[ad_1]

Howdy, and welcome again to Power Supply.

Opec+ caught oil markets abruptly over the weekend with a giant provide reduction geared toward tightening markets and boosting costs. Brent crude popped as much as 8 percent yesterday; however, it gave up a few of these beneficial properties and closed the day up 6.3 percent at $84.93 a barrel.

The try at shock and awe comes after a prolonged interval of weak spots in crude markets. Opec+ has watched oil inventories rise sharply in the latest months amid faltering demand — sentiment soured additional after turmoil within the American banking sector renewed worries of a financial slowdown. The Saudis and different Opec+ leaders wished to attempt to regain management over the market. Be sure to learn David Sheppard’s evaluation of the cuts.

For years, surging output from America’s shale patch put the cartel in a bind. Each time it tried to chop output, a flood of barrels from US producers ate into its market share whereas additionally maintaining a lid on costs — a lose-lose proposition.

However, when Opec+ leaders met with high shale producers in Houston at CERAWeek final month, they all heard that shale progress would be slower this yr irrespective of the worth. That little doubt left Opec+ feeling emboldened.

The Saudis and others in Opec+ utilize the regained effect to push oil costs higher than shale-era norms. The Saudis need Brent costs to stay above $85 a barrel.

With that mentioned, the previous yr has proven that there’s a ceiling on how excessive Opec+ can push costs up. When prices rise above $100 a barrel, shoppers begin moving again. Cranking costs excessively would also stoke inflation and threaten a recession, undermining Opec+. What’s clear is that that is Opec’s oil market once more.

On to this time’s e-newsletter, the place Derek has an interview with the pinnacle of the Worldwide Renewable Power Company, who says the West wants a “Marshall Plan” for inexperienced funding in Africa. And Amanda breaks down what US President Joe Biden’s strikes on electrical automobile subsidies mean for gross sales.

Thanks for studying — Justin

What’s lacking in international apparent vitality deployment

Transparent vitality deployment worldwide is hovering — however, it’s nonetheless far wanting what’s wanted to fulfill the Paris local weather targets. Plus, funding is concentrated in massive economies such because the US, China, and EU, when it must occur in poorer international locations too. World Financial Institutions and governments have to step up shortly.

These had been the takeaways from an interview a final week with Francesco La Digital camera, head of the Worldwide Renewable Power Company. He was talking after Irena issued a preview of its World Power Transitions Outlook.

Among the many report’s conclusions:

- Renewables accounted for 83 percent of worldwide energy-era capability final yr, and their share of put-in capability has reached 40 percent.

- However, deployment should be greater than treble, to about 1,000 gigawatts per yr, if the world is to limit warming to 1.5C by 2030.

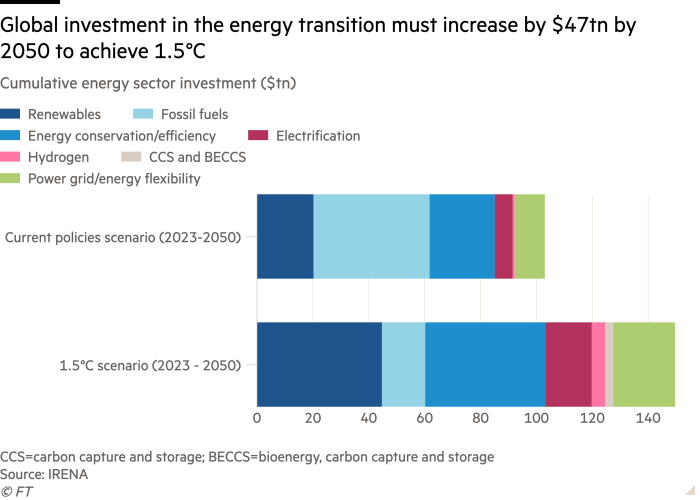

- Annual funding should virtually quadruple to $5tn a yr — and be unfold extra extensively: Africa accounted for simply 1 percent of additional capability final yr.

With mounting anxieties about vitality safety, surging demand for fossil fuels, and the onset of commerce disputes around transparent tech provide chains — all the topics of my column over the weekend — how does the world enhance renewables funding sufficiently?

There must be a “new narrative” about “closing the hole,” La Digital Camera mentioned. It’s part of the pitch Irena will make at the subsequent UN local weather convention this yr within the United Arab Emirates.

