[ad_1]

In case you’re available in the market for a budgeting technique that’s one of the best to your cash, would possibly we recommend the zero-based funds? (We would. We will.) However what makes it one of the best? And the way do you make (and maintain) a zero-based funds?

Let’s reply all that. Proper now.

What Is Zero-Based mostly Budgeting?

Zero-based budgeting is when your earnings minus your bills equals zero. Good title, proper?

So, in the event you make $3,000 a month, all the pieces you give, save or spend ought to add as much as $3,000. Each greenback that is available in has a goal, a job, a aim. Nothing is left hiding or getting mindlessly spent on fancy coffees or $1 bin offers.

Fast callout: This doesn’t imply you’ve got zero {dollars} in your checking account. It simply means your earnings minus all of your bills equals zero. Maintain your self a bit buffer of $100–300!

The way to Make a Zero-Based mostly Price range

Before you start making your zero-based budget, log in to your checking account or seize these financial institution statements out of your drawer. They come in useful if you’re questioning how a lot you usually make or spend on stuff. You can too take a look at these budget percentages and averages.

1. Record your month-to-month earnings.

You are able to do this the old school method with a sheet of paper, or you need to use our free budgeting app, EveryDollar. (We advise the second method. As a result of the mathematics that’s developing is method simpler with EveryDollar.)

Start budgeting with EveryDollar today!

What counts as earnings? Your common paychecks and something further you propose to usher in through the month (assume aspect hustles or baby help). Write all of it down and add it up! That’s your complete month-to-month earnings, aka what you’ve set to work with this month.

P.S. If you wish to start on paper to get all these numbers down, after which swap over to EveryDollar, that’s cool too.

2. Record your bills.

You already know what’s coming in—now plan for what’s going out. Consider all the pieces you spend cash on through the month. Record out your bills like this:

- Giving (This needs to be 10% of your earnings.)

- Financial savings (This will depend on your Child Step, which we’ll clarify later.)

- The 4 Partitions (These are the highest payments to cowl: food, utilities, shelter and transportation.)

- Different necessities (We’re speaking about insurance coverage, debt, childcare, and so on.)

- Extras (Right here’s the enjoyable half: leisure, enjoyable cash, eating places, and so on.)

- Month-specific bills (Any holidays, celebrations or semiannual bills due this month?)

Don’t overlook to offer your self a miscellaneous class too so you’ve got a bit further cushion in your spending. That method, something that pops up unexpectedly isn’t an issue—it’s within the funds.

3. Subtract your bills out of your earnings to equal zero.

If you subtract all these bills out of your earnings, it ought to equal zero. In case you don’t hit zero at your first move, welcome to the bulk! Yep, that’s proper. Virtually nobody will get this proper the primary time. That. Is. Tremendous. However let’s speak about repair it!

Obtained cash left over? First, throw some confetti and do a celebration dance. Like, for actual. Then, put that cash to work!

The place?

In your present Child Step!

What’s that?

The 7 Baby Steps are the confirmed, guided path to save cash, repay debt, and construct wealth. (Aka win with cash.) They’re the seven cash targets that may take you from the place you might be to the place you need to be.

Now, let’s speak about what to do in the event you subtract your deliberate bills and find yourself with a damaging quantity. This implies you’re spending greater than you make, and that simply gained’t work. However don’t freak out. You can get the quantity to zero.

Get out your metaphorical hedge clippers, and trim that funds. That may imply reducing your deliberate spending quantities the place you’re ready, or it could possibly imply cutting spending. (FYI, begin with the restaurant line! Meals is the place we People are inclined to overspend essentially the most. Meal planning will help you get essentially the most out of your meals funds.)

You can too up your earnings by beginning a side hustle, promoting stuff, or discovering another option to make more money.

That’s it for making the zero-based funds, however we’ve obtained two extra steps that’ll enable you truly stick with it.

4. Monitor your bills (all month lengthy).

So, you’ll be able to’t simply arrange that funds and depart it. That will get you actually nowhere along with your cash. You’ve obtained to get in there and track your transactions. Each single one. Meaning any cash that is available in or goes out will get put into the correct funds line.

If you make $100 out of your aspect hustle, add that to the aspect hustle earnings. If you pay the lease, subtract that expense from Housing. If you replenish the gasoline tank, subtract that from the gasoline funds line beneath Transportation.

That is the way you keep on high of your spending. That is how you retain from overspending.

By the way in which, you’ll be able to streamline this course of with the premium version of EveryDollar. You’ll join your financial institution to your funds so transactions stream proper in. Then, you simply have to tug and drop them into place!

