[ad_1]

In case you lease, you want renters insurance coverage! No ifs, ands or buts about it. Except you’re a minimalist whose total life might slot in a suitcase, your belongings are price much more than you understand.

Truly, most individuals underestimate how a lot their stuff is price. However don’t depart your self uncovered. If one thing occurred to your condo or home, renters insurance coverage is the right back-up plan. Plus, many landlords require it. However most renters say they don’t have it.

We’ll clarify extra about why you want it. And we’ll stroll you thru easy methods to purchase renters insurance coverage so you’ll be able to test it off your to-do record.

Why Do I Want Renters Insurance coverage?

Renters insurance coverage is a kind of safety that can cowl the price of your possessions in the event that they’re broken, vandalized or stolen when you’re renting. Like householders insurance coverage, it’s one of many eight sorts of insurance coverage you’ll be able to’t go with out.

Let’s faux you’re renting and your condo is damaged into. Your laptop computer, iPad, jewellery and brand-new flatscreen TV are stolen. Gone with the wind. What are you able to do?

![]()

Defend your property and your price range with the fitting protection!

First, the thief most likely received’t have a change of coronary heart and present up at the doorstep with all of your stuff. And even when the police catch them, that’s nonetheless no assure you’ll see your issues once more. However what about your landlord? Nicely, they’re not within the enterprise of writing checks out of the generosity of their coronary heart.

Enter renters insurance coverage. It does three essential issues:

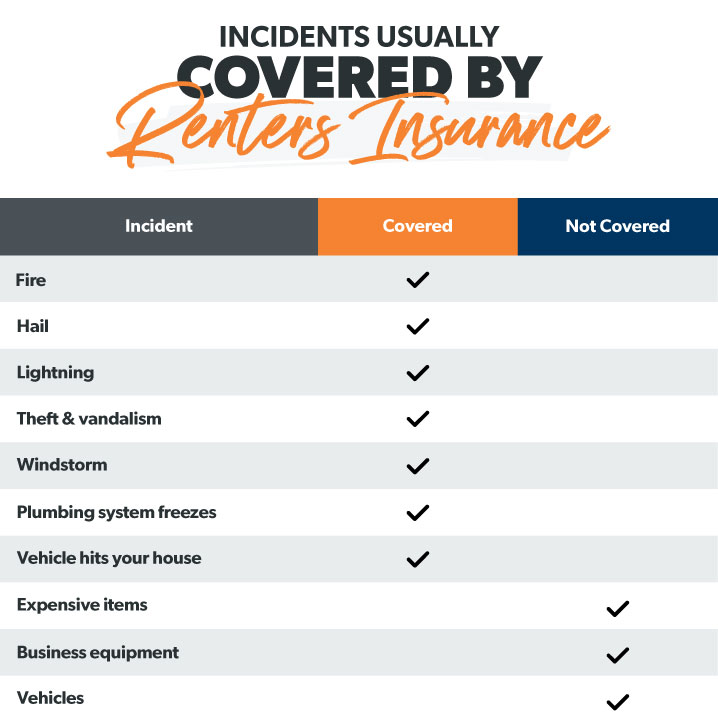

- Covers the price of changing your issues within the occasion of theft, fireplace, storm, vandalism, electrical malfunctions or plumbing points.

- Offers you legal responsibility protection, that means if somebody is injured at your house, you’ll be financially protected against medical payments or authorized charges.

- Pays for extra residing bills if it is advisable to keep at a resort whereas your house is being repaired.

Now that you recognize you want it, you’re most likely asking, How do I get renters insurance coverage? Good query! Let’s discover out.

The right way to Get Renters Insurance coverage: 5 Suggestions

Don’t be overwhelmed. Observe the following pointers and also you’ll quickly be a renters insurance coverage Jedi Grasp (if there’s such a factor).

1. Analysis what your landlord covers.

Step one is to determine what sort of insurance coverage your landlord has. They’re required by regulation to have insurance coverage on their constructing, nevertheless it received’t cowl your stuff. It additionally most likely received’t handle any injury from water backup or appliance-related incidents. Ask your landlord for his or her renters coverage to see what half you’ll have to deal with.

2. Create a listing.

Subsequent, undergo your house and report what you personal. Estimate how a lot protection you’ll want to exchange every thing. Group your stuff into classes like electronics and home equipment, furnishings, garments and footwear, jewellery, tender furnishings, and so forth. Then sort out any particular gadgets, like that fancy train machine or costly bicycle. For higher-end gadgets, chances are you’ll need to buy one thing known as floater insurance coverage. This protects bigger property like artwork or antiques.

Take video and footage of your stuff. Write down manufacturers, fashions and serial numbers if you recognize them. Save receipts for big-ticket gadgets should you can. Preserve all this in a protected place or on a spreadsheet saved to a cloud drive.

