[ad_1]

Obtain free Insurance coverage updates

We’ll ship you a myFT Every day Digest e mail rounding up the newest Insurance coverage information each morning.

The nice naval tactician Horatio Nelson made it a rule by no means to interrupt the enemy when it was making a mistake. British insurer Admiral has adopted an identical technique, staying away from the big losses its rivals have chalked up on underpriced dangers.

Half-year outcomes this week have been a aid for shareholders. Earnings rose and underwriting losses fell.

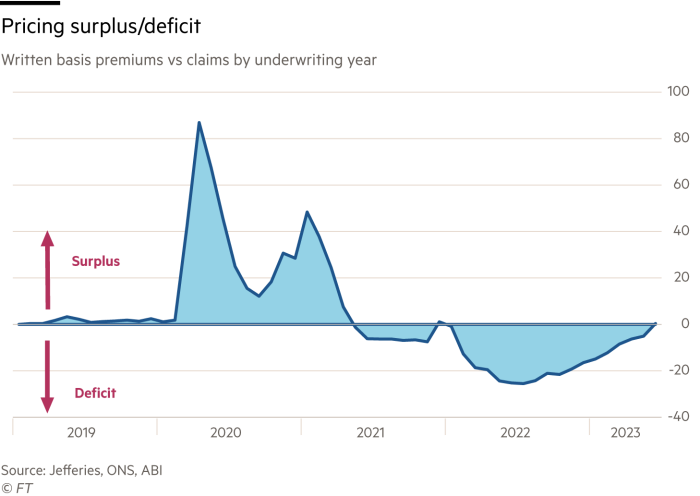

The motor insurance coverage market has had a tough experience of late. The pandemic despatched issues right into a skid as vehicles remained caught on driveways. With fewer drivers on the street, claims fell and so did premiums.

The sample reversed sharply as lockdowns lifted and driving resumed. Then costs for elements, labour and repairs jumped. Speak that inflation was transitory was one motive insurers have been reluctant to boost premium costs. The consequence was the biggest motor insurance coverage loss for a decade in 2022.

Admiral shareholders paid the value. Previous to outcomes revealed on Wednesday, Admiral’s share worth had misplaced nearly a 3rd of its worth because the begin of final 12 months. The inventory rallied sharply with outcomes, rising 7 per cent on the day.

A standard measure of income at insurance coverage firms is the mixed ratio. That is basically a measure of insurance coverage losses and working bills mixed as a proportion of the cash introduced in by premiums. At Admiral it was 101.7 per cent for the group in 2022, reflecting the dangerous 12 months. A determine nicely under 100 within the first half of this 12 months displays the improved atmosphere.

Premium costs at the moment are catching up shortly to compensate. The common UK motor premium of £511 within the second quarter was the very best on document, in response to the Affiliation of British Insurers.

At Admiral, motor premiums rose 21 per cent 12 months over 12 months within the first six months of 2023. Examine this with the paltry 7 per cent improve within the earlier six months, a determine nicely under the ten per cent charge at which claims prices rose.

Admiral has historically led the broader motor insurance coverage market on costs. That’s mirrored out there share it misplaced within the first half. The variety of motor clients was 7 per cent decrease than final 12 months. Higher offers for drivers might clearly be discovered elsewhere.

Shareholders of motor insurance coverage peer Direct Line will hope for the same consequence. The corporate obtained its pricing drastically flawed and incurred steep insurance coverage losses final 12 months. That triggered decrease dividends and the resignation of the corporate’s chief government in January.

However premium rises should not the one factor serving to to revive the steadiness of income for motor insurers. Claims prices are stabilising too, because of higher provides of elements and the slowdown in second-hand automotive worth will increase.

Shareholders have a tendency to love insurance coverage firms for the regular, dependable returns they provide by dividend funds. These dipped barely at Admiral, however the shares ought to nonetheless yield a 5 per cent money return this 12 months. With the prospect of additional earnings upgrades, the dividend and the yield may even grow to be increased, predicts Tom Bateman at Berenberg, an funding financial institution.

Traders will scrutinise outcomes from DirectLine intently too for indicators of enchancment. Some analysts have speculated that losses would immediate a name for shareholders to place extra money into the corporate. An honest efficiency in its motor division in outcomes revealed subsequent month shall be motive to suppose even skinny regulatory capital is sufficient to maintain it on the street.

China banks: demolition danger

Seen however not heard is an old school information to youngsters’s finest behaviour. Beijing bureaucrats are not looking for China’s younger individuals to be seen both. The nation’s statistics bureau introduced it might droop youth jobless knowledge this week.

This means the dire state of the Chinese language financial system and monetary sector. China’s shadow lenders — belief banks — are feeling that stress. These monetary establishments function outdoors the standard, extra closely regulated banking sector. As they falter, bigger state-controlled banks must shoulder extra of the danger.

China’s $2.9tn belief business began out 40 years in the past amid a booming financial system. When bigger native banks couldn’t fulfill mortgage demand from fast-growing firms, trusts stepped in to assist. Given beneficiant licences to spend money on many kinds of property, they centered on property builders and high-risk firms.

The actual property disaster has taken a toll since then. The most important belief, Zhongrong Worldwide Belief, has missed not less than two funds. It has funding merchandise price Rmb39.5bn due this 12 months. As builders lose entry to non-bank financing, the fallout amongst them will unfold.

Rising youth unemployment is one end result of the property stoop: numbers have set new information in current months. Officers cited the necessity to enhance the measurement methodology. However the transfer comes simply after manufacturing unit and retail gross sales knowledge that missed expectations. Altogether, this poses a critical problem for Chinese language lenders.

Lex on the FT Weekend Competition

Ever questioned Tips on how to be a Lex analyst? Be part of Lex writers Alan Livsey, Vanessa Houlder and Jonathan Guthrie at 3pm on the FTWeekend Competition on Saturday September 2. We’ll share suggestions and hacks for personal buyers. The venue is Kenwood Home Gardens, Hampstead Heath. You should purchase tickets right here.

Shares of the biggest banks, together with Financial institution of China and Agricultural Financial institution of China, are nonetheless up a fifth this 12 months. The worst of Beijing’s sector-wide crackdown seems to have handed. But they nonetheless commerce at a couple of third of tangible guide worth, nicely under regional friends. Dangle Seng Financial institution in distinction is rated at nearly 1.2 instances.

Traders fear that the biggest native banks might want to substitute credit score traces, as they’ve accomplished previously. Lenders needed to bail out floundering property teams final 12 months by providing greater than $160bn in contemporary loans. That emergency credit score is more likely to develop to different high-risk native firms.

As financial knowledge reveals weak point, the renminbi has dropped to five-year lows in opposition to the greenback. State banks might due to this fact must help the foreign money too. With so many clean-up jobs forward, buyers ought to stay cautious of even the largest Chinese language banks.

[ad_2]

Source link