[ad_1]

This text is an on-site model of our Unhedged e-newsletter. Join right here to get the e-newsletter despatched straight to your inbox each weekday

Good morning. Simply as Japan appears to be escaping deflation, China could also be falling into it. Shopper costs in China have been asleep in June, reflecting (amongst different issues) oversupply and a dearth of shopper confidence. Bear in mind when shopping for the China restoration was a straightforward commerce? E-mail us: robert.armstrong@ft.com and ethan.wu@ft.com.

What’s subsequent for the magnificent seven?

The earnings that can matter most on this second-quarter earnings season can be these of the magnificent seven — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. It is because (as now we have been reminded each day for months now) these corporations are doing nearly the entire work to maintain the US market rising. If their shares ought to crack within the second half, a superb 12 months for the inventory market may shortly flip into a foul one. So it’s value serious about the set-up going into the reviews, which is able to dribble out over the following month or so.

In early June we famous that, when it comes to their monetary profile, the large techs are a heterogeneous bunch. We summed up the purpose this manner (we didn’t embrace Tesla then):

Alphabet, Amazon, Apple and Microsoft are experiencing a valuation surge. Nvidia is present process a speedy reappraisal of its short-term earnings prospects. Meta is a bit of each.

That time is value revisiting and increasing on. Within the desk beneath, you possibly can see the improbable year-to-date returns for the shares, in addition to a decomposition of these returns between larger earnings estimates and rising valuations. Word two issues specifically. First, exterior of Meta and Tesla, what now we have seen is pure valuation growth. Second, the valuations of the businesses fall into three classes: valued in step with the broader market (Alphabet and Meta), costly (Apple and Microsoft), and wildly costly (Amazon, Nvidia and Tesla; although value/earnings has by no means been an incredible metric for Amazon, which is run with cool indifference to revenue). Information from Bloomberg:

Now contemplate, within the subsequent desk, progress expectations for the 12 months forward. The income progress bar is about excessive for Nvidia and Tesla. The others are anticipated to develop within the single digits. Earnings progress expectations, then again, are in all places. The expectations for a lot larger revenue at Meta, pushed by widening margins, is especially putting:

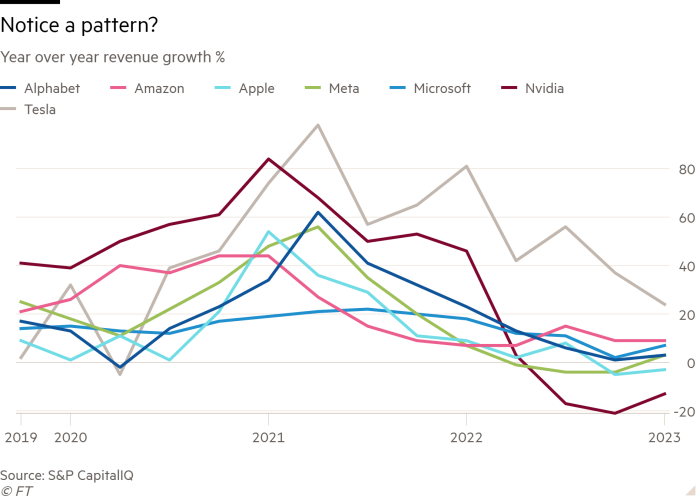

Are these practical expectations? For probably the most half they’re according to the pattern now we have seen throughout the group of seven. Income progress has slowed because the pandemic heyday has slipped into the rear-view mirror:

General, how is the set-up for these essential shares? Efficiency has been pink scorching, pushed principally by larger valuations. Income progress expectations are broadly affordable. The background, nonetheless, is difficult. This can be a hyped group: synthetic intelligence chatter, particularly however not completely round Nvidia, has been intense. Simply as importantly, for a very long time the valuations of tech shares have been justified by reference to low long-term rates of interest. However long-term charges are actually rising. The truth that the argument linking valuations and charges was stuffed with holes could not matter if folks nonetheless consider it. Briefly, these are nice corporations, however the positioning is fairly unappetising.

