[ad_1]

Banks are the Achilles heel of the market financial system. The mix of dangerous long-term property with liquid liabilities redeemable at par is a standing invitation to illiquidity and insolvency. Contagion can also be a everlasting hazard. The occasions of latest weeks have reminded us of those realities.

So, what classes ought to be learnt, together with within the UK? As Andrew Bailey, governor of the Financial institution of England has reminded the Home of Commons Treasury Committee, “Banking is a world business and the UK is a major monetary centre.” The UK needs to get pleasure from the advantages, whereas minimising the dangers. What’s, not less than up to now, a “mini” disaster is a reminder of the dangers.

So, what are the apparent classes?

First, an open monetary entrepot just like the UK is weak to regulatory failures elsewhere. Thus, as Bailey burdened, it was useful that Silicon Valley Financial institution UK was a ringfenced subsidiary, not a department. That allowed the UK to resolve it rapidly and independently.

Second, the story of Credit score Suisse reveals that policymakers might discover it onerous to impose orderly decision on politically delicate establishments, even when a plan for it exists. The UK authorities want to contemplate whether or not and the way they’d have accomplished higher in the same case. Ringfencing of the home retail financial institution didn’t keep away from the issue in that case. That’s disturbing.

Third, if decision is so onerous, it’s much more vital for banks to have a lot credibly loss-bearing fairness and debt and such sturdy liquidity that each one depositors will really feel secure. In any other case, there are prone to be runs and bailouts.

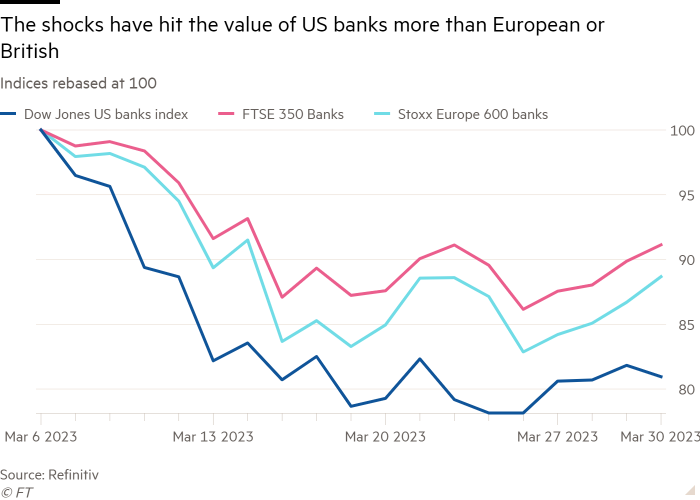

Fourth, massive holes within the regulatory web should be averted. Losses in the marketplace worth of portfolios attributable to larger rates of interest are a doubtlessly related instance. The British authorities seem to have been rather more conscious of the dangers created by such losses than these within the US. Such losses should be taken under consideration in each capital and liquidity necessities and stress assessments.

Fifth, bailouts are all the time systemically vital. If depositors imagine they are going to be protected, banks can be inspired to behave in a extra irresponsible method. So, any financial institution whose losses is likely to be bailed out should be regulated as systemic. Once more, this threat may be diminished with larger fairness capital and “bailinable” debt and stronger liquidity. Fairness and long-term debt must also be written down earlier than deposits. Alternatively, there may very well be extra beneficiant formal insurance coverage of deposits, with premiums associated to a financial institution’s riskiness.

Sixth, the story of SVB reveals the significance of accountable administration. These should not simply profitmaking companies, but additionally utilities supported in various methods by taxpayers. On this case, senior administration took tens of tens of millions of {dollars} out of the financial institution whereas it was being pushed into the bottom. Thereupon, depositors were rescued by taxpayers. This simply must be prevented. As Charles Goodhart of the London Faculty of Economics has famous, managers who fail to handle efficiently should share — and know they are going to share — within the losses. They need to bear private monetary legal responsibility. That change would possibly allow liberalisation, even abolition, of the UK’s onerous “senior managers” regime.

Seventh, think twice about opening holes within the regulatory regime in an emergency. The ringfencing really useful by the Impartial Fee on Banking (of which I used to be a member) was an try and separate home retail banking from the dangers created by the comparatively massive international actions of sure UK banks. That could be a far smaller concern for the US, the place home actions are so massive. Ringfencing was additionally designed to present regulators and the federal government extra choices within the case of decision. By granting HSBC an exemption from ringfencing in its takeover of SVB UK, the federal government has opened a doubtlessly harmful loophole. This must be closed as quickly as potential.

Lastly, the most effective safety towards occasional large banking crises is frequent smaller ones. Worry works. We’ve seen, for instance, some unwise deregulation. That of smaller banks within the US in 2019, which contributed to the latest disaster, is a robust instance. Strain for deregulation has additionally been rising within the UK. A shock like this could make senseless deregulation much less interesting to politicians and senseless risk-taking much less interesting to bankers. Each classes may need been learnt within the US and elsewhere, for some time.

The regulatory regime and financial institution supervision within the UK appear to have been fairly efficient. UK bankers additionally appear to have been fairly smart. So, we did study from the final disaster. That’s good. The most effective results of the current shock is that it ought to reinforce these classes.

martin.wolf@ft.com

Comply with Martin Wolf with myFT and on Twitter

[ad_2]

Source link