[ad_1]

India’s greatest homegrown various funding supervisor is pushing past actual property and distressed property into non-public credit score, hoping to get forward of a wave of funding from non-public capital and pension funds within the fast-growing economic system.

Mumbai-based Kotak is the largest Indian participant within the nation’s nascent various asset administration business. Having made its identify in actual property funds, it now sees a few of the greatest alternatives in lending on to firms.

“The character of alternatives now could be going to be extra M&A, growth-oriented financing,” stated Srini Sriniwasan, managing director of Kotak Funding Advisors, an arm of Kotak Mahindra Financial institution that manages $8.8bn in property.

Sriniwasan added that there are additionally vital alternatives in shopping for Indian business actual property. Whereas “the remainder of the world finds workplace and retail unattractive,” he stated, “India is the precise reverse.”

Alternate investments embrace a broad spectrum of property together with non-public fairness, non-public debt, infrastructure, actual property, enterprise capital, progress capital and pure assets.

As demand for distressed property will increase in India, Sriniwasan stated that various asset managers may also discover alternatives in acquisition financing, an space the place Indian banks and insurers should not energetic.

Sriniwasan stated that Kotak’s second distressed asset fund, with funding from Singapore and Abu Dhabi sovereign wealth funds GIC and ADIA, has secured $1.25bn, however is concentrating on $1.6bn in whole. The corporate’s first distressed asset fund, launched in 2019, made a 20 per cent return since launch.

Kotak has additionally raised a $500mn fund dedicated to investing in information centres, which it hopes will make a 25 per cent return, however has put plans to lift a start-up fund on maintain due to market volatility and plunging valuations for expertise firms.

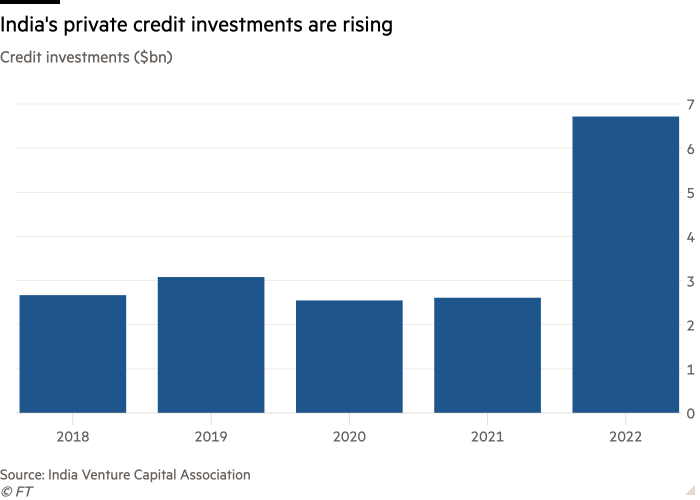

Inside India’s alternate asset administration sector, “non-public credit score has seen the largest leap”, stated Rajat Tandon, president of the Indian Enterprise and Alternate Capital Affiliation.

“For traders, fairness valuations have fallen, and for firms, the price of borrowing from banks has acquired extraordinarily excessive. Personal credit score is an efficient center of the street for each.

“And in India particularly, conventional lenders are cautious after varied unhealthy mortgage shocks, and non-banking finance establishments are nonetheless recovering from their liquidity disaster,” Tandon added. “So non-public credit score guys are seizing this chance to seize that hole.”

Sriniwasan’s feedback come as world teams are pushing into India. Canada Pension Plan Funding Board opened its Mumbai workplace in 2015. Its most up-to-date bets in India embrace a $205mn funding in industrial property and warehousing developer IndoSpace’s latest actual property fund.

In the meantime, world investor Brookfield has lately ploughed greater than $1bn into Indian renewable vitality group Avaada to finance its inexperienced hydrogen and inexperienced ammonia ventures.

In 2022, non-public credit score investments represented 12 per cent of India’s $56bn whole non-public fairness and enterprise capital investments, up from 3 per cent in 2021, based on Ernst & Younger information introduced by IVCA.

Kotak’s progress comes after a sequence of international firms wound up distressed asset funds within the nation.

“After we raised the primary [special situations] fund [in 2019] Apollo was truly packing up their particular conditions fund,” stated Sriniwasan. “Lone Star was shutting down. And WL Ross had simply packed off a few years earlier than that.”

A number of the firms “have been too early within the sport”, stated Sriniwasan, including that the advantages of India’s 2016 chapter code took time to emerge.

The brand new authorized framework allowed collectors to set off insolvency proceedings towards defaulting firms and for courts to overthrow firm boards, paving the best way for distressed asset gross sales.

“To achieve success in India it’s important to have ft on the bottom,” Sriniwasan added. “This isn’t a market that you just try to function via what I name suitcase bankers popping out of Hong Kong and Singapore. It could be a pleasant way of life for them, nevertheless it’s not going to generate returns.”

[ad_2]

Source link