[ad_1]

Hearken to this text

What Is No Medical Exam Life Insurance?

Types of No Medical Exam Life Insurance

How Does No Medical Exam Life Insurance Work?

Do I Qualify for No Medical Exam Life Insurance?

How to Choose the Right No Medical Exam Life Insurance Provider

Compare No Medical Exam Life Insurance Providers

Pros and Cons of No Medical Exam Life Insurance

How Much Life Insurance Can I Get With No Medical Exam?

Whole vs. Term: Which No Medical Exam Life Insurance?

Whole vs. Term Life Insurance

Frequently Asked Questions

Life insurance coverage—it’s been in your to-do checklist for years, proper? You’ve been that means to knock it out however . . . life occurs. Nicely, right here’s some excellent news: As of late there’s one much less hurdle between you and getting coated.

Over the previous couple years, some insurance coverage corporations have began providing an exam-free life insurance coverage possibility—and it doesn’t include sky-high premiums. If you happen to’re underneath 65 and available in the market for a coverage price $2 million or much less, you might be able to skip the lab work and apply with out a medical examination.

![]()

Examine Time period Life Insurance coverage Quotes

So, in case you’ve ever thought, Ugh, I don’t like medical exams, this new versatile possibility ought to ease your thoughts and perhaps get you on a path to peace and safety on your family members! Right here’s what it is advisable to find out about getting life insurance coverage with out a medical examination.

What Is No Medical Examination Life Insurance coverage?

Any such life insurance coverage is an possibility that doesn’t require you to undergo a medical examination to get coated. In sure age teams, prospects procuring insurance policies of $2 million or much less can typically skip the examination utterly and nonetheless get probably the most aggressive time period life charge out there. Usually, we’re speaking about wholesome individuals. These insurance policies are nice if you wish to get protection as quickly as potential. And we expect that’s cool! However there are some circumstances.

Are you assured a no medical examination coverage in case you match these standards? Not essentially. Even in case you really feel actually wholesome and also you’re underneath 65, you’ll nonetheless have to reply questions on your medical historical past and disclose any circumstances you’ve in your time period life coverage utility.

Primarily based in your solutions, the insurance coverage firm will resolve in case you nonetheless want lab work or medical information to get a coverage. Sincere and full solutions are a should as a result of in the event that they discover you’ve hidden one thing in your utility and you find yourself dying, your loss of life profit will probably be withheld out of your beneficiaries. And . . . that’s the entire purpose you are getting the insurance coverage within the first place, proper? Honesty is one of the best coverage, and it’ll show you how to get the proper coverage for you and your loved ones.

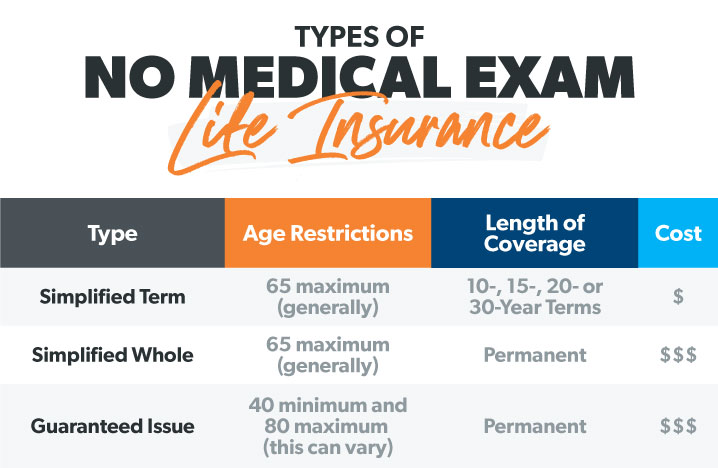

Varieties of No Medical Examination Life Insurance coverage

Is life insurance coverage with no medical examination sounding fairly candy? Nice! However which one’s for you? Let’s go over the most important sorts of life insurance coverage protection you may get with out doing a medical examination.

