[ad_1]

Who doesn’t love the thought of watching the solar dip beneath the Grand Canyon from their entrance porch after which driving 801 miles to get up to a view of the Tetons out their bed room window the following week?

Not everybody truly—that’s why solely 9% of Individuals personal an RV. However for that 9%, this appears like heaven.1 Till a grizzly claws aside their entrance door and raids the kitchen. Then they’re going to hope they’ve good insurance coverage.

If you happen to’re interested by making the RV life yours, you’re most likely questioning, How a lot is RV insurance coverage and the way do I get some?

We’ve bought the solutions so you may drive off into the sundown worry-free.

RV Insurance coverage Protection

At first, you may suppose RV insurance coverage protection can be the identical as automotive insurance coverage. However on second thought, you’d notice an RV comes with much more options and features than a automotive. Plus, you may have the choice to dwell in your RV full time or half time—and the choice you go along with will have an effect on the kind of coverage you get.

So, what sort of protection does RV insurance coverage embrace?

Nicely, first we’ll have to try the totally different sorts of RVs. Then we’ll get into the good things.

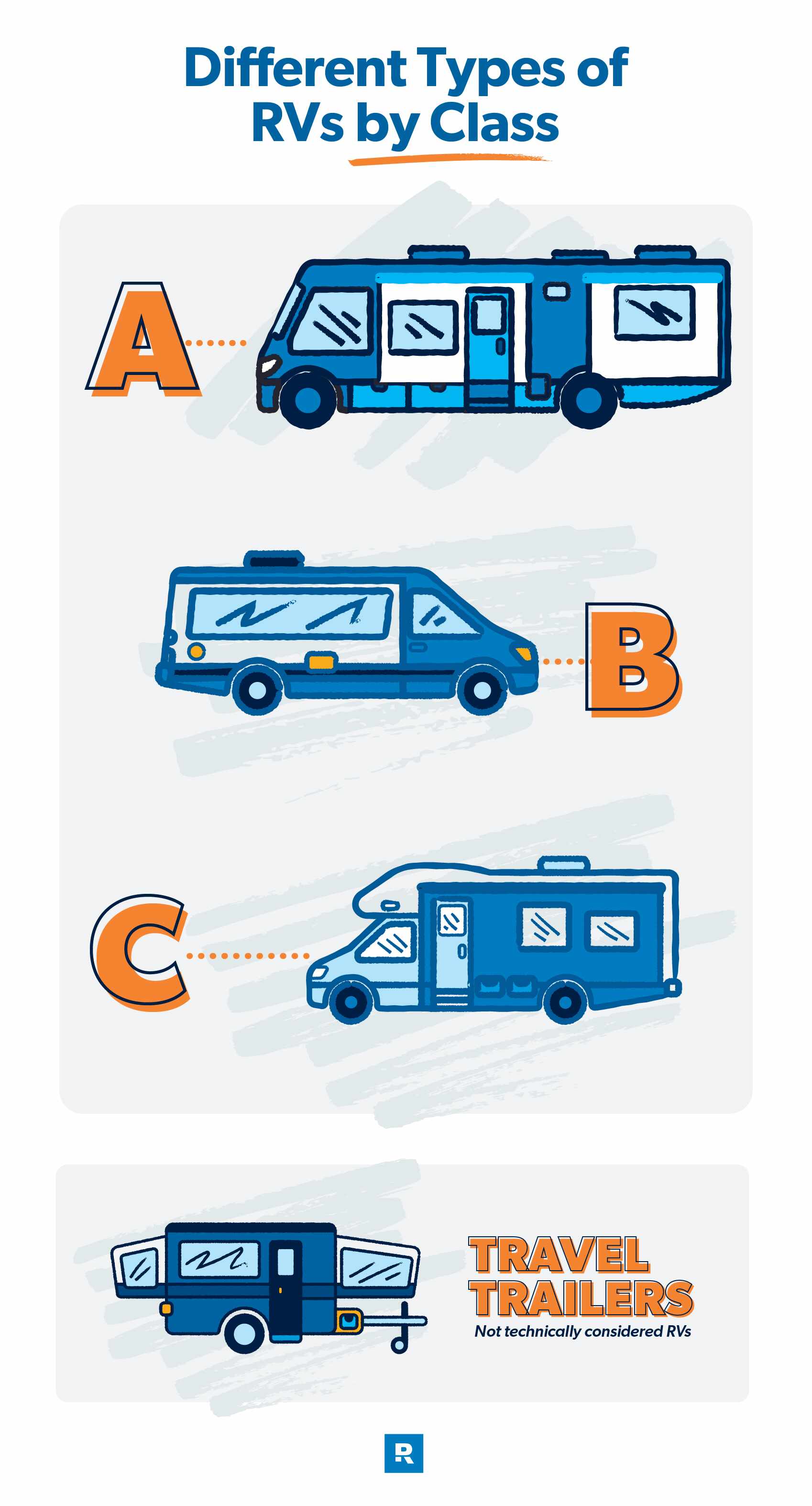

Sorts of RVs

Are you imagining driving down Freeway 65, the desert solar glinting off your silver Airstream? Or is your dream hauling a minimalist teardrop trailer you may drop off at your campsite for flexibility? Relying on what your journey desires are, you’ll want totally different sorts of insurance coverage. That’s as a result of these are totally different lessons of motor properties, and your insurance coverage for every can be totally different too.

Class A motor properties: These are the mansions of RVs. Normally the scale of a business or tour bus, they’ll sleep a big household of eight and have all of the luxuries you’d anticipate to journey in fashion.

Class B motor properties: If you happen to’re seeking to journey with a smaller footprint, certainly one of these—generally often called a camper van—is likely to be your jam. With an inside that may be transformed from mattress to seats and a fundamental meals prep space, this smallest type of motor dwelling can take you from sea to shining sea for lots lower than a category A prices. If you happen to get the type that has a raised roof, your van may sleep 4.

Class C motor properties: Relating to measurement, class C motor properties sit between class A and sophistication B. Yep, that’s proper. Don’t ask us why. However this one can match as much as six individuals and is definitely recognizable for the sleeping compartment over the cab.

Journey trailers: These aren’t technically motor properties as a result of they don’t have a motor, however individuals inquisitive about motor properties are sometimes inquisitive about journey trailers and campers, so we thought we’d throw them in. Additionally they price much less to insure! There are just a few totally different sorts that vary in measurement. Right here’s an inventory from largest to smallest:

- Standard trailer: These will be small or huge.

- Fifth-wheel trailer: These connect by gooseneck trailer to a pickup.

- Pop-up camper: This can be a trailer that’s collapsible for towing.

- Truck camper: Despite the fact that these sit within the mattress of a truck, they’re thought of trailers as a result of they must be hooked up to a different automobile.

- Teardrop trailer: These are compact, light-weight sleeping trailers that may be pulled by a automotive.

Customary RV Insurance coverage Protection

A typical RV insurance coverage coverage will look just like an auto insurance coverage coverage. Since RVs and automobiles are each pushed on the street, you want safety from plenty of the identical dangers.

![]()

Do not let automotive insurance coverage prices get you down! Obtain our guidelines for straightforward methods to save lots of.

Collision: If you happen to get hit by or hit one other automobile or object, collision pays for the damages. It doesn’t matter whose fault it’s.

Complete: This covers harm attributable to issues aside from accidents. Tree drops a limb onto your journey trailer? A twister performs together with your RV and isn’t very mild? Racoons or different thieves break a window? No drawback. Complete covers weather- and nature-related incidents, theft, vandalism, fires, and collisions with wildlife.

Uninsured and underinsured motorist: Each driver’s presupposed to have insurance coverage, however not everybody does. It will cowl your damages, accidents and even misplaced wages in case a kind of drivers hits you.

Legal responsibility: If the accident is your fault, legal responsibility will cowl the price of damages you prompted and lawyer charges if you happen to’re sued. You’ll be able to solely get this protection on an RV since you’re truly driving that. For journey trailers, your auto coverage’s legal responsibility will cowl you.

Medical funds: This protection pays out for you and your fellow vacationers irrespective of who’s at fault. This one doesn’t apply to journey trailer insurance policies.

Further RV Insurance coverage Protection

Right here’s the place protection begins to vary from auto insurance coverage. We’re guessing you don’t often carry round a mattress, pots and pans, and a working bathe at the back of your Civic.

However you’re hauling all of that stuff and certain extra with you in an RV or journey trailer, so that you must ensure that it’s not flying out within the wind. Consider it like this: You’re mainly mashing auto insurance coverage and residential insurance coverage collectively.

Listed below are further coverages you’ll wish to have a look at earlier than you hit the street:

Whole loss alternative: If you happen to complete your RV or journey trailer, insurance coverage offers you what it prices to get a brand new one (no depreciation factored in).

Substitute price for private results: That is like the private property protection in your house insurance coverage coverage and pays to interchange the contents of your RV. We’re speaking bedding, clothes, meals, everyone’s iPads, these $600 Osprey backpacking packs, and your $6,000 price of digital camera lenses.

