[ad_1]

Investing in actual property was as soon as one thing solely open to individuals with vital means.

Luckily, crowdfunding platforms like Fundrise have leveled the taking part in subject by permitting virtually anybody so as to add actual property investments to their portfolio.

If you wish to develop your passive earnings, our Fundrise assessment may also help you identify in the event that they’re a match in your wants.

What’s Fundrise?

Fundrise is a real estate crowdfunding platform that started in 2012. Now one of the well-known gamers within the area, the corporate permits non-accredited buyers to get into actual property with as little as $10.

The Fundrise app removes the necessity to bodily handle properties in addition to the necessity to have vital sums of cash to pursue actual property investing.

This vastly expands the alternatives for individuals to take a position.

Over the previous decade, the platform has carried out over $5 billion in transactions and has paid out over $100 million of dividends to buyers.

How Does Fundrise Work?

If you open an account, you select considered one of 5 choices. So as of funding minimums, these embody:

- Starter

- Primary

- Core

- Superior

- Premium

No matter your choice, your cash is positioned into an actual property funding belief (REIT).

This eREIT homes quite a lot of properties, just like how an ETF holds totally different shares.

Funding properties can embody any of the next:

- Buying facilities

- Combined-use properties (business and residential tenants in a single property)

- Multi-family flats

- Single-family housing

You don’t spend money on particular person properties. As a substitute, you could have a various portfolio of various properties.

The eREIT isn’t publicly traded, although they do can help you liquidate your holdings as soon as 1 / 4 offered you give a 30-day discover.

In the event you make investments extra in your account, extra properties develop into obtainable in your funding portfolio.

How A lot Does the Platform Price?

Property administration holds many individuals again from investing in actual property since they lack the abilities to handle a property or the funds essential to take action.

Fundrise manages that for buyers, leading to a price to make use of the platform. Additionally they present a wealth of academic supplies and incur bills from buying properties.

There are two funding charges Fundrise costs for utilizing their on-line actual property crowdfunding platform. These embody an funding advisory payment and an asset administration payment.

Funding Advisory Payment

It’s necessary to grasp the charges with any funding alternative. Fortunately, Fundrise is clear in what they cost buyers to make use of their platform.

The funding advisory payment is a nominal 0.15 % annual payment. For instance, should you make investments $1,000, you may anticipate to pay $15 in yearly charges.

Asset Administration Payment

All account holders pay an asset administration payment of as much as 0.85 % yearly. In the event you make investments $1,000, it is best to anticipate to pay $85 in charges a 12 months.

Fundrise is aggressive inside the crowdfunding actual property area and is comparatively low price.

Fundrise Options

Every on-line investing platform operates a bit of in a different way. Right here’s what units Fundrise aside from its rivals.

Low Minimal Funding Necessities

Fundrise has the bottom minimal requirement to open an account within the trade. For simply $10, you may open an account and get began in non-public actual property investing.

Many different investing platforms require not less than $500. Whereas that does decrease the barrier to entry for individuals to spend money on actual property, it might nonetheless maintain some buyers again.

Learn our information on the very best ways to start investing with $500 or less if you wish to determine different choices.

You Can Put money into an IRA

Investing in residential actual property is a unbelievable option to diversify your portfolio. Nevertheless, features can influence your taxable state of affairs.

Fundrise alleviates that by permitting customers to deal with investments in a Conventional IRA. This additionally helps you shelter features from taxes till you withdraw them for retirement.

There’s a $125 annual custodial payment to concentrate on for IRAs, so maintain that in thoughts as you take into account your choices. Learn our information on the highest locations to open a Roth IRA on-line if you wish to keep away from the payment.

Additionally they enable belief accounts along with particular person and joint accounts.

You Don’t Have to Be Accredited

Investing in residential or business actual property used to at all times require you to be an accredited investor.

An accredited investor is somebody who meets one of many following three necessities:

- Earned not less than $200,000 (or $300,000 if married) a 12 months for the earlier two years

- Has a net worth of not less than $1 million

- Is Collection 7, 65, or 82 licensed, in good standing

You don’t want to fulfill these necessities to open an account with Fundrise. They do provide alternatives for accredited buyers of their Premium account degree, however that’s not required to begin investing.

Wonderful Diversification

You don’t usually spend money on a single-family housing unit with the platform. Every eREIT consists of quite a lot of funding properties, permitting for fast diversification.

In the event you mix this with investing in stocks, you may enhance your diversification and additional assist your complete portfolio higher climate potential storms.

Fundrise frequently provides new properties to its platform to extend your funding choices.

Debt and Fairness Investments

Two reliable methods to spend money on actual property embody debt and fairness. Debt means that you can lend cash to property homeowners.

