[ad_1]

Nobody desires to get previous. Actually, tens of millions of Individuals dwell like they’ll keep younger eternally. However the actuality is that all of us age, and as we do, well being situations crop up and start robbing us of issues like mobility and on a regular basis actions.

That is the place long-term care insurance coverage is available in. Having a plan for the longer term could make a big distinction.

If you wish to defend your nest egg, take a few of the burden off relations and be extra accountable for your golden years, long-term care insurance coverage is a should!

Why Lengthy-Time period Care Insurance coverage Issues

The numbers present that 65-year-olds at the moment have a 70% probability of needing long-term care and an estimated 20% of Individuals will want it for longer than 5 years.1 That’s some math you don’t need to roll the cube on.

Take Steve and Rachel, for instance. They weren’t at all times sensible with cash, however they labored onerous and constructed up a nest egg of $300,000.

![]()

Lengthy-term care is a vital choice. Join with a trusted professional to be sure to have the proper protection.

When Steve was 67 years previous, he developed Alzheimer’s illness. At first, it wasn’t too unhealthy. Rachel used a few of their nest egg to rent a house care specialist to assist for a number of hours day by day. However as Steve’s situation worsened, he ultimately had to enter a nursing dwelling. Sadly, after 5 years within the dwelling, Steve died. Rachel, now 72, is wholesome for her age, however she has to work full time as a result of her husband’s keep within the nursing dwelling worn out most of their nest egg.

Sadly, Steve and Rachel’s story isn’t distinctive. An estimated one in six Individuals can pay a minimum of $100,000 in out-of-pocket bills for long-term care—out-of-pocket!2 As in immediately out of their financial savings and retirement funds. And solely 7.5 million Individuals have some type of long-term care insurance coverage.3

However you could be completely different. You may set your self up for fulfillment by having a plan. And that plan is known as long-term care insurance coverage.

What Is Lengthy-Time period Care Insurance coverage?

Lengthy-term care insurance coverage helps cowl prices associated to a nursing dwelling keep, assisted residing facility, or caretakers coming to your home when somebody will get older or begins coping with well being points. It covers providers—like getting dressed or taking a shower—that some people will need assistance with as they age. Lengthy-term care is any care that lasts longer than three months.

For a lot of Individuals, long-term care insurance coverage is essential since it may be so costly—like actually costly. The typical price in the USA of 1 month in a nursing house is $7,698.4 (Sure, you learn that proper.)

In line with the Alzheimer’s Affiliation, the estimated price for care within the ultimate 5 years of life is $367,000 for individuals with dementia and $234,000 for these with out.5 The typical American can pay $172,000 for long-term care.6 And whereas common medical insurance received’t cowl these prices, long-term care insurance coverage will.

The Alzheimer’s Affiliation estimated end-of-life care prices within the ultimate 5 years of life begin round $234,000. Merely put, long-term care is dear.

What Does Lengthy-Time period Care Insurance coverage Cowl?

Lengthy-term care insurance coverage covers many of the bills that aren’t coated by Medicare. (Shock! The federal government isn’t going to care for all of your wants). Prices could possibly be for issues like:

- Nursing dwelling care

- Assisted residing amenities

- Grownup day care providers

- In-home care

- Dwelling modifications

- Medical gear

- Care coordination

One of many nice issues about long-term care insurance coverage is that it covers in-home care prices. So that you’ll be capable of dwell in your house longer.

If you concentrate on it, for insurance coverage carriers, loads comes right down to {dollars} and cents. Insurance coverage firms have a monetary curiosity in you residing in your house for so long as attainable. It’s loads cheaper for them to foot the invoice for a small dwelling modification like a ramp than it’s to pay a declare for a nursing dwelling keep.

Doesn’t Medicare or Medicaid Cowl Lengthy-Time period Care?

Chances are you’ll be considering: What about authorities applications? Gained’t they cowl long-term care?

Don’t make the error of believing Medicare will cowl long-term care prices. It received’t. Medicare solely pays for hospitalization and short-term rehabilitative care, and it solely covers you for as much as 100 days.