5. Make a brand new funds (earlier than the month begins).

Whereas it’s true your funds gained’t change a ton month after month, it is going to change some. So, create a brand new zero-based funds each single month. Bear in mind these month-specific expenses we talked about within the second step? That is the place they actually come into play.

Additionally, do that earlier than the month begins so that you’re prepared, forward of time, for what’s coming your method.

Instance of a Zero-Based mostly Price range

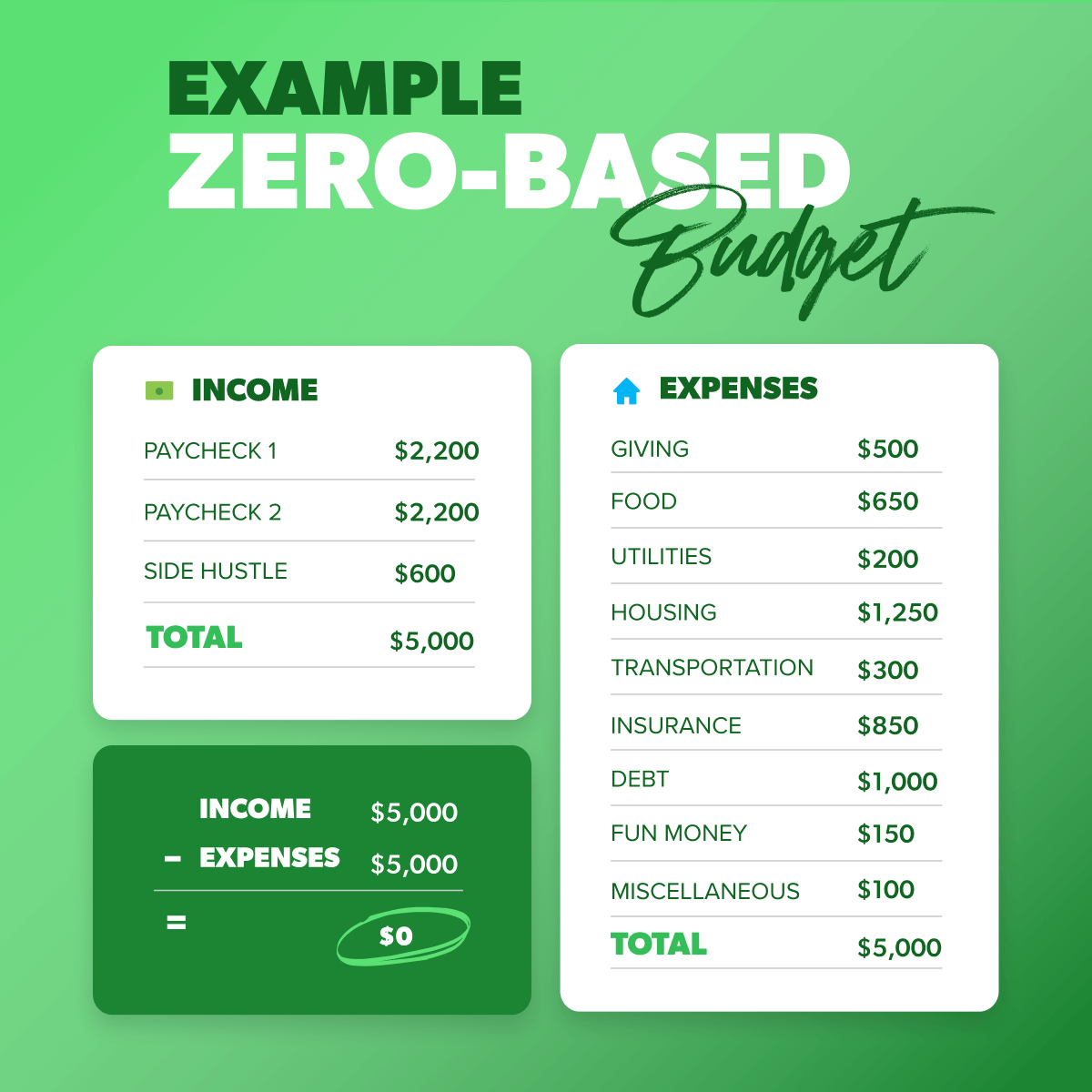

Right here’s a extremely primary instance of a zero-based funds so you’ll be able to see how the mathematics works out.

Benefits of Zero-Based mostly Budgeting (Over Different Budgeting Strategies)

1. 50/30/20 Rule

The 50/30/20 budgeting rule follows these percentages: 50% of your earnings goes towards your wants, 30% goes towards desires, and 20% goes towards financial savings. Although it’s good to have some numbers that can assist you begin budgeting, these numbers depart lots to be desired.

