[ad_1]

Hearken to this text

What Is the Difference Between Term vs. Whole Life Insurance?

What Is Term Life Insurance?

What Is Whole Life Insurance?

Cost Comparison: Term vs. Whole Life Insurance

Don’t Wait Until You Need Life Insurance to Get It

Frequently Asked Questions

If anybody in your life is dependent upon your earnings, you want life insurance coverage. However not any outdated life insurance coverage—the proper life insurance coverage. Let’s discuss time period life vs. entire life.

Life insurance coverage will not be a enjoyable matter, nevertheless it issues! Your two fundamental choices are time period life and entire life. However which is best? The primary is a secure plan to guard your loved ones—the second is a rip-off. We’ll stroll you thru the variations in time period life vs. entire life so you may see what we imply.

What Is the Distinction Between Time period vs. Entire Life Insurance coverage?

We’ll give it to you straight—time period life insurance coverage works, whereas entire life fails. The reason being easy: The true objective of life insurance coverage is to exchange your earnings should you die, and to do it as cheaply as potential. And that’s precisely what time period life does. However entire life? It’s expensive and complicated as a result of it places investing into the combination with insurance coverage. It provides as much as an costly mess, which we’ll talk about intimately under.

![]()

Evaluate Time period Life Insurance coverage Quotes

For now, right here’s the nutshell distinction. Time period life has a set premium that is still the identical all through the lifetime of the coverage, and it solely lasts for an outlined variety of years. Entire life premiums can differ (lots), final your entire life even after you’re previous the age whenever you’d want a demise profit for dependents, and are over-complicated by dangerous funding choices.

Frankly, a life insurance coverage coverage isn’t a money-making scheme. It’s there to offer peace of thoughts for your loved ones ought to the unthinkable occur. Interval. And that’s precisely the best way time period life works: It’s easy, inexpensive and dependable. Consider time period life because the household bulldog—you hope you’ll by no means want him to do his factor, however you’re certain as heck blissful to have him round the home.

After all, we all know you’re most likely serious about constructing wealth and defending your loved ones alongside the best way. And people are each legit targets! However every requires its personal instrument for the job, and you’ll see a lot better outcomes with each should you hold them separate.

Backside line: Don’t combine insurance coverage with investing. You’ve acquired means higher methods to take a position than what you’ll discover in an insurance coverage plan. Which feels like extra enjoyable to you—investing in development inventory mutual funds so you may get pleasure from your retirement or “investing” in a plan that’s primarily based on whether or not you kick the bucket? Straightforward reply!

Now let’s look nearer at time period life vs. entire life.

What Is Time period Life Insurance coverage?

Time period life insurance coverage offers you life insurance coverage protection for a particular period of time. (Therefore the time period time period.) For those who get a 20-year coverage, you’re lined for that 20-year time period.

For those who die at any level throughout these 20 years, your beneficiaries (the folks you picked to obtain the demise advantage of your coverage) obtain a life insurance coverage payout. For instance, should you purchased a $300,000 coverage for a 20-year time period and also you die throughout the subsequent 20 years, your beneficiaries would get $300,000. Sure, it’s actually that straightforward.

And right here’s the important thing distinction between entire life vs. time period life: Time period life plans are way more inexpensive than entire life insurance coverage. It’s because the time period life coverage has no money worth until you die in the course of the course of the time period (we’ll speak extra about that in the entire life part).

However that’s to not say time period life is a waste! In any case, you wouldn’t skip out on householders insurance coverage simply since you’d by no means personally met anybody who’d misplaced their dwelling in a hearth. You’re prepared to pay a small worth for the protection to guard your self from the unthinkable (however completely potential) occasion. Time period life’s the identical. You need it as a result of life is treasured, onerous issues occur, and also you care about your loved ones. And regardless of what you’ll hear from entire life salesmen, life insurance coverage has only one job: to substitute an earnings. (That’s one massive purpose we prefer it.)

