[ad_1]

Medical insurance is difficult stuff—premiums, deductibles, coinsurance, bronze, silver, gold plans (what is that this, the Olympics?!). Then throw in HSAs, HMOs, PPOs . . . what?! Attempting to determine it out could be powerful.

If all these phrases have you ever scratching your head, questioning how medical health insurance works, don’t fear. We’ve bought your again.

We’ll break down precisely how medical health insurance works. As a result of it’s a heck of lots simpler to get the best protection for those who really perceive it.

What Is Well being Insurance coverage?

Medical insurance is a strategy to pay for the prices of well being care by transferring danger to an insurance coverage firm. When you pay your deductible, the insurance coverage firm will cowl some or your whole care. This manner you gained’t end up drowning in medical payments and going through monetary break.

Whereas there are a boatload of various sorts of plans, there are actually solely two foremost sorts of medical health insurance—non-public and public. Each plan falls beneath one in all these.

Non-public protection is the sort you get by means of your employer, union or the armed forces. You may as well purchase it by yourself by means of the federal government’s market—Healthcare.gov—however solely throughout a sure time of yr known as open enrollment.

![]()

Do you’ve got the best medical health insurance protection? Join with a Trusted professional in the present day.

Public insurance coverage is offered by the federal government. Assume Medicare (for these 65 years or older), Medicaid (for low-income households) or care from the Division of Veterans Affairs.

Fundamental Well being Insurance coverage Phrases

Since there’s virtually a medical health insurance time period for every letter of the alphabet, listed here are some definitions that can assist you to higher perceive how medical health insurance works.

Your premium is the quantity you pay month-to-month (generally yearly) for protection.

Your deductible is the quantity you must hand over earlier than your insurance coverage cash kicks in. For instance, in case your deductible is $3,000, you’d must pay $3,000 for care earlier than your insurance coverage firm ponies up.

Your most out-of-pocket prices are the max of what you’ll pay in a given yr. So in case your plan’s most out-of-pocket prices are $6,000, when you pay that quantity, your insurance coverage pays all the pieces over that in the remainder of the yr.

Coinsurance is expounded to the utmost out-of-pocket prices. It’s a strategy to cut up the prices of medical companies together with your insurance coverage provider after you’ve hit your deductible.

Your copay is a set quantity you pay for issues like physician’s visits or different companies. It applies even earlier than you hit your deductible. For example, in case your copay is $20 to see a physician about that bug that flew in your ear, and now you’re listening to a relentless buzzing noise, you’ll solely pay $20. The insurance coverage provider will cowl the remainder. Good!

Coated prices are companies your insurance coverage firm will assist pay for. Assume physician’s visits, assessments, preventative care, and many others.

And that is solely the tip of the medical health insurance iceberg (loopy, proper?). There’s a ton of different phrases—HMO, PPO, HDHP, HRA and HSA, simply to call a number of. We gained’t get into all of them right here (you’re welcome), however you may undoubtedly dig into these plans subsequent time you’re on the lookout for some mild seaside studying . . .

Who Wants Well being Insurance coverage?

Everybody. When you’re alive on Planet Earth, you want some type of medical health insurance. It’s the easiest way to guard your self from the monetary issues that may simply occur resulting from sudden medical occasions. Nobody’s completely resistant to critical medical conditions. That’s why medical health insurance is a should.

You and your loved ones want that further layer of safety. It’s like retaining an umbrella within the automotive for wet days. Most instances you don’t want it. However when it does rain, it actually turns out to be useful. Actually, medical payments are the primary trigger for chapter in America. It’s very easy to rack up lots of of 1000’s of {dollars} in medical bills.

Even for those who’re unemployed, you continue to have choices like COBRA insurance coverage to be sure you’re lined. And for those who’re self-employed, you gained’t have the ability to get an employer plan, however you may nonetheless purchase protection by yourself.

The underside line? No matter your state of affairs, you want medical health insurance. Interval. Full cease.

How Does Well being Insurance coverage Work?

So, how does medical health insurance work?

