[ad_1]

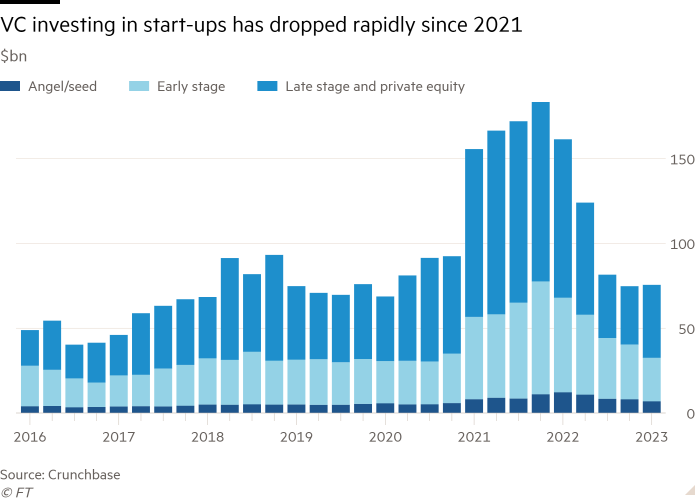

Enterprise capital funding of start-ups has plunged by over 50 percent up to 12 months as a financial downturn weighs on valuations at nascent tech teams.

Globally, enterprise funds invested $76bn into start-ups within the first three months of 2023, lower than half the $162bn they deployed in the identical interval of 12 months in the past, in response to knowledge supplier Crunchbase.

That sharp drop is regardless of two massive fundraising rounds for tech firms going down this 12 months. In January, Microsoft invested $10bn into generative synthetic intelligence firm OpenAI, and final month funds firm Stripe raised $6.5bn from traders.

Without the Microsoft transaction with OpenAI, the prior quarter of 2023 would have been the worst quarter for enterprise funding in additional than five years.

The collapse of the start-up targeted lender Silicon Valley Financial Institution final month will destabilize the funding ecosystem for younger expertise firms, squeezing those who relied on the financial institution for debt, mentioned Gené Teare, senior knowledge editor at Crunchbase.

As worsening financial situations proceed to damp sentiment for riskier investments, 1000’s fledgling firms with a pressing want for capital are being pressured to confront a collapse of their valuations, conform to punitive debt offers, or face insolvency.

“Even earlier than SVB [collapsed], this was the worst enterprise setting anybody had seen,” mentioned Sam Yagan, founding father of relationship website OKCupid and now an investor in early-stage firms.

“Most entrepreneurs and VCs have by no means been by a down market. We have been telling individuals you may assume extra capital can be ready for them. Now there are good firms that may get capital.”

Within the five years to the tip of 2021, funding volumes roughly quadrupled as enterprise funds deployed extra capital on behalf of institutional traders comparable to pension funds and college endowments, in addition to new entrants together with hedge fund Tiger World which seemed to trip the wave of rising tech valuations.

Since then, personal market valuations at many start-ups have been battered as soon as the darlings of Silicon Valley traders. Stripe, valued at $95bn in 2021, is now priced at roughly half that, having been pushed by a fundraising final month at a valuation of $50bn.

The pattern has pressured some VCs to mark down the worth of the businesses held of their funds. Tiger wiped a 3rd, or $23bn, off the value of its start-up holdings with Stripe and TikTok mother or father ByteDance earlier this 12 months.

In response to Crunchbase, VCs had a document of $580bn of “dry powder” — money they’ve raised, however not invested — on the finish of the prior quarter. An essentially frozen marketplace for preliminary public choices has reduced an essential funding supply for late-stage firms.

This has left many start-ups going through an alternative between elevating cash at a decreased valuation, taking up debt, or chopping prices and attempting to limp until the funding set improves.

Traders anticipate a wave of firm failures later this 12 months, as some start-ups run out of money. The founder of 1 massive Silicon Valley enterprise fund mentioned: “Issues are very, very robust.”

[ad_2]