[ad_1]

Renters’ insurance coverage does much more than cowl your belongings. It protects you from lawsuits, costly medical payments, theft, backpacking Europe, etc.

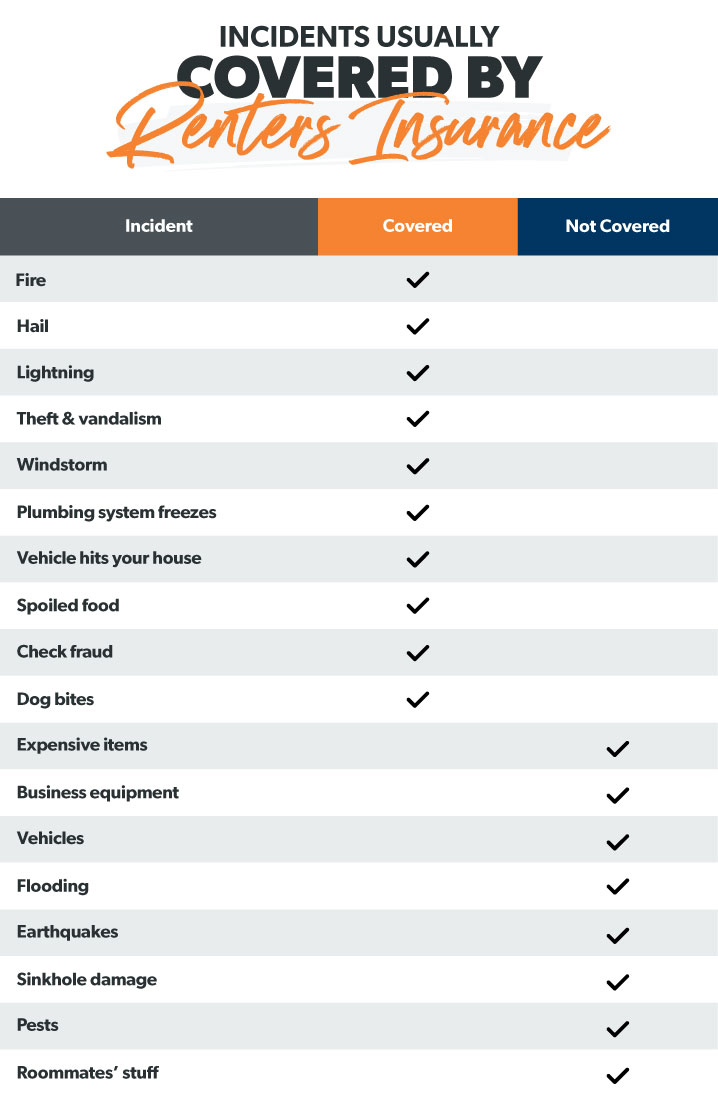

However, there are some things renters insurance coverage gained’t assist with. So for those questioning, What does renters insurance coverage Cowl? You’re in the correct place.

We’ll clarify all the pieces. It is advisable to learn about what renters insurance coverage covers so you’ll be able to be sure you’re protected.

Let’s dig in!

What Is Renters Insurance Coverage?

Renters’ insurance coverage protects your issues if they’re ever broken, vandalized, or stolen. It’s a kind of property insurance coverage that covers you from harmful occasions like explosions, fires, electrical surges, and even sewer backups.

For those who lease, you positively want renters insurance coverage. Without it, you could be on the hook for a reasonable penny changing your possessions after a fireplace or housebreaking. And don’t assume your landlord’s insurance coverage covers you. It gained’t. (Your landlord’s insurance covers their construction, not your stuff.)

Renters’ insurance coverage is instead a lot like householders’ insurance coverage. By paying month-to-month premiums, your insurance coverage firm can produce any claims you make for incidents that might be lined in your coverage, however, solely after you meet your deductible.

What Does Renters Insurance Coverage Cowl?

Here’s a look at four predominant issues average rental insurance covers.

1. Private Property Injury

Renters’ insurance coverage can pay to interchange your issues, as much as certain limits. That’s all the pieces you personal—garments, electronics, furnishings, that epic Beanie Child assortment that’s most likely priced hundreds of thousands.

![]()

Shield your private home and your funds with the proper protection!

Begin by creating a list of your stuff (with images, movies, and spreadsheets). Then estimate how a lot it’s all price. In this manner, you may get sufficient protection to cowl you effectively. For instance, if you probably have $20,000 worth of issues, you’ll want $20,000 in personal property protection.

You must also determine between precise money worth (ACV) and substitute price worth (RCV). Actual money worth means the insurance coverage firm will solely pay you what your objects have been priced once they have been stolen, misplaced, or broken, factoring in depreciation. With ACV, you’ll be in better monetary danger because you won’t get sufficient to exchange particular objects again. For example, for those who paid $400 for their TV 5 years ago, and now its price is $100, the insurer will write you a test for $100—hardly sufficient to purchase a brand new TV.

Then again, substitute price protection pays the overall quantity it will price to interchange no matter if you misplaced. So, if your TV were stolen, your insurance coverage firm would merely write you a test to purchase a new one. And you may get again to the essential work of binge-watching the most recent streaming collection.

2. Private Legal responsibility Protection

If a customer was by accident injured in your residence, they usually sue you; you could be going through a boatload of authorized charges. However, with legal responsibility, you’ll be lined as much as certain limits. A typical coverage presents as much as $100,000 in legal responsibility protection.

Legal responsibility additionally covers some accidents attributable to you. Like in case your residence floods since you left the water working in a plugged bathtub. Your renter’s insurance coverage would assist in paying for your repairs and even damages induced to neighbors. You’d even be lined if the water harm was from structural issues like leaky pipes or flooded bogs.

