[ad_1]

Obtain free African financial system updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the most recent African financial system information each morning.

In early June, Wale Edun, a detailed financial adviser of Nigeria’s new president, indicated that market members wouldn’t have lengthy to attend earlier than the nation’s change charges had been unified. However even he might have been shocked on the velocity of occasions.

On June 15, just some days after former central financial institution governor Godwin Emefiele was suspended and subsequently arrested, banks had been knowledgeable that they may bid for {dollars} at no matter change fee they needed.

The influence was speedy. The naira recorded its greatest fall in historical past. By the top of the day, the official fee had dropped to N600 to the greenback, a 23 per cent fall. Merchants stated the foreign money was altering palms at N750, roughly the identical because the parallel market fee — the unification that Edun had promised.

It’s too early to say what the brand new coverage will probably be, or whether or not a niche will reopen between charges. “There may be nonetheless important uncertainty about how the foreign exchange market will function,” says Razia Khan, chief economist at Commonplace Chartered Financial institution. “At this time’s value motion might level to a free float, although Nigeria has traditionally had a managed change fee.”

She predicts the naira will probably be buying and selling at N695 to the greenback by the top of the 12 months, earlier than appreciating barely.

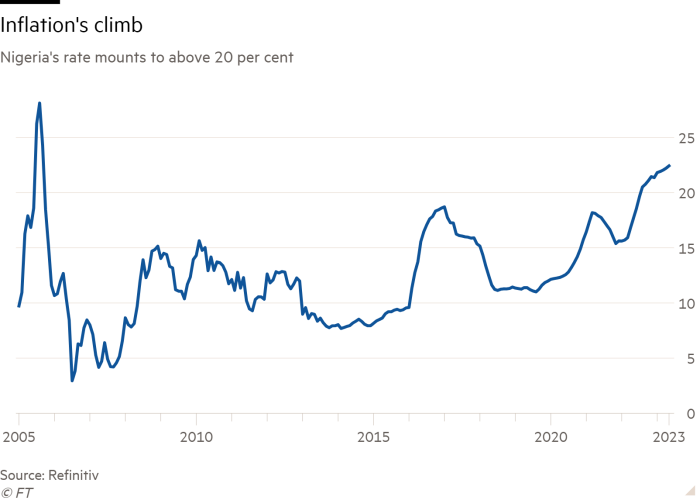

Neither is it sure what the influence will probably be on overseas reserves or inflation, which is already working at 22 per cent. If {dollars} are freely out there there might be, at the least initially, an enormous rush of trapped laborious foreign money leaving the nation. It’s lower than a 12 months, for instance, since Emirates suspended flights to Nigeria as a result of the airline couldn’t repatriate funds.

However, coupled with the scrapping of the gas subsidy, the measures undertaken within the first few weeks of Bola Tinubu’s presidency quantity to the largest reform bundle in a long time, in accordance with Dipo Salimonu, chief government of oil and gasoline firm Moteriba.

“This restoration of fiscal sanity — the boldness is unprecedented,” Salimonu says, including that it introduced an finish to the “evaluation paralysis” of earlier governments that knew they needed to take away distortions within the financial system however lacked the braveness to do it.

Nonetheless, Chidi Odinkalu of the Fletcher College of Legislation and Diplomacy at Tufts College warns that buyers shouldn’t get overly excited by the quick-fire adjustments of Tinubu’s first weeks in workplace. The earlier administration had made no finances provision for gas subsidy, he says, and reasonably compelled Tinubu’s hand.

“The explanation why Tinubu can’t play alongside is that the nation is bancrupt,” Odinkalu says. He could be extra impressed, he provides, if Tinubu — who has already bought clearance to nominate 20 advisers — stops the infamous excesses of presidency and devotes his efforts to tackling the issues of a rustic the place an estimated 90mn folks stay on lower than $1.90 a day. “Which means not funding the life-style of politicians however addressing the social wants of unusual Nigerians,” Odinkalu says.

After eight years by which per capita earnings has stood nonetheless at finest, the issues are deep certainly. On the social facet, a couple of third of Nigerians, in accordance with official figures, are unemployed, whereas authorities knowledge classifies 133mn folks as “multidimensionally poor”.

Years of neglect of the hospital and faculty programs imply Nigeria’s social indices are decrease than anticipated for a middle-income oil producer. Unicef estimates that 18.5mn Nigerian kids are out of college. Life expectancy is simply 53 years, in accordance with the World Financial institution, 9 years decrease than Niger, its a lot poorer neighbour.

The macroeconomic image has been no much less bleak. Tax income has been about 6 per cent of gross home product, in accordance with the OECD, one of many lowest ranges on this planet, although it might have nudged up barely lately. Nearly all federal income goes on paying for presidency and servicing debt, leaving virtually nothing to put money into Nigeria’s future.

Oil theft has been rampant, although there have been indicators of latest enchancment, with the huge Bonny oil terminal reporting just about no losses in Might. Oil income that has are available has largely gone on paying for the subsidy, which rises with the oil value, thus depriving the treasury of the profit.

The dual “shock remedy” as Salimonu calls it — of eradicating the subsidy and releasing up the change fee — might assist take care of these structural points within the medium time period.

The large hope is that the federal government can restore its funds. In addition to saving $10bn on subsidy, a weaker naira implies that each greenback earned from oil interprets into extra naira income.

Exports, which have been battered by an overvalued naira, ought to profit as Nigerian items develop into extra aggressive. International funding, which stalled underneath the earlier foreign money regime, might recuperate. Due to the artificially excessive naira, buyers say they had been reluctant to commit funds for worry of overpaying and nervous that rationing of {dollars} may hinder their means to repatriate income and dividends. Confidence might now construct and funding with it, say economists.

“Nigeria has such enormous potential for progress however has been held again by dangerous insurance policies,” says Abubakar Suleiman, chief government of Sterling Financial institution. He provides {that a} mixture of respectable authorities and a beneficial atmosphere might result in a interval of “hockey stick” progress — specifically, having been flat, instantly surging up.

For now, such a return to quick progress, and to the insurance policies wanted to enhance the lives of unusual Nigerians, is a chimera. However, for the primary time in years, persons are truly speaking about it.

[ad_2]