[ad_1]

Dan Davies is a managing director at Frontline Analysts, a analysis agency. He’s the creator of “Mendacity For Cash” and, considerably inevitably, has a Substack.

Just about all media and data providers are topic to an financial paradox — you solely need to eat the nice if it’s prime quality, however you may’t inform what high quality it’s till you’ve consumed it.

Or from the vendor’s perspective, the one approach that the client can make certain that they need to pay for it’s to get right into a place the place they don’t have to pay for it any extra. This elementary financial downside is on the root of the collapse of sellside analysis in Europe over the previous 5 years.

It happened because of provisions within the Second Markets in Monetary Devices Directive (MIFID 2), which had been initially put in there on the insistence of the UK, however which the UK seems to have modified its thoughts about and is proposing to take away post-Brexit.

With a purpose to perceive the issue, take into consideration the methods during which folks may attempt to monetise their content material.

The primary approach is the “paywall”. Fairly merely, you clear up the paradox by rejecting it; anybody who desires your content material has to pay for it, up entrance. The benefit is that it’s easy to execute and perceive; the drawback is that numerous folks will simply say no and your circulation is perhaps small. Name this the “Bloomberg” strategy, as a result of it’s best to do you probably have a large model and/or a quasi-monopoly on info that individuals actually actually want.

On the different finish of the spectrum, you’ve got “begging”. Give away the data totally free, however preserve reminding people who it prices cash to provide, and that if at the very least a few of them don’t pay up for it, the circulate of content material will stop. The benefit is that you would be able to get wider distribution, the drawback is that you simply’re making an attempt to push water up hill when it comes to regular pricing economics. Name it the “Guardian” strategy, as a result of it’s extra more likely to succeed the extra inclined your viewers is to emotional blackmail.

Neither of those approaches are nice, which is why traditionally, media organisations have tended to chew the bullet and assist themselves with promoting. In case you have an enormous viewers, then you may affect folks to direct their purchases in the direction of advertisers. More often than not, they’re shopping for stuff anyway, the value and high quality aren’t that totally different, so it prices them little that can assist you, fixing the financial paradox that approach. That is perhaps the “YouTuber” strategy.

You may push it a bit additional although. Someplace between begging and branding is “develop a barely bizarre parasocial relationship along with your readers, such that they’ll take care of you thru different channels, rent you for jobs, pay you consulting charges and so forth”.

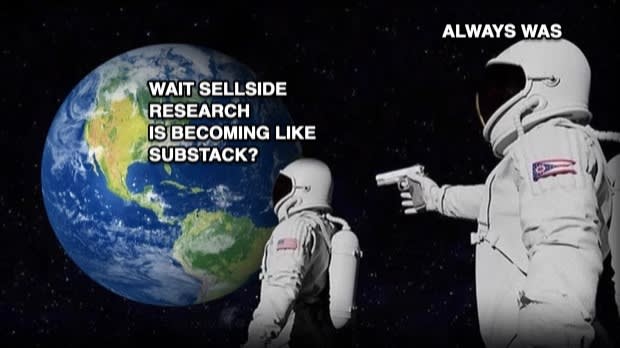

This strategy is surprisingly widespread throughout new media from Substack to LinkedIn, nevertheless it arguably originated in funding banking.

Sellside analysis is to a really small extent commercial for brokerage providers (that are barely worthwhile themselves as of late), and primarily a solution to construct the sort of buddy networks with firms and buyers which might be important if you wish to do advisory or have a capital markets enterprise.

It’s noticeable that Deutsche Financial institution nonetheless has an fairness analysis division despite the fact that it doesn’t have an fairness buying and selling division, and that it seems to have acquired Numis for its community of UK company brokerage relationships (of which the supply of analysis protection is a vital half).

One of many issues which reliably surprises newcomers to the {industry} (significantly if they’ve economics levels) is that regardless of every part being primarily based on transactions, nothing is transactional.

It’s actually gauche to ever point out to a shopper that their employer pays cash to your employers and that’s why you’re speaking to them. It’s simply associates doing favours for associates; a protection banker will assume nothing of entertaining a CEO with lunch, golf and costly proprietary evaluation for a decade, within the hope of getting an advisory mandate when the event arises.

Why do they do that? Partly as a result of that’s the way in which we’re socialised; shoppers are sometimes wealthy folks, and the richer you might be, the much less probably you might be to ever be offered with a invoice and requested to pay it there after which. That’s the way in which it really works; you or I would have to settle up on the Vacation Inn, but when we had been Anna Sorokin we would keep for ages earlier than they requested for a bank card.

It’s an {industry} that works on belief, and one nice solution to construct belief is to provide away beneficial stuff and point out that you simply belief the recipient to pay for it when it fits them.

But additionally, as a result of it really works. This set of social customs survives amongst bankers as a result of it has an financial position; it solves the central paradox of promoting info and recommendation for cash. Solely a small variety of huge suppliers may get the paywall mannequin to work, and the begging mannequin may be very troublesome to make worthwhile. If you wish to have a full ecosystem with all kinds of high-quality product, it’s a must to participate within the parasocial relationships that assist the LinkedIn/Substack sort of strategy.

Regulators, sadly, hate this. There is no such thing as a open market, no arms-length pricing info, and consequently no goal approach of realizing whether or not the enterprise that flows by the buddy networks is value-generating in itself, or only a large industry-size slush fund.

And because the individuals who pay for every part are, within the remaining evaluation, the investing public, there’s no solution to make certain that the charges are truthful or aggressive.

Consequently, MIFID 2 banned all analysis enterprise fashions besides the paywall. (Even begging was disallowed — you’re not allowed to distribute analysis totally free as a result of the regulators assume that you’d sneakily use it to construct a relationship). And as a consequence of that, banks massively decreased their analysis groups.

Whether or not this was a very good or unhealthy factor is a debate for an additional day. It actually wasn’t an unintended consequence — a key perception of the UK authorities a decade in the past was that the market produced a lot an excessive amount of analysis, as a result of the individuals who consumed it had been utilizing their buyers’ cash to reward their kind-of-friends in an opaque approach.

However now the regulatory pendulum has reversed and analysis bundling may come again to the London market. And the brand new technology of bankers and buyers may not be so awkward about monetising content material — they’ve grown up within the information that their web associates are going to maintain shouting “don’t neglect to hit like and subscribe!”.

[ad_2]

Source link