[ad_1]

Making sense of auto insurance coverage choices will be like making an attempt to determine the Rosetta Stone with out your decoder ring. It’s arduous. How a lot do you want? How are you aware in case you’re actually lined? Collision, complete, legal responsibility, limits, deductibles, premiums . . . yikes! Then there’s one thing referred to as private damage safety. What’s that, and do you really want it?

We’ve obtained you lined! We’ll clarify what private damage safety is so you may be sure you have the correct protection.

What Is Private Harm Safety (PIP)?

Private damage safety (PIP) is a particular kind of automobile insurance coverage that covers hospital payments, medical prices and misplaced wages in case you get injured in a automobile accident. It’s additionally referred to as no-fault safety as a result of it doesn’t matter who’s at fault—you’re nonetheless lined. PIP insurance coverage helps fill within the protection gaps for you and your passengers from medical prices your medical health insurance firm received’t cowl.

PIP insurance coverage is much like medical funds protection (MedPay) however has some key variations. First, PIP provides you higher protection with increased limits. But it surely additionally comes with increased premiums and often has a deductible.

![]()

Do not let automobile insurance coverage prices get you down! Obtain our guidelines for straightforward methods to avoid wasting.

Although it varies by state, PIP protection usually kicks in instantly as much as the restrict you select. And PIP have to be used up first earlier than you should use your MedPay or medical health insurance insurance policies.

What Does Private Harm Safety Cowl?

Private damage safety protects you in a wide range of conditions. It might even cowl you in case you’re not driving. Let’s say you’re hit by a automobile whereas strolling down the road, simply minding your personal enterprise. Otherwise you’re injured driving your bike or whereas driving in another person’s automobile. Your PIP coverage may kick in for all these conditions, relying the place you reside.

Listed here are some issues PIP would possibly cowl:

- Medical bills (this contains issues like journeys to the emergency room, surgical procedures, dentistry and optometry, ambulance rides, medicine, prosthetic gadgets and different medical provides.)

- Funeral prices

- Bodily or occupational remedy

- Substitute providers like childcare, garden care or cleansing providers (in case your accident left you unable to care for your loved ones or family chores)

- Partial misplaced wages

- Funds to rent subcontractors to finish your work (in case you’re self-employed)

- Can typically assist cowl your medical health insurance deductible

What’s Not Coated by PIP?

Identical to different kinds of automobile insurance coverage, private damage safety has its limits. It received’t cowl every part below the solar.

Right here’s an inventory of a number of the issues PIP received’t pitch in for:

Private damage safety additionally received’t pay for something above the bounds of your coverage. So in case your medical payments simply maintain getting greater and greater, PIP will solely cowl you as much as a set quantity.

What States Require Private Harm Safety (PIP)?

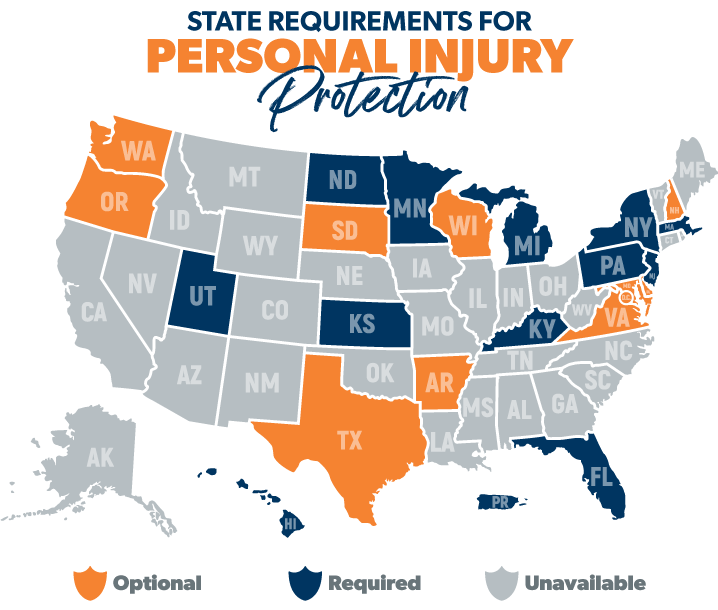

There are 12 states and Puerto Rico that require you to have private damage safety in place.1 There are one other 10 states (and D.C.) the place it’s optionally available.2

Do I Want Private Harm Safety?

If you happen to reside someplace private damage safety is required, you positively want it (thanks, Captain Apparent!).

If you happen to reside someplace PIP is optionally available, you need to take full benefit of this sort of protection.

And in case you reside in a state the place you may’t get PIP, right here’s what would occur in case you have been injured in an accident. If you’re at fault—and you might have medical funds protection—MedPay would possibly cowl a few of these medical bills. If the different driver’s at fault, their bodily damage legal responsibility safety would doubtlessly cowl your medical payments, however solely as much as their coverage limits.

Do I Want PIP if I Have Well being Insurance coverage?

Now, if you have already got medical health insurance, you may be questioning if you really want PIP. The reply? It relies upon.

In case you have actually good medical health insurance, with a coverage that gives thorough post-accident protection, you would possibly wish to merely get the naked minimal of PIP.

However, in case you don’t have medical health insurance, or don’t have a really stable plan, you would possibly wish to look into getting it. PIP provides you with extras like reimbursement of misplaced wages and a few of these useful substitute providers we noticed above. Work together with your insurance coverage agent to see what sort of coverage may be best for you.

How Do You File a PIP Declare?

If you happen to’re trying to file a declare proper after an accident, simply go about it such as you usually would—via the telephone, on-line or via the app. However in case you want medical providers for an extended interval, you’ll must work together with your insurance coverage firm to create a plan for medical care and get it preapproved.

When you file the mandatory paperwork, your insurance coverage firm will look over your declare and both approve or deny it. They may determine to solely approve partial reimbursements. Additionally, your insurance coverage firm would possibly require you to be examined by a medical supplier they decide.

Lastly, concentrate on your insurer’s timeline for submitting claims. They will typically have a strict course of about when you want to file a declare after an accident. If you happen to don’t observe their process, you might find yourself paying hefty penalties.

Get the Proper Protection

In the case of automobile insurance coverage, the naked minimal simply isn’t going to chop it. You want the correct quantity of protection. There’s so much that might doubtlessly set you again from reaching your monetary objectives. That’s why we suggest working with considered one of our insurance coverage brokers who’s a part of our Endorsed Native Suppliers (ELP) program.

They’re RamseyTrusted and can work with you to be sure you’re getting the correct quantity of protection at the very best worth. You’ll sleep so much higher realizing that you’re protected.

Attain out to an area insurance coverage professional at the moment!

[ad_2]

Source link