Legal responsibility even covers you if your beloved pooch bites your neighbor, depending on your canine’s breed.

3. Extra Dwelling Bills

A fireplace destroys your residence, and staying in a lodge for a month or two is essential. With correct renters insurance coverage, this disaster would flip into a minor inconvenience. Extra dwelling bills (additionally known as “lack of use” protection) will assist in paying for additional accounts associated with lodges and eating places.

4. Medical Funds

Renters’ insurance coverage protection also helps pay medical payments if somebody is injured on your property. And the excellent factor is that it doesn’t matter who’s at fault. They’re nonetheless lined.

Different Issues Renter’s Insurance Coverage Covers

Moreover, in these four predominant areas, renters insurance coverage covers several different bonus conditions.

Theft—Renters’ insurance coverage doesn’t simply cowl thieves breaking in and stealing stuff from your residence. It protects you from property stolen from your automobile, at the airport—and even theft that occurs when you’re touring Italy. Principally, your property is roofed—irrespective of the place it’s.

Spoiled Meals—Don’t sweat it if an influence outage shuts down your fridge and that chest freezer full of 100 kilos of floor beef! Renters’ insurance coverage can pay for any unhealthy meals from energy outages.

Eradicating Particles—Your renter’s insurance coverage will generally cowl the prices of particles removed underneath your personal property protection. However, provided that it’s from an occasion that’s lined.

Upgrades or Property Alterations—What for those who paid for a renovation to your rental and it was broken? Your renter’s insurance coverage could cowl you as much as a proportion of your private property protection restrictions.

Monetary Fraud—Surprisingly, your renter’s insurance coverage may assist in paying for cash you lose from a bank card or test fraud. So reach out to your insurance coverage firm if you are ever the sufferer of fraud or forgery. They could be capable of assisting in recouping a few of these losses.

Storage Models Protection—Renters’ insurance coverage sometimes covers stuff in a storage unit. Nevertheless, it doesn’t cowl all of it—often solely around 10% of your personal property protection. So for those with $20,000 of security, you’ll have $2,000 in storage unit protection.

What Does Renters Insurance Coverage Not Cowl?

Like most varieties of insurance coverage, renters insurance coverage gained’t cowl each single doable unhealthy factor that would occur to you. (Like if a scientist truly does convey a T-Rex again to life and it decides to start its rampage in your residence, complicated. Renters’ insurance coverage gained’t assist with that.)

Right here are some things renters insurance coverage doesn’t cowl.

Flood, Earthquake, and Sinkhole Injury

Commonplace renters insurance coverage insurance policies gained’t cowl your stuff if it’s broken in a flood, earthquake, or sinkhole. So for those who stay in a space where the extreme climate is extra frequent, consider getting a separate flood or earthquake insurance coverage. You may additionally be capable of getting a sinkhole endorsement as an add-on.

Pests

No, we’re not speaking about your cousin who’s been crashing at your pad for the final month and a half. We’re talking about insect pests. Renters’ insurance coverage sometimes gained’t cowl harm from issues like rodents, mattress bugs, and insect infestations. Sorry, however, you’re by yourself.

Enterprise Gear

Let’s say you use an enterprise from your private home, and your work laptop computer is stolen. Will your renter’s insurance coverage cowl it? Nope. Your renter’s insurance coverage gained’t often cowl enterprise losses. (You’ll want separate business insurance coverage for that.)

Excessive-Finish Gadgets

For those with costly personal jewelry, collectibles, or a Rembrandt, normal renters insurance coverage gained’t cowl these higher-end objects. You’ll want an additional layer of protection.

Canine Breeds

Specific insurance coverage corporations don’t line canine breeds because their extra aggressive. So if Fluffy is a pit bull, and they finally end up biting somebody, there’s a superb likelihood your insurer gained’t be pitching in.

Automobiles

Car harm isn’t lined underneath renters insurance coverage—you want auto insurance coverage. Nevertheless, the stuff you retain inside your automobile is roofed.

Roommates’ Stuff

Your renter’s insurance coverage gained’t cowl something associated with your roommates’ belongings. They’ll want separate coverage to guard themselves, and we don’t suggest going halfsies on renters insurance coverage coverage for many causes.

File a Renters Insurance coverage Declare.

First, get in contact with your insurance coverage firm ASAP. Clarify what occurred and learn how to start the claims course. Relying on your insurer, submitting a declaration might be as straightforward as filling out a type inside their app.

Subsequent, pull up your stock, together with any receipts. This can function as proof of what was misplaced or broken. And determine which type of declaration you’ll submit: Will it be for private property reimbursement, legal responsibility, or extra dwelling bills?

The subsequent step is to doc all the pieces that occurred. For example, if thieves stole your furnishings, take images and movies of your empty lounge and the window they busted to realize entrance. This can prove to your insurer that it’s a legitimate declaration and can often velocity up the method. That means you’ll get your cash sooner!

As soon as the insurance coverage firm evaluates your information, they will both approve or deny the declaration. (Hopefully, I agree!)

Get the Proper Protection

Getting the correct amount of renters insurance coverage protection might be sophisticated. Too little protection and your declaration might be denied. You may find yourself digging into your financial savings for surprising prices. There is excessive security, and you’re also paying for one thing you don’t want.

That’s why we suggest working with one of our insurance coverage brokers, part of our Endorsed Native Suppliers (ELP) program. You’ll have peace of thoughts understanding your funds are shielded from all the pieces life may throw at you. And all our brokers are RamseyTrusted, so you already know you’ll be working with the perfect within the enterprise.

Join one of our property insurance coverage brokers to get free quotes!

[ad_2]