[ad_1]

In buying and selling on Thursday, shares of Kinder Morgan have been yielding above the 7% mark based mostly on its quarterly dividend (annualized to $1.13), with the inventory altering fingers as little as $16.11 on the day. Dividends are significantly vital for buyers to contemplate, as a result of traditionally talking dividends have supplied a substantial share of the inventory market’s complete return. As an instance, suppose for instance you bought shares of the S&P 500 ETF (SPY) again on 12/31/1999 — you’ll have paid $146.88 per share. Quick ahead to 12/31/2012 and every share was price $142.41 on that date, a lower of $4.67/share over all these years. However now contemplate that you just collected a whopping $25.98 per share in dividends over the identical interval, for a constructive complete return of 23.36%. Even with dividends reinvested, that solely quantities to a mean annual complete return of about 1.6%; so by comparability gathering a yield above 7% would seem significantly engaging if that yield is sustainable. Kinder Morgan is an S&P 500 firm, giving it particular standing as one of many large-cap firms making up the S&P 500 Index.

Begin slideshow: 10 Shares The place Yields Received Extra Juicy »

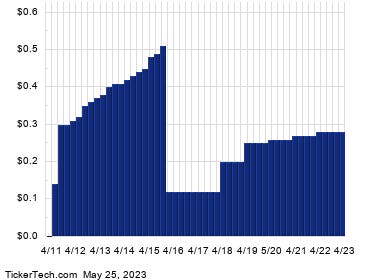

Generally, dividend quantities should not at all times predictable and have a tendency to comply with the ups and downs of profitability at every firm. Within the case of Kinder Morgan Inc., trying on the historical past chart for KMI beneath might help in judging whether or not the latest dividend is more likely to proceed, and in flip whether or not it’s a affordable expectation to count on a 7% annual yield.

KMI

Particular Supply: Obtain our greatest dividend concepts on to your inbox every afternoon with the Dividend Channel Premium E-newsletter

[ad_2]

Source link