[ad_1]

Dad or mum. The official definition needs to be: “Caretaker of kid. Synonyms: nanny, tutor, launderer, chauffeur, coach, nurse, therapist, chef, hand-holder, tear-wiper, picker-upper, fight-breaker-upper, bottom-pamperer . . .”

It’s a wealthy and rewarding position, however the parenting duties by no means appear to cease!

This definition particularly applies to a stay-at-home father or mother (SAHP). Whereas SAHPs could not pull down a six-figure earnings from a nook workplace, they do present rather a lot of invaluable companies for the household.

Let’s discuss why stay-at-home mother and father want life insurance coverage, how large that coverage must be, and what households ought to do with the life insurance coverage payout if the unimaginable occurs.

Understanding the Worth of a Keep-at-Residence Dad or mum

The entire level of life insurance coverage is to exchange your earnings so your loved ones can operate if one thing occurs to you—so getting life insurance coverage for folks who herald an earnings is apparent.

However what about protection for stay-at-home mother and father? Why do SAHPs even want term life insurance in the event that they don’t technically make an earnings? (That’s rhetorical.) It’s due to the high-dollar companies they supply!

Listed below are some of the roles a stay-at-home father or mother covers:

- Instructor

- Childcare supplier

- Chef

- Chauffeur

- Housekeeper

- Laundry employee

- Tutor

- Coach

- Venture supervisor

Operating a family is rather a lot like making an attempt to herd a litter of kittens—with no SAHP, it would all get ugly in a rush. If one thing horrible have been to occur to the father or mother at house, who would care for these wants? The surviving partner can’t give up work—they nonetheless have to convey house an earnings. That’s the place time period life insurance coverage is available in.

Do Keep-at-Residence Mother and father Want Life Insurance coverage?

A life insurance coverage coverage for a stay-at-home father or mother doesn’t substitute their earnings—it offers the cash essential to cowl all the roles the SAHP did earlier than they handed away.

![]()

Examine Time period Life Insurance coverage Quotes

Clearly, it’s inconceivable to exchange a father or mother. Nothing will ever fill that gap within the household. However with the cash from a life insurance coverage payout, the surviving partner can rent somebody to cowl lots of the duties the SAHP used to deal with.

It’s a matter of protecting your loved ones going within the worst of conditions. Life won’t ever return to regular, however by hiring folks to assist fill within the gaps (a minimum of quickly), you can also make positive no one’s wants fall via the cracks. And that’s what issues, proper?

When Ought to You Get Life Insurance coverage as a Keep-at-Residence Dad or mum?

For those who’re recent out of faculty and don’t have debt, you don’t want life insurance coverage fairly but. However if you happen to’re married and youngsters are on the horizon, it’s good to go forward and purchase life insurance coverage now.

By getting life insurance coverage instantly, you’ll be lined regardless of how lengthy it takes for that infant to return alongside. In spite of everything, they have a tendency to reach on their very own schedule—and sometimes sooner than you’d deliberate!

How A lot Life Insurance coverage Do Keep-at-Residence Mother and father Want?

Right here’s the large query is: how a lot time period life insurance coverage do you have to buy for the stay-at-home father or mother? There’s no one-size-fits-all reply to this as a result of each household is totally different, however a basic rule is to get a 15- to 20-year coverage of a minimum of $250,000–400,000.

If you’re younger, getting extra life insurance coverage isn’t that costly, so it’s okay to get greater than you assume you want. After these 15 or 20 years, the youngsters ought to all be grown and out of the home, so there’s no want for protection. To get an thought of how a lot protection you want, take a look at our time period life calculator.

Protection Concerns for Keep-at-Residence Mother and father

As you’re deciding how a lot protection to purchase, you should assume via 5 main areas: household measurement, profession plans, childcare, training and family duties. Every of these particulars has an impression on how a lot life insurance coverage you’ll want for your loved ones.

What number of youngsters do you might have?

Greater households have greater monetary wants—from the price of childcare and groceries to paying for holidays and all of these extracurricular actions. So extra youngsters means you’ll want a bigger life insurance coverage coverage for the SAHP.

Will the stay-at-home father or mother be going again to work?

We’ve already touched on the high-dollar worth of the work a SAHP does (and we’ll do the mathematics within the subsequent few sections). However past what they contribute at house, there’s additionally the likelihood they’ll return to work.

If that’s a part of your SAHP plan, it’s all of the extra motive to get them life insurance coverage. Sooner somewhat than later, you’ll need to purchase a coverage that’s 10–12 occasions their anticipated earnings. Then they’ll be lined both method—whether or not they’re doing the SAHP factor or going again to work. Since the price of life insurance coverage will increase as you grow old, don’t wait till the SAHP returns to work to get their coverage. Lock in a pleasant low price proper now.

How a lot will childcare value?

