[ad_1]

Okay guys, image this: Your mother and father have labored exhausting their complete lives and have a pleasant little nest egg put aside to get pleasure from their retirement years.

Then someday, somebody calls or emails them from the IRS or someplace else tremendous official-sounding, and your mother and father share non-public monetary data with the thriller particular person on the opposite finish of the road. And earlier than it, a scammer has drained their checking account.

It feels like one thing that will by no means occur to your loved ones, proper? Nicely, sadly, issues like this occur each single day to hundreds of older Individuals. Elder fraud is large enterprise for cyber criminals. Individuals over 60 misplaced $1.7 billion—or greater than $18,000 per sufferer—to web scams in 2021 alone.1 Sure, billion. That’s horrible, you guys!

Right here’s the factor, people like your growing old mother and father and grandparents are at a a lot greater danger for being scammed or defrauded out of their cash as a result of they won’t be as tech saavy as younger folks.

Take our identity theft risk assessment.

However you possibly can assist defend your older family members from elder fraud and advertising ploys meant to steal their cash. Now, speaking to your loved ones about their cash isn’t at all times straightforward, however it actually is an act of affection while you do. So I’m going to stroll you thru the most typical scams on the aged so everyone’s on the identical web page.

10 Most Widespread Elder Fraud Scams

There’s straight-up fraud (like somebody stealing your grandma’s checking account info from her mailbox), and there’s additionally simply gross advertising methods geared toward seniors to get them to purchase issues they don’t want (like pay as you go funerals). We’re going to cowl all of it so you possibly can assist your older family members keep away from these traps.

1. Tech Assist Fraud

This one’s a biggie proper now. Scammers impersonate tech firms after which electronic mail or name saying you should pay to repair a phony tech problem or join a subscription for a pretend safety service. In addition they would possibly impersonate a customer support rep for a utility firm, a authorities company or a financial institution and let you know there’s an issue together with your account and so they want private data to repair it.

These scammers will strive any means doable: electronic mail, telephone, textual content, social media, snail mail, you identify it.

However bear in mind, no authorities company, together with the IRS, will ask for private info over the telephone. And typically, the most effective methods your older family members can defend themselves is to by no means give their private info to anybody except they know precisely who the particular person is and why they want it.

2. Stolen Tax Refunds

Tax identification theft is likely one of the prime scams the IRS offers with annually. Scammers steal somebody’s Social Security quantity, file taxes utilizing the stolen identity, after which steal the tax refund. Yuck. These individuals are decrease than low. They’ll fortunately steal your mother and father’ refund however actually gained’t be stepping in to assist in the event that they owe cash!

One of many perfect methods to forestall tax identification theft is to file your taxes as early as doable. Encourage—and even assist—your older family members to file as quickly as they will. The earlier they file and get their refund, the earlier they’re not a goal.

3. Mail, E mail and Cellphone Fraud

A part of the explanation the aged are a goal for scammers is as a result of they are often simpler to succeed in. Whereas youthful generations head off to work every day or are tied up with different commitments on nights and weekends, older people simply are likely to have a bit of extra time on their arms.

Meaning they could be dwelling in the course of the day to reply a robocall or chat with a smooth-talking telephone scammer. And these telephone scammers are good. They sound official and sometimes use worry (“It’s not secure to go with out our medical protection”) and urgency (“We gained’t supply protection at this fee ever once more”) to become older people to present out private or monetary info.

The identical goes for electronic mail and mail fraud. Fraudsters are banking on older people not being as tech savvy and can use electronic mail as a technique to get entry to delicate info. Or scammers will ship “official” paperwork within the mail that appears legit however isn’t in any respect.

A superb rule of thumb right here (and it would sound like a no brainer by now) is: Don’t give anybody private info over the telephone, over electronic mail, in a mail-in envelope—nothing—in the event you don’t know what firm they’re with and why they’re requesting this info. It’s that easy. And if a request is definitely for actual, then they need to don’t have any drawback with you calling customer support or your private account consultant to verify their request.

4. Well being Care Fraud

It is sensible that as folks age, their well being care wants go up. This makes the aged a chief goal for well being care fraud.

Give it some thought like this: In the event you’re younger and wholesome, you’re most likely not interacting that a lot with medical doctors, your medical health insurance firm, or different well being care-related companies. However in the event you’re older or have a whole lot of well being challenges, your private, monetary and medical info is getting handed round rather a lot. And sadly, meaning an elevated probability of your older family members’ info falling into the mistaken arms.

Hold a detailed eye on statements, insurance coverage claims and medical payments. See a service mother or dad didn’t get? Name their supplier and medical health insurance firm ASAP to report the problem.

