[ad_1]

This text is an on-site model of our Power Supply e-newsletter. Enroll right here to get the e-newsletter despatched straight to your inbox each Tuesday and Thursday

One factor to begin: The large information over the weekend within the US was the debt ceiling deal struck between the White Home and Republicans. Whereas it nonetheless must be authorised by Congress, the deal delivers yet one more win for West Virginia senator Joe Manchin, who managed to slide into the deal an expedited approval for the Mountain Valley Pipeline venture.

Welcome again to Power Supply. The oil supermajors’ proxy season culminates with ExxonMobil’s and Chevron’s annual conferences tomorrow. Local weather activists have already made a stir on the AGMs throughout the Atlantic, forcing fossil gas bosses corresponding to BP’s Bernard Looney and Shell’s Wael Sawan to defend their emissions plans. And Norway’s colossal sovereign wealth fund will aspect with local weather activists in opposition to the boards of the US supermajors tomorrow.

Immediately we feature a candid op-ed from Mark van Baal, head of Comply with This, a small activist shareholder which tabled a few of the latest local weather resolutions. Van Baal argues that institutional buyers must get critical about their very own dedication to the Paris Settlement local weather targets once more. Exxon’s and Chevron’s responses to van Baal’s resolutions are of their proxy statements. Write in along with your views: derek.brower@ft.com.

In the meantime, voters within the oil-rich western Canadian province of Alberta, the US’s largest supply of international crude, went to the polls yesterday, electing Danielle Smith of the United Conservative Get together as premier. For vitality and local weather watchers (or half-Albertans like me) the marketing campaign was underwhelming. Even the brutal wildfires raging within the province throughout an abnormally dry spring didn’t spark critical dialogue of local weather change.

Will the outcome result in extra confrontation with Ottawa over local weather coverage and carbon taxes, or much less? Both method, the province’s carbon-intensive oil sands are on the up once more, as Myles experiences.

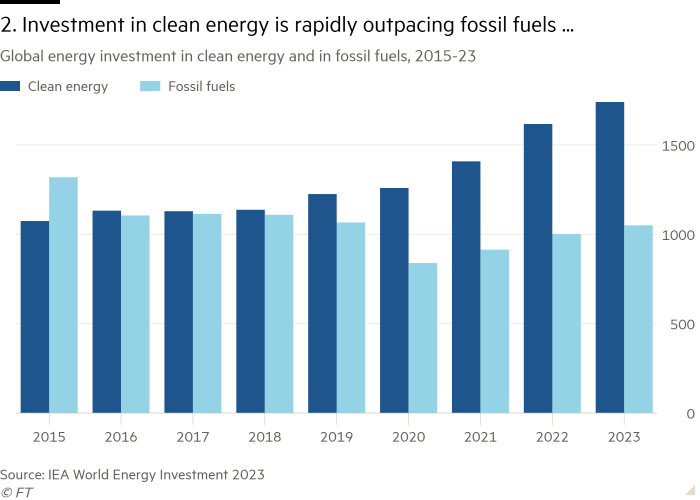

Information Drill picks out a few of the most startling takeaways from final week’s Worldwide Power Company report into international vitality funding. Thanks for studying. — Derek

Opinion: Shareholders are essential to unlocking vitality transition

Mark van Baal is the founding father of Comply with This.

On occasion, the CEO of a giant oil firm invitations me for espresso. I get pleasure from this courtesy, the swoosh of the elevate, a seat at that huge boardroom desk — by no means thoughts the intention, I inform myself. Maybe all it is a sign of respect.

Afterwards, I’m exhausted. Each time. The dialog goes like this: one of many executives will ask my organisation, Comply with This, to withdraw our shareholder decision from their firm’s AGM. My colleagues and I reply that we’re looking for a shareholder mandate that may assist administration to guide the vitality transition.

A brief second later, we shake palms — as if to substantiate our disagreement. Then I make my method down the plush C-suite corridors again to the elevator.

Comply with It is a motion of 9,000 shareholders in oil and fuel corporations. Our local weather resolutions specific assist for oil majors — Shell, BP, TotalEnergies, Chevron, and ExxonMobil — to align their CO₂-emissions discount targets with the Paris Settlement on local weather change and make investments accordingly.

Traders’ assist for Comply with This resolutions has grown from 2.7 per cent in 2016 to about one-third of AGM votes in 2021. It is a logical trajectory. Any investor considering the financial and environmental harm from carbon emissions must take an extended view of their fiduciary accountability.

In 2022, the oil empire struck again. Struggle in Ukraine triggered a surge in oil costs. Tremendous income for Massive Oil and fears of rising vitality insecurity lifted the defensive temper in these boardrooms. A way of delayed vindication amongst oil business executives was nearly palpable when, final yr, assist for Comply with This’s resolutions slumped.

Oil corporations have claimed — defying logic or accountability — that rising funding in hydrocarbons is an crucial made extra pressing by the vitality disaster. A brief-term panic in commodity markets eclipsed the bigger disaster of local weather disaster.

In fact, oil executives, specialists within the intermittently profitable enterprise of turning hydrocarbons into petrodollars, are reluctant to guide the vitality transition.

Up to now yr, we’ve met executives at 11 oil majors, each one decided to stay with what they know greatest — for so long as attainable. Emboldened by their windfall income, multiple has answered my entreaties with a easy query: how may he make the identical income from renewables?

That’s the improper query. Time is up for Massive Oil’s enterprise mannequin. Immediately’s income needs to be funding exploration of latest enterprise fashions. My argument — that the enterprise case for oil will collapse, simply as quickly as fossil gas producers are held responsible for local weather harm — falls on deaf ears.