First, you pay a month-to-month premium to your insurance coverage firm. They then conform to pay for any medical prices you would possibly want all year long—however solely after you pay your deductible. So it doesn’t matter what, you’re going to have some out-of-pocket prices.

If you wish to pay fewer out-of-pocket prices, you may go along with a decrease deductible—however you’ll pay a better month-to-month premium. And vice versa, if you wish to pay a decrease premium—much less monthly—you may go for a better deductible.

When you hit that deductible, you may file a declare. If it’s lined, your insurer will cowl the prices of the care. In the event that they deny your declare, you may enchantment it. Worst-case situation, you’ll must cowl the prices by yourself.

One other factor to remember is that, relying in your plan, you might be restricted to a sure community of suppliers. Some plans don’t allow you to merely use any physician you need. You need to work within a longtime community.

What Does Well being Insurance coverage Cowl?

Medical insurance helps cowl a lot of the prices of medical care. Issues like prescribed drugs, hospital stays, emergency care, preventive and non-preventive care, common physician’s visits, and different medical companies like X-rays, CT scans or assembly with specialists (relying in your plan). And do not forget that a few of this care solely kicks in after you’ve met your deductible.

Due to adjustments from the Inexpensive Care Act (ACA), medical health insurance has to cowl a minimum of these 10 important companies:

- Preventive care—like routine checkups for you or your youngsters

- Hospitalization

- Lab assessments—suppose blood work

- Being pregnant, maternity and new child take care of that new baby

- Emergency room care—relying on the circumstances, your insurance coverage would possibly nonetheless cowl this if it’s out of community.

- Psychological well being, substance-abuse companies

- Rehabilitation companies

- Outpatient care—service you get once you don’t have to remain on the hospital

- Pediatric companies (together with oral and imaginative and prescient care)

- Prescribed drugs1

One other change because of the ACA is that insurance coverage firms are not allowed to disclaim you primarily based on preexisting situations. So in case you have diabetes, you’ll now have the ability to get lined.

What Does Well being Insurance coverage Not Cowl?

There’s at all times a catch, isn’t there? Medical insurance isn’t a magic bullet that addresses each potential factor that would go incorrect. There are some issues it normally doesn’t cowl.

Listed below are a number of examples:

- Cosmetic surgery—Sorry, your insurance coverage gained’t cowl that nostril job you’ve at all times dreamed of.

- Different or homeopathic drugs like acupuncture, therapeutic massage or naturopaths.

- Experimental stuff—If there’s new expertise on the market that your physician is recommending, it in all probability gained’t be one thing your provider will cowl. Simply test upfront to see if it’s an possibility.

- Lengthy-term care—A giant false impression about medical health insurance is that it covers long-term care. It doesn’t. And this delusion may cause actual issues since long-term care is so expensive.

- Elective surgical procedure—These are issues you may want executed however your physician can’t show you want.

- Weight-loss surgical procedure—Though some plans do cowl this if it’s deemed medically obligatory, most instances you’ll must pay for this out of pocket.

- Medical care that’s unapproved—This implies you didn’t get the sign-off out of your well being insurer earlier than you bought the care. Professional tip: Verify together with your insurance coverage firm earlier than you get the medical care to ensure they’ll cowl it.

The ethical of the story? Rigorously learn your Abstract of Advantages Protection to verify that no matter medical care you want is really lined. And attain out to your insurance coverage firm to double-check.

How A lot Does Well being Insurance coverage Price?

