[ad_1]

Say you reside in Minnesota: You’re driving alongside consuming your tapioca pudding in your solution to play ice hockey when a deer steps into the street. You slam on the brakes and the man behind you plows into your trunk.

Now say you reside in Arizona: You’re driving alongside consuming prickly pear jerky in your solution to hike the Sonora when your tire explodes from the scorching asphalt. The man behind you doesn’t cease. Smash.

In Minnesota, your insurance coverage pays in your accidents. In Arizona, the opposite man’s does. Complicated? Yep. It boils right down to no fault insurance coverage. Let’s check out what it’s, the way it works and what states require it.

What Is No Fault Insurance coverage?

No fault insurance coverage is insurance coverage that covers your private accidents irrespective of who’s at fault within the accident.

Don’t let car insurance costs get you down! Download our checklist for easy ways to save.

With a no fault system, all people’s primary accidents or medical bills are lined by their very own no fault insurance coverage, often known as private damage safety (PIP) insurance coverage (as much as a sure restrict). Folks typically use no fault insurance coverage and PIP to imply the identical factor, however this could get complicated. Simply bear in mind, no fault may discuss with the authorized system that lays out who pays for an accident.

The concept behind no fault insurance coverage is to ensure everybody can get the medical consideration they want with out ready to determine who brought on the accident (and whose supplier is on the hook for the medical payments).

No fault insurance coverage is a part of the no fault system of legal guidelines many states have that require individuals to hold particular insurance coverage to pay for their very own medical remedy in the event that they’re injured in an accident.

One other large take care of no fault legal guidelines is that they prohibit your skill to sue the individual at fault for the accident.

Not each state has no fault legal guidelines, and even in states that do have a no fault system, the legal guidelines nonetheless differ. We’ll get into that extra in a minute.

What Does No Fault Insurance coverage Cowl?

This sort of insurance coverage covers just about all the things that doesn’t should do with the automobile (so no fault will cowl the fee to get your again’s slipped disc rehabbed, however it received’t cowl the fee to repair your BMW’s disc rotors).

Right here’s what no fault insurance coverage covers:

- Medical bills

- Funeral bills

- Misplaced earnings (for those who’re injured and may’t work)

- Childcare bills (for those who’re injured and may’t care in your youngsters)

- Survivors’ loss advantages (for those who die and have dependents this may cowl the lack of monetary assist you’ll’ve supplied—this doesn’t substitute your want for all times insurance coverage although)

- Family companies (for those who’re injured and may’t run your family)

Kinds of No Fault Insurance coverage

Simply because your state has no fault insurance coverage doesn’t imply the foundations are the identical from state to state. In reality, they are often fairly completely different relying on the place you reside. One of many largest elements, as you’ll see, is whether or not your state lets you sue the at-fault driver or not.

Pure No Fault

Like pure Angus beef with no fillers, pure no fault is the actual deal. In case your state has it, then each driver should purchase it—no ifs, ands or buts. Drivers aren’t allowed to sue when damage bills fall beneath a specific amount (states set the quantity). And you’ll’t choose out. There are 9 states with pure no fault legal guidelines.

Alternative No Fault

That is the place the fillers are available (you could possibly name this your McDonald’s patty). With this sort of no fault regulation, you possibly can select to purchase no fault insurance coverage or choose out. In case you choose out, your premium might be cheaper, and for those who’re in an accident, you possibly can sue the opposite individual concerned. However that additionally means different drivers on the market can sue you too!

Add-On

This type will get tough (straight Past Burger stuff). In some states with this label, no fault is just certainly one of many insurance coverage choices accessible. Drivers may select so as to add PIP (aka no fault) to their auto insurance coverage protection as a result of they don’t need the fear of determining who’s at fault earlier than their insurance coverage kicks in to pay their medical prices. In different add-on states, PIP is required, however they don’t restrict lawsuits.

In each circumstances, the states get labeled add-on, although, as a result of so long as a state doesn’t prohibit your skill to sue the at-fault driver, they technically aren’t a no fault state—even when PIP is required. Yeah, complicated.

How Does No Fault Insurance coverage Work?

Let’s return to our Minnesota instance at the start: If somebody rear-ends you and also you get whiplash, your PIP kicks in instantly and pays for an X-ray and no matter different medical consideration you want. If the man who hit you smashes his head, his PIP pays for his ER go to and misplaced wages if he can’t work for some time.

