[ad_1]

All of us do it. It doesn’t matter what we’re looking for, we have a look at the value first, after which have a look at the main points. We’re searching for that candy spot between an excellent value and good high quality.

The identical is true for flood insurance coverage. You need the best protection on the proper value—as a result of the very last thing you need while you’re coping with property broken from a flood is to search out out your protection falls brief. That will help you discover that candy spot, we’ll go over the common value of flood insurance coverage in your state, learn how to perceive the elements that have an effect on your flood insurance coverage premiums, and the fee variations between FEMA and personal flood insurance coverage.

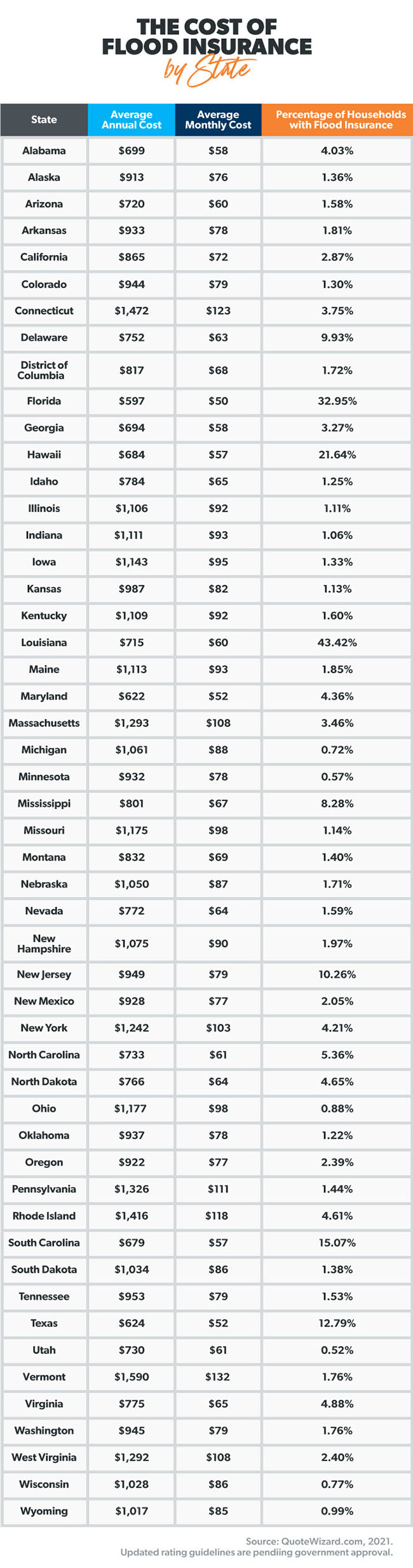

Common Value of Flood Insurance coverage by State

So as to add to every little thing else we’ve got on our fear checklist lately, information footage of flood injury has grow to be an everyday a part of newscasts throughout the nation. Getting flood insurance coverage isn’t only a low-priority process anymore that retains sliding down to-do lists. It’s tremendous essential now for good property homeowners (and renters) to do their homework on flood insurance coverage, particularly value.

![]()

Defend your house and your price range with the best protection!

Flood insurance coverage charges range extensively from state to state. And several other elements (some you’ll be able to management) affect particular person premiums. However earlier than we get into the causes of value variations, let’s have a look at the common value per state.

Probably the most essential issues to recollect about flood insurance coverage is that owners and renters insurance coverage do not cowl flood injury. It’s essential to buy flood insurance coverage individually.

As we talked about above, the value you pay would possibly range out of your state’s common. Let’s go over the totally different causes that may have an effect on your fee.

Components That Have an effect on Flood Insurance coverage Prices

In keeping with FEMA, authorities packages and personal corporations have a look at these essential elements to determine their flood insurance coverage charges:

- Flood threat

- Location

- Age

- Development

- Protection

- Flood Insurance coverage Charge Maps (FIRMs)

- Danger Ranking 2.0

- Deductible

We’ll go over every one.

Flood Danger. First, the largest issue that determines flood insurance coverage value is the historic threat of flooding in your space. If your house is in an space that has skilled flooding up to now, the extra your flood insurance coverage is more likely to value. That’s as a result of premiums are based totally on threat, and insurance coverage corporations cost larger premiums to compensate for threat. To be taught extra about flood threat in your space, you’ll be able to try FEMA’s flood maps.

