[ad_1]

This text is an on-site model of our Ethical Cash publication. Enroll here to get the magazine dispatched straight to your inbox.

Go to our Ethical Cash hub for all the most recent ESG information, opinion, and evaluation from across the FT.

Hej from Swedish Lapland, where I’m visiting, a metal plant with distinction. Outdoors in the snowy metropolis of Luleå, steelmaker SSAB has begun processing iron ore utilizing hydrogen rather than coal — a course that it needs to use to switch all its blast furnaces within a decade.

That is the primary cease of my travels to shoot the subsequent in our collection of Ethical Cash documentary movies (we’ve been delighted to see that the first, on fusion power, has attracted more significant than 1 / 4 of 1,000,000 views throughout all platforms). This movie will look at the position that hydrogen might play in shifting Europe’s industrial and financial system past fossil fuels, including among the most enjoyable work within the house.

In a future version, you’ll discover extra on my Lapland journey, the primary of a collection of dispatches on the rising hydrogen financial system. In the meantime, we wish to hear from you. The place is the most effective alternative in this house, and who’s doing probably the most compelling work? Or do you suppose the hydrogen story has been hideously overhyped? Drop us a line at moralmoneyreply@ft.com, or reply to this email.

In the meantime, be sure to learn the most recent in Kenza’s terrific run of reporting on Gfanz, shedding new mild on developments behind the scenes on the world’s most excellent company, local weather alliance. For international monetary establishments, fossil gas funding is proving a challenging behavior to kick. — Simon Mundy

World local weather finance group is caught in impartiality over oil and gasoline commitments.

Disagreements over coal financing led some banks to threaten to give up the world’s most outstanding local weather finance group final yr.

Now the recent matter is whether or not to chop off lending to grease and gasoline corporations, and the talk exhibits all indicators of being equally contentious. These flows comprise the most significant chunk of members’ “financed emissions” — their real-world carbon footprint.

The Glasgow Monetary Alliance for Internet Zero is a mammoth grouping of greater than 550 central banks, insurers, asset managers, and asset house owners. Its trade subgroups are pivotal in debates regarding the shift to cleaner capitalism.

Based on a leaked doc seen by Ethical Cash, the Internet Zero Banking Alliance, a Gfanz subgroup led by international banks together with HSBC and Morgan Stanley, made plans final yr to inform members to slash their fossil gas financing based mainly on a simple metric of carbon emitted.

This paper marked a significant step, requiring banks to make real-world modifications to reduce emissions. Its passage would have successfully concluded the talk about whether or not banks ought to lower lending to fossil gas corporations.

The proposals had been open for session till September and appeared to focus on swift implementation of the principles. The paper regarded “when the rule of thumb is formally adopted by the NZBA Steering Group (subsequent assembly on the eleventh of October).” More than five months later, the NZBA stated it had not been despatched to executives for approval.

A critical sticking level has been the obligatory use of a more complex “absolute” accounting metric for measuring decarbonization based on a financial institution govt that sits on the NZBA’s management group and doesn’t want to be named. Most European banks already set absolute targets, whereas few US banks do — except for Citigroup.

Presently many banks, significantly within the US, focus as an alternative on pushing power corporations they finance toward much less carbon-intensive manufacturing, like how Saudi Aramco invests in renewable power, and carbon seizes to cut back the day-to-day emissions of its oil rigs. The NZBA’s present place allows banks to use a weaker intensity metric that may be met with no change in actual world carbon emissions.

