[ad_1]

Keep in mind Jack and people’s magic beans of his. Nicely, money-worth life insurance coverage guarantees magic beans—like, money—nevertheless, it seems these beans don’t develop into a lot in any respect. (Undoubtedly not on that enormous, skyscraper-size beanstalk degree.) That’s because life insurance coverage corporations aren’t lovely at investing and may stick with what they do greatest: changing your revenue whenever you die.

So, what is money worth for life insurance coverage? And what’s the money worth of life insurance coverage? Most significantly, is it well worth the effort? We’ll enable you to reduce confusion and discover the solutions you’re searching for.

What Is Money Worth Life Insurance Coverage?

Money-worth life insurance coverage is a kind of life insurance coverage coverage that’s in place for your entire life and comes with a type of financial savings account constructed into it.

So, you’re paying for two issues right here—the life insurance coverage half (the bit that covers your loved ones in case you die) and the money-worth half (the financial savings account that supposedly grows your cash over time). How much it grows relies on your purchase money-worth coverage and its returns.

Varieties of Money-Worth Life Insurance Coverage

Every of those insurance policies works slightly in another way—and there’s plenty of lovely print to use. Here’s a breakdown of every sort of money-worth life insurance coverage.

Complete Life Insurance coverage

Complete life insurance coverage is the least versatile of our three decisions. When you resolve your premium, that quantity will get wholly laid out in your range. You’re caught paying that premium quantity yearly (or month) for your entire life. A slice of that premium will go into the money worth a part of your coverage, which may change both. You may count on your charge of return to hover around 2%—so it’ll principally simply sustain with inflation. The longer your coverage lasts, the more money worth you’ll construct up.

Common Life Insurance coverage

Joint life insurance coverage is different (and extra sophisticated) from entire life because it comes with “versatile” premiums and payouts. This implies you will have some management over how much you pay in premiums. If you’re feeling flush, you could “overpay” your month-to-month premium and have the distinction go into the money-worth facet of your coverage. And if you’ve constructed up sufficient of that money worth over time, this may be used to scale back your premiums (extra on this later).

![]()

Examine Period Life Insurance Coverage Quotes.

Relating to how your cash will construct up over time, all of it relies on the standard life insurance coverage you will have (keep in mind once we mentioned it was sophisticated?). These varieties are variable everyday life, assured everyday life, and listed everyday life.

Variable Life Insurance coverage

Variable life insurance coverage serves up an additional serving of complication as a result of in contrast to everyday life and entire life—each of which may have an assured charge of return—variable life permits you to resolve how your money worth is invested. This may very well be in shares or bonds, for instance. So that you’d be making the decision, and it’s dangerous in case you’re not constantly keeping track of your investments. Oh, and variable life insurance coverage comes with crazy-high charges, so don’t count on seeing a lot of money worth within the first three years!

How Does Money-Worth Life Insurance Coverage Work?

That phrase “money worth” sounds fantastic. Possibly you’re considering you’ll have a private ATM that spits money whenever you want. Sadly, it doesn’t dwell as much as that promise.

