[ad_1]

By one measure a minimum of, the US inventory market has slipped into unfavourable territory for the reason that begin of the 12 months.

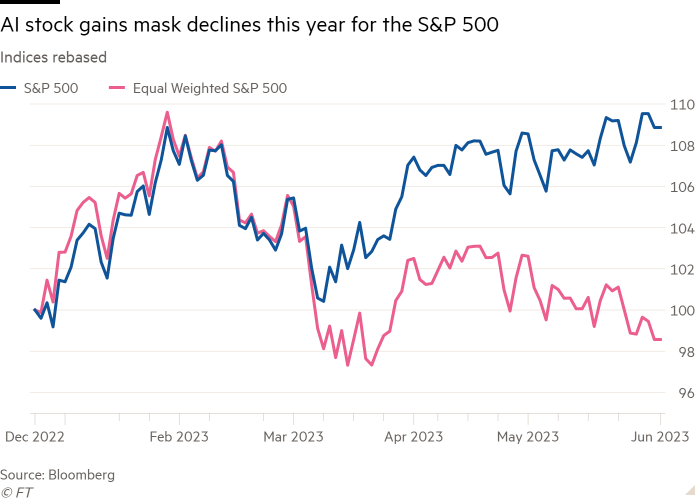

The S&P 500 Equal Weighted index, which supplies equal worth to every inventory, has fallen 0.35 per cent since January, information from Refinitiv exhibits. That stands in stark distinction to the 9.5 per cent acquire for the benchmark S&P 500, the place firms with bigger market capitalisations account for a bigger share of the index.

Though greater gaps have beforehand opened up between the 2 measures of the identical inventory market’s efficiency, “there has by no means been such a robust unfavourable divergence”, stated Manfred Hübner, managing director at analysis home Sentix.

Quickly rising demand for the very largest shares explains the distinction. Using the AI wave, Nvidia, Microsoft, Alphabet, Apple, Amazon and Meta have added a complete of $3.1tn in market cap phrases in 2023, information from AJ Bell present. Ignoring their contribution, the S&P 500 has shed $286bn up to now this 12 months.

Prime quality, low-risk tech shares can also have begun to commerce like conventional haven property comparable to US Treasuries and the greenback, “each of that are beset by doubt”, argued Erik Knutzen, chief funding officer multi-asset class at Neuberger Berman. “Maybe market individuals are extra involved than they give the impression of being,” he stated.

Stripping out risky meals and power costs, core inflation stays stubbornly sticky, suggesting the US Federal Reserve might need to proceed elevating rates of interest or maintain them “larger for longer” to engineer a recession within the subsequent 12 months.

Simply 12 per cent of S&P 500 firms are outperforming the index on a 60-day trailing foundation, the bottom degree since a minimum of 1993, in accordance with Liz Ann Sonders, chief funding strategist at Charles Schwab.

Quoting actor Michael Caine, Sonders stated the surprisingly buoyant S&P 500 now resembles a duck: “calm on the floor however paddling just like the dickens beneath.”

Bull runs within the late Nineteen Nineties and between 2019 and 2021 had been equally pushed by a handful of the most important firms, stated Thomas Mathews, markets economist at Capital Economics.

The latter bull run slowly broadened out as buyers grew to become extra assured concerning the state of the US financial system post-pandemic, solely to tail off as rates of interest started to rise in 2022. Inventory markets reversed sharply when the dotcom bubble burst.

“If we’re proper that development will falter later this 12 months . . . we suspect some ache is on the best way for the S&P 500, and world equities typically,” stated Mathews.

[ad_2]

Source link