[ad_1]

This text is an on-site model of our Unhedged e-newsletter. Enroll here to get the e-newsletter despatched straight to your inbox each weekday

Good morning. During the last 10 days or so, there was a type of little shifts in markets that’s simply sufficiently big to be noticeable and simply logical sufficient to look significant.

The transfer seems to have been kicked off by three items of robust financial information: the apparently dovish Fed assembly on the primary of the month, and the robust jobs report and the massive bounce within the ISM companies survey, each a few days later. The rapid response to those occasions didn’t appear to be a normal good-news-is-bad-news-in-a-rate-hiking-cycle transfer down, however over time the temper modified. As futures-market rate of interest expectations rise, the greenback is firming up. The speed-sensitive Nasdaq is down 4 per cent because the third, and the speculative-risk proxy Ark Innovation ETF is off 13 per cent. Bond yields have ticked up. Flows into fairness funds had been unfavourable final week for the primary time after being robust through the previous two. Rising markets flows reversed too.

Most likely that is only a blip throughout the 2023 threat rally, however value watching as this week unfolds. Ship us your ideas: robert.armstrong@ft.com and ethan.wu@ft.com.

US earnings season: recession hints?

The US economic system is sending blended indicators. As we wrote final week, there’s — to choose three consultant examples — a robust labour market, a weak housing market and blended indicators on credit score availability. It is smart that the image can be extra ambiguous than regular. The massive pandemic shift from items to companies spending has but to unwind and the financial and monetary stimulus, together with direct assist for customers, nonetheless echoes throughout the economic system. What market watchers try to do, with very restricted success, is make out a cyclical sample beneath these two large shocks. Are we heading in direction of a recession, because the deeply inverted yield curve implies, or is that this time totally different?

A detailed take a look at fourth-quarter earnings offers a couple of clues. Two-thirds of the S&P 500 has reported outcomes to date. And the combination image — fleshed out properly in FactSet’s helpful Earnings Perception report (here) — is that income progress is slowing, margins are compressing, and earnings are falling. Among the many S&P corporations which have reported, gross sales are up 4.6 per cent from a yr in the past, and earnings are down 4.9 per cent. Internet revenue margins subsequently compressed by a full share level, from 12.4 a yr in the past to 11.4 right now. Unhedged (and a complete lot of different individuals) said this needed to occur, and now it’s taking place.

What’s the supply of the strain? It is going to be laborious, till reporting season is full, to tease out how a lot of the online margin tightening comes right down to larger curiosity expense, however given what number of large corporations locked in low charges once they may, it’s very seemingly that what we’re seeing is working margins coming down.

Savita Subramanian of Financial institution of America argues that, traditionally, the important thing issue driving margins has been the rise and fall of gross sales, and the identical is occurring right now:

Analytically, and on the combination degree, the story is very simple: wage and enter prices are actually rising quicker than gross sales:

The hyperlink between the margin squeeze and the economic system is, once more, easy: corporations lower prices to assist margins, this implies firing individuals, and that weakens combination demand. From excessive altitude, then, it appears to be like like earnings are hinting at recession.

The issue is that as you get nearer the image turns into more durable to learn. Sector efficiency varies quite a bit. Margins are widening within the vitality, actual property, industrials and utilities sectors. In data expertise and client discretionary, virtually half of corporations are reporting widening margins. Some however not the entire dispersion may be defined by the products weak/companies robust split. In companies, airways are doing very properly, so are resorts and eating places. Weak earnings from the most important tech corporations (particularly Alphabet, Meta, and Amazon) clarify a lot of the decline within the tech and communications sector, which, just like the surge in companies spending, looks as if a pandemic impact.

Fully indifferent from these pandemic overhangs, although, excessive capital expenditure helps industrials corporations, from equipment to aerospace. That is hardly suggestive of impending recession. Subramanian thinks that reshoring, excessive labour prices and an ageing capital inventory is all however forcing corporations to splash out on capital expenditure, however it appears to me that administration groups may look previous all this in the event that they had been correctly anxious a few downturn.

My unsatisfying conclusion on earnings season, then, is that I can’t fairly see previous the pandemic noise to make out a cyclical sign. The information in combination shouldn’t be nice, however it’s laborious to make out whether it is outright dangerous.

In the meantime, in Europe . . .

Europe earnings aren’t wanting too dangerous. To date, European corporations are squeaking out 4.2 per cent earnings progress within the fourth quarter, in comparison with shrinking income throughout the US, Japan and rising markets.

Europe’s unbelievable supply of energy: financials. You’ll be able to hear it from the likes of BNP Paribas and UniCredit elevating revenue targets and projecting confidence. Binky Chadha and Parag Thatte of Deutsche Financial institution calculate that Europe financials are contributing 4.1 share factors to combination earnings progress — making the distinction between modest progress and none in any respect. In contrast, financials dragged down revenue progress most in all places else.

One essential tailwind has been brighter financial prospects liberating up cash as soon as put aside for a recession in Europe, notes Simon Peters, a portfolio supervisor at Algebris Investments:

European banks have held on to substantial, unused Covid provisions on their steadiness sheets, in addition to making important precautionary provisions final yr in anticipation of the ‘apparent’ recession that was considered coming on the finish of 2022. Sluggish or no progress appears to be like seemingly however it seems that a deep, lengthy recession has largely been averted, as vitality has not wanted to be rationed. The large provisions constructed up will more and more be fed again into financial institution income this yr.

Would possibly this already be priced into shares, although? Europe financials have had a very good 4 months of outperformance, however that’s stalled since late January:

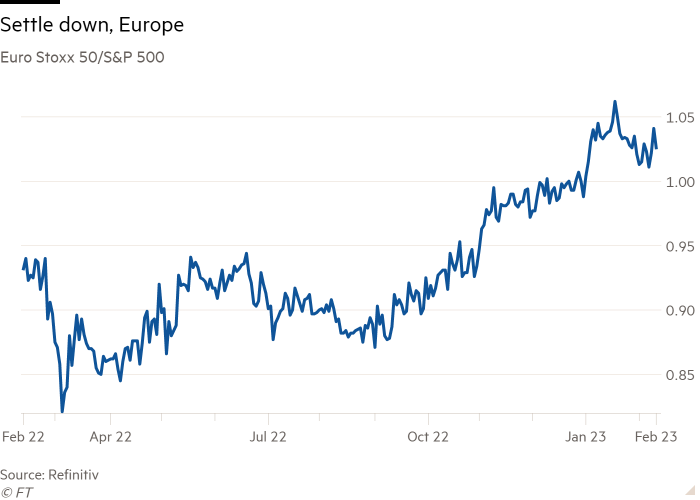

Extra broadly, too, European equities’ outperformance versus the US has come off the boil:

A sterner Fed could possibly be accountable, as larger charge expectations enhance the greenback, weighing on ex-US equities. However we’re unsure fairly what to make of it but. Extra on this later within the week, and if in case you have a hunch, do tell us.

One good learn

Social scientists aren’t any higher at making predictions about social tendencies than easy algorithms. This isn’t shocking, and it applies to buyers, too, most likely to an much more excessive diploma. However the teachers’ predictions enhance if they’ve particular experience within the prediction area, are interdisciplinary, persist with easy fashions and observe the info. There’s hope. Hat tip to (who else?) Phillip Tetlock for the pointer.

[ad_2]

Source link