3. Analysis renters insurance coverage insurance policies.

Nobody likes homework. However this step will repay should you ever truly need to make a declare in your renters coverage. Do your analysis on renters insurance coverage insurance policies to get a really feel for what’s coated and what isn’t. This can assist later when it comes time to buy round.

There are two totally different sorts of renters insurance coverage: alternative price and precise money worth. Substitute price is a bit more costly because it pays the total quantity to exchange your belongings, nevertheless it’s properly definitely worth the distinction, and we advocate you at all times get it. Positive, precise money worth is cheaper, however that’s as a result of it solely covers what your stuff was price when it was broken. Do your self a favor and get alternative price protection.

You’ll additionally need to add some sort of flood or earthquake insurance coverage should you dwell in areas susceptible to those disasters.

4. Contemplate your liabilities.

Take into consideration any further legal responsibility protection you would possibly want. In case you’re a smoker or have pets, you would possibly need to enhance your legal responsibility. You’ll be requested about these as a result of each can have an effect on your premium. Additionally, take into account how usually you have got firm in your house—whether or not you host a e-book membership or simply plain previous events! The extra folks you have got over, the extra doubtless it’s somebody might get damage. Rising your legal responsibility protection is basically price contemplating. It usually solely prices a number of {dollars} however can prevent a bundle when catastrophe strikes. And should you assume you’ll want extra than the same old quantity of legal responsibility protection, try umbrella insurance coverage for further safety.

5. Be prepared to supply particulars.

Relying on the place you reside, you’ll be requested to reply these questions and extra when it comes time to get a quote:

- What’s your full deal with and kind of residence?

- Does your property have a smoke alarm, carbon monoxide detector, sprinkler system and safety alarm?

- Is your property powered by electrical energy, gasoline or each?

- What ground do you reside on should you’re in an condo constructing?

- Who lives with you?

- Does your entrance door have a deadbolt?

In case you don’t know the solutions to those questions, you’ll be able to attain out to your landlord. Present as a lot element as potential to get the very best charge.

How A lot Does Renters Insurance coverage Price?

Now that you know the way to get renters insurance coverage, how a lot does it price?

The typical individual pays round $10 to $21 a month for renters insurance coverage.1 The typical annual premium is $174—that’s about what it could price to exchange your fancy air fryer.2

The price of renters insurance coverage varies based mostly on issues like the place you reside and the way a lot protection you need. For instance, should you get $100,000 in private property protection, you’ll clearly pay extra in premiums than should you acquired $25,000. And choosing alternative price protection as a substitute of precise money worth will even enhance your premium. Rising your legal responsibility restrict will even bump up your premium a bit.

If you wish to carry your premium down, you might elevate your deductible. (Your deductible is the quantity you must pay earlier than your insurance coverage firm will begin ponying up.) The next deductible means you’ll pay much less in month-to-month premiums however extra out of pocket whenever you make a declare. It’s positively price elevating your deductible should you can afford the additional threat.

You can even generally get reductions should you set up further security measures like burglar alarms or deadbolt locks.

Needless to say even the upper finish of a renters insurance coverage premium prices much less over the course of a yr than changing a broken or stolen laptop computer or TV. And also you don’t need to lose every thing directly to have the ability to file a declare.

Is Renters Insurance coverage Price It?

Renters insurance coverage is a superb deal and it’s completely price it. It’s reasonably priced and affords wonderful safety to your issues. And because the variety of renters will increase throughout the nation as a result of unprecedented housing market, extra folks will want renters insurance coverage. (In case you don’t need to lease the remainder of your life, try these tricks to get your funds on observe.)

With out renters insurance coverage, you’d have to empty your financial savings or go into debt to exchange your stuff—to not point out you’ll be financially accountable if somebody is damage in an accident or canine chunk in your house.

Give it some thought. You’re defending your private laptop, TV, favourite armchair, these early hardback editions of Harry Potter you collected years in the past, and that pair of footwear you’re keen on greater than it is best to and simply can’t discover anyplace anymore.

If you whole how a lot this stuff are price in {dollars} and cents, and how a lot they’re sentimentally price to you, it’s greater than the premium after which some. That’s why renters insurance coverage is one thing all renters ought to have.

Get Protection In the present day!

The steps for easy methods to purchase renters insurance coverage are fairly easy. In case you’re able to get began, you might log on and begin gathering quotes your self. Or you might work with an impartial insurance coverage agent that can assist you get the very best coverage.

Our Endorsed Native Suppliers (ELPs) know the insurance coverage market inside out and may also help you discover a coverage that provides you a similar or extra protection than the one you discovered on-line and for the same price or much less in premiums. They’re RamseyTrusted and may advise you on protection you’ve forgotten to incorporate or reductions you’re eligible for—like bundling renters insurance coverage along with your auto insurance coverage.

Backside line? Unbiased brokers can scan many extra insurance coverage firms, saving you time and presumably cash.

Discover an impartial agent in the present day!

[ad_2]

Source link