[ad_1]

This text is an on-site model of our Vitality Supply publication. Enroll right here to get the publication despatched straight to your inbox each Tuesday and Thursday

Welcome to a different Vitality Supply.

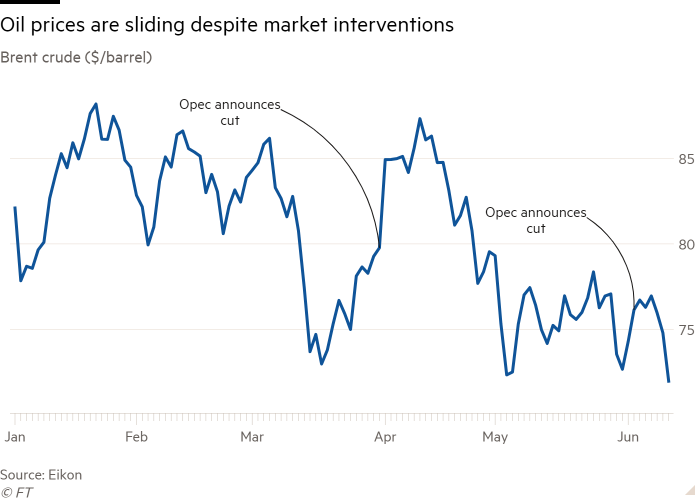

Oil stays the large story in power markets, with costs down sharply once more yesterday. In our first word, I discuss with Ed Morse, Citigroup’s international head of commodity analysis and the doyen of oil market analysts. He shares his view on why the crude worth continues to be defying Saudi Arabia, which introduced new cuts simply over per week in the past — however has watched costs proceed to float decrease.

In our second merchandise, Aime stories on a proposal to avert extra carbon commerce rivalry. In Knowledge Drill, Amanda picks up a report on fossil gas producers’ flaky web zero commitments.

Thanks for studying. Derek

PS Be part of us on June 15 for the FT’s Hydrogen Summit, the place power CEOs, senior policymakers and financiers will talk about the alternatives and obstacles in harnessing the complete energy of hydrogen. FT Premium subscribers can register at no cost right here.

The view from the bears’ perspective

Saudi Arabia is reducing oil output and analysts from the Worldwide Vitality Company to Wall Road suppose a roaring Chinese language financial system will put rockets underneath demand later this yr, whereas provide development stays tepid.

So why are oil costs persevering with to float decrease? We requested Ed Morse, Citi’s veteran head of commodity analysis and a bearish voice in a thicket of market bulls.

Morse’s argument: there’s nonetheless loads of provide on the market; and the bullish religion of market cheerleaders is misplaced. “Our primary judgment is that offer goes to outstrip demand within the second half of the yr,” he informed ES.

Costs is not going to common far more than $82 a barrel this yr, he predicts — 20 per cent beneath some forecasts. Subsequent yr, they are going to be “effectively under” that stage. That is his case:

1. China isn’t going to trip to the rescue

There was a longstanding perception that China’s energy-thirsty financial system goes to lastly crank again into gear later this yr to bolster international crude demand and push costs greater.

Not so, says Morse.

“They [oil bulls] have a notion — that’s strengthened by each the IEA and the Opec Secretariat — that demand goes to essentially loom massive within the second half of the yr,” he informed ES. “They’re tremendous bullish on China discovering a method to stimulate the financial system in ways in which the federal government has opted not to take action far.”

However in actuality, Chinese language diesel demand has lengthy since peaked, he says. And its gasoline demand can be near peaking by the center of the last decade.

“We expect {that a} consensus out there about China having a number of years of excessive demand development can be a misunderstanding of the place the drivers of demand have been within the nation . . . ”

2. GDP development is decoupling from oil demand

Financial development not carries the identical punch for the oil market.

Earlier than the pandemic, gross home product development of 1 per cent a yr implied about half a per cent development in oil demand, Morse stated. However that elasticity has fallen — and the autumn is about to get sharper.

“We expect individuals are underestimating the structural phenomena which are at work,” he stated. “They definitely convey down the connection between GDP development and oil demand.”

By the center of the last decade, a peak in motorized vehicle demand within the US and Europe, coupled with a peak in Chinese language diesel consumption and a nearing peak in its gasoline consumption, means even a fast-growing financial system is not going to be sufficient to set a hearth underneath oil demand.

That’s a deeply bearish underlying notion for the oil market.

“Should you get 4 per cent GDP development world wide, what’s demand development more likely to be? You might be hopeful for those who’re on the environmentalist facet and suppose it’s going to be zero. Or I believe you might be extra lifelike and say it’s going to be lower than 1%. And it might even be half a per cent,” stated Morse.

And if demand is just to develop by 0.5 per cent, that’s simply 500,000 barrels a day. Can the world discover that a lot further oil? “It’s not laborious,” stated Morse.

The US alone will most likely account for that a lot further provide.

3. ‘There’s quite a lot of oil round’

The truth is, taking a look at development in oil producing hubs world wide, supplying that development appears to be like fairly straightforward.