And whereas Medicaid—the federal government program for many who really don’t have any cash—will cowl long-term care bills, it ought to by no means be your first alternative. You received’t have the standard of care you need, and also you’ll have restricted choices.

Oh, and one different factor. For Medicaid to even kick in and canopy long-term care, you’d first have to make use of up no matter belongings you had. This will imply you’re knocking on poverty’s door earlier than Medicaid decides to assist.

Aspect notice: It’s frequent for individuals to attempt to cheat the system by shifting their people’ belongings round to attempt to get them to look broke so that they’ll qualify for presidency assist. That’s thought-about fraud—a federal crime—and the federal government will prosecute you! Don’t turn out to be a prison simply since you did not plan forward.

5 Advantages of Lengthy-Time period Care Insurance coverage

In relation to long-term care insurance coverage, there are a ton of advantages (effectively, 5 to be actual). Let’s have a look!

1. Your belongings will probably be protected.

You labored your entire life to avoid wasting and make investments for the longer term. Nice job! However now that you just’re getting older, the very last thing you need is to spend a giant chunk of your hard-earned money on long-term care. (In case you have a excessive sufficient web value although, you might be able to self-insure.)

Lengthy-term care insurance coverage will hold that nest egg heat and comfy so you may have a extra snug retirement. You’ll know that for those who do turn out to be in poor health, you may afford the care you want and nonetheless have the funds for left over so that you and your partner can eat.

2. Your family members received’t have the total burden of care.

Once you or a beloved one wants care, this generally is a large burden on a partner or relations. Lengthy-term care insurance coverage can present the additional assist you and your loved ones want by way of what can typically be a difficult time. And typically the quantity of care is greater than a partner or member of the family can deal with. That is the place it’s at all times good to produce other choices.

Plus, your children received’t be burdened with big funds in your care.

3. You and your loved ones could have much less stress with care administration providers.

Lengthy-term care insurance coverage doesn’t simply pay for in-home care or a nursing dwelling keep. It additionally may also help with care administration (or care coordination). That is somebody who can are available in and discover the assist that’s wanted, set it up, and supervise it to be sure to’re being taken care of. This further assist is a giant blessing for relations throughout instances which are typically bodily and emotionally exhausting.

4. You may dwell in your house longer.

Many individuals affiliate long-term care insurance coverage with protection that merely pays for a nursing dwelling keep. However as we noticed earlier, long-term care insurance coverage additionally covers lots of in-home bills. You’ll be capable of dwell in your house longer due to issues like dwelling modifications and medical gear.

In-home caretakers may make issues rather more snug for you as you take care of decrease mobility and different well being conditions.

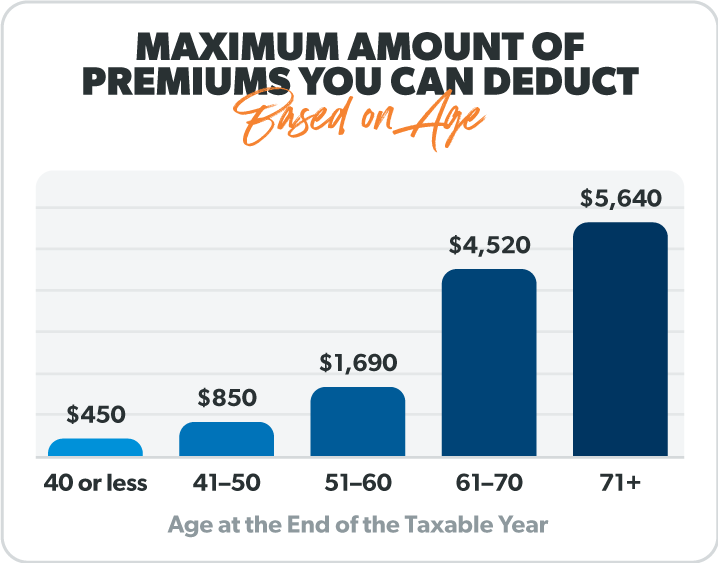

5. You’ll pay much less taxes with tax-deductible premiums.

Lengthy-term care insurance coverage premiums are tax deductible as much as a specific amount. So that you’ll hold extra of these Benjamins within the financial institution. And also you would possibly even be capable of pay premiums out of a tax-free Well being Financial savings Account. (Extra on tax benefits in a second.)