Immediately, buyers know that the local weather disaster poses a fabric danger to their complete portfolios. The results of floods, droughts and excessive climate need to be paid for. That’s why many establishments make public commitments of assist for the Paris Settlement, which requires the world to nearly halve emissions on this decade.

Others discuss constructive engagement and transition pathways, however to little impact. The correct to vote at AGMs is the one significant energy wielded by shareholders. Why then is it so tough for a similar establishments to vote in favour of resolutions that align with their introduced insurance policies to attain the Paris objectives?

I’ve heard many solutions to that query. In 2016, when Comply with This filed our first local weather decision at Shell, we had been instructed that it was uncommon to vote in opposition to the corporate’s board; unreasonable to ask for cuts in (so-called Scope 3) product emissions; and that it was pointless as a result of oil corporations had agreed to set Scope 3 targets — within the very distant future.

These excuses have worn skinny. By 2022, the ten largest buyers within the Netherlands all voted in favour of our resolutions. Within the UK, two of the 4 largest institutional buyers (HSBC and Schroders) voted for the Comply with This proposal final yr.

The others, Abrdn and Authorized Common Funding Administration, voted in opposition to. This allowed buyers to “proceed constructing on the constructive engagements” with oil corporations, stated LGIM. However because the Church of England pension fund has acknowledged, constructive engagement and voting for the Comply with This decision usually are not mutually unique. They’re codependent.

Asset managers, whose efficiency is measured quarterly, fear that setting medium-term Scope 3 emissions discount targets would result in a decline in short-term income. In brief, they prioritise short-term income over long-term danger. This line of argument is a fallacy. Growing new oil and fuel tasks can take a decade or extra. Investments made now to extend capability herald local weather catastrophe.

So long as buyers enable Massive Oil to do what they know greatest, oil and fuel corporations will follow their technique of investing extra in new fossil fuels capability far past the boundaries of the Paris Settlement, whereas lobbying in opposition to local weather laws, and even largely ignoring court docket rulings to curb all emissions on this decade.

Massive Oil wants to alter, or Paris will fail. That’s a choice for shareholders. (Mark van Baal)

Canada’s oil sands are again

Subsequent week marks two years because the axing of the Keystone XL pipeline, which was set to pump heavy oil from Alberta to refineries on the US Gulf Coast. The implosion of the venture, many commentators stated on the time, was one other nail within the coffin of the Canadian oil sands.

However now issues are wanting up for Alberta’s oil sands, the world’s third-largest deposit of crude — and certainly one of its dirtiest.

The oil sands are set to supply 3.7mn barrels of oil a day by the tip of the last decade, based on a brand new outlook from S&P World Commodity Insights. That’s half one million barrels a day greater than right now — and 140,000 b/d greater than forecast a yr in the past.

The revision could be modest, but it surely marks the primary time S&P, an authority on international output, has upped its manufacturing forecast in 5 years. And it means that the loss of life of the oil sands has been exaggerated.

“Many individuals prophesied about writing its epitaph,” Kevin Birn, vice-president and Canadian oil markets chief analyst at S&P World Commodity Insights, instructed ES.

However whereas elevating capital for large new tasks had grow to be difficult, he stated, the sector had grow to be more and more adept at extracting ever better volumes from current tasks, whereas nonetheless returning giant quantities of money to shareholders.

“What we’re actually seeing is this huge put in capability that was constructed out over a few years and the business attempting to squeeze that capability to maximise output.”

Canada is the world’s fourth-biggest oil producer, pumping 4.8mn b/d of oil final yr, of which oil sands accounted for 3.2mn b/d.

The rise in manufacturing to 2030 underlines the endurance of the sector in a world more and more centered — rhetorically no less than — on slicing emissions. Whereas the international oil majors have principally pulled out of oil sands, native producers are juicing extra oil out of tasks by making small tweaks. Not like shale, the place manufacturing declines quickly, oil sands venture can maintain manufacturing comparatively steady for years.

Nonetheless, oil sands manufacturing — with its important ecological affect and excessive emissions profile — stays within the crosshairs of environmentalists. The difficulties of extracting and upgrading bitumen from the oil sands makes them one of the crucial carbon-intensive sources of oil on the planet. The sector can be one of many fastest-growing sources of greenhouse fuel air pollution in Canada, with complete emissions up by an element of 10 over the previous 30 years.

And as authorities in Ottawa look to sq. internet zero objectives with continued manufacturing, the federal authorities is pushing ahead with an oil and fuel cap which is ready to ascertain an absolute emissions degree for the oil sands. That’s already taking its toll.

“Though we’re seeing development, that has sort of sterilised funding just a little bit,” Celina Hwang, director of North American crude oil markets at S&P, instructed ES.

“At these costs I feel the marketer may anticipate extra development . . . However we’re not likely seeing the identical degree that we would have.” (Myles McCormick)

Information Drill

The Worldwide Power Company launched its annual World Power Funding report final week.

It contained loads of information to crunch. Listed below are three issues that we discovered notably attention-grabbing.

Energy Factors

Power Supply is written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu and Emily Goldberg. Attain us at vitality.supply@ft.com and comply with us on Twitter at @FTEnergy. Compensate for previous editions of the e-newsletter right here.

Advisable newsletters for you

Ethical Cash — Our unmissable e-newsletter on socially accountable enterprise, sustainable finance and extra. Enroll right here

The Local weather Graphic: Defined — Understanding a very powerful local weather information of the week. Enroll right here

[ad_2]

Source link