[ad_1]

This text is an on-site model of our Power Supply publication. Sign up here to get the publication despatched straight to your inbox each Tuesday and Thursday

Welcome again to Power Supply.

As oil costs slid in current weeks, an aversion to hedging left many gamers within the US shale patch uncovered, as Justin studies this morning.

However has the value rout now ended, or is there extra ache to return? In at the moment’s publication, Derek asks if oil costs are about to rebound.

Christine Murray studies from Mexico on warming relations between the federal government and personal capital, after a deal was struck to push ahead growth of a serious new oilfield. And Amanda studies on the place oil staff see their future.

Thanks for studying — Myles

The crude comeback . . .

Crude costs jumped yesterday, with Brent settling up 4 per cent at $78.12 a barrel amid hopes that the banking disaster that has rattled international markets has begun to ease.

The lack of about 5 per cent of world provides as exports from northern Iraq to Turkey had been shut was extra bullish information for crude.

So is that it for the March insanity in oil markets? The brief reply isn’t any. Brent continues to be about $8 beneath its worth from the day earlier than Silicon Valley Financial institution’s troubles went public. And speculators stay bearish.

Internet lengthy positions in main crude contracts as a share of open curiosity available in the market have greater than halved in current weeks, representing simply 5 per cent. That’s decrease than at any level since oil costs went sub-zero in April 2020, famous Rory Johnston at Commodity Context. The sheer scale of the change in speculators’ place in current weeks, famous the ever-astute Reuters analyst John Kemp, implies a “basic change within the outlook”.

SVB’s failure, Credit score Suisse’s demise and the concern of additional contagion have alarmed even probably the most bullish analysts. Goldman Sachs cited banking stress, recession fears, and surging volatility because it slashed its Brent worth forecast for 2023 by $7/b, to $85/b.

“Traditionally, after such scarring occasions, positioning and costs get better solely steadily,” the financial institution stated.

The tightening of credit score circumstances can be weighing on an oil market all the time petrified of recession danger, famous analysts at Power Features. It’s no repeat of 2008, “However funding prices for US regional banks will rise to compete for deposits, which is able to squeeze internet curiosity margins, tightening the credit score cycle and slowing the financial system.”

Within the background are sloppy international provide and demand fundamentals. Russian provide has not fallen as steeply as anticipated, and Chinese language demand has not picked up as shortly as forecast. Strikes at French refineries have weakened crude consumption; the US authorities is holding off shopping for oil for the Strategic Petroleum Reserve; and wealthy world industrial oil inventories are rising shortly. Opec exhibits little inclination of stepping in till it higher understands the outlook, famous Power Features.

And but, if something, the value drop of current weeks solely enhances the possibilities of a robust restoration later.

Russian provide could have proved resilient to this point. However the absence of western capital within the upstream will finally erode capability. In the meantime, the Kremlin final week stated it was about to implement a unilateral minimize of about 5 per cent of provide.

Though China’s demand has underperformed expectations, that appears unlikely to final for much longer. The Worldwide Power Company stated this month {that a} “resurgent China” would assist push international oil demand up between the primary and fourth quarters this 12 months by 3.2mn barrels a day, “the most important relative in-year improve since 2010”.

The current worth drop, in the meantime, has uncovered much more frailties within the shale patch, the place excessive prices and capital restraint had been already creating headwinds for vital provide development.

Briefly, the oil worth rout this month has, if something, most likely solely delayed a reckoning to return later within the 12 months, when the world’s shoppers are anticipated to burn report quantities of crude once more.

To make certain, a worldwide recession would destroy this bullish thesis — and warnings from the World Financial institution of a “misplaced decade of development” to return will hardly metal the nerves of some oil merchants. Till the banking issues are decisively resolved, the macro threats will loom over crude costs.

Oil markets have turned “excessively pessimistic”, famous Goldman, ever the bull. But it surely has a degree. If recession is averted, the restoration in oil costs might be swift. The buying and selling methods and position-covering strikes that triggered such volatility on the way in which down might be simply as violent on the way in which up.

(Derek Brower)

Detente between Mexico and personal oil funding

Mexico’s fraught relationship with personal sector vitality funding appears to be thawing.

That’s the primary takeaway from the breakthrough deal struck between state oil firm Pemex and a non-public sector consortium to develop the large Zama oilfield.

The venture in 2017 grew to become Mexico’s first huge personal sector oil discovery in three-quarters of a century after a landmark 2013 reform that threw the doorways open to personal capital.

However a stand-off between the consortium and Pemex, which owns a number of the acreage on which it’s located, prompted a drawn out battle over who ought to be in cost — making it a take a look at case for international funding below president Andrés Manuel López Obrador.

