[ad_1]

One unhealthy automobile wreck. One raging kitchen fireplace. One main surgical procedure. When you’re not cautious, simply one factor can derail years of monetary progress.

That’s why insurance coverage is the perfect protection on your life and funds. It protects you from the dangers you simply can’t afford to take.

However as necessary as insurance coverage is to your monetary plan, that doesn’t imply you need to overpay for the suitable protection. Simply how a lot do individuals pay for insurance coverage on common? How a lot is insurance coverage monthly relying the type you want?

We’ll check out the prices of the 4 predominant kinds of insurance coverage you want—auto, householders (or renters), medical insurance and life insurance coverage.

How A lot Ought to You Pay for Auto Insurance coverage?

Screeech! Bang! There are few issues worse than the jitters you get after a automobile accident. It doesn’t take lengthy for the adrenaline rush to get replaced by nervousness over the price of repairing or changing your automobile. Fortunately, auto insurance coverage softens the blow.

![]()

Do you could have the suitable insurance coverage protection? You possibly can be saving tons of! Join with an insurance coverage professional at this time!

However how a lot does auto insurance coverage value? In keeping with a research from AAA in 2020, the typical American pays $1,202 for full-coverage automobile insurance coverage and $644 for legal responsibility.1 (That works out to about $100 for full protection or $54 for legal responsibility automobile insurance coverage monthly.)

Bear in mind, although, that not all auto insurance coverage payments are created equal. If Bubba subsequent door drives his truck like a maniac and will get right into a fender bender (or three) yearly—and your driving report is squeaky clear—who do you assume will get the larger auto insurance coverage invoice? You guessed it. The insurance coverage firm will cost Bubba extra as a result of he’s riskier to insure.

The place you reside may also be a think about how a lot you pay. Right here’s a take a look at the typical value of automobile insurance coverage by state (please embody knowledge desk from this text):

How A lot Ought to You Pay for Owners (or Renters) Insurance coverage?

Dorothy was proper. There’s no place like dwelling. And householders insurance coverage is there to assist shield your funds if one thing horrible occurs to your house and every thing in it.

The typical householders insurance coverage annual premium is $1,015.2 However householders insurance coverage prices vary broadly relying in your scenario.

Your value might be based mostly on the worth of your house, your previous historical past of insurance coverage claims, what kind of protection you want, your credit score rating, if you happen to want flood insurance coverage, and the way a lot your belongings are value.

However right here’s some excellent news. For most owners, your property insurance coverage is often included in your mortgage fee, so it doesn’t actually really feel like an additional expense in any respect.

Similar to with actual property, the largest issue that impacts how a lot you’ll pay for householders insurance coverage is location, location, location. Of us who reside in main cities and densely populated areas will seemingly have greater charges than those that reside in additional rural areas. And if you happen to occur to reside in a state the place pure disasters are extra widespread—assume tornados, hurricanes and wildfires—you’re extra prone to have greater insurance coverage charges too.

Trying on the states with the very best and lowest householders insurance coverage charges, it’s not very stunning to see that the states with greater charges have handled main pure disasters prior to now few years:

The Most and Least Costly States for Owners Insurance coverage3 (Annual Premiums)

| Most Costly | Least Costly |

|

1. Louisiana ($1,968) |

1. Oregon ($677) |

|

2. Florida ($1,951) |

2. Utah ($692) |

|

3. Texas ($1,893) |

3. Idaho ($730) |

|

4. Oklahoma ($1,885) |

4. Nevada ($755) |

|

5. Kansas ($1,584) |

5. Wisconsin ($779) |

Now, if you happen to’re renting, you’re not off the hook. You want sufficient renters insurance coverage to switch your stuff if it will get stolen or destroyed in a fireplace or another catastrophe. With out it, you’ll have to switch every thing by yourself dime. And since renters insurance coverage solely prices roughly $15 monthly, there’s actually no excuse for you not to have it!4

How A lot Ought to You Pay for Well being Insurance coverage?

A visit to the emergency room turns into an emergency surgical procedure, which then turns into just a few days in a hospital mattress to get better earlier than you’re despatched dwelling. The prices add up, and shortly you end up swimming in hundreds of {dollars} in medical payments.

That’s the place medical insurance is available in—to take a number of the burden of these payments off your shoulders. However how a lot does medical insurance value?