La Digital Camera mentioned that the obstacles slowing the vitality transition embody inadequate grid capability, inadequate coverage path, and poor institutional capability and assistance — for issues like skilling up employees.

“Universities usually are not getting ready engineers for the brand new vitality system,” he mentioned.

La Digital Camera, one of the world’s most seasoned local weather diplomats, is satisfied that COP28 in Dubai in November can restore momentum to the battle towards international warming.

“A mighty train of the COP is the stocktaking,” he mentioned. “So they may say to begin with that we’re not on observe . . . the governments will admit formally that they haven’t fulfilled the guarantees of the Paris settlement. This will likely be essential because the COP can’t conclude like this. It will additionally [have to] say easy methods to shut the hole.”

On the agenda, he mentioned needs to be a “form of Marshall Plan” for inexperienced funding in Africa, led by multinational funding establishments. To that finish, he welcomed the modifications on the high of the World Financial institution, the place David Malpass — appointed president of the financial institution by former US chief Donald Trump — introduced he would step down later this yr following criticism of the establishment’s response to local weather change.

Several Western international locations have been referred to as a fast overhaul of the financial institution, post-Malpass, to extend its deal with global warming.

“The modifications in the management of the World Financial institution imply one thing. There’s a political understanding that the multinational establishments need to be doing extra,” La Digital Camera mentioned. “They need to work on putting in the situation for funding to be attainable.”

Authorities’ path would stay essential for the vitality transition because the market was “failing,” La Digital Camera mentioned. “If the oil and fuel corporations are gaining extra cash from this [energy] disaster, it’s as much as governments to make this cash go to the fitting place.” (Derek Brower)

Information Drill

The Biden administration on Friday launched extremely anticipated steering on electrical automobile tax credit, slicing down the variety of eligible autos whereas extending an olive department to Europe within the subsidies dispute.

The landmark Inflation Discount Act included a $7,500 shopper tax credit score for EVs. To qualify for the total credit score, an automobile has tomustembled and supplied half the worth of its battery parts in North America. Forty percent of the value of its essential minerals should even be sourced domestically or from international locations which have free commerce agreements with the US. These thresholds are set to extend by 10 percent yearly.

On Friday, the US Treasury introduced that sourcing necessities would apply to autos beginning on April 18. A senior administration official acknowledged that the principles would “cut back the variety of electrical autos presently eligible for the total credit score within the quick period” till home manufacturing elevated.

Electrical autos made up 9 percent of all gross automobile sales within the US in January, the second highest determined so far, in response to Atlas Public Coverage. Regardless of the discount in eligible fashions, the think-tank doesn’t count on steering to sluggish EV adoption.

The Treasury additionally took a lenient interpretation on critical components of the tax credit score, broadening the definition of a free commerce settlement to appease allies equivalent to Japan and the EU, which lack an excellent commerce deal. Likewise, the steering categorized lively electrode supplies as essential minerals somewhat than battery parts, opening up sourcing alternatives past North America.

“Treasury’s carried out in addition to it may supply guidelines that meet the statute and replicate the present market,” mentioned John Bozzella, head of the Alliance for Automotive Innovation, the commerce group representing the biggest EV and battery producers.

One massive query left unanswered is what constitutes a connection to an overseas entity of concern. To qualify for the tax credit score, the IRA stipulates that starting in 2024, no parts could be manufactured in international locations which can be considered overseas entities of concern, equivalent to China, Russia, Iran, and North Korea. From 2025, no essential minerals could be sourced from these international locations both.

The Treasury delayed steering for this provision until later, leaving the eligibility of high-profile offers with Chinese language-affiliated corporations, equivalent to Ford’s $3.5bn battery plant with CATL expertise, up in the air.

“Kicking the can down the highway . . . just isn’t the very best given what number of battery producers automakers have to form of get a way of what’s honest play,” mentioned Corey Cantor, a senior affiliate of electrical autos at BloombergNEF, including that the uncertainty dangers delays in funding choices and the event of the US provide chain. (Amanda Chu)

Energy Factors

Power Supply was written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu, and Emily Goldberg. Attain us at vitality.supply@ft.com and observe us on Twitter at @FTEnergy. Make amends for previous editions of the e-newsletter right here.

Beneficial newsletters for you

Ethical Cash — Our unmissable e-newsletter on socially accountable enterprises, sustainable finance, etc. Sign up here

The Local Weather Graphic: Defined — Understanding an essential local weather knowledge of the week. Enroll here

[ad_2]