[ad_1]

When Vicki Hollub flew Occidental Petroleum’s Gulfstream V jet to Omaha for a gathering with billionaire investor Warren Buffett in April 2019, she wanted money to put a guess.

The $10bn cheque with which she emerged allowed her to outbid rival Chevron in an epic company battle to amass Anadarko Petroleum, doubling Occidental, higher often known as Oxy, in measurement. However the takeover saddled the corporate with money owed totalling nearly $50bn. For the gamble to repay, oil costs wanted to stay elevated.

Issues shortly began to go flawed. A bit over six months later, because the Covid-19 pandemic upended the worldwide economic system, oil costs started a collapse wherein the US benchmark would commerce under zero — down as a lot as 177 per cent from the worth on the day the Anadarko deal closed.

Oxy’s inventory was demolished by a market that had already soured on an business that had burnt via investor money in a collection of debt-funded drilling sprees with little to indicate in the way in which of returns. Critics panned Hollub for recklessness in ploughing forward with out regard for value.

“It was the dumbest deal in historical past,” mentioned one senior oil govt.

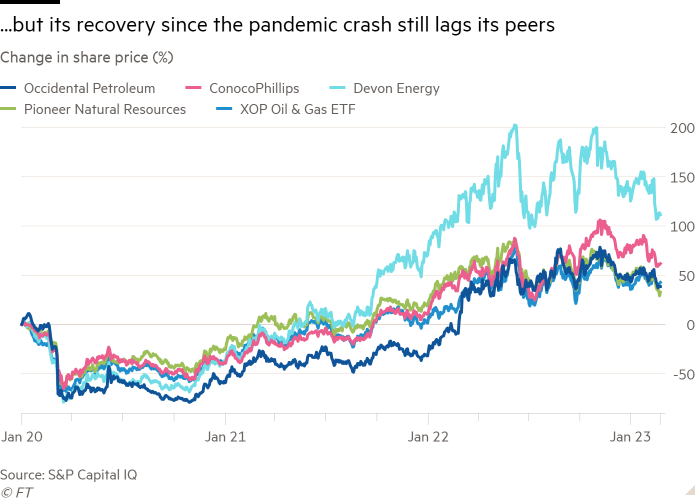

Nearly 4 years later, Oxy isn’t solely again from the useless, it’s thriving. The corporate was the perfect performer on the S&P 500 in 2022, with its inventory rising 119 per cent, because it reaped the rewards of elevated oil and fuel costs within the wake of Russia’s invasion of Ukraine.

When it stories 2022 earnings on Monday, analysts anticipate Hollub to unveil the corporate’s most worthwhile yr ever, with a internet revenue of just about $13bn — roughly double its earlier report.

The money haul has allowed Oxy to pay down nearly half of the debt it took on to win Anadarko. Having soared to $39bn after the takeover, long run debt ranges had been halved to $19bn as of September 2022. The corporate’s market capitalisation, which collapsed to lower than $10bn after the Covid-19 pandemic, has recovered to $54bn — larger than pre-deal ranges.

It’s a stark turnround for a corporation that many feared was dealing with chapter simply three years in the past because it led the US shale patch in slashing its dividend and reducing spending.

The criticism of each Oxy and Hollub had been intense. Chevron had emerged from the conflict with a $1bn kill-fee, with chief govt Mike Wirth insisting his firm was not “determined” to do a deal to amass Anadarko. Billionaire investor Carl Icahn, in the meantime, branded the transaction “one of many worst disasters in monetary historical past” as he launched an activist marketing campaign in search of to unseat Hollub. Icahn didn’t reply to a request for remark.

However because the oil value has rebounded so too have Oxy’s fortunes.

“Generally it’s higher to be fortunate than good,” mentioned Andrew Gillick, a director at consultancy Enverus. “Crude is 80 bucks and every thing’s OK now — so it labored out. Ought to now we have anticipated it to work out? I don’t know, however one can argue that Oxy benefited greater than some other vitality firm from the rebound in oil-price expectations since 2020.”