Emergency bills: If you happen to break down someplace or get in an accident and must return to your everlasting residence, you may decide to have insurance coverage pay for the journey and resort bills to get dwelling. Nevertheless it’s not a very whole lot since it could possible price lower than a grand to get dwelling and it is best to have greater than that in your emergency fund.

Trip legal responsibility: Possibly you met some pals whereas climbing, and also you invite them again to your RV for dinner. However Bruce decides to slide and fall in your steps (reasonably than on all these slick rocks on the path) and bash his knee. Now he’s suing you. Vacay legal responsibility will cowl you as much as a set restrict.

This could additionally cowl your RV or trailer whereas it’s in storage.

Full-timer’s legal responsibility: That is legal responsibility protection meant for somebody who makes use of their RV as a full-time residence. Just like dwelling insurance coverage legal responsibility, it’ll cowl you as much as a set restrict.

Loss evaluation: Some RVers take pleasure in belonging to a membership or affiliation to take pleasure in reductions and membership services. However these particular perks may additionally include a accountability to pay for damages in frequent areas. Your insurance coverage, do you have to select to just accept it (and pay for it), will cowl these charges.

Pet damage: Who doesn’t wish to have man’s finest good friend by their facet whereas they see the world from the consolation of their very own dwelling? Nicely, possibly cat individuals. However it doesn’t matter what pet you personal, you should buy an add-on that covers vet payments in case your furry good friend is injured in an accident whereas using with you. Once more, it’s an choice—however your emergency fund is a greater option to cowl pet bills.

Pest harm safety: Whether or not you’re on the street or parked in storage for the winter, if some pest (aka birds, rodents, and many others.) damages your motor dwelling, this protection pays for the repairs.

RV Insurance coverage Exclusions

RV insurance coverage will shield you financially towards plenty of issues, however not the whole lot. Let’s have a look at the incidents RV insurance coverage excludes:

Mould or fungi: Even when the harm is attributable to a storm, RV insurance coverage received’t pay to restore or exchange your motor dwelling if it’s broken by mould. In case your coach or camper is broken by water, ensure you clear it up correctly to stop mould development.

Awnings: These are a generally factor. Many insurance policies do cowl them, however some exclude them. There’s additionally the choice to decide on to exclude them your self to probably save on premiums.

Rodents: Rodents are available all styles and sizes, and there’s typically heaps extra out within the wild locations. A number of chipmunks going to city in your wiring could cause plenty of harm. However this one isn’t a rule. Generally insurance policies will cowl the harm, generally not.

Earthquakes: This one is type of just like the rodents exclusion. Some insurance policies cowl earthquake harm and a few don’t. You should buy it as an add-on if you happen to’ll be touring in earthquake territory and your coverage doesn’t have it.

Does RV insurance coverage cowl water harm?

Whether or not you’re lined for water harm can depend upon the coverage you may have. Most RV insurance policies cowl water harm from a damaged plumbing system or equipment, however not from a roof leak attributable to poor upkeep.

Many will cowl flooding from overflowing streams or lakes or excessive rainfall, however ensure you examine the coverage you’re contemplating or speak to your unbiased insurance coverage agent. Some carriers require you to purchase flood or water harm protection individually as an endorsement. And there are often guidelines about how far you have to be parked from a physique of water to be lined.

RV Harm Settlement Choices

Like with auto insurance coverage, if you happen to had been to get in an accident together with your RV and complete it, your commonplace insurance coverage would provide you with what your RV is price on the time of the crash—not the price to interchange your RV model new.

However you’re not caught with that protection.

You’ll be able to select certainly one of three bodily harm settlement choices. You will get paid:

- Your RV’s (or journey trailer’s) precise money worth (ACV)

- A certain quantity written in your coverage that you just and your provider agreed on

- The entire alternative price, the place you get as a lot cash because it prices to get a brand new one of many identical worth (this often solely works in case your RV is lower than 5 years outdated)

|

RV Harm Settlement Choices |

||

|

Least Protection |

Customizable |

Most Protection |

|

Precise money worth |

Particular payout written in coverage |

Whole alternative price |

How A lot Does RV Insurance coverage Price?

As you may anticipate, prices for RV insurance coverage change based mostly on what class of RV you’re insuring. A category A RV is far greater and fancier than a category B or teardrop trailer, so a coverage to cowl your tour-bus-level RV will price a bit extra. Let’s have a look at how a lot RV insurance coverage prices for every class.

How a lot is RV insurance coverage for sophistication A RVs?