Simplified Difficulty

Who doesn’t love easy? You will get each entire life and time period life simplified concern insurance policies, so let’s go over every sort.

Simplified Time period Life With No Medical Examination

The identify says all of it. These simplified time period life insurance policies allow you to get time period life insurance coverage (the type of protection we at all times suggest for each value and ease), however they don’t require a medical examination. That’s superior! However even with out the medical step, these insurance policies do require candidates to reply a well being questionnaire.

Simplified Entire Life With No Medical Examination

Once more, the identify helps right here: You possibly can apply for this coverage with out a medical examination by answering a well being questionnaire. However we don’t suggest entire life protection in any respect. Why not? As a result of entire life insurance coverage is without doubt one of the worst monetary merchandise available on the market. It mixes two necessary jobs—life insurance coverage and investing—and offers you a horrible payoff in each departments. Don’t simply skip the medical examination—skip entire life insurance coverage utterly.

Assured Difficulty

Assured concern is one other no medical examination possibility, however the catch is that it’s additionally one of the vital costly methods to get life insurance coverage. To get a assured concern coverage, you get to skip the medical examination and the well being questionnaire!

However the marketplace for this type of coverage is fairly restricted. It’s designed to assist individuals who would in any other case be uninsurable. Along with the excessive value, many corporations additionally impose just a few fundamental limits for this kind of protection:

- Age minimal: normally 40 years previous

- Age most: normally 80 years previous

- Protection limits: sometimes from $5,000–100,000

These aren’t laborious and quick guidelines, however in case you’re in that four-decade window of life, you could possibly qualify for assured concern.

Now, there’s one other wrinkle with this coverage sort you must find out about. Assured concern has what’s referred to as a graded loss of life profit. What’s all of it about? It means in case you’re the policyholder and also you die shortly after getting the coverage—say inside three years—your beneficiaries would solely get a portion of the complete loss of life profit.

But it surely’s life insurance coverage protection, and it has the fewest strings hooked up of any sort. If you happen to’ve been declined for different kinds of life insurance coverage due to well being issues, a assured concern coverage may get you sufficient protection to handle your last bills.

Group Life Insurance coverage

Group life insurance coverage is a option to get a good value on modest protection via your employer (therefore the phrase group within the identify). Protection quantities are capped fairly low, but it surely normally received’t require a medical examination.

If no examination and discounted premiums sound good to you, you’ll be able to choose in at open enrollment time. You too can add supplemental life insurance coverage to your group protection to be sure you have sufficient life insurance coverage. Simply remember that including extra protection usually requires filling out a medical questionnaire.

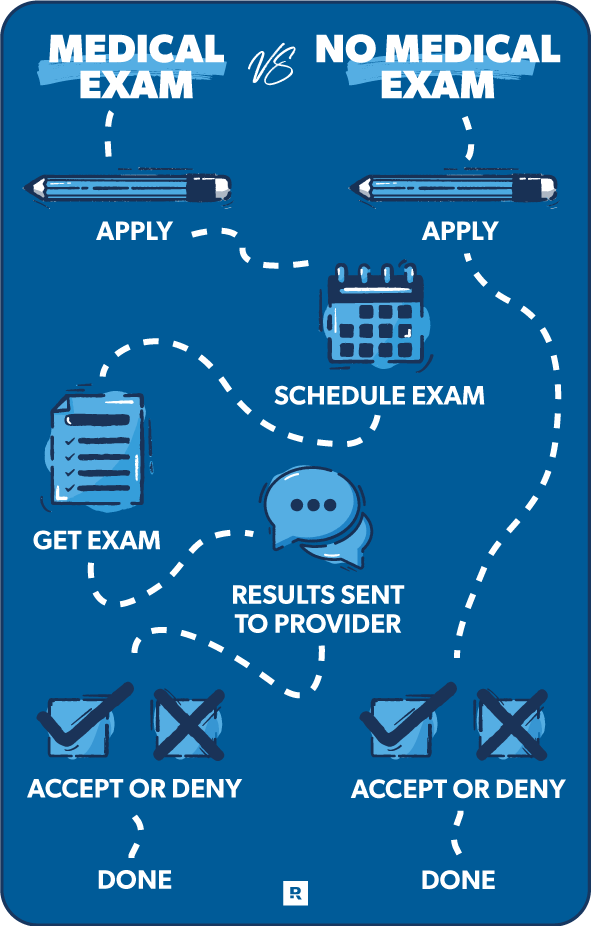

How Does No Medical Examination Life Insurance coverage Work?

