[ad_1]

What can be a wise development technique for the UK? For a solution, overlook what Jeremy Hunt, chancellor of the exchequer, stated in his Budget final week. Flip as a substitute to A New National Purpose, a report from Tony Blair and William Hague. The large lesson from this report is that after an extended interval of disappointing efficiency, the nation wants a extra radical method. They’re proper.

Among the many most vital areas the place the UK lacks a wise technique is pensions. It has persistently answered the improper questions, with dire outcomes for each the economic system and for individuals.

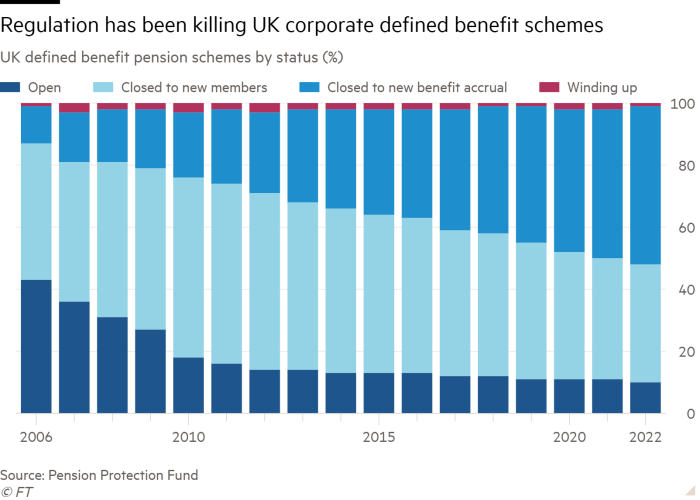

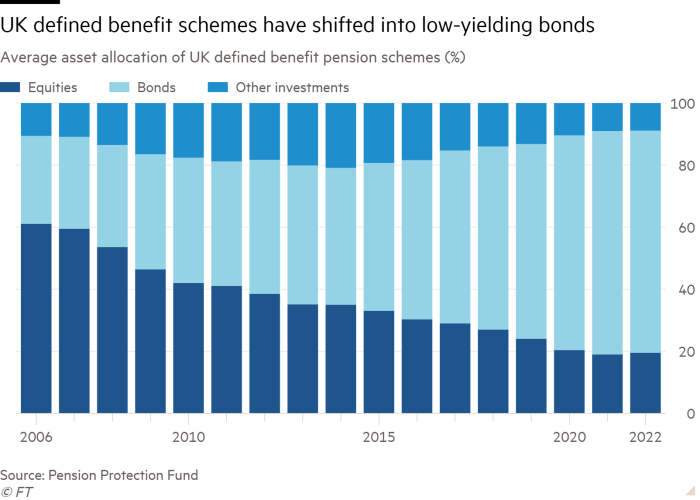

As soon as, the query was how employers have been to supply salary-linked pensions to their staff. The reply meant 7,751 defined benefit funds in 2006. Then the query was make these pensions protected. The reply was to slash the proportion of funds open to new members and new contributions from 43 per cent in 2006 to 10 per cent in 2022 and to scale back the share of property invested in equities from 61 per cent in 2006 to 19 per cent in 2022. The value of creating DB pensions completely protected was to show them into financiers of the federal government, whereas killing them off.

Then the query was get individuals to avoid wasting for pensions on their very own. The reply was the creation of outlined contribution funds during which people bore the chance, contribution charges have been too low and pensions can be insufficient. In the meantime, public sector employees get index-linked pensions that they don’t even appear to worth that a lot.

The UK pension system is incoherent, fragmented and risk-averse. Not surprisingly, Blair and Hague observe, “abroad pensions make investments 16 instances extra in enterprise capital and personal fairness within the UK than home private and non-private pensions do”. That is insanity.

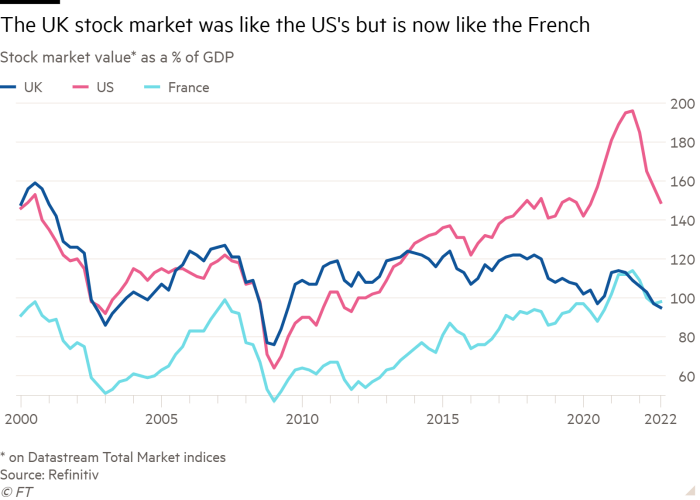

Between the third quarter of 2000 and the final quarter of 2022, the worth of the inventory market within the UK additionally fell from 159 per cent of GDP to 95 per cent. Over the identical interval, the US ratio went from 153 to 149 per cent, whereas the French ratio stayed at 98 per cent. Thus, the UK market has moved from being like that of the US to being just like the French. The FTSE 100 is a company museum, not a house of dynamic new companies. It’s implausible that new massive home firms will emerge with out home swimming pools of affected person, dedicated capital.

The underlying errors are characteristically British. First, coverage is made piecemeal, fairly than systematically. Second, there’s over-reliance on the rationality of monetary markets and so forth the existence of a measurable “fairness threat premium”. Lastly, there’s a tendency to deal with particulars fairly than on the massive image. A smart nationwide pensions coverage should ship two issues: safety in previous age and a extra dynamic economic system. That is possible. However it is not going to occur with no new method.

The reply, as I’ve argued earlier than, lies in making a restricted variety of massive collective outlined contribution funds. These can be everlasting. The contributions of energetic members, plus the upper anticipated returns on fairness, would enable such funds to supply (moderately) predictable — although additionally, when mandatory, adjustable — pensions. In return for the tax advantages granted by the federal government, these can be required to speculate a sure proportion of their funds in new and dynamic companies. However selections on the place and the way to take action would relaxation with the funds. Given their economies of scale, such funds ought to be capable to establish and put money into new alternatives. This could be good for everyone.

So, how may the nation get from right here to there? As Michael Tory, of Ondra, has argued and Blair and Hague repeat of their report, the dying DB schemes of at present (nonetheless 5,131 in quantity in 2022) ought to be radically consolidated and was open collective outlined contribution schemes. The federal government would then assure the already vested pensions. Folks with investments in at present’s DC schemes can be allowed to switch their funds into these new schemes. Ideally, so ought to public sector staff. Furthermore, employers and staff can be given mandates, incentives and encouragement to contribute on a scale enough to supply first rate pensions in retirement. Lastly, the funds would put money into ways in which make sense for a multi-generation contract, specifically in prosperity, not in slender security, and in their very own economic system, in addition to in others.

In lots of areas, UK coverage must be bolder, but in addition wiser. Brexit was daring; nevertheless it was not clever. In pensions, the UK has muddled its approach by to injustice, inefficiency and absurdity. The time has come to embark on coherent reform. Insurance policies that don’t work ought to be reworked into ones that may.

martin.wolf@ft.com

Comply with Martin Wolf with myFT and on Twitter

[ad_2]

Source link