[ad_1]

Frequent sense tells us that home-owner’s insurance coverage ought to cowl our properties. However does it cowl all the things that might have an effect on our properties, together with “acts of God?” What in regards to the 15 pure disasters the U.S. confronted simply final 12 months that every triggered greater than a billion in damages—have been these properties that have been included within the $45 billion in losses protected by their home-owner’s insurance coverage?(1)

It’s essential to grasp what precisely your home-owner’s insurance coverage covers earlier than an “act of God” happens. You additionally have to know the disaster insurance coverage choices accessible to cowl what your home-owner’s coverage doesn’t. The very last thing you need to discover out after an occasion is that you just don’t have the protection you want.

Pure Disasters: What’s an “Act of God”?

Relating to insurance coverage, an “act of God” usually refers to an occasion, like a pure catastrophe, that happens “by means of pure causes and couldn’t be prevented by means of using warning and preventative measures.”(2) A disaster like an earthquake or a tropical storm—no matter the way you may attempt to put together for it—is solely out of your management.

Nonetheless, the query stays: What does your insurance coverage cowl? And what, if any, exclusions apply? As a result of insurance policies differ relying in your location, your insurance coverage service, and your threat ranges, it’s clever to by no means assume you’re coated. Ask an insurance coverage agent that can assist you perceive what your coverage entails and which exclusions could apply to you.

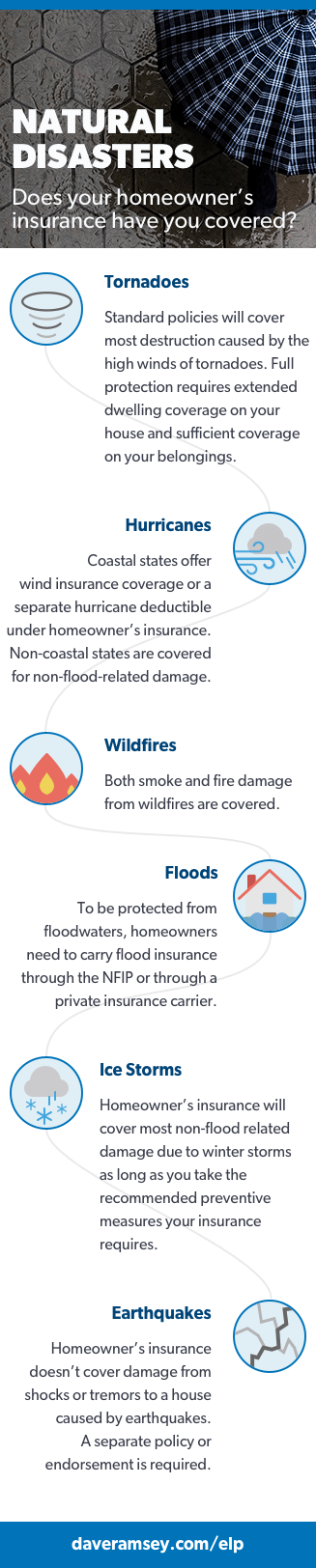

Beneath are a few of the commonest pure disasters and what you’ll want to find out about defending your house with every of them.

Tornadoes

Yearly about 1,200 tornadoes contact down in america bringing as much as 300 mph winds with them.(3) Deemed the “most sudden, unpredictable and violent” storms on earth, tornadoes account for roughly 40% of disaster claims.(4, 5) Whereas Florida sees its justifiable share of twisters, the various tornadoes happen in “Twister Alley” which stretches all the way in which from west Texas to Iowa.(6) However, within the final 20 years, “Dixie Alley” (a handful of southeastern states) has seen devastation far worse than “Twister Alley” as a consequence of its climate situations and better cell dwelling inhabitants.(7)

Fortunately, customary home-owner’s insurance coverage insurance policies will cowl most destruction brought on by the excessive winds of tornadoes. Take into account that, with the intention to be totally protected insurance-wise, you want prolonged dwelling protection on your own home and enough protection in your belongings. In any other case, your insurance coverage firm pays you in your dwelling’s present market worth, somewhat than what it might value to rebuild.