Bear in mind once we talked about the lower cost level of time period life as one in every of its principal points of interest in comparison with entire life? Nicely, what good is that if you must pay increased premiums for the no medical model of time period life? The excellent news is, you in all probability received’t need to!

If you happen to go for a time period life coverage with out a medical examination, the value ought to nonetheless be fairly inexpensive—and it’ll positive as heck beat any charge you’d get for a complete life coverage.

So, how do these corporations resolve whether or not to cowl individuals for all times insurance coverage with out giving them the conventional examination for top, weight and different fundamental well being measures? The reply: expertise. Yep! By utilizing statistics and algorithms to research your questionnaire solutions, insurance coverage corporations can provide the identical aggressive charges that used to require an examination with one much less hurdle to leap.

Do I Qualify for No Medical Examination Life Insurance coverage?

If you happen to fall into one of many classes beneath, you could possibly be an incredible match for a no medical examination life insurance coverage coverage:

- People who find themselves fairly wholesome and don’t have an extended medical historical past

- Busy individuals who simply need protection quick however don’t need to idiot round with appointments and needles (relatable!)

- Younger people who smoke who don’t have another medical circumstances

Select the Proper No Medical Examination Life Insurance coverage Supplier

One option to evaluate suppliers is to have a look at their AM Greatest score—AM Greatest is an company that charges an organization’s capacity to pay claims over the lengthy haul. (Identical to in class, A-plus is great work.) You’ll clearly need to evaluate costs as you store too.

Examine No Medical Examination Life Insurance coverage Suppliers

|

Insurance coverage Firm |

A.M. Greatest Ranking* |

Medical Examination** |

|

American Common Life Insurance coverage Firm |

A |

Sure |

|

Banner Life Insurance coverage Firm |

A+ |

No** |

|

Bestow |

A+ |

No |

|

Lincoln Nationwide Life Insurance coverage Firm |

A+ |

No** |

|

Pacific Life Insurance coverage Firm |

A+ |

No** |

|

Protecting Life Insurance coverage Firm |

A |

No** |

|

Pruco Life Insurance coverage Firm |

A+ |

Sure |

|

Financial savings Financial institution Mutual Life Co of MA |

A |

No |

|

United of Omaha Life Insurance coverage Firm |

A- |

Sure |

*A.M. Best is an company that charges insurance coverage corporations on their capacity to pay claims over the lengthy haul. An A+ score means this firm has a “Superior” capacity to pay out claims.

** All you must do is reply just a few well being questions as a substitute of establishing medical exams and blood checks. Relying on responses, you should still want a medical examination to acquire a coverage.

We all know discovering life insurance coverage can really feel fairly overwhelming. With all of the choices on the market, selecting the correct one can really feel like discovering an trustworthy man in Congress. So, right here’s a useful device and a number of the high choices for no medical examination life insurance coverage that will help you get began.

Protecting Life

Protecting Life was based in 1907. At the moment, they supply life insurance coverage protection for thousands and thousands of consumers. A medical examination isn’t required for some Most well-liked Plus candidates.

Lincoln Monetary

Since its founding in 1905, Lincoln Monetary has coated greater than 17 million People. A medical examination isn’t required for many Most well-liked Plus candidates.

SBLI

1907 was a well-liked time to start out life insurance coverage corporations, and SBLI is one other that launched that 12 months. To this point, they’ve protected over 1,000,000 households with their life insurance coverage. A medical examination isn’t required for any applicant who qualifies.