This is one other situation: In Florida (a no fault state), you swerve to maintain a truck from hitting you, however you hit another person. That individual dies and also you’re severely injured.

The opposite driver’s PIP would pay for his or her funeral bills and likewise pay their partner for the motive force’s misplaced earnings. Your PIP covers your hospital payments, rehab, misplaced wages from not working, and home visits from a nurse to care in your mother as a result of you possibly can’t look after her when you’re injured.

In each circumstances, whether or not you’re at fault or not, every drivers’ PIP insurance coverage covers their medical and different associated bills.

What if each events are at fault in an accident?

Automotive accidents aren’t all the time reduce and dry. Generally each drivers share fault for the collision. On the subject of bodily damage claims, this doesn’t actually matter in a no fault state. Every driver’s PIP covers them it doesn’t matter what.

If this occurs in a state that isn’t pure no fault, the state’s negligence legal guidelines (guidelines that lay out what’ll occur if somebody doesn’t do what they need to have) will decide how a lot every get together pays typically based mostly on percentages of fault.

Is not any fault insurance coverage required?

Whether or not you’re required to hold PIP or not is completely as much as the state you reside in. And like we mentioned earlier than, some states are known as no fault and say PIP is necessary, however there’s nonetheless an choice to waive PIP and choose out of the no fault system. Let’s get into which states haven’t any fault legal guidelines and which don’t, and which of them require PIP.

No Fault Insurance coverage States

You could have heard that Florida is a no fault state—or New Jersey is a no fault state. In case you’re like lots of people, you might have questioned, What the heck does that imply? States are labeled no fault and at-fault relying on how they deal with lawsuits and who pays for what in an accident.

In a no fault state, you’re not allowed to file a lawsuit towards the opposite driver in case your medical bills fall beneath a specific amount (set by the state). In case your accidents and losses are excessive although (higher than the set restrict), then you possibly can sue their butts (however please don’t be a kind of guys firing off frivolous lawsuits).

