[ad_1]

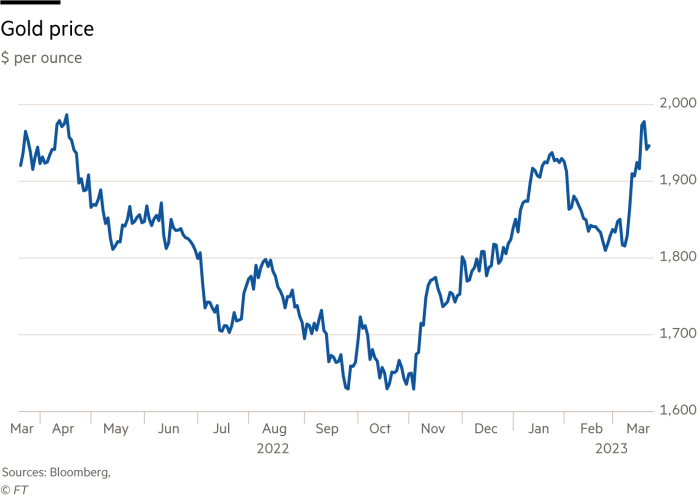

Merchants quip that one of many few issues to rally throughout bear intervals is volatility. Add gold to the listing. Its worth has leapt about 7 per cent thus far in March to one-year highs of slightly below $2,000 per ounce. With buyers dumping shares and company bonds, cash has flowed into each authorities bonds and gold.

Curiosity within the yellow steel appears odd, on condition that worth inflation within the US and elsewhere might properly have peaked. And gold affords no revenue to buyers, solely capital good points and losses. In bodily type, its storage presents downside. So what explains the renewal of curiosity?

Nicely, gold does supply a secure haven, notably for retail buyers nervous that their cash will not be secure in a financial institution. Bars, cash and jewelry make up the majority of gold demand, about 72 per cent final yr. These proportions have modified little in years.

Over the previous yr or so, a key supply of demand has been central financial institution shopping for. Between 2020 and 2022 central financial institution purchases went up 4.5 instances. Within the last quarter of 2022 the main consumers have been China and Turkey.

Nations corresponding to China, the world’s largest producer of gold, Russia and Turkey have aimed to bolster their overseas alternate reserves. However in addition they have a want to diversify from any dependency on the world’s hottest reserve forex, the US greenback.

Funding flows into bodily gold alternate traded funds can swing costs quick time period. These ETFs are pooled open-ended funding funds divided into simply traded, usually low-cost items. Just lately, inflows into these ETFs jumped to their highest weekly stage since March final yr at 21.4mn tonnes. Virtually all of that was in North America, based on World Gold Council knowledge.

Gold seems to have attracted consumers exactly as a result of inflation might decelerate and international financial development may sluggish. That ought to imply presently excessive actual rates of interest — these adjusted for inflation — will begin falling. Bulls consider constructive actual charges kill off demand for gold, to not point out inflation itself.

This month, two-year actual US Treasury yields have dropped under 1.4 per cent, the bottom in six months. That trajectory hints that US rates of interest might have peaked for this yr at the least. That will additionally start to take some stress off any indebted corporations borrowing in {dollars}, on the very least.

Greater gold costs is sweet information for mining bankers. A spurt in gold costs late final yr triggered dealmaking. In December, Agnico Eagle and Pan American gazumped South Africa’s Gold Fields to purchase Canadian gold producer Yamana for $4.8bn. In February, US gold miner Newmont confirmed its curiosity in a $17bn bid for smaller Australian rival Newcrest.

Extra offers ought to comply with if gold costs proceed ascending. With central banks, particularly the Fed, more likely to rethink the trajectory of charge will increase, gold’s worth ought to stay properly bid this yr.

Maserati: tuning wanted for listings race

Are you able to hear a faint roar within the distance? It could be the sound of Maserati heading to the general public markets. The Italian luxurious sports activities automotive maker remains to be miles from that vacation spot. However it’s already a separate enterprise inside carmaker Stellantis.

With Porsche up virtually 40 per cent since its float final yr and Ferrari’s valuation thundering forward, the market is beginning to do a spot of window buying.

Warning applies to funding in charismatic companies corresponding to luxurious carmakers and soccer golf equipment. It’s straightforward to get carried away. Lex as soon as valued Aston Martin Lagonda shares at £10. They’re now price simply over £2.

We now have subsequently subjected Maserati to sceptical evaluation properly earlier than any IPO and the breathless advertising that goes with that.

Maserati is halfway by a strategic U-turn. It’s in search of to give attention to income reasonably than gross sales. It has spruced up its vary, including the MC20 mannequin with a £200,000 price ticket. Revenues are rising once more after just a few difficult years, up 15 per cent in 2022 to €2.3bn.

Working revenue margins have additionally recovered, to eight.7 per cent in 2022. It’s concentrating on 15 per cent by 2024 and 20 per cent long term. No itemizing is probably going earlier than then.

In the present day, Maserati is miles behind Porsche and Ferrari. The typical promoting worth of its automobiles is lower than €100,000, based on Bernstein evaluation — not that completely different from pricier Mercedes or BMW automobiles. Ferraris can price €500,000 or extra. Porsche — whose fashions run a large gamut — has larger volumes to lend a serving to hand.

Maserati might discover it troublesome to go face to face with tremendous sports activities automotive manufacturers. However it’s charting a unique route. Maserati has pledged to carry out an electrical model of all its fashions by 2025, and to go totally electrical by 2030. That may be a canny transfer. It ought to assist Maserati appeal to a unique kind of buyer, not least amongst eco-conscious tech entrepreneurs.

How a lot would possibly Maserati be price? On as we speak’s paltry margin, it could not deserve a lot of a premium to the likes of BMW. The enterprise worth of the latter — which totals market capitalisation and web debt — is round one instances final yr’s gross sales. However the group does have room to lift profitability because it focuses on pricier fashions. If one — generously — utilized Porsche’s valuation of two.6 instances final yr’s gross sales, that will elevate Maserati’s enterprise worth to €6bn.

In fact, the market would wish to see continued proof of a well-executed turnround earlier than it gave the carmaker something like that type of accolade. Stellantis is true to maintain Maserati within the storage till its engines are firing on all cylinders once more.

Lexfeedback@ft.com

Lex is the FT’s concise each day funding column. Professional writers in 4 international monetary centres present knowledgeable, well timed opinions on capital traits and large companies. Click on to discover

[ad_2]

Source link