Probably the most interesting, from a purely monetary standpoint, are Microsoft and Alphabet. Alphabet has run up lower than the others, has an affordable valuation and expectations aren’t set too excessive. Microsoft is a little more costly, however has the benefit of promoting principally to enterprise clients, who ought to preserve investing even when the patron pulls again (simply look within the line chart above at its slow-but-steady efficiency over the previous few years). Distinction that to, say, Alphabet’s extra cyclical promoting machine or Apple’s consumer-driven enterprise.

We’re very eager to listen to readers’ opinions on which of the magnificent seven will carry out greatest over the rest of the 12 months. E-mail them to us.

The opposite 493

If fairness analysts are to be believed, this earnings season is as dangerous because it will get for company income.

Backside-up estimates for the second quarter are forecasting flat revenues and a 6-8 per cent year-over-year earnings contraction, as excessive enter prices drag on earnings per share. Then it’s proper again to growth within the third quarter, when the S&P 500 is predicted to return to (meagre) progress. By subsequent 12 months, recession hand-wringing can be lengthy gone, consensus estimates counsel. Earnings are anticipated to develop 12 per cent in 2024.

The second-quarter contraction displays acute ache in a couple of sectors somewhat than a broad-based crunch. The vitality business is coming off the excessive of an oil value surge. Supplies corporations are dealing with a pointy drop in gross sales as international progress sags. Healthcare is scuffling with excessive enter prices (it’s the pickleball plague!). However in lots of sectors, earnings look OK:

You’ll discover above the spectacular earnings growth at shopper discretionary corporations, thanks partly to resilient progress. Neither is this all simply Amazon and Tesla (see earlier piece). In a observe out yesterday, Ryan Grabinski of Strategas rounds up the businesses seeing probably the most enchancment in second-quarter expectations over the previous three months. Journey is a constant theme: Royal Caribbean, Delta, American Airways, and two casinos (MGM and Las Vegas Sands) are all within the prime 10. Enterprise journey is back.

Throughout the S&P 500, too, analysts have grown cheerier (that’s, much less damaging) on earnings. An increase in earnings revision breadth — the variety of analysts elevating earnings estimates minus these decreasing them — has lent help to rallying shares, notes Mike Wilson of Morgan Stanley. He argues, nonetheless, that the S&P has run previous what higher revision breadth can justify (discover the divergence in Wilson’s chart beneath):

The truth that earnings expectations aren’t particularly excessive, similtaneously the economic system retains shocking everybody with excellent news, offers us consolation about second-quarter outcomes. Trying additional out, although, issues really feel a bit precarious. Sure, progress is holding up, however fee will increase, now we have to imagine, haven’t absolutely bitten but. And regular progress isn’t the identical as re-accelerating progress, which is what’s wanted for 2024’s rosy earnings estimates to carry true. The truth that this 12 months’s inventory positive factors have come nearly totally from a number of growth suggests the excellent news has to maintain on coming if the market goes to maintain on rising. This earnings season, watch the businesses that give mediocre (however not essentially horrible) ahead steering. If these shares get brutalised, that’s an indication that expectations have been set too excessive, and that the months to return may very well be tough. (Ethan Wu)

One good learn

The key to creating good market calls shouldn’t be making too a lot of them, writes Howard Marks. As they are saying in baseball: anticipate the fats pitches.

FT Unhedged podcast

Can’t get sufficient of Unhedged? Take heed to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the newest markets information and monetary headlines, twice every week. Atone for previous editions of the e-newsletter right here.

Really helpful newsletters for you

Swamp Notes — Skilled perception on the intersection of cash and energy in US politics. Join right here

The Lex E-newsletter — Lex is the FT’s incisive each day column on funding. Join our e-newsletter on native and international traits from skilled writers in 4 nice monetary centres. Join right here

[ad_2]

Source link