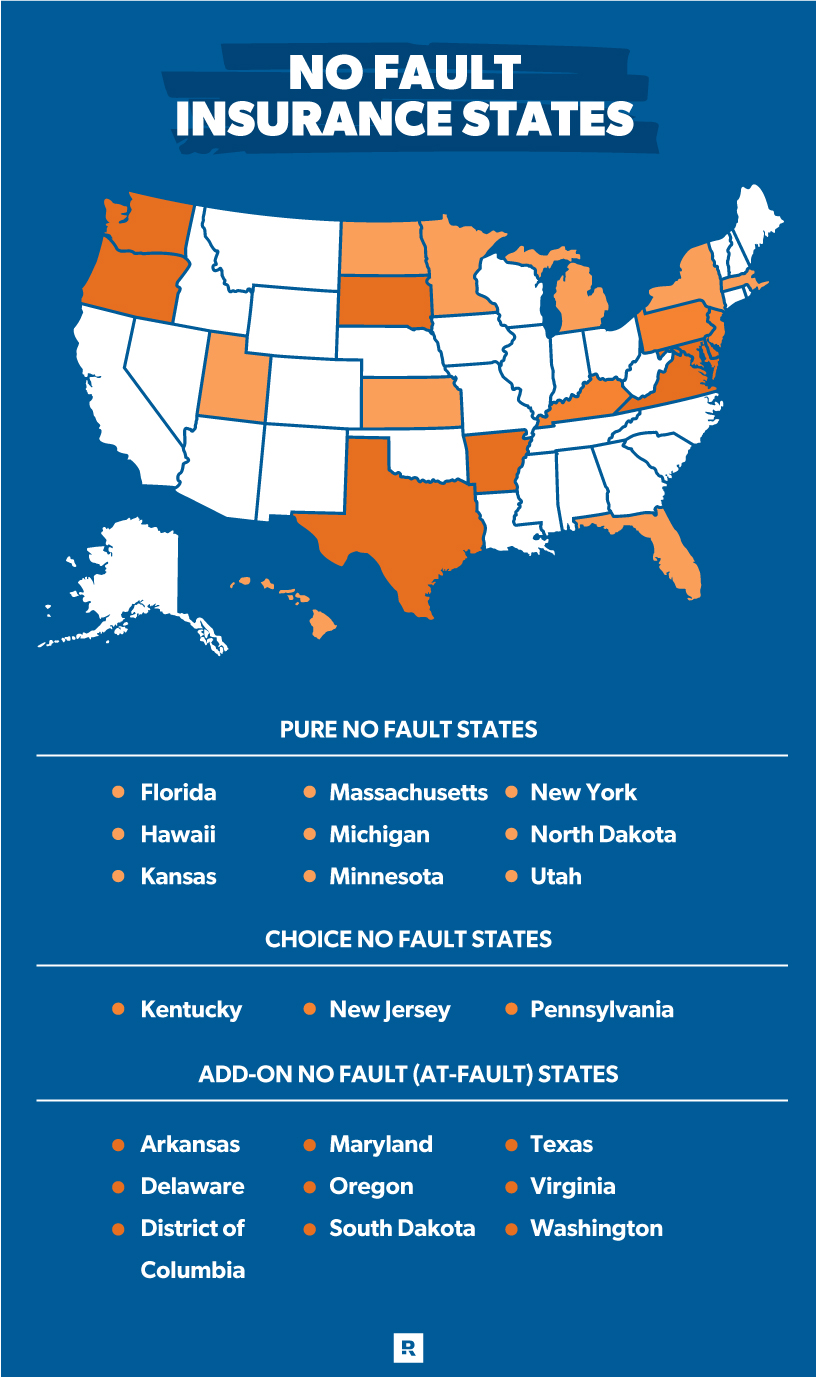

Pure No Fault States

With a purpose to hit the roads in these 9 “pure” no fault states, you should carry PIP insurance coverage.

- Florida

- Hawaii

- Kansas

- Massachusetts

- Michigan

- Minnesota

- New York

- North Dakota

- Utah

Alternative No Fault States

The subsequent three are “alternative” no fault states, which implies drivers can select to choose out of the state’s no fault system. This lets drivers who don’t have PIP protection sue different drivers for damages.

- Kentucky

- New Jersey

- Pennsylvania (their no fault system makes use of Medical Advantages insurance coverage moderately than PIP, however the identical thought applies)

Add-On No Fault (At-Fault) States

The ultimate group is “add-on” no fault states. In a few of these states, drivers can select to hold PIP or not. In others, PIP is necessary. However in all of them, there are not any limitations on whether or not you possibly can sue an at-fault driver, and so these states are known as at-fault (yeah, so complicated—Past Burger, bear in mind?).

- Arkansas

- Delaware

- District of Columbia

- Maryland

- Oregon

- South Dakota

- Texas

- Virginia

- Washington

In our Minnesota rear-end instance from earlier, each drivers are required by state regulation to hold PIP as a result of it’s a pure no fault state. In addition they can’t sue one another except their accidents are above a specific amount. If we transfer our rear-end instance to Texas although, issues are completely different.

If the accident is just not your fault, your insurance coverage will cowl your medical bills instantly—except you selected to waive PIP. In that case, you’ll be accountable to pay for medical bills out of your pocket or by way of your medical insurance. No matter whether or not you waived PIP or not, you could possibly sue the opposite driver at any level.

If the accident is your fault, you’ll be open to a lawsuit from the opposite driver. The opposite driver’s PIP would cowl their medical bills except they waived it—then it might come out of their pocket.

All states not listed within the desk above are known as tort states and don’t supply a no fault system (however some nonetheless supply PIP insurance coverage). We’ll discuss these subsequent.