Final Thursday, Pemex and the consortium of firms led by US group Talos Power said that they had submitted a joint plan to hydrocarbons regulator CNH to develop the sphere, which might produce as much as 180,000 barrels per day, equal to 10 per cent of the nation’s oil manufacturing.

“It’s big information,” stated John Padilla, managing director at IPD Latin America. “It’s indicative of the actual fact that there’s a willingness, inside the constraints of the administration, to maneuver good issues ahead.”

López Obrador, who took energy in 2018, is an old-school vitality nationalist who has upended the nation’s oil and fuel business. He has successfully reversed elements of the 2013 reform stalling new funding within the sector.

In 2021, his authorities handed management of Zama to Pemex. Talos, which says it has invested greater than $100mn within the subject, filed notices of dispute below the United States-Mexico-Canada free commerce settlement (USMCA).

Below final week’s agreement, Pemex will retain 50.4 per cent of taking part pursuits, with Talos holding 17.4 per cent, Germany’s Wintershall DEA 19.8 per cent and Harbour Power of the UK 12.4 per cent.

The market continues to be dramatically modified from the broader opening for funding below the prior administration, and new tasks should align with López Obrador’s imaginative and prescient to enhance the state firms somewhat than compete with them.

Nonetheless, the Zama settlement is the newest signal that his authorities is now permitting a restricted variety of giant offers within the vitality sector to maneuver ahead, significantly within the type of joint ventures.

-

In November Pemex stated it might develop the Lakach deepwater pure gasfield with US firm New Fortress Power.

-

In February, US firm Sempra and billionaire Carlos Slim’s Grupo Carso signed a memorandum of understanding with electrical energy utility CFE to work on a brand new pure fuel pipeline in north-west Mexico.

-

TransCanada signed a cope with CFE final 12 months to collectively construct an offshore pure fuel pipeline within the south-east.

Consultants stated actuality was catching up with the federal government. Pemex’s manufacturing has dropped to historic lows of about 1.8mn barrels per day and the closely indebted firm confronted greater than $5bn of debt repayments in simply the primary quarter.

“As we speak is a greater second than two or three years in the past,” stated Ramón Massieu Arrojo, an vitality lawyer who was normal counsel for regulator CNH till the tip of 2020. “Issues are going to get higher, not change radically, however they may get higher within the subsequent two years and indubitably within the subsequent administration whoever turns into president.”

(Christine Murray)

Information Drill

With the vitality transition below manner, a looming query faces oil and fuel staff: what’s going to occur to their jobs?

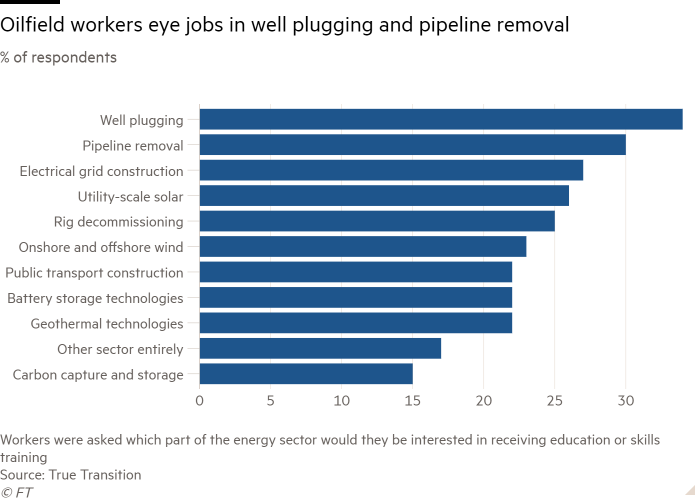

A new report by True Transition surveyed greater than 1,600 oil and fuel staff on their outlook for the business and their future employment. Greater than half of them supported federal motion to ensure jobs to these displaced by the transition, and 42 per cent supported subsidised coaching in a brand new subject.

The survey comes because the Biden administration seeks to spark a growth in clear vitality jobs. But in terms of new sectors within the vitality business, staff most well-liked jobs requiring related experience reminiscent of well-plugging and pipeline elimination. Jobs in grid electrification and utility photo voltaic had been additionally among the many prime decisions, nonetheless, with greater than 1 / 4 of respondents reporting curiosity in coaching for these fields. (Amanda Chu)

Energy Factors

Power Supply is written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu and Emily Goldberg. Attain us at vitality.supply@ft.com and observe us on Twitter at @FTEnergy. Compensate for previous editions of the publication right here.

Really helpful newsletters for you

Ethical Cash — Our unmissable publication on socially accountable enterprise, sustainable finance and extra. Sign up here

The Local weather Graphic: Defined — Understanding an important local weather knowledge of the week. Enroll here

[ad_2]

Source link