Bestow

One of many newcomers to life insurance coverage, Bestow was based in 2016. A medical examination isn’t required for any applicant who qualifies.

Professionals and Cons of No Medical Examination Life Insurance coverage

Now that we’ve gone over the great and the dangerous, let’s dig into some extra particulars about no medical examination life insurance coverage.

|

Professionals |

Cons |

|

Getting protection with out going wherever |

Not at all times an possibility for these with plenty of well being issues |

|

Avoiding pesky dwelling visits from a nurse |

Protection restrict of $2 million |

How A lot Life Insurance coverage Can I Get With No Medical Examination?

If you happen to qualify for no medical examination life insurance coverage, you may get protection as much as $2 million. That feels like rather a lot—and it’s. However you’ll want 10–12 occasions your annual wage in time period life insurance coverage to verify your loved ones can exchange your revenue if one thing occurs to you. So, in case you make over $200,000 a 12 months, you’ll want extra protection than a no medical examination coverage can present.

Life insurance coverage with no medical examination was once dearer than conventional insurance policies, however not anymore! Each sorts of insurance policies are just about the identical value now. The precise month-to-month fee you’ll get will differ relying in your age, medical historical past and different elements, although. When you fill out your utility, the insurance coverage firm figures out whether or not they can insure you and the way a lot they’ll cost on your coverage.

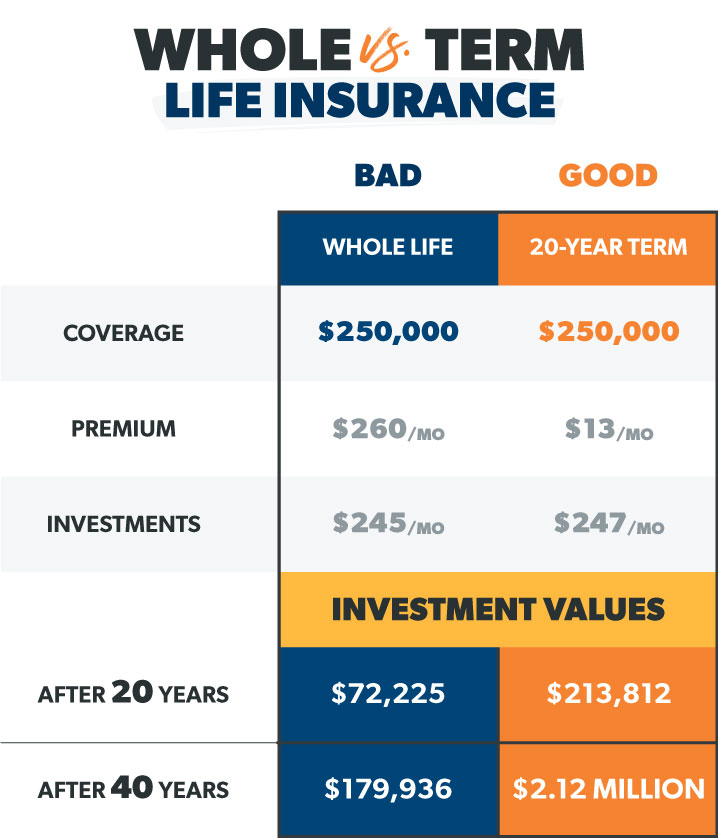

Entire vs. Time period: Which No Medical Examination Life Insurance coverage?

Whereas we’re with reference to life insurance coverage, we additionally have to flesh out the variations between entire and time period life insurance coverage. Selecting the proper is important for safeguarding your cash and your loved ones.

Remember, with or with out a medical screening, time period life is at all times higher than entire life. Why? First, time period is approach cheaper. Second, life insurance coverage has one job—to exchange your revenue in case you die. With time period life, you’re placing your self and people you like within the ultimate place. Time period life will exchange your revenue in case the unthinkable occurs—and at a extremely inexpensive value.

As for whole life? It’s a serious rip-off! It’s not solely approach pricier than time period protection, but it surely additionally mixes in dangerous funding merchandise with the life insurance coverage. And ultimately, it doesn’t do both of these issues effectively. Medical examination or no medical examination, keep away from entire life insurance policies.