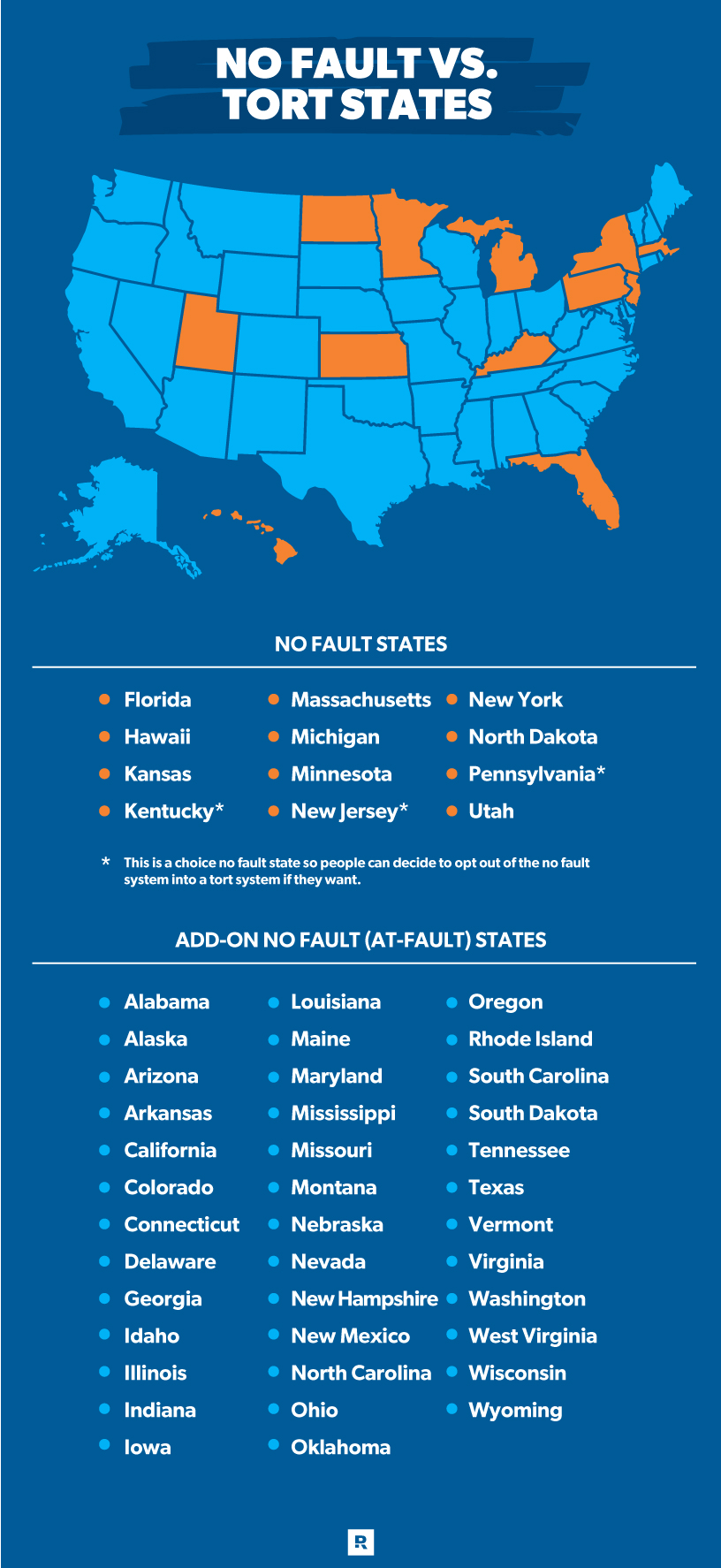

No Fault vs. Tort

A tort system is one other identify for the at-fault system and is the set of state insurance coverage legal guidelines that lays out who has to pay for damages and accidents attributable to a visitors accident. In a tort system, fault is assigned to one of many drivers (or typically break up) and that driver’s insurance coverage should pay for all the things (automobile injury, medical bills, and so on.)

If each drivers brought on the accident, fault is doled out in percentages (we talked about this earlier). So, if Suze doesn’t see Damien arising on her left, adjustments lanes and smashes into Damien, however a part of the explanation why Suze didn’t see him is as a result of Damien was dashing 15 mph over the restrict, Suze would pay one thing like 70% of damages and Damien 30%.

No Fault States vs. Tort States

One other large distinction between no fault and tort programs is tort states don’t put restrictions on lawsuits. So if Gerry will get in a crash and loses the usage of his pinkie toe, he can sue the opposite driver for medical bills, ache and struggling, and anything his billboard lawyer can consider.

In a no fault system, drivers can’t sue one another except they meet state-specific thresholds—and even then, you possibly can’t sue for issues like ache and struggling or emotional scarring. Some states’ threshold is bodily damage, like in Florida the place it’s essential to both lose essential physique operate or endure everlasting damage, scarring disfigurement or demise. Different states use a financial threshold, like in Hawaii the place you possibly can go to courtroom briefcases blazing in case your medical bills exceed $10,000.

No fault states require drivers to buy a specific amount of PIP, so all people pays for their very own accidents. Tort states don’t require PIP, however they do nonetheless have minimal mandates for different sorts of insurance coverage, like uninsured motorist and legal responsibility.

*It is a alternative no fault state so individuals can determine to choose out of the no fault system right into a tort system if they need.

Submitting a No Fault Insurance coverage Declare

Because you don’t want to ascertain fault in a no fault state, you possibly can file a declare instantly along with your insurance coverage firm. You may file on-line immediately, on an app or name them up similar to you’ll with every other declare.

