[ad_1]

Obtain free UK rates of interest updates

We’ll ship you a myFT Each day Digest e mail rounding up the most recent UK rates of interest information each morning.

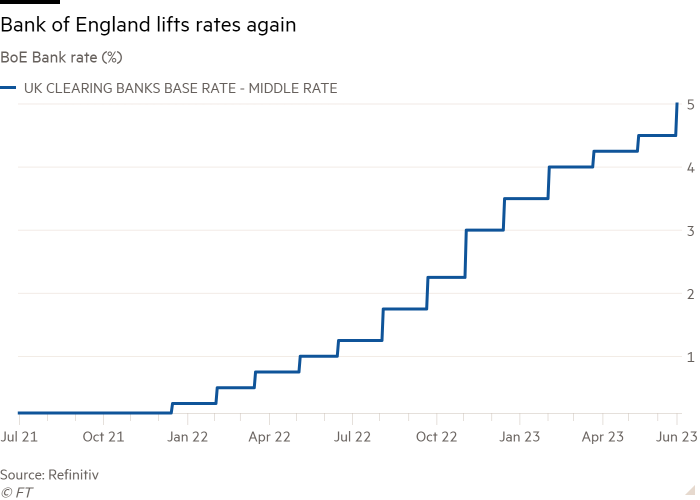

The Financial institution of England has raised rates of interest to five per cent, a shock half-point improve, because the central financial institution and prime minister Rishi Sunak vowed to crush persistent inflation.

Sunak stated he supported the BoE’s resolution and warned Conservative MPs that tax cuts must be placed on the backburner, as he promised to maintain a agency grip on fiscal coverage to regulate inflation, caught at 8.7 per cent in Could.

“Would I like to chop taxes tomorrow? After all I might,” Sunak stated at a press convention in Kent. “However borrowing a great deal of cash to do issues that sound nice isn’t the accountable strategy.”

Andrew Bailey, the BoE governor, was additionally uncompromising about the necessity to reduce inflation. “We’re not anticipating, we’re not wanting a recession, however we’ll do what is important to convey inflation down to focus on,” he stated.

Voting 7-2 in favour of the speed rise, the BoE’s Financial Coverage Committee stated on Thursday it was responding to “materials information” in latest information that confirmed stronger inflationary pressures on the UK financial system.

The BoE hopes its decisive transfer — taking charges to their highest degree since 2008 — will display its willpower to deal with inflation.

“We all know that is laborious — many individuals with mortgages or loans will probably be understandably nervous about what this implies for them,” Bailey added.

“But when we don’t elevate charges now, it may very well be worse later. We’re dedicated to returning inflation to the two per cent goal and can make the selections mandatory to attain that.”

Jeremy Hunt stated the BoE “has my full help”. In a letter to Bailey, the chancellor stated the federal government would proceed to align its fiscal coverage with the financial institution’s harder financial coverage.

“It will require continued self-discipline on public spending and tax coverage,” he stated. Many Tory MPs have been pushing Hunt to chop taxes in his Autumn Assertion forward of a common election subsequent 12 months.

With its half-point improve — the thirteenth consecutive fee rise — the MPC defied market and most economists’ expectations of a quarter-point transfer.

It would reinforce market actions over the previous month which have prompted lenders to reprice fixed-rate mortgage offers in what has grow to be often called a mortgage “time bomb”.

Debtors on variable or tracker offers will in all probability see their month-to-month payments rise quickly. For a borrower with a £200,000 mortgage over 25 years on a typical variable fee of seven.99 per cent, their funds will rise by £67 a month — or £800 a 12 months — in accordance with dealer L&C Mortgages.

Bailey stated the choice to lift charges had been taken “in gentle of stronger resilience within the UK financial system and additional proof of persistence in inflation”.

Implementing such a big fee rise makes the BoE an outlier amongst different huge central banks. Final week, the US Federal Reserve skipped a fee improve for the primary time in additional than a 12 months, whereas the European Central Financial institution carried out a quarter-point rise.

A lift to sterling from Thursday’s resolution pale shortly. Having briefly risen to $1.2838, up 0.4 per cent towards the greenback, the forex traded down 0.2 per cent to $1.2746. UK authorities bond yields have been little modified, with the two-year yield flat at 5.04 per cent.

The MPC made little touch upon market expectations that rates of interest would climb to a peak of about 6 per cent by the top of the 12 months. As a substitute, the committee reiterated its dedication to tighten financial coverage additional “if there have been to be proof of extra persistent pressures”.

Within the minutes of the MPC assembly, the seven members who voted for the big improve pointed specifically to inflation information and labour market figures over the previous six weeks that had been considerably worse than they’d forecast in early Could.

Elevating the rate of interest to five per cent has already elevated borrowing prices to the next degree than the BoE recommended can be the height fee in its Could forecasts.

The 2 members who dissented from the bulk vote — Swati Dhingra and Silvana Tenreyro — voted to carry rates of interest at 4.5 per cent. They stated the consequences of the fee rises already carried out “have been nonetheless to return via”.

[ad_2]

Source link