The typical particular person in America pays $452 monthly for market medical insurance.5 The typical American household pays an estimated $1,779 monthly.6

What about employer protection? The typical American employee paid $5,969 in 2021 for employer-sponsored group medical insurance.7 The whole value of annual premiums (employer and worker) in 2021 for employer-offered protection rose 4% over 2020 to $22,221. And the typical deductible individuals paid was $1,669 for single protection in plans that had a normal annual deductible.8

However prices range fairly broadly based mostly on components like your age, the variety of individuals in your plan, degree of protection, your location and employer. And if you happen to’re seeking to hold that month-to-month premium down to avoid wasting cash in your funds, select the next deductible plan.

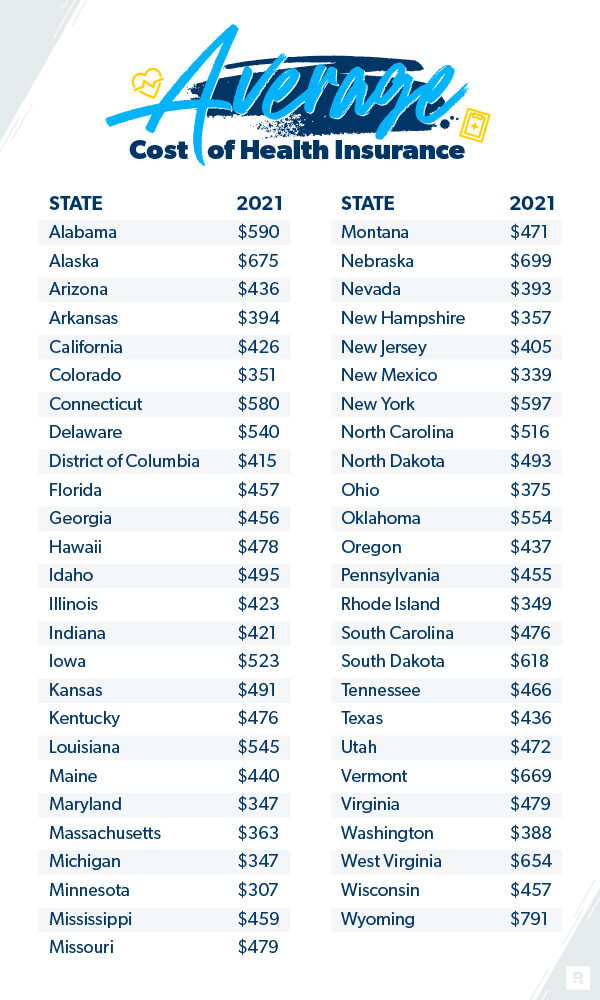

Right here’s a breakdown displaying the typical prices of market insurance coverage relying in your state:

Kaiser Household Basis, 2021.

How A lot Ought to You Pay for Life Insurance coverage?

Life insurance coverage has one job: to assist your loved ones substitute your revenue if you happen to all of a sudden died. We advocate getting a 15- or 20-year time period life insurance coverage coverage that covers 10–12 occasions the quantity of your annual gross revenue. So how a lot does life insurance coverage value?

Nicely, if you happen to’re a wholesome 30-year-old who needs to take out a 20-year time period life coverage with $500,000 value of protection, you’d in all probability pay round $240 every year, or $20 a month.7

However the actual quantity you’ll pay will range based mostly on the size of the coverage, your age, your well being historical past, tobacco use, gender and the way a lot protection you need.

The Proper Protection on the Finest Value

So, how a lot will you pay on insurance coverage? It is determined by your scenario.

As your life adjustments, so will your insurance coverage wants. That’s why we created a free software referred to as the insurance coverage protection checkup. It helps you know the way protected you’re, what protection you continue to want and what type you are able to do with out.

And if you happen to really feel such as you’re paying an excessive amount of for insurance coverage, you may be! Many individuals simply don’t take the time to buy round for brand spanking new auto, householders or medical insurance.

We get it. Purchasing for insurance coverage appears like a problem. However our Endorsed Native Suppliers (ELP) program provides you entry to a number of the greatest insurance coverage brokers within the nation. They’ll store for you and provide you with free quotes so you may know you’re not overpaying. They usually’re RamseyTrusted, in order that they have the center of a trainer and may clarify to you what you want.

Join with an impartial insurance coverage agent at this time!

[ad_2]

Source link