[ad_1]

Obtain free Pure gasoline updates

We’ll ship you a myFT Day by day Digest e mail rounding up the most recent Pure gasoline information each morning.

This week’s violent surge in European gasoline costs underscores how the area’s success in weaning itself off Russian vitality has left it extra susceptible to the ebb and circulate of risky international vitality markets.

Europe managed to avert an vitality disaster final yr by quickly rising imports of liquefied pure gasoline. The seaborne gas changed the circulate from Russian pipelines after the Kremlin minimize off nearly all of provides in an escalating vitality confrontation following its invasion of Ukraine.

However the newfound dependence on LNG, which is a world commodity, has left European vitality costs extra delicate to provide disruptions from around the globe — at the same time as far afield as Australia.

European pure gasoline costs surged practically 40 per cent on Wednesday because the prospect of strikes at a number of massive Australian LNG tasks — collectively offering about 10 per cent of world seaborne gasoline provides — despatched panic by way of markets.

Analysts stated the transfer was significantly sharp as a result of many merchants had been betting on additional value declines, and have been compelled to abruptly ditch their quick positions when the market moved in opposition to them.

For vitality analysts the transfer confirmed Europe’s new actuality: the gasoline provides it depends on, like oil, at the moment are really international.

“The potential for strike motion at LNG export vegetation in Australia as soon as once more highlights the truth that we at the moment are clearly in a globalised gasoline market,” stated Tom Marzec-Manser at vitality consultancy ICIS. “Europe has understandably backfilled Russian pipeline provide with versatile LNG. However that versatility results in elevated value volatility.”

Goldman Sachs, one of the influential banks in commodities, is warning European costs may double and even triple this winter.

Previous to the Russian invasion of Ukraine, what occurred in Asian gasoline markets solely had a restricted affect in Europe, the place low-cost and plentiful Russian pipeline gasoline meant the continent was solely a minor purchaser of LNG. In 2021, the super-chilled gas solely accounted for about 20 per cent of the EU’s total gasoline imports, knowledge from think-tank Bruegel confirmed. Russian gasoline accounted for 40 per cent.

However Russia’s invasion of Ukraine has shifted the steadiness profoundly. LNG made up 34 per cent of the EU’s gasoline imports final yr and that whole is predicted to rise once more in 2023 to 40 per cent — giving it the identical significance Russian gasoline as soon as had.

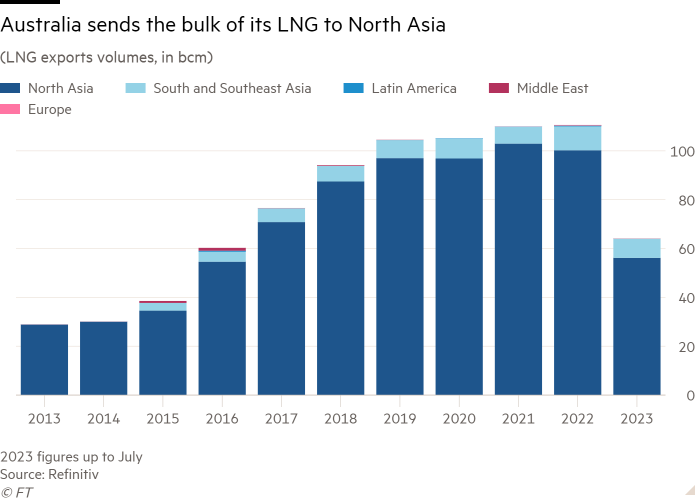

LNG from Australia hardly ever makes it on to European shores, because the size of the voyage makes excessive delivery prices uneconomic.

But when consumers of Australian gasoline in Asia must hunt for alternate options it would pitch them instantly into competitors with Europe and its newfound thirst for the gas. Japan, China and South Korea are a number of the world’s greatest LNG importers.

“Plenty of US quantity . . . that are presently being despatched to Europe, might be taken to Asia, elevating the chance of an inter-regional bidding conflict,” stated Kaushal Ramesh, head of LNG analytics at Rystad Power.

Costs on the Title Switch Facility, the European gasoline benchmark, fell 7.5 per cent to €36.6 per megawatt hour ($11.7 per million British thermal items) on Thursday.

Storage, which is vital for assembly winter demand, is near 90 per cent full, and will attain capability within the subsequent month or so, analysts have predicted — weeks earlier than the heating season begins.

Whereas Europe sits on a snug degree of reserves now, “the market stays unstable as this winter may nonetheless prove extreme and quickly deplete storage”, Ramesh stated.

Moreover, storage alone can’t meet demand within the winter, and Europe would nonetheless must proceed importing enormous quantities of LNG.

European gasoline costs will should be increased than costs in Asia to incentivise merchants to ship LNG to Europe.

Goldman Sachs analyst Samantha Dart stated that if the Australian strikes go forward it might require “a lot much less of a climate affect to take [European] storage under common by the top of March 2024”.

She added {that a} TTF value vary of €68/MWh to €97/MWh within the winter “could be possible till we all know extra about winter temperatures”.

[ad_2]

Source link