[ad_1]

HSBC is elevating mortgage charges for the second time in every week, a transfer anticipated to be copied by different lenders that may ramp up the monetary strain on UK households and the political peril for prime minister Rishi Sunak.

Brokers warned that different UK lenders would comply with HSBC’s resolution on Wednesday, exacerbating the price of dwelling disaster forward of an election subsequent 12 months.

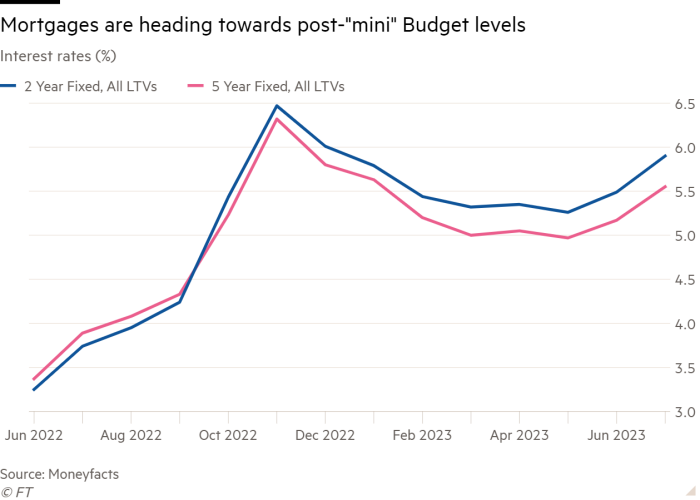

Strikes to withdraw or reprice mortgage offers have elevated in latest weeks because the monetary markets react to stubbornly excessive inflation information, which has modified expectations of how far the Financial institution of England must increase rates of interest.

The problem dominated exchanges at prime minister’s questions on Wednesday, with Sunak insisting the federal government’s “primary precedence” was chopping inflation and bearing down on rates of interest.

However Sir Keir Starmer, Labour chief, claimed Sunak was distracted by political infighting within the ruling Conservative get together at a time when individuals have been fearful about “their payments, the price of the weekly store and spiralling mortgage charges”.

HSBC, one of many UK’s largest mortgage lenders, mentioned it will withdraw its charges for brand new residential mortgages by 5pm on Wednesday, earlier than saying new costs on Thursday. Final week the financial institution wrongfooted mortgage brokers by pulling its offers at quick discover earlier than repricing earlier this week.

“Over latest days, price of funds has elevated and, like different banks, we’ve needed to replicate that in our mortgage charges,” it mentioned.

Lenders worry that volatility in swap price markets — which they use to cost their fixed-rate mortgages — will go away them uncovered. Adrian Anderson, director at dealer Anderson Harris, mentioned he was “assured different [lenders] will comply with shortly”.

Andrew Montlake, managing director at dealer Coreco, mentioned HSBC was unlikely to be the final lender to boost charges this week. Having withdrawn and repriced its charges to permit it to course of a flood of functions, he mentioned “swap charges have moved once more and so they’re nonetheless getting a lot of enterprise, so that they’ve needed to transfer them up once more”.

Simon Gammon, founder and managing companion at dealer Knight Frank Finance, mentioned: “They’re nervous about lending at a loss.”

The problem of rising mortgage prices is turning into more and more political. Fears amongst Tory MPs a few “mortgage time bomb” contributed to the ousting of Liz Truss as prime minister final 12 months, after her “mini” Funds spooked markets and pushed up rates of interest.

Labour is making an attempt to conflate the Truss financial catastrophe with the present rise in mortgage charges, suggesting a sample of Tory financial mismanagement. Sunak insisted the state of affairs now was utterly totally different and the financial system was “resilient” and inflation was falling.

Earlier on Wednesday, chancellor Jeremy Hunt mentioned tackling inflation was the “primary problem” and mentioned the BoE had “no various” however to boost rates of interest to sort out it. “Now we have to do all the things we are able to as a authorities, as a rustic, to assist the Financial institution of England of their mission to squeeze inflation out of the system. And that’s our main focus.”

On Monday, Santander mentioned it was briefly withdrawing all of its fastened and tracker mortgages for brand new debtors “in gentle of fixing market situations”. Clydesdale Financial institution, NatWest and Coventry Constructing Society have been amongst lenders that raised charges throughout their residence loans portfolio this week.

BM Options, a specialist buy-to-let lender that’s a part of Lloyds Banking Group, mentioned on Wednesday it will withdraw charges throughout its vary on Thursday night, and return with increased costs from Friday.

The common rate of interest on a two-year residential fastened product hit 5.9 per cent on Tuesday, up from 5.26 per cent at the start of Might, in keeping with finance web site Moneyfacts. A 12 months in the past, charges on two-year fastened mortgages have been averaging 3.25 per cent.

The rise in the price of borrowing is already being felt by property brokers. “It isn’t beginning to damage but,” mentioned Matthew Leonard, director at property agent Winkworth in Tub, however added that the gross sales market was “positively quieter” in latest weeks.

[ad_2]

Source link