[ad_1]

Obtain free Commodities updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the most recent Commodities information each morning.

This text is an on-site model of our Vitality Supply publication. Enroll right here to get the publication despatched straight to your inbox each Tuesday and Thursday

Hey from London, the place we’re heading right into a bumper week of firm outcomes.

However earlier than these come out — we predict Shell and TotalEnergies on Thursday, amongst many others — Chevron has jumped the gun with an announcement late on Sunday that its chief government Mike Wirth would keep in place past the corporate’s obligatory retirement age. You may learn Myles McCormick’s story on that right here.

In Vitality Supply this week, we check out the upcoming scarcity of metals wanted for the vitality transition — and the way a lot the supply-demand hole might be alleviated by recycling.

We additionally take a look at the most recent information out of Beijing, and whether or not the muted financial restoration there’ll forged a shadow over China’s oil demand this yr.

Thanks for studying. — Leslie Hook

Why the vitality transition might hinge on . . . recycling

There’s loads of hand-wringing over how a scarcity of metals might pose a danger to the vitality transition. All these transmission strains, wind generators and electrical automobile batteries would require quite a lot of copper, nickel and lithium — excess of is produced at this time. Or so goes the widespread orthodoxy.

Nonetheless a report from the Vitality Transitions Fee shines a recent mild on this subject, and presents some radical projections for a way this supply-demand hole for metals might be diminished — by recycling and utilizing materials extra successfully.

Take lithium: by 2030 demand for the steel is anticipated to soar six-fold from present manufacturing ranges. At that time, lithium demand will likely be 30 per cent greater than projected provide, in a base-case state of affairs.

With in depth recycling and utilizing much less lithium in future batteries, that hole might slender to simply 10 per cent — which the report dubs the “most effectivity” state of affairs.

Lord Adair Turner, chair of the fee, mentioned demand for these metals would reply rapidly to market alerts. “This stuff transfer quickly,” he mentioned. “Even imperfect markets do induce responses.”

The influence of recycling battery metals would develop over time, he added, as alternatives to recycle batteries enhance. “Recycling out to 2030 can, by definition, solely play a comparatively small function, as a result of there are solely so many [electric vehicles] . . . by 2040 it will probably make an enormous distinction.”

The pattern is much more pronounced for copper and nickel. By 2030, copper demand will outstrip provide by 10 per cent in a base-case state of affairs. However that hole might reverse if recycling and copper substitution are very excessive — probably resulting in a slight surplus in copper provide by 2030, in keeping with the projections within the report.

For nickel, an aggressive shift in direction of battery chemistries that use much less nickel, together with elevated recycling, might additionally result in a surplus in 2030, it finds.

Even so, the report’s authors acknowledge the vitality transition will nonetheless require an enormous variety of new mines. As many as 40 copper, 55 nickel and 65 lithium mines might be required by 2030, in keeping with the report. Elevated recycling and effectivity would cut back the variety of extra mines wanted.

However even with an incredible enlargement in metals recycling, new mines will nonetheless be wanted.

Knowledge Drill

On Monday night, a intently watched assembly of the Politburo issued its verdict on China’s financial restoration after the coronavirus pandemic: “tortuous”.

Whereas this didn’t come as an enormous shock after China’s second-quarter gross home product development was a lot decrease than anticipated, the pronouncement is worrying for individuals who had been banking on a stronger restoration.

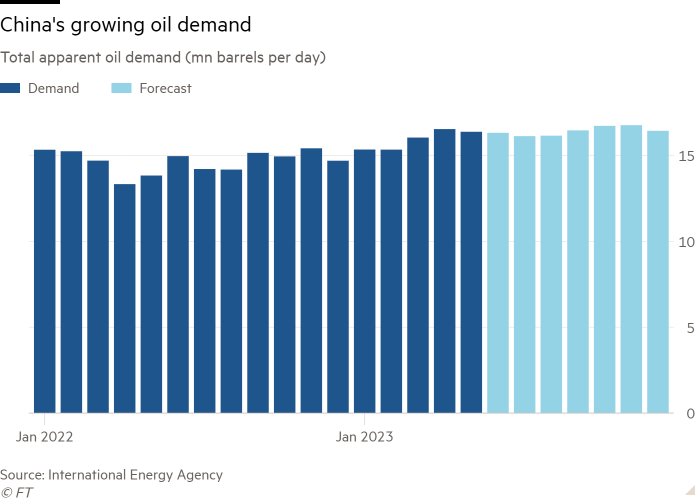

A vital query is how the sluggish economic system will have an effect on Chinese language oil demand. To this point this yr, demand has raced forward of financial development, and rose to an all-time excessive in April.

A lot of this seems to be linked to bodily demand, as individuals begin driving and flying once more after the pandemic lockdowns final yr. Sinopec, China’s largest vendor of gasoline and jet gasoline, reported that oil product gross sales had been up 28 per cent throughout the second quarter of 2023, in comparison with the earlier yr.

“The restoration goes very slowly, and but the oil demand knowledge has been extremely sturdy,” mentioned Neil Beveridge, senior analyst at Bernstein in Hong Kong.

However will that proceed into the second half of this yr? So much is using on the reply: China is anticipated to account for 70 per cent of complete international oil demand development this yr, in keeping with the Worldwide Vitality Company.

The IEA expects that international oil markets will tighten within the second half of 2023, and it expects Chinese language oil demand to proceed at greater than 16.3mn barrels per day — hovering close to April’s report highs.

However with the gloomy readout from Monday’s Politburo assembly, that projection could quickly begin to look a bit too rosy.

Energy Factors

Vitality Supply is written and edited by the FT’s international vitality group. Attain us at vitality.supply@ft.com and observe us on Twitter at @FTEnergy. Compensate for previous editions of the publication right here.

Beneficial newsletters for you

Ethical Cash — Our unmissable publication on socially accountable enterprise, sustainable finance and extra. Enroll right here

The Local weather Graphic: Defined — Understanding a very powerful local weather knowledge of the week. Enroll right here

[ad_2]

Source link