Fairness helps you to personal a stake in properties. Every of those funding kinds has its personal goal, and you’ll select both with Fundrise to additional improve your investing.

Targets-Primarily based Investing

In the event you open an account with not less than $1,000, you may make the most of their goals-based funding method. This opens up extra funding alternatives for customers.

It additionally means that you can choose a particular technique. These embody:

In the event you’re unsure which technique it is best to select, they supply a small questionnaire that can assist you decide which is finest in your state of affairs.

What are the Minimal Necessities to Make investments at Fundrise?

Till lately, you wanted not less than $500 to open an account with Fundrise. It’s now potential to take a position with simply $10.

This allows you to spend money on their Starter portfolio and has quite a few choices for a diversified portfolio of eREITs to select from.

The Starter portfolio is an equal mixture of earnings and growth-related investments.

What’s the Common Charge of Return on Fundrise?

Funding returns are an integral part of growing wealth. Fundrise has had a wholesome charge of return over the previous a number of years.

Right here is how they’ve carried out since 2014, after charges:

- 2014: 12.25 %

- 2015: 12.42 %

- 2016: 8.76 %

- 2017: 11.44 %

- 2018: 9.11 %

- 2019: 9.47 %

- 2020: 7.4 %

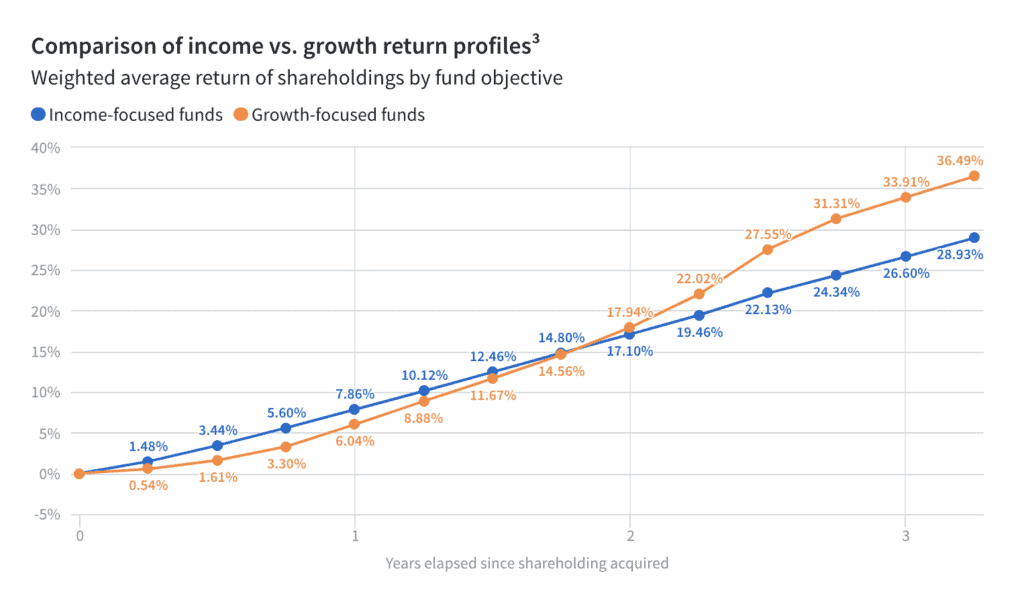

Relying on should you select earnings vs. progress portfolios, you’ll expertise totally different features between the 2.

Right here’s how the 2 have carried out since inception.

This compares nicely in opposition to the inventory market. The S&P 500 has had an 8% average historical return since 1958, so Fundrise festivals nicely as an alternative to stocks for wealth creation.

The way to Redeem Your Fundrise Shares

You may solely liquidate your Fundrise shares by submitting a web-based request not less than 15 days earlier than the calendar quarter ends. When the redemption window opens, they’ll start promoting your shares.

It might probably take a number of weeks for the corporate to switch the money into your checking account.

The platform usually costs an early redemption payment for shares you’ve owned for lower than 5 years.

Right here is the early redemption payment relying on how lengthy you maintain them:

- 90 days as much as three years: Three %

- Three years to 4 years: Two %

- 4 years to 5 years: One %

- Longer than 5 years: Zero %

In the event you personal the shares for lower than 90 days, you may promote them inside the introductory interval and obtain your preliminary buy value again.

Who Ought to Use the Platform?

Not sure should you ought to make investments with Fundrise? Right here’s who ought to use the platform.

Lengthy-term Buyers

Until you’re a flipper, investing in actual property is usually not a match for short-term buyers. Residential or business actual property investing is a wonderful option to develop your wealth, however it takes time.