Usually Coated by Dwelling Insurance coverage:

- Meals spoiling within the freezer because of an influence outage brought on by a twister

- Short-term relocation bills (meals and lodging)

- Wind harm (besides in coastal states)

- Injury to your house as a consequence of a tree falling on it (assuming you didn’t already know you have been in danger)

- Elimination of a tree that causes harm to your house (no matter who it belongs to)

Usually Coated by Automobile Insurance coverage:

- Injury to your automobile ensuing from the twister

Hurricanes

Due to the Atlantic hurricane season (June by means of November) that impacts practically each coastal state, 19 states supply wind insurance coverage protection or a separate hurricane deductible below home-owner’s insurance coverage.(8)

Fairly than typical “greenback” deductibles, these deductibles are primarily based on a share of the insured property to attenuate doable losses. For instance, if your house is value $250,000 and you’ve got a ten% hurricane deductible, you would wish to pay $25,000 out of pocket earlier than your insurance coverage firm would cowl any repairs for hurricane harm. Outdoors of those states, home-owner’s insurance coverage sometimes covers non-flood-related harm as a consequence of hurricanes.

![]()

Defend your house and your funds with the appropriate protection!

To be protected against floodwaters, householders want to hold flood insurance coverage by means of the NFIP or by means of a personal insurance coverage service along with their home-owner’s insurance policies.

Usually Coated by Dwelling Insurance coverage:

- Wind harm (besides in coastal states)

- Short-term relocation bills (meals and lodging)

- Flooding brought on by water coming by means of a gap within the roof

- A lightning storm destroys your favourite oak tree (as much as $500)

- Meals spoiling within the freezer because of an influence outage brought on by a hurricane

Usually Coated by Automobile Insurance coverage:

- Hail harm to the hood of your SUV

Usually Coated by Wind Insurance coverage:

- Dwelling harm brought on by wind-driven rain (in coastal states)

Usually Coated by Flood (or Hurricane) Insurance coverage:

- Water harm to your house brought on by flooding

- Water-damaged home equipment because of a flood

- Furnishings destroyed by floodwaters

Wildfires

The primary three quarters of 2017 alone noticed practically 50,000 wildfires rage throughout 8.4 million acres in america.(9) Whether or not it’s a campfire left unattended, burning particles that will get uncontrolled, negligence or arson, roughly 90% of wildfires are brought on by people.(10)

The excellent news for householders is that you just don’t want extra protection, like a disaster insurance coverage coverage, to guard your house from wildfires—each smoke and fireplace harm are coated by your home-owner’s insurance coverage.

Your insurance coverage premium will largely rely upon each the danger stage of the world you reside in and the way shut your house is to firefighting assets. In case your group has taken steps to restrict wildfire destruction, ask your native insurance coverage agent in the event you’re eligible for a reduction.

Usually Coated by Dwelling Insurance coverage:

- Injury from smoke or flames

- Loss as a consequence of looting or theft within the wake of a hearth

- Hearth brought on by a damaged gasoline line

- Short-term relocation bills (meals and lodging)

Usually Coated by Automobile Insurance coverage:

Associated: Saving cash shouldn’t imply sacrificing protection. Individuals who have labored with an insurance coverage Endorsed Native Supplier saved over $700 and acquired 50% extra protection. Learn how a lot you may save.

Floods

Whether or not it’s rising water from a heavy rainfall, a hurricane, or a dam break, flooding is likely one of the most misunderstood pure disasters in the case of each threat and insurance coverage protection.

It’s straightforward to suppose that since you reside in a low-risk zone that you just’re in a “no threat” flood zone. However you don’t should reside in a floodplain or be in a high-risk space to expertise harm from floodwaters. Within the final three years alone, Houston, Texas, has seen three “500-year floods” with waters affecting areas so low-risk that they have been anticipated to flood simply as soon as each 5 centuries.(11)

Opposite to standard perception, harm from floodwaters is usually not coated below your home-owner’s insurance coverage. Although roughly 90% of all pure disasters contain flooding, solely about 12% of householders have protection for it.(12,13)

To make sure your house and belongings are coated for harm brought on by flood waters, you’ll want to buy flood insurance coverage by means of the Nationwide Flood Insurance coverage Program (NFIP) or by means of a personal insurer. NFIP premiums for low-risk zones begin out at $112 yearly, however can vary as much as $1,200 in higher-risk areas.(14,15) Non-public flood insurance coverage protection presents increased limits of protection, however it can possible be dearer. Since NFIP protection maxes out at $250,000 in your dwelling and $100,000 in your belongings, some householders select so as to add protection by means of a personal insurer or carry the whole quantity by means of a personal insurer.

