[ad_1]

You’re nearly there. Nearly prepared to join long-term care insurance coverage. However you’re simply doing a little extra analysis . . .

Effectively, we’re about to make your resolution tremendous straightforward. As a result of in the event you itemize your deductions, you possibly can rely long-term care insurance coverage premiums towards your tax invoice.

Yep. You learn that proper. This implies much less cash going towards taxes, and extra money in your pocket.

In case you’re questioning, Is long-term care insurance coverage tax deductible?, the reply is sure. So long as you itemize your deductions. And whereas we’d by no means let you know to purchase long-term care insurance coverage simply to get a tax deduction, if the time is best for you to get protection, that tax break can come in useful!

We’ll present you the way it works and the way a lot you possibly can deduct.

What Is Lengthy-Time period Care Insurance coverage?

Lengthy-term care insurance coverage is among the most inexpensive methods to cope with these hefty prices of us run into as they age and start needing assist with on a regular basis duties. Ongoing care like that, typically known as custodial care, isn’t coated by Medicare or different medical health insurance. However long-term care insurance coverage will assist cowl the prices of a nursing dwelling keep (that lasts greater than 100 days) or an assisted dwelling facility. Even higher, long-term care insurance coverage additionally helps pay for in-home caretakers and even dwelling modifications that will let you reside in your house longer (and who doesn’t need that?).

![]()

Lengthy-term care is a vital resolution. Join with a trusted professional to ensure you have the precise protection.

Likelihood is, you’re ultimately going to want long-term care. Sixty-five-year-olds at this time have a 70% probability of needing long-term care, and an estimated 20% of People will want it for longer than 5 years.1 These are odds you don’t wish to be on the improper aspect of.

We will all agree, the very last thing anybody desires to do is drain their retirement financial savings or depend on household and pals to deal with them. However solely 7.5 million People have some type of long-term care insurance coverage.2

Tax Benefits of Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage has a ton of advantages. It’s inexpensive and it prevents you from tapping into your nest egg to pay for the prices of long-term care. It additionally has some good tax benefits.

First, Uncle Sam and sure states will let you rely some or your whole premiums as tax-deductible medical bills. Second, the cash you obtain out of your insurer to cowl long-term bills isn’t normally counted towards your earnings.

However like all the pieces in life, there’s some tremendous print:

- Your premiums and different medical bills have to succeed in a specific amount (7.5% of your earnings) earlier than you possibly can deduct them.3

- It’s a must to itemize your tax deductions.

- Not all long-term care insurance coverage insurance policies are eligible. For example, one requirement is that your insurer has to a minimum of give you the choice of including inflation and nonforfeiture protection. (Work with an impartial insurance coverage agent to see in case your plan qualifies.)

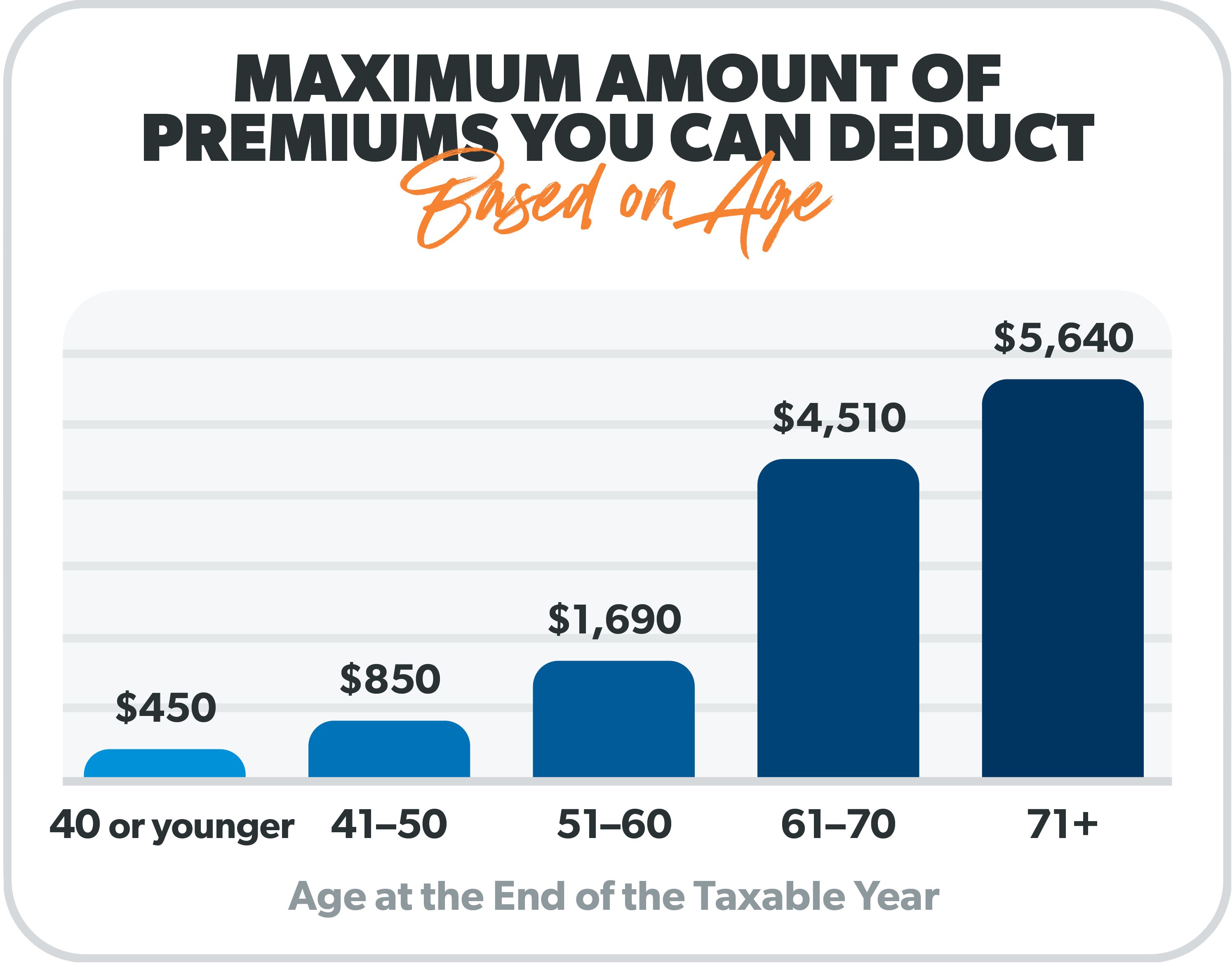

Here’s a breakdown of the utmost quantity of your premiums you possibly can deduct relying in your age.4

And in the event you’re self-employed, you possibly can usually deduct 100% of your premiums as much as the quantities above.5

Don’t Put This One Off . . .

In case you’re 60 or older, now’s the time to guard your monetary future and get long-term care insurance coverage. Plus, you’ll get some candy tax perks alongside the best way.

However it may be powerful to determine precisely what you want. That’s why we created our Endorsed Native Suppliers (ELP) program. It’s a community of hand-selected impartial insurance coverage brokers who’ve the guts of a instructor. They’ll clarify your choices so that you really perceive what you’re shopping for. Plus, they’re RamseyTrusted, so you understand you’re working with high brokers.

That is one to-do listing merchandise you don’t wish to postpone. Your golden years may look so much completely different and not using a stable plan in place. Lengthy-term care insurance coverage permits you to take pleasure in life with out questioning the way you’ll pay for long-term care in the event you want it.

Join with an ELP at this time!

[ad_2]

Source link