As the biggest and most luxurious motor coach, class A RVs are the costliest to insure. Prices nonetheless fluctuate based mostly on how fancy your RV is, however on common, a gas-powered class A RV prices round $1,000–1,300 yearly to insure for leisure use.2

How a lot is RV insurance coverage for sophistication B RVs?

If you happen to keep in mind from earlier, class B RVs are camper vans—these shiny inexperienced eye-poppers dotting the panorama (if you realize, you realize). They don’t must be shiny inexperienced, however they are often lined underneath a daily ol’ auto insurance coverage coverage. That’s proper! Despite the fact that they’re known as RVs, they’re nonetheless thought of a standard van.

However there’s rather a lot occurring in a camper van that isn’t in a standard automobile, so it’s fairly laborious to offer a typical quantity for insurance coverage price. A number of elements that go into pricing are:

- Driving file

- Worth of van

- Frequency of use

- Age of van

- State you purchase your coverage in

- Protection you need

How a lot is RV insurance coverage for sophistication C RVs?

These midsized RVs are a bit cheaper to insure than class As. The identical elements that go into class B charges additionally have an effect on how a lot you’ll pay for a coverage in your class C RV: age, worth, measurement, location, and many others. On common, class C RV homeowners pay within the neighborhood of $800–1,000 (or extra) on their coverage premiums yearly.3

How A lot is RV Insurance coverage for Journey Trailers?

Since these run the gamut from fundamental pop-up campers to huge trailers that would match just a few horses (if you happen to felt like having horses in your front room), the value on a coverage varies rather a lot. The identical worth elements we talked about for the opposite lessons have an effect on journey trailer insurance coverage as properly (age, worth, state, utilization, measurement, and many others.). Premiums for a journey trailer can run wherever from $200 to over $1,000 a 12 months.4

What Impacts the Price of RV Insurance coverage?

We famous just a few price elements above, however there are much more to consider while you’re looking to buy insurance coverage to your RV. For instance, prices from state to state fluctuate anyway, however some states require you to have extra insurance coverage than others.

Right here’s an even bigger listing of things that go into the price of your RV insurance coverage premium:

- Driving historical past: Do you crash rather a lot, or are you a secure driver?

- Wants: What are you utilizing this RV for? How a lot are you driving?

- Utilization: Are you a leisure person or a full-timer?

- Location: Insurance coverage in your state is likely to be costlier.

- Age: How outdated are you? How outdated is your RV? These items matter. The older you might be, the extra expertise you may have driving. The older your RV, the much less it’s price.

- Mannequin or class: Do you may have an RV that would rival U2’s tour bus or are you pulling a camper?

- State’s insurance coverage necessities: Some states require solely legal responsibility whereas others need the whole lot out of your grill to your taillights lined.

- How a lot protection you purchase: Would you like commonplace protection or some extras like full alternative price protection? That’ll price you.

- Deductible: The best option to change your premium? Push your deductible up or down.

- Legal responsibility limits: A $500,000 legal responsibility restrict will price greater than a $10,000 restrict. However having an even bigger restrict right here is price it, so get it.

- Claims historical past: Do you file plenty of insurance coverage claims? If you happen to do, that’ll make your subsequent coverage costlier.

Methods to Save Cash on RV Insurance coverage

In case your coverage is trying pricier by the minute, don’t panic. Try these methods to save lots of in your motor-coaching dream.

Think about Bundling A number of Insurance policies

Bundling insurance policies is among the most-loved methods to economize on insurance coverage. Many carriers will reduce you a deal if you happen to purchase a number of insurance policies by means of them.

If you happen to’re searching for RV insurance coverage, examine to see if shopping for it by means of your owners and auto insurance coverage firm will get you a reduction. However even when it does, don’t cease there. Ensure you nonetheless store round. An unbiased insurance coverage agent might help you with that by doing the legwork for you and determining what your finest guess is.

An analogous tack is bundling a number of RVs. That’s a uncommon state of affairs (you’d most likely be on Child Step 11 at this level), however if in case you have a camper and an RV or another mixture, you’ll possible get monetary savings if you happen to get them insured by means of the identical coverage.

RV Insurance coverage Reductions

Right here’s a hefty listing of the way it can save you cash on insurance coverage earlier than you hit the street:

RV affiliation: Belonging to an RV affiliation may prevent a pair bucks on insurance coverage.

RV security course: You possibly can earn a reduction if you happen to take an RV security course (and move it!) by means of the state.

RV security tools: In case your RV has factory-installed airbags, antilock brakes and different security options, you may qualify for a reduction.

Unique proprietor: If you happen to’ve owned your RV from its infancy on the seller’s lot, that would earn you a reduction.

