[ad_1]

This text is an on-site model of our Ethical Cash publication. Join here to get the publication despatched straight to your inbox.

Go to our Ethical Cash hub for all the most recent ESG information, opinion and evaluation from across the FT

This morning, the monetary neighborhood awoke in a world the place Credit score Suisse has been snuffed out.

All monetary establishments have good years and dangerous years. However what mattered to Credit score Suisse was beating UBS. Now, to be acquired by your rival, it should be a giant shock to these at each banks. It’s a tectonic shift for Switzerland’s storied banking tradition and, extra broadly, for international finance.

I’ll say, in my interactions with Credit score Suisse’s individuals — particularly in Washington — they have been well mannered, pleasant and keen to elucidate issues. I might not say that about all the worldwide banks.

Within the US, which stays roiled in its personal banking disaster, the main target is on regional banks and their potential to resist the contagion from Silicon Valley Financial institution. Neighborhood banks play a giant function in funding business actual property and if the banks pull again lending, how will that have an effect on assist for the Inflation Discount Act? Will a credit score squeeze now element the IRA? This can be a concern we shall be following.

We might additionally like to spotlight our colleagues’ report on the finish of final week in regards to the responses to the EU’s proposals to spice up renewable manufacturing. European photo voltaic firms complained limits on Chinese language imports may stymie their very own manufacturing. Not less than one wind vitality enterprise stated the measures gained’t work till they’re backed up with exhausting money.

In right this moment’s publication, Kenza investigates the continued energy of the “greenium” within the sustainable bond market. And Tamami delves into large questions in regards to the Financial institution of Japan’s local weather concerns now that the central financial institution is underneath new management — Patrick Temple-West

Inexperienced flavours trump plain vanilla

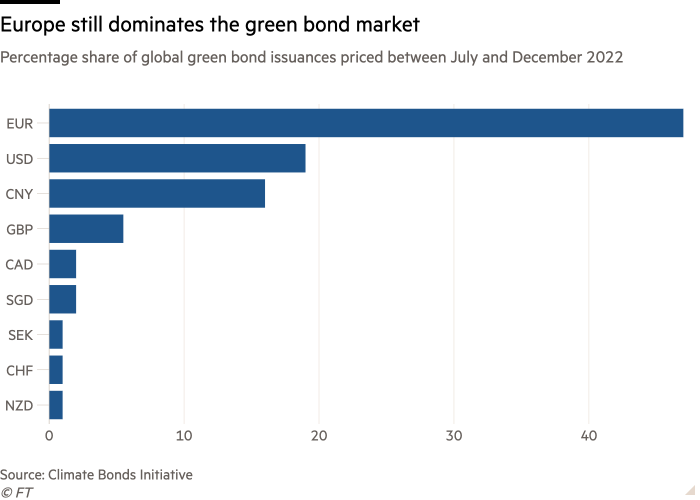

Within the debt markets, inexperienced sells. Bonds with sustainability labels of any type outperformed “vanilla” equivalents within the second half of final 12 months, in keeping with new analysis, including to proof the sort of debt can nudge up returns for fastened revenue funds.

Evaluation of 72 euro and dollar-denominated corporate bonds by the non-profit Climate Bonds Initiative discovered each flavour of sustainable debt outperformed different debt issued by the identical firms within the second half of final 12 months.

This included so-called sustainability-linked bonds, which penalise issuers who fail to fulfill sure environmental and social objectives, and extra conventional “use-of-proceeds” bonds which earmark money raised for initiatives reminiscent of photo voltaic panels or assisted housing.

“Thematic bonds have issuers and traders head over heels for each other,” stated Sean Kidney, CBI’s chief govt. “In a vital decade for local weather motion, the sustainable bond market is the goose that laid the golden egg.”

Debt with a inexperienced label had the very best enhance, often called a “greenium”: yields averaged near half a proportion level decrease in contrast with equal bonds, in keeping with the CBI. (Bond yields fall as costs rise.) This implies firms raised their cash extra cheaply than they in any other case would have completed.

It additionally discovered proof of upper value rises in secondary markets within the month following issuance, which might have benefited traders.