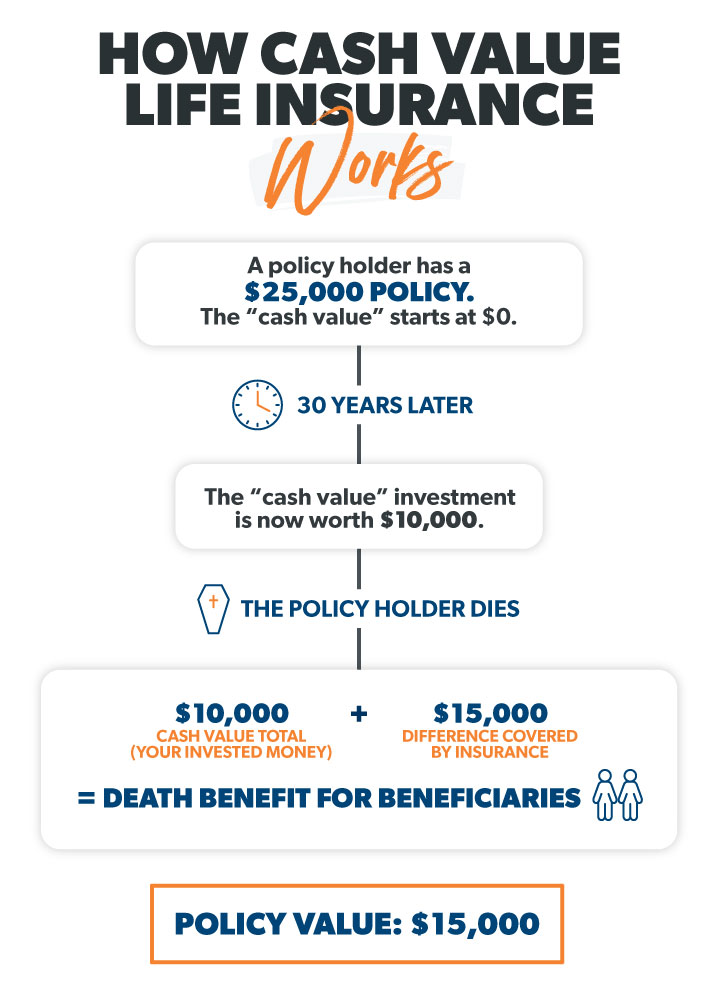

Money worth works like this: Say you’re paying $100 monthly for your money-worth life insurance coverage. A portion of that $100 covers the price of insuring your life; the remainder is put into investments by the insurance coverage firm.

The breakdown of how a lot is invested versus how a lot goes towards your coverage varies over time. Within the earlier years, a more significant proportion of your premiums is put towards the money’s worth. In contrast, in the later years, extra tips are going towards your coverage since the insurance coverage price will enhance as you age.

These investments are supposed to construct and make you cash over time. As we mentioned earlier, the return charges in your money-worth funding rely upon what sort of money-worth life insurance coverage you’re shopping for.

Insurance coverage corporations will level to the money worth as an optimistic factor. You pay your premium, a part of it will get invested, and ultimately you get a pile of money . . . simply so long as you’re nonetheless alive.

Wait, what?

Yep. More often than not, in case you don’t use the money worth when you’re alive, it goes again to the insurance coverage firm whenever you die.

Right here’s the factor: If you attempt to get your arms on some money out of your money-worth life insurance coverage after 12 months, guess how much you’ll have? An enormous fat zero. After three years? Nonetheless zero.

Throughout these first few years, you’ll see no money worth due to all of the charges, bills, commissions, and prices you’re paying the insurance coverage firm to have coverage in the first place!

How Do I Entry the Money in Money Worth Life Insurance Coverage?

Jack didn’t have to attend lengthy for these magic beans to show into an enormous beanstalk. However, what’s the money worth of a life insurance coverage—and are you prepared to attend 10–15 years for some decent money worth? As a result, the, it’s how long it’ll take.

You can wait 10–15 years to construct your money’s worth. How will you take it out? Nicely, listed below are your decisions, relying on whether or not you’ve acquired entire life or typical/variable life insurance coverage . . .

1. You may take out a mortgage towards the money’s worth.

- With entire life: Taking out a mortgage towards the money worth is the worst factor you can do. Why? First, you’re going into debt, which isn’t a good suggestion. Second, you pay curiosity on the mortgage, and if you don’t spend all of it again, your demise profit will lower. Take into consideration how loopy that is—you’re paying curiosity on a mortgage made up of your individual cash.

- With standard or variable: The same applies to all complete life insurance coverage. If you take out a mortgage towards your typical/variable money worth, your demise profit will scale back. And also, you’ll pay curiosity on the mortgage you’ve taken out too.

2. You can also make a partial withdrawal.

That is the closest you’ll get to truly taking out money. However, guess what occurs if you withdraw cash and don’t put it again into your coverage? Your demise profit (the money paid out whenever you die) will be lower.

- With entire life: Though you could money out a portion of the dividend paid by the insurance coverage firm, you can not use the funds worth you’ve gathered like an ATM without surrendering the coverage. That’s loopy, contemplating it’s your invested cash. Nevertheless, it’s so demanding to get your arms on it!

- With common or variable: A partial withdrawal is like getting a piece of the demise profit early. So, the quantity you withdraw is subtracted from the demise profit payout on the finish. You received’t get taxed in your withdrawal if it’s for an amount that provides as much less than what you’ve paid in premiums.

3. You may give up coverage.

- With entire life: This implies you inform your insurance coverage firm you need to surrender the coverage and get the full money worth you’ve constructed up in a single lump sum. Sounds straightforward sufficient, proper? However, you pay the price to the insurance coverage firm, and you’ll be taxed on the quantity you obtain if it’s greater than what you’ve paid in premiums over time!