Accountable driver: Have you ever ever been in a crash? In case your reply isn’t any, that would work in your favor with cheaper premiums.

Pay in full: Individuals prefer to receives a commission. Insurance coverage firms are not any totally different. If you happen to pay your annual premium in full reasonably than month-to-month, they might reward you with a reduction.

Immediate fee: This one’s similar to the one earlier than. Pay on time and also you received’t get charged late charges.

Declare-free renewal: You possibly can earn a reduction if you happen to go an entire coverage interval with out making a declare.

House owner: Some insurance coverage firms offers you a reduction if you happen to personal a house along with your RV.

Steady insurance coverage: If you happen to don’t let your protection lapse, you might earn a reduction. This implies sustaining insurance coverage in your RV even when it’s in storage.

Paperless: Final however not least, you may snag a reduction if you happen to comply with do all transactions and communication on-line.

If that huge listing of reductions has your head spinning, don’t fear. The best option to ensure you’re saving all the cash you may is to undergo an unbiased insurance coverage agent. They give you the results you want, not a particular insurance coverage firm, so their job is to search out you one of the best deal on the market. They’ll run the numbers and seize you all of the reductions.

Do You Want RV Insurance coverage?

The straightforward reply is sure. In case you have an RV, you want RV insurance coverage. RVs are rather a lot totally different from automobiles—and so they’re often much more costly too. So, specialised RV insurance coverage is a should.

It’s additionally required by legislation. States often have the identical minimal insurance coverage necessities for RVs as they do for automobiles, which suggests you not less than want legal responsibility protection.

From a monetary standpoint, if you happen to can’t pay with out blinking to interchange or restore your RV if you happen to harm it, it is best to insure it. And whereas there are rather a lot fewer RV crashes than automotive accidents within the U.S., RVs include plenty of different hazards that automobiles don’t.

Right here’s an inventory of among the most typical hazards RV homeowners expertise:

- Tire blowouts: These are far more harmful on an enormous automobile like an RV and may trigger plenty of harm.

- Fridge fires and propane leaks: RV fridges run very in another way than your common kitchen fridge. These use warmth and generally open flame to run the cooling system. Fires are a really actual hazard. Yearly it’s estimated 2,000 RVs catch fireplace.5

- Collisions with overhangs and bridges: You most likely received’t be used to driving such a tall automobile, which suggests working into overhangs can be an actual hazard (suppose fuel stations and overpasses).

- Forgetting to retract steps and awnings: There’s rather a lot to consider while you’re packing up. If you happen to overlook to drag in your awning or stairs, you may end up needing new ones—and that’s not low cost.

- Pest infestation: Pests prefer to nest in automobiles anyway, however a automobile with meals in it? You’ll be able to simply see all of the mice with heart-eye emojis.

Select the Proper RV Insurance coverage Coverage

Selecting the best RV coverage actually comes right down to understanding what you need. What sort of RV would you like? The place do you wish to go? How a lot protection would you like? How lengthy do you wish to dwell in it?

Let’s check out that final one in a bit extra element.

RV Insurance coverage Protection for Full-Time vs. Half-Time Dwelling

We talked about earlier your coverage can be totally different relying on whether or not you’re a leisure RVer or a full-timer. The principle distinction is how lengthy your coverage will cowl you.

A leisure coverage will cowl you on quick journeys, however a full-timer coverage will cowl prolonged durations in your RV (often six months or longer). This coverage may also supply extra coverages, like medical funds and private legal responsibility, to guard you whilst you’re parked for lengthy durations. As a result of this selection provides extra protection, a full-timer coverage will price extra.

Do you have to simply add your RV to your current auto coverage?

RVs have much more occurring than a automotive or truck. So generally, you received’t have the ability to add your RV on to your current auto coverage. However if in case you have a category B RV (camper van), you might do this. Relying on how a lot it price you to package out your camper van, you’ll most likely wish to look into the opportunity of including just a few extra coverages to your coverage—like alternative price for private results.

Get RV Insurance coverage

You’ve picked out your RV, mapped your route, and all you want is insurance coverage. So, how do you get RV Insurance coverage? It’s not laborious to search out. Most carriers that supply auto insurance coverage additionally supply RV insurance coverage. However what’s the easiest way to do it?

The best option to ensure you’re lined in all the correct locations and paying the correct worth is to speak to a RamseyTrusted insurance coverage professional. They’re consultants and might help you determine one of the best coverage to your RV and way of life. And, as a result of they give you the results you want and never a particular insurance coverage firm, they’ll store round to get you one of the best deal.

Join with an insurance coverage professional immediately!

[ad_2]

Source link