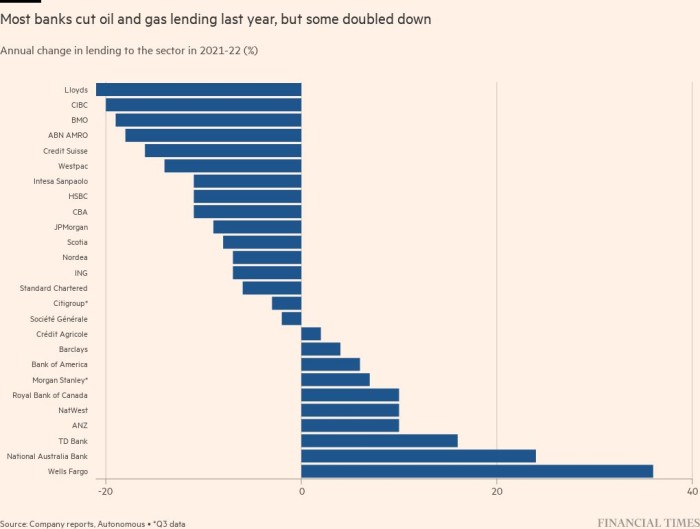

4 in 10 international banks elevated their lending publicity to grease and gasoline corporations final yr, together with alliance members NatWest and Barclays, based on analysts at Autonomous.

Mike Coffin, head of oil, gasoline, and mining on the think-tank Carbon Tracker, which advises the NZBA, stated establishments ought to give attention to slicing actual financing flows to the oil and gasoline sector by making absolute emissions cuts obligatory. “Decarbonised fossil fuels are a little fable,” he stated.

Metrics apart, one other sticking level stays over the energy of the steerage. Whereas the unique draft used the phrases “ought to” and “shall,” the most recent working draft replaces these instructions with softer language like “might” and “might,” based on an individual who has labored on the paper for the NZBA.

The particular person stated that this linguistic tweak was agreed on final yr to guard banks against the chance of being attacked underneath competitors’ legislation for collaboration on local weather targets. Such worries triggered the departure last week of Munich Re, one of the world’s greatest reinsurers, from the insurers’ group it helped to discover, citing “materials antitrust dangers” to collective motion.

However, critics additionally attributed monetary corporations’ sluggish progress on tightening requirements to a reluctance to forego oil and gasoline sector enterprise at a time of booming income and renewed give attention to power safety.

“The failure to provide this paper reveals banks’ unease about internet zero targets and what these indicate for his or her relationships with the oil and gasoline sector in apply,” stated Lucie Pinson, founding father of the NGO Reclaim Finance.

Vitality corporations BP, TotalEnergies, and Shell, which use a combination of absolute and depth targets in their very own internet zero targets, had been listed as knowledgeable advisers to the NZBA’s oil and gasoline working group within the doc seen by the Monetary Instances, alongside a trade group and non-profits.

“The presence of fossil gas corporations as knowledgeable members [is] not inflicting a delay within the progress of this work monitor,” the NZBA stated. It added that the draft paper outlines a spread of choices that banks can select from to set targets and that it’s persevering in working on its oil and gasoline place.

A special draft place paper seen by Ethical Cash tells another story of thwarted good intentions. It exhibits that the Internet Zero Asset Homeowners Alliance (NZAOA) — whose members embrace UK insurance coverage group Aviva and Calpers, the most extensive public pension plan within the US — additionally made plans final yr to usher in robust guidelines on oil and gasoline.

These guidelines are helpful for buyers to avoid investing in new oil and gas fields, not solely by ways of finance but also ways of equities and bonds. Most oil and gasoline financing is finished with a company degree, not a mission degree.

When the group printed new tips the final week that they had noticeably softened, they stated members ought to lower off mission finance for oil and gas fields or baseload gas-fired energy technology without carbon seize expertise. However, they didn’t check with company bonds or fairness stakes.

The NZAOA declined to remark. Shaped earlier than Gfanz was based, the grouping has a robust status for local weather commitments. It now represents more significant than $11tn in belongings in portfolios that are straight owned and, due to this fact, more straightforward to tweak. So its urge for food for decarbonization (or lack thereof) might set the tone for the tempo of change by banks and asset managers. (Kenza Bryan)

Sensible watch

Swedish actor and Zoolander star Alexander Skarsgård have recorded a tongue-in-cheek take for the New York Instances on Cambridge professor Sir Partha Dasgupta’s theories about together with the price of nature in mainstream economics, which will be neatly summarised as “Pay for what we use.” Revisit Ethical Cash’s interview with Dasgupta right here.

[ad_2]