sectors resembling industrials and supplies, which every vacuumed up $1.6bn.

Bartolini famous that cyclical sector ETFs listed within the US took in virtually $8bn in July, whereas defensives had outflows.

“Cyclicals have now outpaced defensives for 2 consecutive months. That is the primary time that has occurred for the reason that begin of 2022, additional illustrating how buyers have been extra prepared to precise danger lately,” he stated.

Chedid was unconvinced of the deserves of such shopping for, nevertheless.

“After we are nonetheless in a downturn it’s uncommon to get inflows to cyclicals. They have a tendency to do properly within the early cycle. These are gentle touchdown flows. That’s not our view. We firmly consider we’re heading for a recession [in the US] within the second half of the 12 months.”

[ad_2]

Source link