To begin with, in the event you’re utilizing our Child Steps (which you actually ought to), you aren’t all the time placing cash towards financial savings. You’re taking your targets one (child) step at a time. That form of focus brings fast wins and lasting wealth.

Second, the 50/30/20 rule lumps debt into wants—however requires you to make minimal funds solely. You possibly can’t make most progress with minimal funds.

And eventually, these three percentages keep the identical regardless of the place you might be in life. In case you’ve obtained a ton of scholar mortgage debt—50/30/20. In case you’re debt-free and investing in retirement—50/30/20.

Your funds ought to change based mostly in your earnings, targets and life stage. This budgeting technique simply doesn’t have room for that.

2. 60% Resolution

Within the 60% answer technique, you cowl all of your desires and desires with 60% of your funds. The opposite 40% is for saving. Then, that 40% will get divided up into these financial savings classes: 10% for retirement, 10% for long-term financial savings, 10% for short-term financial savings and 10% for “enjoyable.”

To begin with, that’s numerous dividing. Second, we love financial savings—however in the event you’ve obtained debt, you shouldn’t be placing 40% of your cash into financial savings. Try to be destroying that debt. Hardcore. And after that, you must put as a lot as you’ll be able to into constructing your fully funded emergency fund. And after that, you must make investments 15% in retirement.

This technique falls brief too. It simply doesn’t account for each budgeter’s particular person state of affairs.

3. Reverse Budgeting

Many budgeting strategies have you ever put aside cash for spending first and financial savings second. With reverse budgeting, it’s the other. (Therefore the title.)

On this technique, you set your funds for saving and investing first. Then you definitely put all the pieces else in there (like housing, gasoline, meals, insurance coverage, debt and the nonessentials).

So, we love the emphasis on financial savings not being an afterthought! As a result of it’s too straightforward to overlook about it.

However once more, this technique locks you into a method which may not match the cash aim you’re in the course of! In case you’re on Baby Step 2, you aren’t considering financial savings first. You’re targeted on kicking debt out of your life without end.

4. Set It and Neglect It

Okay, you’ve obtained to start out someplace with a funds. In case you’ve by no means made one, getting all of your numbers down (earnings and bills) is your first step. However you don’t cease there. You don’t simply depart these numbers on the web page and hope you’ll live by them.

That is the “set it and overlook it” budgeting technique. And it actually doesn’t work. It helps you see the place your cash ought to go—but it surely doesn’t make you accountable for the place it truly goes. And it’s an effective way to overspend.

5. Zero-Based mostly Budgeting

You possibly can in all probability see why we love zero-based budgeting a lot. It’s far more customizable to the place you might be in your life. You get to determine how a lot to place towards debt, financial savings, retirement, and so on. Each. Single. Month.

You can too adapt your zero-based funds as you undergo the Child Steps. That’s what it’s made for! Each single greenback is working for you. All the time.

Can You Make a Zero-Based mostly Price range With an Irregular Revenue?

Sure! When you’ve got an irregular income (which means your earnings isn’t the identical every paycheck or comes at completely different occasions within the month), you’ll be able to nonetheless use zero-based budgeting. It’ll simply look a bit completely different for you.

- If you’re itemizing your earnings, discover out what you’ve made the previous couple of months. (That is one other place your financial institution statements are useful.)

- Take the lowest quantity you made in that point and checklist it within the funds as this month’s deliberate earnings.

- You possibly can regulate the earnings later within the month in the event you make extra.

If you’re itemizing your bills, comply with the checklist we gave you earlier. Simply know that the extras might need to attend. Cowl a very powerful issues first. In case you receives a commission greater than you deliberate, add that more money to your Child Step or one other funds line.

You should utilize our Irregular Income Budget Planning form to get began!

So, Why Is Zero-Based mostly Budgeting Essential?

Right here’s the deal. If you wish to make any progress along with your cash, it’s essential make a monthly budget. Individuals say budgeting takes them from questioning the place their cash went to telling it the place to go. That. Is. Empowering.

And a zero-based funds? Even higher. Since you’re telling each single greenback the place to go. You’re employed arduous to your cash—all of it. So all of it ought to work arduous for you.

And don’t overlook EveryDollar—the free option to create your zero-based funds. You make the cash, and it does the mathematics. What a fantastic relationship.

Pay attention: No matter your money goal, no matter your Child Step, wherever you might be in your private finance journey—a zero-based funds is what is going to get you (and maintain you) transferring ahead.

[ad_2]

Source link