Time period Life Execs and Cons

Typically time period life will get hate from entire life entrepreneurs as a result of time period doesn’t allow you to construct money worth. They’re flawed after all—however we get why money worth would possibly sound like a sensible concept. Simply to spell out extra of why we advocate time period life all day lengthy, right here’s a abstract of the professionals and cons.

|

Execs |

Cons |

|

Is far more inexpensive than entire life. |

You’ll hear some smack a couple of lack of funding choices, however this isn’t a lot a con as it’s a option to muddy the waters and promote you entire life. |

|

Offers you the choice to take a position nonetheless you like (as an alternative of locking your money into a really low-return funding). |

|

|

Means that you can transfer towards turning into self-insured (extra on that under). |

Bear in mind the one job life insurance coverage has is to exchange the policyholder’s earnings. From nearly any angle, time period life will get that job completed higher than entire life.

After all, nobody needs to make use of their time period life insurance coverage coverage—but when one thing does occur, a minimum of you recognize your loved ones will probably be taken care of. They’ll nonetheless miss you, however they received’t miss you and surprise how they’re going to pay the payments.

What Is Entire Life Insurance coverage?

Entire life insurance coverage (typically known as money worth insurance coverage) is a sort of protection that—you guessed it—lasts your entire life. Entire life plans are typically way more costly than time period life. There are a few causes for that, however largely it’s since you’re not simply paying for insurance coverage right here.

Entire life insurance coverage prices extra as a result of it’s designed to construct money worth, which implies it tries to double up as an funding account and life insurance coverage. Mixing insurance coverage and a financial savings account into one product? That is mindless! It’s like coaching your home cat to be a watchdog: She would possibly learn to scratch a couple of intruders, however she’ll by no means actually guard your property, and she’ll be a depressing pet.

Right here’s one other fact in regards to the distinction between entire life and time period life insurance coverage. For those who comply with Ramsey’s 7 Child Steps, you received’t want life insurance coverage endlessly. In the end, you’ll be self-insured. Why? Since you’ll have zero debt, a full emergency fund and a hefty sum of money in your investments. Hallelujah!

Entire Life Cons and Execs

We don’t have lots of optimistic issues to say about entire life insurance coverage. And for excellent purpose! It’s one of many worst monetary merchandise available on the market, it’s complicated, and it’s a budget-buster as well. However we’ll simply add this chart to make the issues crystal clear.

|

Cons |

Execs |

|

Is much dearer than time period life. |

The one one we’ve found: entire life is best than no life insurance coverage in any respect! |

|

Tries to do two monetary jobs (insurance coverage and investing) directly however finally ends up doing neither effectively. |

Trying to find good issues about entire life may grow to be a brand new interest? |

|

Delays or stops you from ever turning into self-insured. |

Attempting to consider entire life advantages may enable you construct endurance . . . |

|

You (and your loved ones) can lose a ton of your money worth should you die with out cashing it out. |

. . . nonetheless ready . . . |

The ethical of the story is that this: Hold your insurance coverage and your investments separate. You don’t wish to spend years investing your hard-earned cash solely to depart all of it to your insurance coverage firm. Be sensible. Get time period life insurance coverage.