5. Reverse Mortgages

Some individuals are out to steal identities to allow them to nab your older family members’ cash. However extra typically than that, there are only a ton of sleazy companies on the market that aren’t technically doing something unlawful, however they’re more than pleased to con your family members out of money. And reverse mortgage lenders are the proper instance.

Okay, initially, on the subject of reverse mortgages, the identify says all of it. You’re getting into reverse! And howdy, don’t we need to be going ahead? Sure! So, reverse mortgages are an enormous, fats N-O.

With a reverse mortgage, you’re getting a mortgage that makes use of your house fairness to supply the cash for the mortgage itself. Reverse mortgages are solely accessible to folks 62 and older. (Proper out of the gate, it is a setup for seniors.) It’s like this: As an alternative of making funds on a house mortgage such as you would with a conventional mortgage, you’re taking funds out of the fairness you’ve constructed. The financial institution is lending you again the cash you’ve already put into your house and charging you curiosity. See? Large, fats N-O.

Not solely are reverse mortgages a black gap of charges, however your older family members may additionally find yourself owing extra on their dwelling than it’s value, or worse, dropping their dwelling altogether.

6. Gold and Silver Scams

These gold and silver gross sales pitches you see each 10 seconds on TV are designed to prey on worry that the economic system will crash, and also you’ll want gold to outlive. Or they’ll say gold is the sure-fire technique to make a fortune.

The folks hawking commodities are backside feeders. Many will let you know they purchased gold or silver for you that they’ll retailer in a secure place till you want it. However actually, they’re simply taking your cash.2

However even in the event you discover a respected treasured metals vendor, there’s no purpose—zero—to purchase gold or silver. It’s a horrible funding.

Okay, say a zombie apocalypse occurs and the economic system goes stomach up. In fact zombies don’t carry money, so wouldn’t all of us be bartering for shelter and meals, not buying and selling in little gold bars? I imply, that’s what I might be doing! Assist your older family members by encouraging them to speculate their cash in mutual funds as a substitute.

7. Unintentional Loss of life Insurance coverage

Right here’s some fast actual discuss. You solely die as soon as. That’s proper, it’s loopy however true. Anybody attempting to promote your older family members on unintended loss of life insurance coverage is principally attempting to persuade you of double-death. Sorry, that’s not a factor.

You don’t want unintended loss of life insurance coverage, which pays in the event you die in an accident. How you die doesn’t change your loved ones’s monetary wants. An awesome term life policy will meet their wants. Your family members are losing cash for double protection in the event that they purchase unintended loss of life insurance coverage.

8. Pay as you go Funerals

Sure, making ready for future bills is at all times a good suggestion. However making ready and prepaying are completely various things.

It’s regular to suppose extra about loss of life (and the bills that include it) as you become older. So it’s not completely loopy in case your mother and father or grandparents are serious about prepaying for his or her funeral. However prepaying for funerals is definitely a waste of funding alternative.

Assist your older family members skip the prepaid funeral. (It’s a gross sales gimmick for folks within the funeral biz to get money available now.) Then set them up with a qualified investment professional who will educate them the right way to make investments and develop their cash. When the time comes for a funeral, there might be greater than sufficient for the funeral after which some.

9. Most cancers Insurance coverage

Illness-specific protection simply isn’t a factor your family members want. Once more, it’s a means for companies to money in on worry, promoting your loved ones one thing you most likely have already got protection for someplace else. Give it some thought—do you might have coronary heart assault insurance coverage? Stroke insurance coverage? Damaged arm insurance coverage? No. As a result of most insurance coverage insurance policies already cowl these varieties of occasions. And it’s the identical with most cancers.

In case your older cherished one’s insurance coverage coverage doesn’t cowl most cancers care, I nonetheless don’t suggest getting cancer insurance. As an alternative, get with one among our health insurance experts who will help your family members decide the most effective coverage for his or her wants. Don’t go shopping for specialty protection although!

10. Different Household Members

Let’s face it, nearly each household’s received a wild card (or two, or three). Perhaps mother and pa flip a blind eye to your 40-year-old brother’s can’t-keep-a-job antics and nonetheless pay his hire for him. Or grandma and grandpa have been bankrolling your Aunt Sally for many years. It’s actually powerful on the subject of household to maintain a transparent head.

However it’s additionally actually vital that your loved ones’s wild card doesn’t derail mother or grandma’s lifetime of working and saving. There must be no less than one particular person within the household protecting a detailed eye on issues and serving to your older family members make vital monetary choices with their head as a substitute of their coronary heart.