Location. The precise location of your house inside a floodplain additionally performs an essential function in figuring out value. Floodplains are in areas subsequent to rivers and creeks that overflow due to heavy rain. Until your house is constructed on a hill or different elevation, the nearer you’re to a floodplain, the upper your flood insurance coverage premium can be.

Age. Flood insurance coverage suppliers additionally base your premium on the age of your house. Older properties might be extra liable to flood injury due to their construction or constructing supplies. Insurance coverage corporations think about this an enormous threat and—no shock—they increase premium prices accordingly.

Development. Some trendy development supplies like bricks and concrete are extra flood-resistant and assist shield newer properties from injury attributable to floods. Additionally, new development in flood zones usually features a floodwall (everlasting barrier) across the construction to stop floodwaters from reaching it. Flood insurance coverage suppliers pay shut consideration to options like this after they’re figuring out your coverage premium.

Protection. Right here’s the reality. The extra flood injury protection you request, the upper your premium can be. If your house is price greater than $500,000, is stuffed with costly vintage furnishings and also you’re in a high-risk space, your premium will possible be on the excessive aspect. But when your house is new development and is valued at $250,000, your premium value might be minimal.

FIRMs. FEMA creates Flood Insurance coverage Charge Maps (FIRMs) for every group throughout the US. FIRMs are utilized by authorities packages and personal insurance coverage brokers to find out flood insurance coverage charges. Each FIRM exhibits the zones FEMA has designated as an official flood space, together with the potential severity of the kind of flooding in that space.

Danger Ranking 2.0. FEMA is updating the Nationwide Flood Insurance coverage Program (NFIP) with charges which are extra according to present traits. One of many targets of Danger Ranking 2.0 is to cut back the distinction between flood-insurance prices for lower- and higher-valued properties. Beginning in October 2021, new insurance policies and insurance policies which are eligible for renewal can be based mostly on the brand new ranking tips.

Deductible. A deductible is the quantity it’s essential to pay while you file a declare earlier than your insurance coverage coverages kicks in. The identical math applies to a flood insurance coverage deductible because it does to all insurance coverage deductibles. The upper your deductible, the decrease your premium.

FEMA vs. Personal Flood Insurance coverage Prices

Don’t assume that FEMA is your solely selection for flood insurance coverage. You could have choices! You possibly can both get flood insurance coverage by FEMA’s Nationwide Flood Insurance coverage Program (NFIP) in case your group participates in this system, or you may get flood insurance coverage by a personal insurer. Or each. We’ll break down what it is advisable know in regards to the totally different prices between the 2 suppliers.

Usually, it’s cheaper to get non-public flood insurance coverage than it’s by the NFIP, however not at all times. One of many causes non-public flood insurance coverage tends to be cheaper is as a result of their threat evaluation is extra refined.

For instance, a personal insurer can probably decide that your property is in a decrease threat space—and subsequently doesn’t require as a lot protection—extra rapidly and extra precisely than FEMA’s NFIP can.

Another excuse non-public insurance coverage might be cheaper than your NFIP choices is the way in which its protection is structured. Personal flood insurance coverage corporations present protection to your constructing property and your private property, whereas NFIP flood insurance coverage requires you to purchase these two coverages individually.

This distinction impacts value as a result of NFIP insurance coverage requires you to pay your deductible twice—as soon as for constructing protection and as soon as for private property protection while you file a declare. Paying two deductibles can add up rapidly, particularly in case your coverage carries the beneficial excessive deductible.

Ask your native insurance coverage agent to make clear the coverage value choices of NFIP vs. non-public flood insurance coverage.

Get the Greatest Flood Insurance coverage Value

Anytime you make an funding as massive because the one you’ve made in your house, it simply is smart to guard it. Flood injury can occur quick—and it’s costly to restore. Earlier than it creates an ideal storm in your life, be ready with the best flood insurance coverage.

We suggest speaking to considered one of our Endorsed Native Suppliers (ELPs) who is aware of about flood insurance coverage prices in your space. You should definitely ask about FEMA vs. non-public flood insurance coverage charges. Learn the way a lot it can save you.

Join with an ELP at present!

[ad_2]

Source link