Just like the inventory market, actual property experiences ups and downs. Threat is inherent, as is alternative. However, it doesn’t occur in a single day.

When you’ve got a long-term view, Fundrise is usually a good addition to your funding portfolio.

Newer Buyers

All of us have to begin someplace, and Fundrise is a wonderful approach for brand spanking new buyers to invest in real estate with little money.

Not solely are you able to begin with as little as $10, however additionally they have an intensive library of academic assets to get began.

They even vet all properties earlier than making them obtainable, so that you don’t have to decide on them by yourself.

Who Shouldn’t Use Fundrise?

Not all investing platforms work for everybody. Right here’s who ought to look elsewhere for funding alternatives.

Individuals Who’re Money Strapped

Investing, whatever the car, is an effective way to develop your wealth. Nevertheless, actual property investing isn’t a short-term recreation.

It usually takes a number of years for returns to materialize, tying up your cash. When you’ve got minimal financial savings, you could need to wait till you enhance your financial savings.

The inventory market could possibly be a greater choice, however you’ll nonetheless need to have some emergency financial savings earlier than starting.

Individuals Who Keep away from Threat

Threat is inevitable with investing. You discover it within the inventory market, and it’s simply as prevalent in actual property.

In the event you’re very risk-averse, you could need to maintain off on beginning a Fundrise portfolio. As a substitute, educate your self on the fundamentals of investing in actual property, then you may take into account making an attempt the platform.

Professionals and Cons

There’s lots to think about when selecting an funding platform. Right here’s what to bear in mind about Fundrise:

Professionals:

- Open an account with as little as $10

- 90-day introductory interval

- Put money into each business and residential actual property

- Terrific option to develop passive earnings

- Don’t should be an accredited investor to make use of the platform

- Plenty of academic assets

- Put money into IRAs

Cons:

- Investments are illiquid

- Dividend distributions are taxed as unusual earnings

- Can’t hand-select funding properties

General, Fundrise is a reliable alternative for novices to spend money on actual property.

How Does Fundrise Evaluate In opposition to the Competitors?

Fundrise isn’t the one crowdfunded actual property platform within the area. Listed here are a number of rivals that fare nicely in opposition to them.

DiversyFund

DiversyFund is a high competitor to Fundrise. The platform doesn’t require you to be an accredited investor, and you’ll open an account with as little as $500.

It makes use of an eREIT mannequin for funding selections. DiversyFund additionally invests in multi-family properties, so it’s a unbelievable alternative for residential actual property.

The perfect half is that DiversyFund doesn’t cost any charges to make use of the service.

Learn our review of the platform to be taught extra.

Roofstock

Roofstock is a bit distinctive compared to Fundrise. As a substitute of eREITs, you spend money on turnkey rental properties with Roofstock.

You should purchase and promote properties on the platform, and so they handle your entire course of for you.

There’s no minimal to begin, however it’s essential to have a 20 % down fee to buy properties. It’s open to each accredited and non-accredited buyers.

Charges range relying on should you’re shopping for or promoting. Nevertheless, they’re aggressive.

Learn our review of Roofstock to be taught extra.

CrowdStreet

CrowdStreet is an appropriate different for accredited buyers with not less than $25,000 to take a position. The perk of CrowdStreet is you get to personally choose funding properties.

Business actual property is the distinguished funding choice on CrowdStreet. That’s not one thing obtainable on different platforms.

The platform is free to make use of, however anticipate a administration payment of 0.50 to 1.00 %. Like Fundrise, that is aggressive inside the market.

Fundrise Evaluation

-

Pricing and Charges

-

Instruments

-

Ease of Use

-

Buyer Service

-

Funding Choices

Fundrise Evaluation

Fundrise is a number one crowdfunded actual property investing platform that lets individuals spend money on actual property with as little as $10.

Professionals

✔️ You solely want $10 to begin investing ✔️ Open to non-accredited buyers ✔️ Usually pays quarterly distributions ✔️ Number of academic assets for brand spanking new buyers ✔️ The platform vets all properties for funding potential

Cons

❌ Is extremely illiquid ❌ It’s essential to pay taxes on distributions if not utilizing a retirement account ❌ Unable to spend money on particular person properties

Abstract

Fundrise is among the best methods to begin investing in actual property. Nevertheless, it is best to solely make investments money you don’t want for not less than 5 years since business actual property is a long-term funding.

If you wish to spend money on actual property and have restricted funds, you are able to do so with as little as $10.

What are your ideas on investing in actual property? How are you at the moment working to develop your wealth?

Associated Posts

[ad_2]

Source link