Assist your older family members identify a financial power of attorney. That is normally completed when individuals are creating a will, however you are able to do it at any time. A monetary energy of lawyer is a doc that enables somebody to generate profits choices in your family members’ behalf within the occasion they will’t make these choices for themselves.

Say grandma’s been in a automotive accident and is in a coma. Her monetary energy of lawyer is legally in a position to maintain her cash issues, like paying the mortgage and hospital payments when she will’t. It’s not a cushty dialog to have, I do know. However when push involves shove, you desire a dependable particular person in that place.

How Can You Inform if You’re Being Scammed?

New elder scams pop up on a regular basis, however most have some issues in frequent. So, alarm bells ought to go off in the event you or your beloved encounters a few of these scammy traits:

- An electronic mail that seems to be from an actual group, however has a fishy electronic mail deal with

- A notification that you just gained a contest you didn’t enter

- A name or electronic mail from the IRS that requires private data

- A name or electronic mail that asks you to pay a price or high quality with a present card or wire switch

- A caller who pressures you to make a fee or give them private data

What Do You Do if You’ve Been Scammed?

In the event you or a cherished one has been a sufferer of fraud, contact your financial institution instantly to report any suspicious transactions. It’s additionally a good suggestion to name the Nationwide Elder Fraud Hotline (1-833-FRAUD-11) to report the crime.

What Are the Emotional Results of Elder Fraud?

Getting scammed could make your beloved really feel embarrassed, unhappy and anxious. Don’t allow them to beat themselves up for getting tricked. Stroll with them by way of their feelings, and take a look at your greatest to assist them see the sunshine on the finish of the tunnel.

The Greatest Strategy to Defend Older Beloved Ones From Elder Fraud

Speaking about elder fraud and scams together with your family members is so vital. Is it enjoyable? No, normally not. Is it a technique to present them how a lot you care? Sure, 100%.

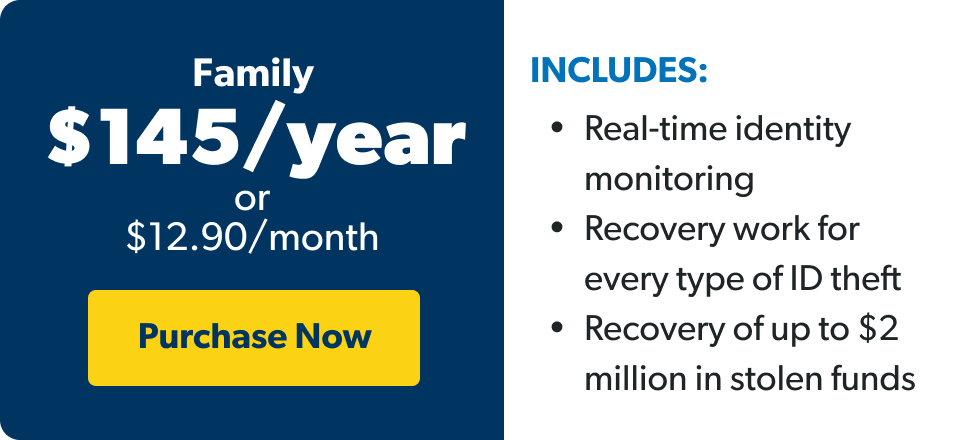

One of the vital vital steps you possibly can take to guard your mother and father or grandparents from completely different sorts of elder fraud is to set them up with identity theft protection. I like to recommend working with RamseyTrusted supplier Zander Insurance coverage. With identification theft safety in place they will concentrate on what they’ve spent a lifetime working to get pleasure from—retirement, holidays, time with grandkids and a lot extra. You possibly can assist them get and keep protected in the present day!

Steadily Requested Questions

How do you determine elder fraud?

It’s not at all times straightforward to know if your beloved has been a sufferer of elder fraud. And actually, scammers typically get the most effective of us. So, having identification theft safety is essential.

However you would possibly spot another indicators that one thing is amiss—like if grandma abruptly doesn’t have cash to pay her payments as a result of her checking account is brief. Don’t be afraid to ask your family members questions on their funds or go over their finances with them. You might discover out they’ve been victimized.

How frequent is elder fraud?

In 2021, greater than 92,000 folks over the age of 60 had been victims of on-line scams. This was a 74% improve from 2020.3 This doesn’t even embrace the hundreds of fraud instances that go unreported annually.

What sort of fraud is the fastest-growing type of elder abuse?

Tech help fraud was the most typical sort of fraud amongst victims over age 60 in 2021. One of these fraud, which normally has victims pay for nonexistent tech or safety companies, resulted in $238 million in losses.4

[ad_2]

Source link