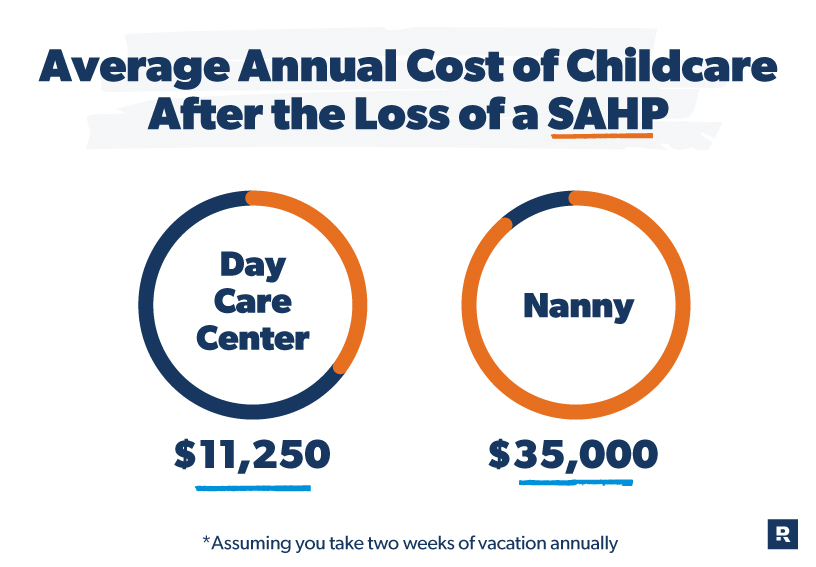

If one thing occurs to the SAHP, how a lot cash would you should cowl childcare bills? In keeping with Care.com, childcare for an toddler prices about $225 per week for a day care heart and $700 per week for a nanny.1

So, 52 weeks of care (as a result of—gross as it’s—you must pay for day care even on days your child isn’t there) might run between $11,700 and $36,400. And that’s only for one baby. In fact, these prices differ relying on the place you reside, however you get the thought.

How a lot will training value?

Loads of households select to homeschool their youngsters. If that’s the case in your loved ones, you and your partner have to determine the place the youngsters will go to highschool if one thing occurs to the SAHP.

If you wish to go the personal college route, you’ll have to consider these prices. The nationwide common for personal college tuition is about $12,167 a 12 months.2 Once more, that’s only for one baby. And that doesn’t embrace all the additional prices—like provides, charges and extracurriculars.

Who will tackle family duties?

Who’ll be chargeable for cleansing the home if one thing occurs to the stay-at-home father or mother? For those who simply paid somebody for primary housekeeping, it’d value you about $14 an hour.3 (In fact, there’s much more to operating a family than primary cleansing—every other chores you want completed will solely drive the invoice larger and better.) And that’s a mean, so if you happen to stay in California or New York, you will have to supply up the occasional arm or leg to pay for these prices.

Bear in mind, how a lot life insurance coverage you get for the SAHP will rely on your loved ones’s wants.

As you’ll be able to see, the sensible value of what a SAHP provides their household is big! And life insurance coverage protection may give SAHP households some actual peace of thoughts that these duties might be effectively lined it doesn’t matter what.

We’ve heard from loads of happy clients in our Ramsey Child Steps Group Fb group who purchased life insurance coverage for a SAHP. Take it from stay-at-home mother Vanessa D.: “We homeschool our 4 youngsters. If I used to be to die, I’d need my husband to have the ability to proceed that. Because of this we have now $750,000 on me. It will cowl the price of the home and sufficient for school too. Hubby has a pension and VA incapacity and will stay off of that.” Nice considering, Vanessa!

And take a look at Micaylee N.’s testimony. She is aware of the worth of her husband’s SAHP contribution: “My husband is a stay-at-home dad, and we have now a $700,000 coverage on him.” Good for you guys, Micaylee!

Each households worth their stay-at-home father or mother sufficient to know that if the worst have been to occur, it will value a complete lot to pay for the numerous jobs they do on a weekly foundation. In order that they’ve purchased insurance policies value 10 occasions the quantity they’d pay to cowl the work the SAHP does in a 12 months.

Now Vanessa’s and Micaylee’s households have the peace of thoughts understanding that if something occurred to their SAHPs, the surviving father or mother might work with a monetary advisor to place the life insurance coverage payout in a superb mutual fund. (And simply so you understand, a life insurance coverage profit is nearly by no means taxable.)

Annually, they may use the expansion from that mutual fund (which could possibly be round 10% a 12 months) to pay for the prices of childcare, meal prep, home cleansing and the opposite jobs their SAHP used to deal with.

Your individual life insurance coverage wants will rely rather a lot on the components we outlined above, however let’s take a look at Vanessa’s scenario for instance. Her coverage is $750,000—so that might give her household a payout of $75,000 a 12 months (that 10% of annual progress we talked about earlier) to get the whole lot lined.

And the way’s this for a life insurance coverage endorsement from Melissa B.? “Begin with Zander. We did and it was very reasonably priced.” We couldn’t agree extra, Melissa!

Get the Proper Life Insurance coverage in Place Right now

Keep-at-home mother and father usually decrease the monetary position they play of their household. Don’t make that mistake, particularly in relation to life insurance coverage! No person might ever take the place of your loved ones’s stay-at-home nurse-chauffeur-coach-therapist-hugger—however it is necessary for your loved ones to have the cash they’ll have to care for your most elementary duties.

We advocate working with our RamseyTrusted companion Zander Insurance coverage. They’ll store the highest insurers in the marketplace and provide help to get the perfect protection for your loved ones. Make sure that your wants are met by getting the precise life insurance coverage protection for each mother and father.

[ad_2]

Source link