“If world demand isn’t rising at 2mn barrels a day, and also you add up what’s taking place within the US and Brazil and Guyana and Australia and Argentina and Norway and Canada and even Venezuelan numbers . . . there’s quite a lot of oil round.”

Oil output is rising once more in every of these international locations. Sure, even Venezuela, which Platts believes is now producing nearly 800,000 b/d.

Arguments {that a} lack of funding — within the US shale patch and past — will curtail provide within the coming years are overstated, he stated. “So far as we will inform, the argument that prices are going up and spending goes down is improper, as a result of it misses the better effectivity of capital use.”

Huge shale drillers, together with ExxonMobil and Chevron, are capable of produce roughly double what they did in 2019 for a similar worth, Morse stated.

“We’ve seen it time and time once more, we noticed it definitely between 2014 and 2016, when capital spending did go down however productiveness went up — approach up, as corporations discovered methods to provide extra with much less.”

5. What’s Opec going to do?

The large wild card then, is Opec. Is the cartel keen to make additional cuts to help the market?

Past Saudi Arabia, there doesn’t appear to be a lot urge for food. And the group’s repeated efforts to intervene out there of late have carried out little to help costs.

“I’m sceptical about an organisation that has modified manufacturing outlook 3 times since October saying: ‘Hey, that is everlasting,’” stated Morse.

That Opec will hold its newest manufacturing plans intact to the top of 2024 appears unlikely. “I definitely don’t suppose it’s everlasting for Iraq, and their plans. And it’s positively not for the UAE.”

Certainly, with Brent down greater than $4 a barrel since Saudi Arabia’s announcement of an additional momentary 1mn b/d lower final week, the group’s skill to prop up the oil worth towards the tide of macro dynamics appears more and more restricted. (Derek Brower and Myles McCormick)

A brand new proposal to simmer inexperienced commerce tensions

Joe Biden has largely put a cease to the fractious commerce wars of the Donald Trump period, soothing allies by suspending tariffs and providing recent talks on a long-running dispute on plane subsidies.

However the president has introduced together with him a brand new period of inexperienced commerce friction, angering America’s allies with a beneficiant subsidy bundle accessible to corporations making automobiles, batteries and different clear tech bits within the US.

A disagreement between the US and EU over methods to account for carbon in traded items is about to accentuate. This yr, the EU launched the world’s first carbon border tax. The levy, which is utilized to imports specifically sectors, is linked to the carbon worth set by the EU and paid by its home producers.

In a brand new paper, former White Home local weather adviser Paul Bledsoe and former commerce official Edward Gresser counsel a neat answer: Europe may very well be lower in on among the Inflation Discount Act’s subsidies in trade for rethinking its carbon border tax.

The deal may apply extra broadly than simply to Europe, the authors say. Throughout the G7, international locations may comply with measure the emissions depth of merchandise in sectors together with metal, aluminium, fertiliser, hydrogen, cement and electrical energy. Any traded items with embedded emissions above the agreed threshold may very well be taxed.

In trade, traded items from G7 international locations agreeing to the phrases may very well be eligible for among the subsidies underneath the IRA, together with however not restricted to tax credit for minerals, batteries and automotive elements.

The G7 has been contemplating the main points of a “local weather membership” on commerce since late final yr, however has thus far launched few particulars. Alongside this, the US and EU are engaged in slow-moving talks on a climate-related deal for metal and aluminium. However little or no has been completed.

Bledsoe stated it was nonetheless unclear how the proposal to tug again on the carbon border tax in trade for a slice of the inexperienced credit would go down in Brussels. However he added: “There isn’t any purpose to limit our commerce — there’s each purpose to belief our allies to supply safe provide traces to essential power assets.” (Aime Williams)

Knowledge Drill

Web zero commitments from fossil gas producers are “largely meaningless”, says a brand new report by Web Zero Tracker, a analysis consortium that features Oxford college and the College of North Carolina at Chapel Hill.

Two-thirds of the world’s largest fossil gas corporations have made web zero commitments, up from 45 per cent final yr, in keeping with the report. However most don’t embrace or make clear protection of Scope 3 emissions — these generated from finish merchandise — which make up the majority of the business’s carbon footprint. No corporations have made commitments to part out oil and gasoline manufacturing by mid-century, defying UN pointers saying credible web zero pledges should have “particular targets geared toward ending of and/or help for fossil fuels”. (Amanda Chu)

Energy Factors

Vitality Supply is written and edited by Derek Brower, Myles McCormick, Amanda Chu and Emily Goldberg. Attain us at power.supply@ft.com and comply with us on Twitter at @FTEnergy. Atone for previous editions of the publication right here.

Advisable newsletters for you

Ethical Cash — Our unmissable publication on socially accountable enterprise, sustainable finance and extra. Enroll right here

The Local weather Graphic: Defined — Understanding a very powerful local weather knowledge of the week. Enroll right here

[ad_2]

Source link