Value Comparability: Time period vs. Entire Life Insurance coverage

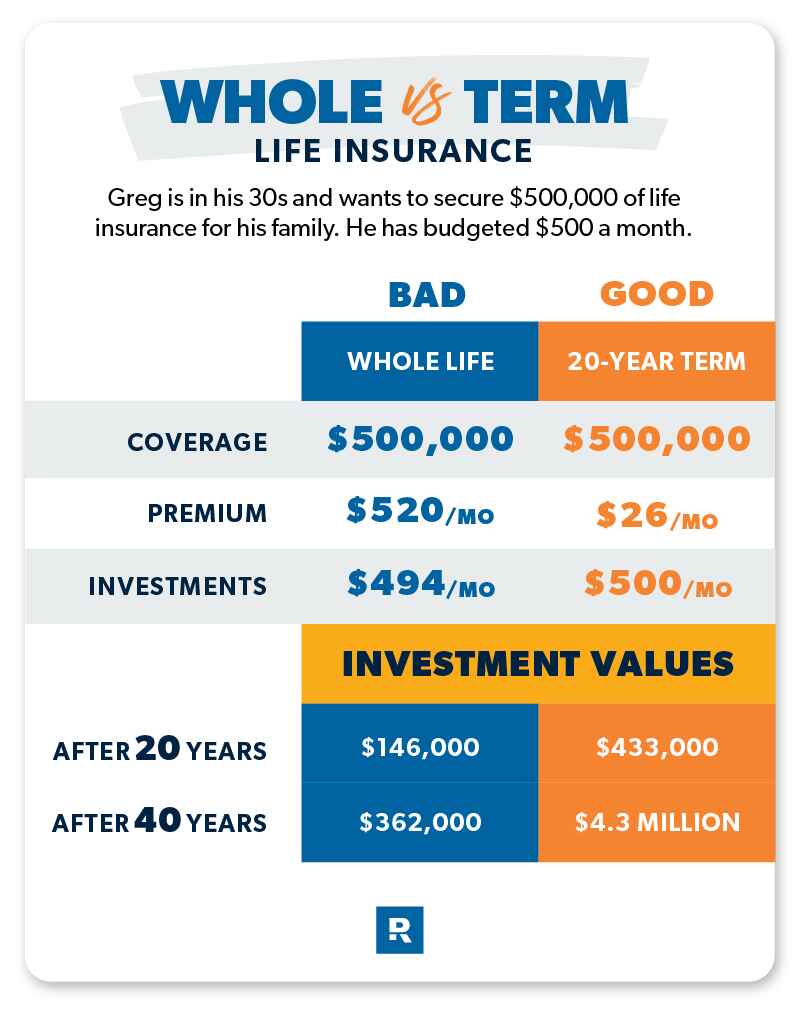

Let’s say now we have a buddy named Greg who’s in his 30s and needs to get $250,000 of life insurance coverage for his household. He meets with a complete life insurance coverage agent who pitches a $260-per-month coverage that may embody the insurance coverage protection and construct up financial savings for retirement (which is what a money worth coverage is meant to do).

Alternatively, a time period life agent tells Greg he can get a 20-year time period with $250,000 of protection for about $13 per thirty days—that’s a $247 distinction in comparison with entire life.

If Greg goes with the entire life, money worth choice, he’ll pay a hefty month-to-month insurance coverage premium. But it surely’s as a result of the a part of his premium that isn’t insuring him goes towards his money worth “funding,” proper? Effectively, you’d suppose, however then come the charges and bills . . .

In fact, the extra $247 per thirty days disappears into commissions and bills for the primary three years. After that, the money worth portion will supply a horrifically low charge of return for his investments (we’re speaking 1–3% right here!).

However right here’s the worst half. Let’s say Greg will get this $250,000 entire life coverage at 30 years outdated. He pays $260 per thirty days, with $15 going to the insurance coverage and the remainder into that financial savings account with a 2% return charge. After 40 years of paying means an excessive amount of for his insurance coverage, Greg is 70 and has $250,000 in insurance coverage and roughly $180,000 in money worth. Then, Greg dies. How a lot does the insurance coverage firm pay out to his spouse and children? $250,000. However wait! What occurred to the $180,000 of Greg’s hard-earned financial savings? The insurance coverage firm retains it. Sound like a rip-off? That’s as a result of it’s!

You see, solely Greg was entitled to the cash in that financial savings account. So to maintain it out of the insurance coverage firm’s pockets, he would have wanted to withdraw and spend it whereas he was nonetheless alive. Discuss stress! Sadly, Greg died earlier than he had the prospect to dwell it up. Now Greg is rolling in his grave and his insurance coverage agent is staying in a five-star resort on Greg’s dime.