Entire vs. Time period Life Insurance coverage

To point out simply how dangerous of a deal entire life is, we did the maths. Say you’ve $260 a month in your finances to pay for all times insurance coverage. If you happen to paid $13 a month for a time period life coverage and invested the opposite $247 in mutual funds, you’d find yourself with $2.1 million after 40 years!

Alternatively, if in case you have a complete life coverage as a substitute, you’d be paying $260 a month on your premiums. About $245 of that may go towards the investing a part of your entire life coverage, however the returns can be approach much less—solely about $179,936 after 40 years. That’s a fairly large distinction.

Use a Supplier You Can Belief

Getting life insurance coverage simply acquired simpler. You now have one much less excuse to go forward and get your loved ones set for all times in case one thing ever occurs to you. For a small amount of cash per thirty days, you may get protection that’ll offer you peace of thoughts realizing your loved ones’s protected. We suggest RamseyTrusted supplier Zander Insurance coverage. Get your time period life coverage began at this time.

Incessantly Requested Questions

Are you able to get life insurance coverage with out a medical examination?

Sure! Though you may assume this type of protection would for positive require some prodding and poking, expertise has made these strategies optionally available. Many carriers can now use algorithms to see in case you’re a great match for protection. Take a look at our no medical examination evaluation device above.

Ought to I get no medical examination life insurance coverage?

The quick reply? Sure—so long as you don’t want greater than $2 million in protection. If you happen to meet the correct standards, no medical examination insurance policies are nice. They’ll prevent the time and problem of a medical examination. Plus, they’re inexpensive. It’s a win-win-win.

Is there a ready interval for no examination life insurance coverage?

No. You possibly can apply as shortly and simply for no examination protection as you’d for a medically underwritten coverage.

Can seniors qualify for no examination life insurance coverage?

For simplified concern, the utmost age for protection is usually 65. But it surely’s potential for individuals as much as age 80 to qualify for assured concern.

Are you able to borrow cash from a no medical examination life insurance coverage coverage?

You may be capable of do that with some entire life no examination insurance policies. Then once more, why would you ever need to borrow cash? Particularly your personal cash? And also you’d by no means need to get a complete life coverage until it was the one sort of insurance coverage you may get accepted for!

Does no examination life insurance coverage have time period and entire choices?

Sure. However that doesn’t imply getting entire life is a good suggestion. With or with out an examination, at all times go for stage time period life protection that’s price 10–12 occasions your annual revenue.

Is not any medical examination life insurance coverage price it?

We predict it’s! Life insurance coverage is without doubt one of the greatest and most inexpensive methods to guard your loved ones’s future. And skipping the medical examination makes the entire course of extra handy.

How lengthy does a no examination life insurance coverage coverage final?

If it’s a time period coverage (and it needs to be), it’ll final for 10, 15, 20 or 30 years. If you happen to make the error of shopping for entire life, it’ll final your entire life (until you let the coverage lapse by not paying for it).

Who’s the beneficiary?

The beneficiary is the one that you select to obtain the loss of life profit out of your life insurance coverage coverage after you die.

Who’s the policyholder?

The policyholder is the particular person coated by the life insurance coverage coverage (so, in all probability you).

What’s a loss of life profit?

That is the life insurance coverage payout the corporate sends to the beneficiary after the policyholder has died.

How lengthy do you must declare life insurance coverage?

There’s normally no time restrict on this. In spite of everything, survivors who lose a cherished one want as few issues as potential to fret about as they grieve.

Does life insurance coverage pay for loss of life by suicide?

Usually it does. There are exceptions, although. Many insurance policies have a clause stating that if the policyholder commits suicide inside two or three years of the coverage being written, the insurer can deny the declare.

Are you able to get life insurance coverage if in case you have most cancers?

Sure, you’ll be able to. However you may even see fewer choices, increased premiums or decrease protection limits.

[ad_2]

Source link