Be sure to concentrate to any submitting deadlines your provider has. Some have a strict window after an accident during which you could file. After your insurer will get your declare, they’ll look it over and determine whether or not your declare is roofed and the way a lot they’ll pay. They could make you get an examination by a health care provider they select.

Like we talked about earlier, no fault insurance coverage solely covers medical bills and different injury-related bills and never that large dent in your candy Mustang.

Since PIP doesn’t cowl injury to your automobile, you’ll should take care of the opposite man’s insurance coverage to get that lined—except it was your fault, after which your collision and legal responsibility coverages will kick in.

How A lot Is No Fault Insurance coverage?

Minimal protection required by every no fault state may be very completely different—New York requires $50,000 in protection whereas Utah solely mandates $3,000! These variations make the fee to buy PIP fluctuate wildly based mostly on the place you reside.

In case you’re in one of many 12 states the place PIP’s required, take a look at your state’s minimal PIP protection quantity to get an thought of how a lot it’ll value you (the upper it’s, the extra it’ll value):

- Florida: $10,0001

- Hawaii: $10,0002

- Kansas: $4,5003

- Kentucky: $10,0004

- Massachusetts: $8,0005

- Minnesota: $40,0006

- Michigan: $50,0007

- New Jersey: $15,0008

- New York: $50,0009

- North Dakota: $30,00010

- Pennsylvania: $5,00011

- Utah: $3,00012

In every state, extra protection is often accessible if you would like extra safety—that is simply the naked minimal you’re required to buy.

The best way to Purchase No Fault Insurance coverage

Whenever you go to purchase insurance coverage in your automobile, PIP might be a compulsory a part of your coverage for those who stay in a no fault state or one of many tort states that also mandates PIP.

As you choose your coverages, the one choice you’ll have on the subject of PIP is how a lot you purchase. If in case you have a extremely nice medical insurance coverage that may cowl you after an accident, you could possibly go along with the state minimal for PIP protection. If you need extra safety or your state minimal may be very low, you may wish to purchase additional.

In case you stay in a “alternative” no fault state and don’t wish to purchase PIP, you’ll should file a no fault rejection type or waiver along with your state. In Kentucky, for instance, you’ll must file with the Division of Insurance coverage.

For anybody in a state with “alternative” or “add-on” no fault insurance coverage, the choice to purchase or cross on PIP is as much as you. In case you’re making an attempt to determine for those who want PIP, now can be an excellent time to do a protection checkup—as a result of in case you have primary medical insurance, it’s a good suggestion to get PIP.

Connecting with an unbiased insurance coverage agent may also help you save on automobile insurance coverage—even when your state mandates $50,000 in PIP. As a result of an unbiased agent doesn’t work for any particular firm, they’re free to work for you. By evaluating quotes from throughout, a RamseyTrusted insurance coverage professional can discover you the most effective deal.

Speak with an unbiased insurance coverage agent in the present day.

Regularly Requested Questions

Are PIP and no fault insurance coverage the identical factor?

Just about. These are each names used for insurance coverage that covers your medical bills irrespective of whose fault the accident was.

However don’t get confused. No fault may discuss with the entire system of legal guidelines in a state the place drivers depend on their very own insurance coverage to pay for accidents and aren’t allowed to sue one another. Private damage safety (PIP) is simply the insurance coverage you purchase that covers you.

Must you waive PIP or choose out of no fault insurance coverage for those who stay in a “alternative” state?

Normally, waiving PIP will prevent cash on the entrance finish by bringing your premiums down, however saving cash within the quick run isn’t all the time the most effective plan. In lots of circumstances, opting out of your state’s no fault system will open you as much as the potential for lawsuits from different drivers for those who trigger an accident—and this might value you rather a lot greater than an additional couple hundred {dollars} a 12 months.

You additionally wish to take into consideration what sort of medical insurance plan you’ve. In case you’re sittin’ fairly with a coverage that gives wonderful protection, you may be capable of get by with out it. However, in case your well being protection is on the essential aspect, holding PIP is a good suggestion—even when it prices a bit extra.

Can I get no fault insurance coverage in an at-fault state?

Many at-fault states additionally supply no fault or PIP insurance coverage. Simply store round insurance coverage suppliers in your state to see if they’ve it. Have in mind, you’ll nonetheless be susceptible to being sued for those who trigger an accident even in case you have PIP insurance coverage in an at-fault state.

[ad_2]

Source link