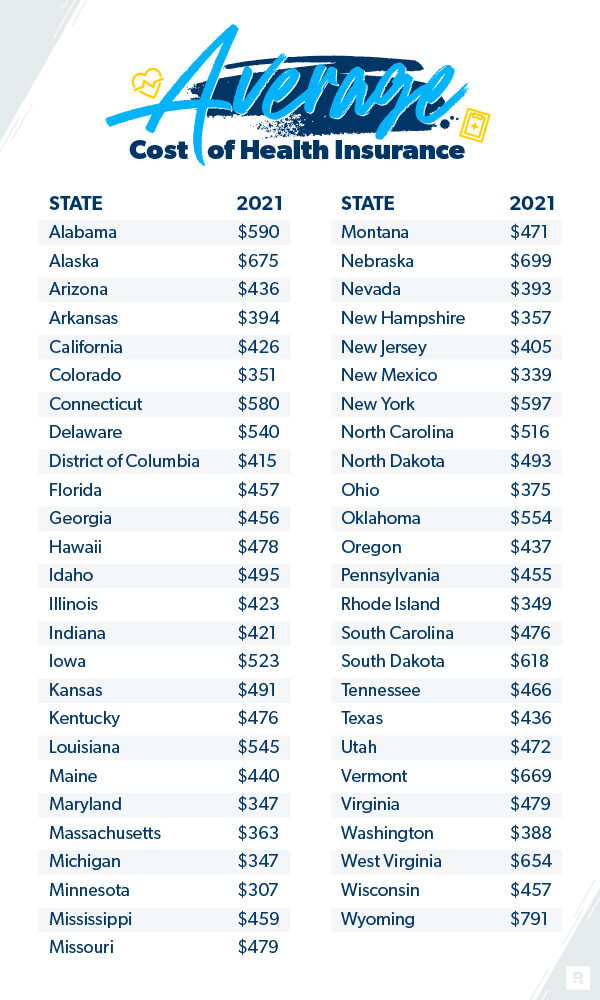

The price of well being care insurance coverage varies fairly extensively and could be onerous to pin down. However there may be some knowledge on it.

The common American pays $452 monthly for market medical health insurance.2 The common household can count on to pay $1,779 monthly.3

And if it looks like well being care insurance coverage is getting dearer, it’s as a result of it’s. During the last decade, prices have risen considerably. For instance, the common household is paying 55% extra of their premium in 2020 versus 2010 based on the Kaiser Household Basis.4 And that quantity is up 22% since 2015.5 However premiums have solely risen 4% when evaluating 2020 in opposition to 2019.6

Well being care prices are primarily based on a ton of various elements—issues like your age, how many individuals are in your plan, your stage of protection, the place you reside and who your employer is. A few of these issues aren’t in your management, however some are.

There are some issues you are able to do to save cash in your medical health insurance premiums. And as we noticed earlier, if you wish to pay much less now (however extra later), go for a decrease premium and better deductible. When you’d quite pay extra up entrance, pay a better month-to-month premium and a decrease deductible.

A Well being Plan Instance

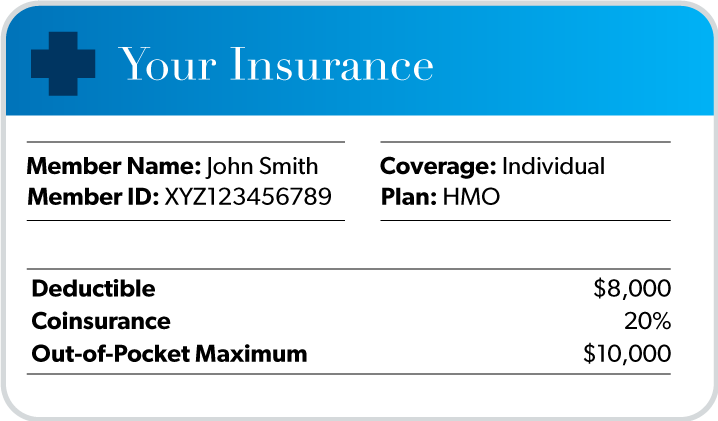

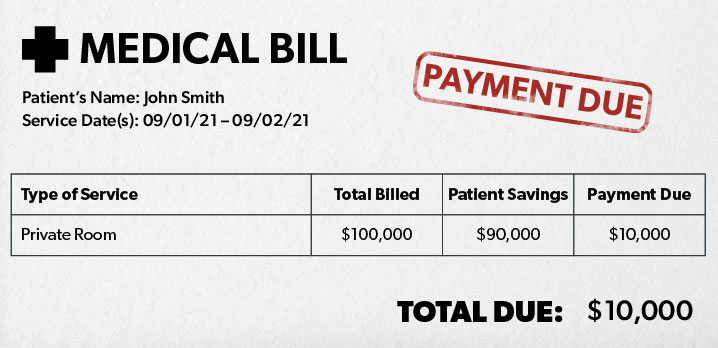

So, we’ve dug into the medical health insurance phrases, damaged down how medical health insurance works, and discovered what’s and isn’t lined. Now we’re prepared to take a look at a number of actual numbers. Medical insurance could make an enormous distinction in overlaying life’s sudden occasions and retaining you out of medical debt.

