[ad_1]

Obtain free Private pensions updates

We’ll ship you a myFT Each day Digest e mail rounding up the newest Private pensions information each morning.

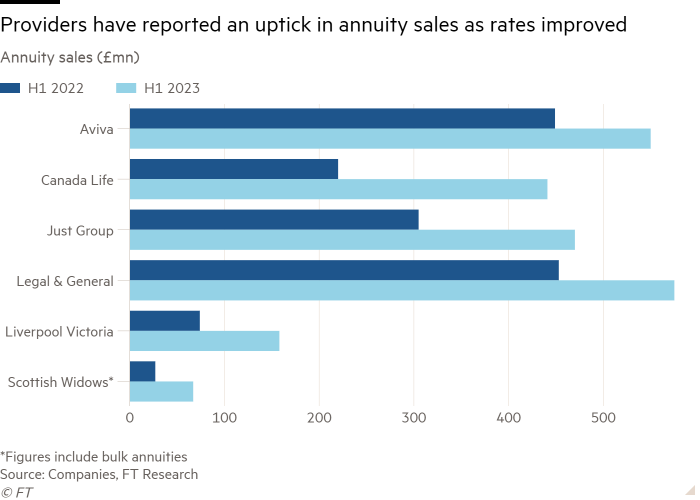

Spiking annuity charges have led to a surge in gross sales for insurers, as UK savers search assured incomes to climate unsure financial circumstances.

Canada Life reported annuity gross sales doubling to £441mn within the first half of the yr, in contrast with the identical interval in 2022. Simply Group noticed gross sales leap by 54 per cent to £470mn and Authorized & Basic reported a 27 per cent rise to £575mn.

These gross sales figures embody each lifetime annuities and fixed-term merchandise, giving an revenue for a set interval similar to 10 years.

For lifetime annuities, the majority of the market, the Affiliation of British Insurers, a commerce physique, experiences that some £2.3bn have been bought within the first half 2023, up from £1.7bn in the identical interval final yr.

The rise in demand has been triggered by the speedy rise in rates of interest, which has seen the very best charge available on the market soar from 5 per cent in August 2021 to 7.3 per cent this month for somebody taking out an annuity aged 65, in accordance with platform Hargreaves Lansdown.

Savers have additionally been drawn to the safety of an annuity revenue at a time when investments in shares and bonds, the mainstays of most retirement portfolios, have been battered by issues about excessive inflation and unsure funding returns.

“Volatility available in the market and certainty that annuities present are altering mindsets,” stated Lorna Shah, managing director of retail at Authorized & Basic. “Persons are shifting away from a as soon as and accomplished binary determination on whether or not you’ve gotten an annuity or drawdown.”

The comeback in annuities follows a collection of monetary reforms that inspired savers to look elsewhere.

The introduction of pension freedoms in 2015 damped demand for the product, as older savers have been not compelled to buy an annuity with their pension. As an alternative, they have been capable of maintain their pot invested whereas taking an everyday revenue.

A median of 70,914 annuities have been bought available in the market every monetary yr between 2015-16 and 2021-22, in accordance with the Monetary Conduct Authority. Gross sales initially declined however bounced again final yr.

“You may need needed to dwell 20 years to get your a reimbursement. As charges improved, the maths works out higher,” stated Pete Matthew, chief government of Jacksons Wealth Administration. He stated annuities have been useful in securing shoppers a minimal revenue, enabling them to take extra threat with the rest of their pot.

Knowledge from the ABI reveals that the variety of suppliers out there on the open market fell from 14 in 2013 to 6 at the beginning of this yr. Customary Life is now within the means of re-entering the market.

Tim Pike on the Pension Coverage Institute, a think-tank, stated market consolidation had beforehand contributed to extra folks opting to enter drawdown attributable to restricted client alternative. He stated customers have been now extra attuned to charge variations, however merchandise would wish to evolve to fulfill the wants of savers retiring and not using a outlined profit pot.

Matthew argued that annuities have been nonetheless much less interesting for these with massive pension pots as they might nonetheless draw a good revenue regardless of market dips, whereas others have been delay by the upfront price and the truth that an annuity usually died with the holder or their partner.

Suppliers maintained that the product would proceed to draw retirees regardless of the likelihood that charges will begin to fall subsequent yr.

Shah added: “Sooner or later, annuity charges will begin to come again down, however at ranges increased than the lows we have now seen in recent times . . . The understanding it offers to retirees is absolutely necessary.”

[ad_2]

Source link