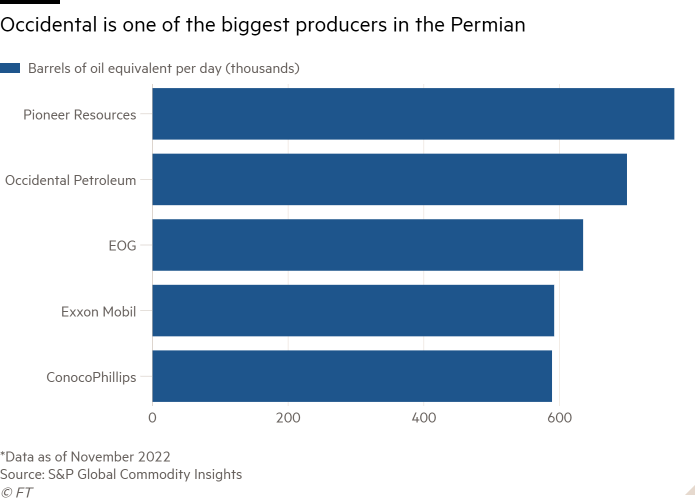

As we speak Occidental is the second largest oil and fuel producer within the US’s prolific onshore oilfields. Its so-called stock of promising areas to drill is among the many largest within the shale patch — a bonus in a sector the place rising prices imply scale is changing into more and more vital, say analysts.

“Oxy put itself in place by getting larger on the proper time,” mentioned Raoul LeBlanc, vice-president for upstream oil and fuel at S&P World Commodity Insights. “Whereas it took on an unlimited quantity of debt and required some deft dealmaking, given the place costs have gone, it appears to be like like a fantastic deal.”

Elevated costs, mentioned LeBlanc, imply Anadarko has “simply become an enormous ATM to repay the debt”.

For some, the turnround is a vindication of Hollub’s technique. Hollub declined to be interviewed for this text. Criticism of the deal was additionally typically laced with misogyny in a male-dominated shale patch.

“I felt just like the media unfairly characterised Vicki personally,” mentioned Katie Menhert, chief govt of Ally Power. “If she had been Victor . . . had she been a person, would this have been the dramatic state of affairs it was?”

As we speak, analysts are extra within the group’s pivot into carbon seize. Oxy reckons its experience in enhanced oil restoration — wherein carbon dioxide is injected into the earth to launch extra oil — will give it a leg-up because the world scrambles to search out methods to retailer carbon again underground.

The transfer has made the corporate a significant beneficiary of the Inflation Discount Act, Joe Biden’s sweeping $369bn local weather regulation, which pumps enormous funds into carbon seize and storage. However the shift, which features a $1bn funding on as-yet unproven direct air seize, can also be one other gamble for Hollub, analysts say.

With Buffett on board, Hollub has entry to probably the greatest capitalised steadiness sheets on the earth. His involvement on the time of the deal was vital: using most popular shares helped safeguard Oxy’s credit score scores whereas additionally avoiding the necessity for a shareholder vote on the takeover, one thing the Anadarko board refused to entertain.

Berkshire has since scooped up way more of Oxy, shopping for greater than 20 per cent of its widespread inventory within the open market. The purchases have fuelled hypothesis that Berkshire might at some point make a full-throated play for the US oil firm, partly as a result of Buffett’s firm has gained approval to purchase as much as half of Oxy.

“He actually likes her and appears like she is a brilliant prime quality chief govt,” Jim Shanahan, an analyst at Edward Jones, mentioned of Buffett’s view of Hollub. “Maybe there’s a hyperlink he sees to mix pursuits” between Oxy and Berkshire’s personal vitality and utility companies.

However there are clouds on the horizon. Shale producers, together with Oxy, have efficiently ridden a wave of rising oil costs since Russian troops spilled into Ukraine. However these costs have been steadily drifting decrease in current months. And banking on supplying extra oil in a world in any other case needing to curb its consumption of fossil fuels stays the most important gamble of all.

Hollub was unfortunate {that a} international pandemic arrived simply on the flawed time. However she has been lucky that an invasion has helped rescue her firm’s inventory value too.

“Oxy weathered the storm,” mentioned LeBlanc. “And it’s in a fairly robust place each in its core enterprise and with the dangers that they’re taking. I don’t know if these dangers are going to pan out — however they’re in a fairly good place when it comes to their method and technique — and on the execution — to this point.”

Extra reporting by Amanda Chu

[ad_2]

Source link