Let’s fake you bought in a critical automotive accident (I do know, it’s not enjoyable to consider however bear with us).

You get house from the hospital after making a speedy restoration (nice job!). You open your mail. You’re pondering the invoice is perhaps perhaps round $10,000. Perhaps $20,000 tops. Nope. A whopping $100,000. What?! However I used to be solely within the hospital for 2 days, and the meals wasn’t even that good.

Fortunately you thought forward for moments like this. You may have stable medical health insurance protection in place. Right here’s what it appears like:

- Your deductible: $8,000

- Your coinsurance: 20%

- Out-of-pocket most: $10,000

Assuming your care was from medical doctors and hospitals that had been inside your insurance coverage firm’s community, right here’s what occurs to that $100,000 invoice.

Assuming your care was from medical doctors and hospitals that had been inside your insurance coverage firm’s community, right here’s what occurs to that $100,000 invoice.

First, you must pay the $8,000 to satisfy your deductible.

Subsequent, you’re going to want to pay 20% of the prices till you hit your out-of-pocket most. So that you’ll find yourself paying one other $2,000 till you hit that $10,000 restrict.

However right here’s the great half. Although you simply spent $10,000, your insurance coverage firm will (lastly) kick in and canopy the remainder of the invoice.

So right here’s the abstract of what you’d find yourself paying in complete after the $100,000 occasion:

Complete value of medical care: $100,000

Your share: $10,000

Your insurance coverage firm’s share: $90,000

It’s apparent simply how useful medical health insurance could be in instances like this. With out it, you’d be caught with that $100,000 invoice. Not good.

It’s apparent simply how useful medical health insurance could be in instances like this. With out it, you’d be caught with that $100,000 invoice. Not good.

What Are the Advantages of Well being Insurance coverage?

Although it would seem to be a ache, there are numerous advantages to medical health insurance.

Listed below are just some:

- You’ll get monetary savings. Medical insurance helps offset what can generally be sky-high well being care prices. You gained’t be caught paying for each penny out of pocket.

- Entry to a Well being Financial savings Account. Sure plans will assist you to put cash in a pretax account known as a Well being Financial savings Account (HSA). HSAs are like a superpower in relation to paying for medical bills. If you will get one, it is best to.

- You’ll be more healthy. Having medical health insurance—with usually no out-of-pocket prices for preventive care—will imply you’ll catch well being points early on.

- Peace of thoughts. You’ll sleep higher figuring out you and your loved ones are protected if one thing sudden occurs.

- Keep away from monetary break. Medical insurance will preserve you out of chapter or combating hospitals over lots of of 1000’s of {dollars} in medical care. Yuck!

What’s the Finest Approach to Get Well being Insurance coverage?

There are a pair alternative ways to get medical health insurance. First, you should buy it by means of your employer’s plan. Generally it’s cheaper to purchase it this fashion since they’ll get a reduction from shopping for in bulk. However this isn’t at all times the case. It’s best to take into account different choices as a substitute of simply mechanically signing up for an employer’s plan.

One other approach is thru the federal government market. Round 175 insurance coverage firms supply packages there. And relying in your revenue, you would qualify for presidency tax incentives that can deliver down the price of your premiums. A 3rd approach is to purchase it straight from medical health insurance firms.

Lastly, since medical health insurance could be tremendous difficult, it may be onerous to determine the perfect plan for you and your loved ones. You don’t need to overpay or underpay. That’s why we suggest working with a trusted and unbiased insurance coverage agent who’s a part of our Endorsed Native Suppliers (ELP) program. They’ll store so that you can discover you the perfect protection on the proper value. And so they can clarify what’s really in your coverage, so you already know precisely what you’re paying for.

Join with an ELP in the present day!

[ad_2]

Source link