- With common or variable: Surrendering your coverage has identical outcomes as with your life. Giving up range and cashing in your money worth comes with charges. Oh, and don’t overlook—since you’ve surrendered the field, you’ve additionally ended your life insurance coverage protection.

4. You may promote your coverage for a life insurance coverage settlement.

- With entire life: As a substitute for surrendering your coverage, you could promote it for a monetary settlement. Money sounds good, proper? Particularly in case, your premium is excessive or your youngsters have left the nest. However, there’s a catch! (There’s at all times a catch.) The dealer who units you up with the corporate shopping for your coverage will get a reduction out of your settlement quantity.

- And regarding the settlement, it’ll be lower than your demise profit quantity. The corporate shopping for your coverage (often some funding firm) will attempt to swing this by saying that when you’re getting much less cash than your demise profit, you’re receiving greater than no matter the money worth you will have. That doesn’t imply lots because it’s your cash in the first place! Plus, if your settlement is greater than the full you’ve paid over time in premiums, you’ll pay beneficial capital properties and revenue tax on this “revenue.”

- With standard or variable: Promoting your coverage comes with related points to your life. You’ll pay taxes on the quantity you’ve made in money worth if it totals more significant than what you’ve paid in premiums over time.

5. You may pay your life insurance coverage premium with the money worth.

- Whether or not you will have entire life or standard/variable:

Some of us use our money to pay for the month-to-month or annual premium. That’s if they’ve constructed up a giant pile of money! However, this is senseless because the fundamental level of cash worth life insurance coverage is to use the money worth to spend on the enjoyable stuff—to not use these financial savings on the detailed life insurance coverage invoice. That is not sensible monetary planning.

Discover how all those methods of accessing the money worth include a catch. You’ll both slash your demise profit, face a heavy tax, or pay the price. Getting maintenance of the money worth with no penalties to you isn’t within the insurance coverage firm’s pursuits. It’s how they make cash, but another excuse to avoid money-worth life insurance coverage.

Is Money Worth Life Insurance Coverage a Good Technique to Increase My Retirement Revenue?

This one’s straightforward: No! One of many worst issues you can do is purchasing money worth of life insurance coverage with the hopes of it serving you in retirement. The returns will barely sustain inflation, and you’ll be hit with charges and commissions.

You’d be significantly better off shopping for a period of life coverage and investing 15% of your family revenue into good development inventory mutual funds through a Roth IRA and 401(ok).

What Occurs to the Money Worth When You Die?

By now, you’ve probably got the trace—money-worth life insurance coverage is a complete waste of cash. However, we haven’t even hit the worst half! As we discussed earlier, the one cost your loved ones will get is the demise profit quantity whenever you die. Any money worth you’ve constructed up will return to the insurance coverage firm.

Let that sink in.

You faithfully invested your entire life solely to go away all that cash to the insurance coverage firm. It doesn’t sound correct. However, that’s how insurance coverage corporations make their cash, and that’s why they’re so fast to promote your money-worth life insurance coverage.