However what if Greg as an alternative selected the $13, 20-year time period life coverage and determined to take a position the $247 per thirty days he’ll save by not selecting the entire life plan? If he invests in good development inventory mutual funds with an 11% common annual charge of return, he would have about $214,000 in investments by the point his 20-year time period life coverage expires and greater than $2.1 million at age 70. That’s lots of bang in your buck! We predict Greg will relaxation a lot simpler realizing his household will probably be staying at that five-star resort.

Don’t Wait Till You Want Life Insurance coverage to Get It

Look, this demise stuff isn’t simple to consider. However life is treasured! We are able to’t see the longer term and aren’t promised tomorrow. The price of not having a plan in place for the unthinkable is far increased than the price of time period life insurance coverage. You have to hold your family members protected.

The best time to purchase life insurance coverage is whenever you’re younger and have a clear invoice of well being, particularly as a result of life insurance coverage corporations take a look at the dangers of the individual buying the coverage when underwriting it. For those who’re out there for brand spanking new life insurance coverage or need an professional to speak to, we advocate RamseyTrusted accomplice Zander Insurance coverage. Don’t let one other day go by with out being protected. Begin right here to get your time period life insurance coverage quotes.

Time period Life vs. Entire Life Insurance coverage FAQs

Is time period life higher than entire life?

Sure, it is much better to get time period life than entire life. We don’t need you to get ripped off, we do wish to see your loved ones effectively protected, and we for certain need your monetary future to incorporate wealth and the prospect to grow to be self-insured. The one form of coverage that allows you to hit all these targets is time period life. However entire life misses the mark in each division.

How a lot life insurance coverage do I would like?

That’s simple. You want coverage protection equal to 10 to 12 occasions your annual earnings. Say you’re making $50,000 a yr. You want a minimum of $500,000 in protection. That replaces your wage for your loved ones if one thing occurs to you. You possibly can run the numbers with our time period life calculator. Fast be aware: Don’t overlook to get time period life insurance coverage for each spouses, even when one in every of you stays at dwelling with the children. Why? As a result of if the stay-at-home mum or dad was gone, changing that childcare and residential repairs can be costly! If you wish to be sure that your loved ones is roofed, take our 5-Minute Protection Checkup.

How lengthy do I would like time period life insurance coverage?

We advocate a coverage with a time period that may see you thru till your youngsters are heading off to school and residing on their very own. That’s wherever from 15 to twenty years relying in your youngsters’ ages. Why so lengthy? Effectively, lots of life can occur in 20 years.

Let’s say you get time period life insurance coverage in your early 30s, whenever you and your partner have an cute 2-year-old toddler. You’re laser-focused on paying off all of your debt (together with the home), however you could have an eye fixed on retirement planning sooner or later. Quick-forward 20 years—you’re each in your 50s and that little pint-sized toddler is now a university grad. The years glided by quick.

However look the place you’re! You’re debt-free—and along with your 401(okay), financial savings and mutual funds, you’re sitting at a cool web value of $500,000 to $1.5 million! By working the plan, you constructed up your web value and your peace of thoughts. Now if the unthinkable ought to occur, even with out life insurance coverage, the surviving partner may dwell off your financial savings and investments. Congratulations, you’ve grow to be self-insured! Your want for all times insurance coverage has shrunk or vanished by now.

What occurs to time period life insurance coverage on the finish of the time period?

It’s nothing sensational. The coverage will simply expire, however you received’t discover. You’ll already be within the cash.

What info do I would like when getting a life insurance coverage coverage?

Making use of for all times insurance coverage will imply offering some private information, so let’s take a look at a couple of of the belongings you’ll must reply as you search for protection.

- Do you have already got any present life insurance coverage?

- How’s your general well being?

- Any medical historical past of great sickness?

- What’s your family earnings?

- How a lot are your month-to-month bills?

- How a lot debt do you could have, together with a mortgage?

- What plans have you ever made towards retirement?

- What are your plans to cowl faculty in your kids?

- Have you considered the way you wish to pay for funeral bills?

- What’s your technique round property planning and tax?

- Do you could have a will, and does it embody plans for a belief?

- What’s your age?

- The ages of your kids?

[ad_2]

Source link