How A lot Does Lengthy-Time period Care Insurance coverage Price?

The price of long-term care insurance coverage can differ fairly extensively. Yearly premiums can run as little as $1,000 to round $10,000. The insurance coverage firm will have a look at issues like your age, gender, location, present well being and household well being historical past. You’ll additionally pay extra for those who select a long run or an even bigger profit. Additionally remember the fact that your provider can increase your premiums after you obtain the coverage.

Proper now, the typical 55-year-old man can pay $1,700 per yr for a three-year coverage that covers $164,000 in care and a day by day max of $150.7 The typical 55-year-old lady can pay $2,675 for a similar degree of protection.8 It’s because ladies are likely to outlive males, so insurance coverage firms require girls to fork over more cash. In line with federal knowledge, ladies outlive males by about 5 years and wish a median of three.7 years of care versus solely 2.2 years for the typical man.9,10

The excellent news is that {couples} get reductions. Some states permit for financial savings as much as 30%, however others are trimming them again to round 15%.11

Forms of Lengthy-Time period Care Insurance coverage

Conventional Lengthy-Time period Care Insurance coverage

Conventional long-term care insurance coverage is a no-frills, stand-alone insurance coverage coverage. It’ll pay for long-term care providers if you want them. That’s it!

When does a conventional coverage kick in? The coverage is triggered when you may not carry out two out of six actions of day by day residing:

- Dressing

- Bathing

- Consuming

- Caring for incontinence

- Mobility

- Utilizing the bathroom

Your coverage may begin for those who undergo from extreme cognitive impairment. Beneath most insurance policies, you’ll have a ready interval between 30 and 90 days earlier than insurance coverage kicks in. This implies you’ll must plan for about three months of out-of-pocket bills even with long-term care insurance coverage in place.12

So far as the payout, the everyday long-term insurance coverage coverage gives a good thing about $160 per day for nursing dwelling take care of a time period, or set variety of years (three is most typical).13

You may as well add an inflation rider, which is a elaborate technique to say “inflation safety.” With an inflation rider, your profit will enhance over time (normally about 3% a yr) to maintain up with inflation. However truthful warning, including a rider will in all probability price you somewhat further.

Hybrid Life and Lengthy-Time period Care Insurance policies

An alternative choice is a coverage that mixes life insurance coverage with long-term care protection. With a hybrid coverage, you may entry the loss of life profit—the cash that your beneficiaries would obtain if you die—if you are nonetheless alive to pay for long-term care.

And if you find yourself not needing care, your heirs get the total payout. Charges are thought-about “noncancelable,” which implies premiums are fastened for all times.

However brace your self—the worth tag for a hybrid coverage is normally 1000’s of {dollars} greater than a conventional coverage. That’s since you’re additionally shopping for life insurance coverage you won’t even want together with long-term care protection. And in contrast to conventional long-term care insurance coverage, the premiums for hybrid insurance policies are not tax deductible.

Just like entire life insurance coverage, a hybrid coverage signifies that insurance coverage firms are investing your cash for you. The issue is, they’re not making good investments, and your returns will in all probability barely sustain with inflation. In the event you take into consideration all of the misplaced earnings, hybrids could also be the costliest long-term care coverage of all. That’s why hybrid insurance policies ought to usually be a final resort.

The one time you would possibly contemplate shopping for a hybrid is for those who don’t qualify for a conventional long-term care insurance coverage coverage primarily based in your well being standing. If that’s not the case, purchase long-term care insurance coverage and life insurance coverage individually—don’t attempt to marry the 2! (And whereas we’re as regards to life insurance coverage, be taught why time period life is your only option to guard your revenue and your loved ones’s future.)

When to Purchase Lengthy-Time period Care Insurance coverage

Dave suggests ready till age 60 to purchase long-term care insurance coverage as a result of the probability of you submitting a declare earlier than then is slim. So, in your sixtieth birthday, exit and purchase your self the present of a long-term care coverage! (We all know, it’s not essentially the most thrilling birthday current, however it’s positively one of many smartest.)