Usually Coated by Dwelling Insurance coverage:

- Short-term relocation bills (meals and lodging)

Usually Coated by Flood Insurance coverage:

- Water harm to your house brought on by flooding

- Water-damaged home equipment because of a flood (non-coastal states)

- Furnishings destroyed by floodwaters (non-coastal states)

Usually Coated by Automobile Insurance coverage:

Not Usually Coated by Insurance coverage:

- Completed basements ruined by floodwater

- Landscaping washed away by floodwater

- Sewage backup into the home (ask about buying a separate coverage)

Associated: Earlier than it Floods: Obtain our free guidelines to be sure to’re ready!

Ice Storms

Annually, winter storms end in about $1.5 billion in claims, and in 2016 alone, winter storms accounted for practically 7% of all disaster losses—inflicting all the things from flooding and energy outages, to timber and roofs collapsing below the load of ice and snow.(16)

In case you have home-owner’s insurance coverage, you’ll possible be coated for many non-flood associated harm as a consequence of winter storms so long as you’re taking the really useful preventive measures your insurance coverage requires, like protecting your warmth on throughout a freeze or ensuring your pipes are in good working situation. In case your space is vulnerable to heavy snowfalls and fast temperature adjustments that trigger flooding, you could need to take into account including flood insurance coverage by means of the NFIP or a personal insurer. And don’t neglect to hold complete protection in your automobile as nicely, because it’ll cowl any wanted repairs if black ice decides to take you and your automobile for a journey.

Winter storms could carry their share of harm, however you don’t should face the winter season unprepared. With the appropriate insurance coverage in place, you could be protected!

Usually Coated by Dwelling Insurance coverage:

- Short-term relocation bills (meals and lodging)

- A neighbor slipping and falling after you simply cleared the snow off your entrance porch

- Wind-driven rain or snow (besides in coastal states)

- Roof harm as a consequence of hail

- Pipes bursting throughout a freeze (regardless of you taking preventative measures)

- Meals spoiling within the freezer because of an influence outage brought on by the storm

Usually Coated by Wind Insurance coverage:

- Hail harm to your house (in coastal states)

Usually Coated by Automobile Insurance coverage:

- Fender bender with a tree as a consequence of black ice

Earthquakes

Of the greater than three million earthquakes that happen worldwide yearly, greater than 900 of them measure a 5 or increased on the Richter scale. Traditionally, California experiences the very best variety of quakes inside the U.S. whereas Alaska tends to have essentially the most damaging—as much as a 9.2 on the Richter scale.(17)

As a result of home-owner’s insurance coverage doesn’t cowl harm from shocks or tremors to a home brought on by earthquakes, personal insurers or the nonprofit California Earthquake Authority (CEA) supply earthquake insurance coverage. That is accomplished by means of a separate coverage or endorsement with a deductible that ranges from 5–15% of your coverage restrict.(18)

Take into account that when earthquakes happen greater than 72 hours aside, they’re sometimes thought-about separate occasions which might imply a number of claims and deductibles. As a result of deductibles often run 2–20% of your house’s substitute worth, this could add as much as a big of out-of-pocket expense.(19)

Not all earthquake insurance policies cowl the associated fee to stabilize the land beneath the house, substitute the construction of your house, or restore brick or stone, so remember to ask your insurance coverage agent precisely what options your coverage presents, and the way they outline an “earthquake.”

Usually Coated by Dwelling Insurance coverage:

- Short-term relocation bills (meals and lodging)

- Shake harm to your house or basis as a consequence of an earthquake

- The storage must be rebuilt as a consequence of an earthquake

Usually Coated by Automobile Insurance coverage:

- Injury to your automobile ensuing from the earthquake

Pure Disasters: Are You Coated?

As a result of billions of {dollars} in claims pure disasters have value insurance coverage firms—practically $50 billion in 2016 alone—many have made adjustments to their protection that make it vital to have a wholesome emergency fund in place so that you’re ready to deal with a few of the prices your self.(20)

Don’t wait till it’s too late to get educated about your protection. Although enough protection could come at a major value, the results for not having it will probably shortly add up. Ask your insurance coverage agent to clarify precisely what your insurance coverage covers so you recognize what to anticipate if you’ll want to file a declare. And don’t be afraid to buy round for the very best charge! You need essentially the most reasonably priced coverage that may present the correct quantity of protection for you and your loved ones.

In powerful instances, the appropriate insurance coverage protection could make all of the distinction once you and your loved ones are attempting to rebuild on a regular basis life.

Contact one in all our ELPs right this moment to make sure that, when the winds of change come, you might be standing on stable monetary floor.

[ad_2]

Source link