The Distinction Between Money Worth and Period Life Insurance Coverage

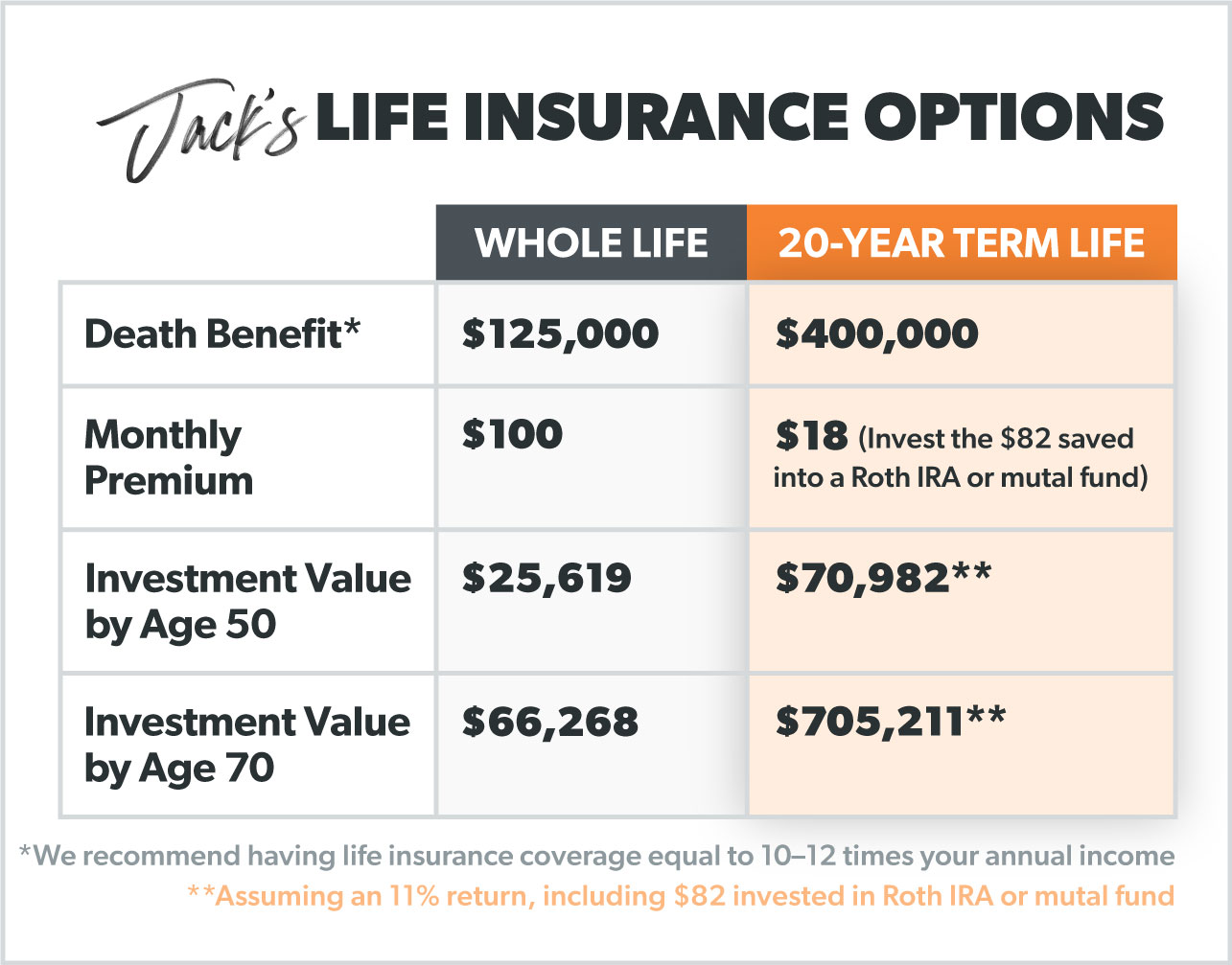

Let’s discuss a unique Jack. He’s 30 years previous, doesn’t smoke, is pretty wholesome, and needs life insurance coverage. However, he’s confused with all of the choices on the market. (Aren’t all of us, Jack?)

He heard {that a} period life insurance coverage coverage is different because it solely lasts for a certain period (we advocate 15–20 years). He is aware that a period of life insurance coverage coverage is simply life insurance coverage and no money worth, so that makes it cheaper. This Jack may not have magic beans. However, he desires to benefit from what he does have. So what are his choices?

Relating to Jack’s demise profit, period life affords nearly four instances of protection. However, he’s solely paying $18 a month for it! If he follows Dave’s recommendation regarding investing and paying off his money owed, he could be self-insured by the point he retires. The most significant distinction between a period life insurance coverage coverage and money-worth coverage is the worth he would pay each month. Although he’s placing a few of the $100 of his cash-worth premium into investments, it won’t make him as much in the long term compared to investing outdoors of his life insurance coverage.

What Life Insurance Coverage Does Dave Ramsey Advocate?

Dave always says not to purchase life insurance coverage as funding! That’s not what it’s for—and it’s an awful option to make investments.

In recent times, extra folks have been shopping for money-worth insurance policies, so it’s much more necessary for us to say this loud and clear: With money-worth life insurance coverage, you’re throwing away extra of your money when you’re nonetheless alive when you could be saving and investing it someplace else for rather more return.

If you’re in debt and assume money worth, the life insurance coverage will enable you to, down the road, it received. You (and your loved ones) will likely be higher off getting a period life coverage and placing 15% of your family revenue right into a Roth IRA and 401(ok) that provides good mutual funds. It’s the sensible option to make your money just right for you!

If you’re available for brand-spanking new life insurance coverage or need someone to speak to, we advocate RamseyTrusted supplier Zander Insurance coverage. Don’t let one other day go by without being protected. Begin right here to get your period life insurance coverage quotes.

[ad_2]