Get this—about 95% of long-term care claims are filed for individuals older than age 70, with most new claims beginning after age 85.14 However bear in mind, insurance coverage shouldn’t be one-size-fits-all. You want to do what’s finest for you and your loved ones. In the event you or your partner has a household historical past of sickness at a younger age or have a number of well being points, you could must get long-term care earlier. In the event you’re in your late 60s, you would possibly really feel prefer it’s too late, however it’s nonetheless good to see what you may qualify for.

You might have heard that you just’ll pay much less and lock in a decrease month-to-month premium for those who purchase your coverage at age 50 as an alternative of age 60. That is likely to be true, however you’ll even be allotting cash for an additional decade—for no purpose. Dave won’t ever inform you to purchase one thing primarily based on how a lot the month-to-month cost is. That’s what broke individuals do. It’s about what you want, when you want it.

Many individuals fear that in the event that they wait till age 60 to purchase long-term care, they’ll develop a medical situation that can both stop them from qualifying for protection or considerably increase their premiums. Once more, in case you have genetic well being considerations otherwise you’re shedding sleep since you’re frightened about getting sick and never with the ability to afford care, then purchase long-term care when you may afford it. The peace of thoughts is value greater than any money you’ll save on premiums. However don’t purchase long-term care at a younger age simply since you suppose you’ll lower your expenses by doing it.

How you can Purchase Lengthy-Time period Care Insurance coverage

You may both purchase long-term insurance coverage by yourself or you may work with an insurance coverage agent. Some employers additionally provide group plans by way of one among their insurance coverage brokers. The advantages of working with an insurance coverage professional is that you may have somebody in your aspect to have a look at your state of affairs and be sure to’re getting the proper plan.

The following step is to fill out an utility. You’ll reply a number of questions on your well being standing. Even be ready to supply medical information in the event that they’re requested.

Subsequent, you’ll undergo an interview course of over the cellphone or typically in particular person.

You’ll then select the protection that matches your wants. Choose a time period size and profit (the quantity your insurer can pay). Once you want in-home, assisted residing or nursing dwelling care, your insurer can pay your month-to-month profit to assist cowl these prices for the size of your time period.

As soon as it’s accepted, you begin paying the month-to-month premiums and also you’re good to go!

Lastly, remember the fact that long-term care insurers could deny you in case you have various well being points. Certainly one of our trusted insurance coverage professionals who’re a part of our Endorsed Native Suppliers (ELP) program may also help you discover out for those who qualify for conventional long-term care insurance coverage. And for those who do have a disqualifying well being difficulty, they’ll enable you to perceive your different choices—so you may get the care you deserve.

Tax Benefits of Shopping for Lengthy-Time period Care Insurance coverage

In the event you itemize your deductions, long-term care insurance coverage can have some tax benefits. It’s because the federal authorities and a few states allow you to rely some or your whole premiums as tax-deductible medical bills. However they should rise to a sure degree.

And never all long-term care insurance coverage are relevant for these tax breaks. Make sure you ask an insurance coverage professional to see if yours is tax certified.

Right here’s a helpful breakdown from the IRS exhibiting the utmost quantity of your premiums you may deduct primarily based in your age.15

The Finest Method to Get Lengthy-Time period Care Insurance coverage

So, what’s the easiest way to seek out long-term care insurance coverage? Go to an impartial insurance coverage agent. They’ll store round a number of completely different long-term care insurance coverage firms and get you quotes that may prevent 1000’s of {dollars} and a great deal of pointless worries. Lengthy-term care is a vital choice, so be sure to get knowledgeable in your aspect!

Don’t know the place to look? Our ELPs are trusted insurance coverage specialists who can reply all of your questions. Your ELP will hearken to your wants and enable you to make the proper choice for you and your loved ones—and your finances.

When you get a strong long-term care insurance coverage coverage in place, you’ll have much more peace of thoughts if you’re enthusiastic about previous age.

Contact an impartial insurance coverage agent at the moment!

[ad_2]

Source link