[ad_1]

Late final Saturday evening, Jason Calacanis, a outstanding web entrepreneur and investor, hit the caps button on his keyboard and tweeted out a warning in regards to the collapse of Silicon Valley Financial institution.

“YOU SHOULD BE ABSOLUTELY TERRIFIED RIGHT NOW — THAT IS THE PROPER REACTION TO A BANK RUN AND CONTAGION,” he wrote. “THIS WILL SPIRAL INTO CHAOS”.

The fast fall of the tech sector’s regional financial institution has upended social mores within the Valley. Buyers like Calacanis who sometimes upbraid regulators for stifling innovation turned to Washington of their hour of want.

Most warned of extreme repercussions if depositors misplaced everlasting entry to their cash. Hedge fund supervisor Invoice Ackman wrote on Twitter that the consequence of presidency failure to ensure SVB deposits can be “huge and profound”. Y Combinator chief government Garry Tan known as the financial institution’s failure an extinction degree occasion for start-ups — just a few days earlier than the tech accelerator laid off 20 per cent of its personal employees in a non-SVB linked transfer.

David Sacks, basic companion of VC agency Craft Ventures, who like Calacanis is a detailed affiliate of Elon Musk and has a big following on Twitter, warned of additional financial institution runs. “Place SVB with a Prime 4 financial institution,” he tweeted. “Do that earlier than Monday open or there will probably be contagion and the disaster will unfold.”

Their appeals labored. Two days after the Federal Deposit Insurance coverage Company took management of the financial institution’s property, the Treasury, Federal Reserve, and FDIC introduced on Monday morning that depositors would have entry to all of their cash.

Reduction has been tempered, nonetheless, by criticism of the position that some enterprise capitalists performed within the disaster at SVB. When issues about SVB’s stability sheet rose final week, VC corporations together with Peter Thiel’s Founders Fund urged portfolio corporations to behave in their very own finest pursuits and take away funds. This helped to set off a run on the financial institution.

There’s a broader cost of hypocrisy in direction of a number of the enterprise capitalists who chafe in opposition to authorities regulation of tech however demanded regulators step in to assist SVB depositors. Logging on to plead for assist “was an ‘atheist in a foxhole’ second”, says one government at a enterprise capital fund who was derisive of his friends’ conversion.

Some buyers are involved that the meltdown at SVB might feed right into a backlash in opposition to the tech sector at a time when there may be already rising debate in regards to the influence of social media on younger folks and the potential monopoly energy of a number of the largest tech corporations.

Supporters can level to the tech sector’s position because the American economic system’s engine of innovation. However after a pointy stoop in tech shares over the previous 12 months, giant lay-offs and now the failure of the sector’s favorite financial institution, corporations are navigating an more and more hostile setting.

Margaret O’Mara, historical past professor on the College of Washington and writer of The Code: Silicon Valley and the Remaking of America, says it’s doable that regulators might use SVB’s collapse to push for tougher regulation of the tech sector.

“There may be some shamelessness of outspoken libertarians who have been fast to scold [Treasury secretary] Janet Yellen about what she wasn’t doing,” she says. “However a few of that was defensive. There’s a sense amongst some folks that there’s a conflict on tech and that regulators wouldn’t assist.”

Foyer valley

Based in 1983, Silicon Valley Financial institution was the go-to lender for tech start-ups. The financial institution understood the idiosyncrasies of early stage corporations, which frequently have funding however no income. It provided loans, checking accounts, VC funding, networking alternatives and monetary recommendation to buyers and founders. On the time of its failure, it was doing enterprise with virtually half of all VC-backed start-ups within the US.

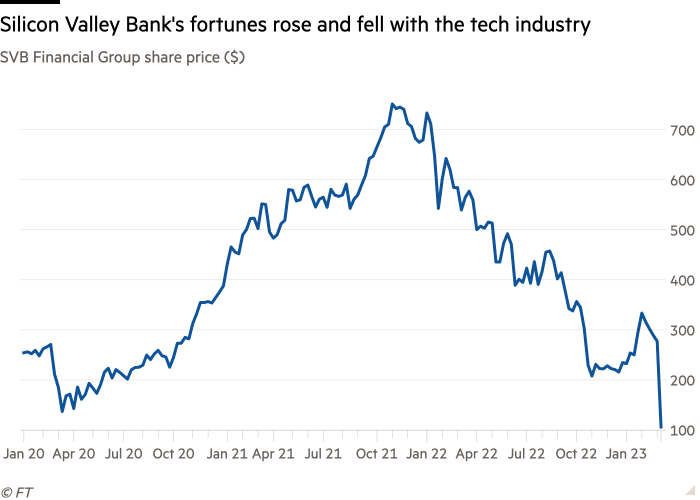

These shut ties meant the financial institution’s fortunes rose and fell with the tech business. Over the previous decade, ultra-low rates of interest have fuelled an funding growth in tech. Debt was low cost and development was prioritised over income. When tech valuations hit a peak in 2021, deposits in SVB reached a file $198bn.

Now the tide has gone out. Rising charges curb investor urge for food for dangerous tech investments. SVB was uncovered to increased charges on two fronts: falling deposits and a decrease worth for the financial institution’s portfolio of supposedly secure long-dated securities.

As efforts accelerated over the weekend to save lots of the financial institution, some enterprise capitalists took pains to distance themselves from the present taking part in out on social media. “Folks suppose that six folks on Twitter, as a result of they’re outspoken, converse for Silicon Valley,” says Peter Hébert, co-founder and managing companion at enterprise fund Lux Capital who spent the weekend calling representatives in authorities.