German authorities bonds are sometimes used for example the pricing advantages of inexperienced bonds, because the nation points inexperienced and non-green debt concurrently in an easy-to-compare “twin” construction. The typical yield on a €5bn German authorities issuance with a inexperienced tag was 1.25 foundation factors decrease than its plain equal final August, the CBI stated.

Nevertheless, critics level out that within the absence of sturdy regulatory scrutiny, any issuer can resolve so as to add a inexperienced tag to a bond, albeit not with out controversy within the case of massive polluters like airways or oil majors. It should merely promise to spend the cash it raises on initiatives with biodiversity or local weather advantages.

As bond markets tanked around the globe final 12 months and retail consciousness of the potential for greenwashing grew, issuances within the sustainable bond market fell for the primary time ever, from $1.1tn in 2021 to $863bn in 2022, in keeping with Bloomberg knowledge.

Even so, a number of traders advised the CBI they’d not have purchased some bonds if it weren’t for the inexperienced label hooked up, together with these issued by automotive firms Renault and Volkswagen. (Kenza Bryan)

Questions on local weather threat abound underneath new BoJ management

After Haruhiko Kuroda led the Financial institution of Japan by means of 10 years of “unprecedented” financial easing, Kazuo Ueda is about to turn out to be the following Financial institution of Japan governor on April 9.

The primary activity Ueda will face shall be to normalise Kuroda’s ultra-loose financial coverage — with out inflicting big side-effects on the world’s third-largest financial system. However ESG-conscious traders might need one other query: how will Ueda deal with Kuroda’s local weather change legacy?

Kuroda made clear his perception that serving to society sort out local weather change is inside the central financial institution’s mandate. Underneath his watch, the BoJ launched a scheme that supplied zero-interest loans to banks to spice up inexperienced and transition finance.

Ueda, who will turn out to be the primary BoJ chief from academia in postwar Japan, has made only a few feedback on the subject of utilizing financial coverage to answer the dangers of local weather change. A uncommon instance is Nikkei’s article printed in December 2021 (obtainable here for any Japanese-speaking readers.)

Within the article, Ueda argued that whereas central banks can handle the dangers of local weather change, the motion needs to be temporal and proceed with further care. Guiding markets and societies to decarbonise is extra of a job for fiscal authorities, because the central banks don’t have sufficient instruments to take action, he added.

He additionally stated that establishing carbon tax and carbon pricing schemes, which he believed would set off improvements within the subject of fresh vitality, is extra of “a pure approach” to attain a web zero society than interventions by central banks. If companies can’t increase sufficient cash for inexperienced transformation and want public assist, “monetary establishments that are near the governments” — relatively than the central banks — ought to step in, he wrote.

His scepticism in direction of the central financial institution’s function in mitigating local weather change reveals a stark distinction from a former candidate to steer the BoJ. Masayoshi Amamiya, a BoJ veteran whom Nikkei reported had been approached as a attainable successor to Kuroda, believed that responding to local weather change was an necessary a part of the BoJ’s mandate.

With Ueda’s obvious reluctance to deepening the central financial institution’s involvement within the struggle in opposition to local weather change, many BoJ watchers don’t anticipate additional commitments on this space.

However however, only a few anticipate Ueda will introduce drastic adjustments in contrast together with his predecessor. As Fumio Kishida’s administration units inexperienced transformation as one among its high priorities, it’s unlikely that Ueda will unwind Kuroda’s initiatives, stated Satoru Kado, principal economist at Mitsubishi UFJ Analysis and Consulting. (Tamami Shimizuishi, Nikkei)

Good learn

Firms that again off their social and environmental commitments within the face of “nonsense” political assaults threat alienating a technology of expertise, Mars’s new chief govt has warned. In his first interview since changing into CEO final September, Poul Weihrauch advised our colleague Andrew Edgecliffe-Johnson that “high quality firms are deeply invested in [ESG] and if I stroll out of this workplace and I take a 25-year-old affiliate that has joined us from college they may need us to do that”.

“We don’t imagine that function and revenue are enemies,” he added.

[ad_2]

Source link