Among the many billionaires working by means of their rolodexes have been Ron Conway, an early investor in Twitter, Google and Fb and a serious backer of Democrat causes, and Doug Leone, a Sequoia Capital companion and a monetary backer of Republicans together with Donald Trump, in response to two folks with information of the lobbying efforts.

“Little or no of the exercise was centrally co-ordinated, this was only a brigade of individuals doing what they felt they wanted to do,” says Hébert.

There was a component of self-interest to those efforts: SVB’s collapse left enterprise capital corporations’ deposits and people of their portfolio corporations locked away, threatening to sluggish already-sluggish tech funding additional.

However the repercussions from SVB’s failure couldn’t all be written off as issues solely of the rich. Because the weekend progressed, founders of small corporations have been frantically looking for money with the intention to pay employees the next week. Lay-offs appeared inevitable with out intervention.

For a lot of unprofitable start-ups requiring near-continuous strains of credit score, SVB was not simply the most suitable choice, it was the one one. “Conventional banks don’t present these strains of credit score and enterprise debt which can be so vital to the tech ecosystem. SVB did,” says Maëlle Gavet, chief government of Techstars, one of many world’s largest buyers in early-stage start-ups.

“Over and once more founders will say to you — ‘once I went by means of the demise valley, SVB was there. My relationship supervisor discovered the suitable credit score to get me to the opposite facet’. That’s why SVB was so vital: they perceive what it’s to run a tech firm,” she says.

The lobbying effort on behalf of SVB performed on the tech sector’s significance to the US economic system — and even to nationwide safety.

In conversations with congressional representatives, buyers emphasised the significance of these early stage corporations now left weak, and performed to bipartisan fears about being outstripped by China. “This isn’t a bailout of massive tech, like Fb or Amazon, it’s a bailout of little tech,” says one senior banker at a Wall Road agency who was concerned over the weekend. “[The case being made was] ‘if you need the Chinese language to get forward of us, then stifle that innovation machine’.”

It was a tough promote, in response to the banker, to drum up assist on either side of the political divide. “It couldn’t be worse. ‘Silicon Valley’ and ‘Financial institution’, these are the 2 issues that carry Republicans and Democrats collectively: they each hate Silicon Valley and so they each hate banks.”

“Most of the folks in Silicon Valley have virtually taken delight in having nothing to do with DC or Wall Road. That’s not helpful in instances of disaster,” says Hébert. “There was nonetheless schadenfreude [in Washington], the idea that this was the comeuppance for know-how.”

Finally, nonetheless, efforts made by Silicon Valley luminaries have been profitable, helped over the road by fears in Washington that SVB may very well be the primary domino in a procession of regional lenders. These fears appeared extra justified over the course of the week. Late on Thursday, a number of of the nation’s largest banks introduced $30bn in help for First Republic Financial institution with the intention to shore up investor confidence within the California lender.

On Friday, Calacanis used a weekly podcast he hosts with Sacks and Chamath Palihapitiya, one other enterprise capitalist, to clarify his tweets.

“The alarm bell I sounded was as a result of I noticed a hearth . . . after Silicon Valley Financial institution was put into receivership and once I noticed extra financial institution runs occurring,” he mentioned. He conceded that utilizing all caps was “maybe a bit of an excessive amount of”. It was actually a comedy “bit”, he added, however “folks didn’t perceive that.”

Will there be a invoice from Washington?

On Monday night, a gaggle of tech buyers and start-up founders gathered on a terrace in Mountain View, California to have a good time St Patrick’s Day early and rehash the occasions of the previous few days. One visitor, Conrad Burke, co-founder of San Francisco-based MetaVC Companions, describes the occasion as group remedy. “After 4 days of sheer hell you may really feel the reduction within the air,” he says.

However amid the jubilation, there’s a rising recognition that the federal government’s largesse is prone to come at a value. Because the aftershocks reverberate by means of the US monetary system, there may be already discuss of extra regulation of banks.

Ro Khanna, the Democratic congressman from California who additionally performed a job in talks over the destiny of SVB on the weekend, mentioned the financial institution’s collapse was “a transparent reminder that Congress has didn’t correctly regulate banks . . . Congress tends to behave when there may be momentum round a difficulty and I’m hopeful that public stress might carry some Republicans to the desk on this.”

That political sentiment might additionally have an effect on Washington’s strategy to the tech sector. The business just isn’t keen on admitting it, however its fortunes have all the time been entwined with the state. US authorities funding for the chilly conflict and area race performed a key position in Silicon Valley’s creation.

For years, electrical automobile firm Tesla has relied on authorities incentives to generate income, by promoting carbon credit to conventional carmakers. Final 12 months, the Pentagon break up an enormous $9bn cloud computing contract between Google, Amazon, Oracle and Microsoft. The US chip sector is within the means of making use of for $39bn in funding from the US Chips and Science Act.

The federal government nonetheless creates a clean runway for development, says O’Mara, the educational. “Within the US we now have state constructing by stealth,” she says. “Authorities cash flows to personal corporations in a method that permits the state to place its thumb on the size however makes folks within the business really feel as in the event that they did it on their own.”

Having rescued their native financial institution, some buyers count on that the federal government will probably be a extra apparent presence. “The federal government is squarely in Silicon Valley and they’re right here to remain,” says the Wall Road banker concerned in rescue talks. “It’s a bit of unnerving.”

Extra reporting by Colby Smith in Washington

[ad_2]

Source link