[ad_1]

Prepared for some insider data?

Entire life insurance coverage sucks. Insurance coverage corporations promote it as an superior product that lasts your complete life—they name it everlasting life insurance coverage. Then they costume it up with issues like fastened premiums and money worth accounts to lure you into shopping for a coverage.

However identical to these prolonged warranties you should purchase for a lightweight bulb, entire life insurance coverage is a method higher deal for the corporate promoting it than it’s for you. That’s why they dangle so many carrots they know will seize your consideration.

Don’t fall for it! We’re right here to inform you all of the stuff life insurance coverage corporations don’t. By the tip of this text, you’ll see why time period life insurance coverage is all the time the best choice.

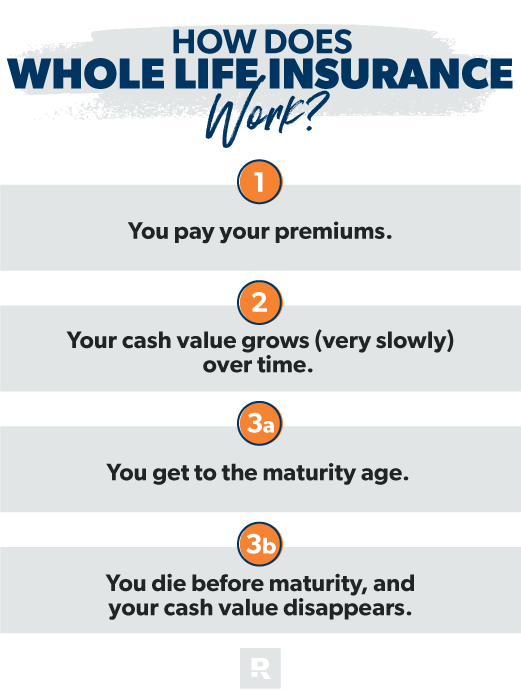

How Does Entire Life Insurance coverage Work?

Entire life insurance coverage insurance policies bundle life insurance coverage protection with a financial savings or funding account that’s supposed to construct money worth. They usually include a assured return in your money worth, however these income are fairly low on common. Decrease returns are simpler to ensure, proper? However that’s just the start of the dangerous information about entire life.

![]()

Evaluate Time period Life Insurance coverage Quotes

Let’s dig just a little deeper into how this con—err, course of—works.

1. You pay your premiums.

Each month, the insurance coverage firm makes use of a part of your premium to cowl your life insurance coverage prices and places the remaining right into a money worth account. The breakdown of how a lot is invested versus how a lot goes towards your coverage adjustments over time. Within the earlier years, a bigger proportion of your premiums pays into the money worth, whereas within the later years, extra goes towards your life insurance coverage protection since the price of life insurance coverage will increase as you age.

2. Your money worth grows (very slowly) over time.

Your insurance coverage firm gives you an (unimpressive) rate of interest in your money worth account. If these charges have been slices of cake, they’d be the almost-stale ones you see within the get-it-before-it-expires stand. So, identical to in a financial savings account, your money worth is meant to develop. And after you’ve constructed some financial savings, you possibly can select to borrow towards it or depart it as it’s (each choices include downsides, which we’ll clarify in a minute).

3a. You get to the maturity age.

Maturity age is when you possibly can lastly withdraw all the cash you’ve saved in your money worth account. Some insurance coverage corporations outline this age otherwise, however most agree on 120 years outdated.

Or (and this subsequent state of affairs is almost certainly):

3b. You die earlier than maturity, and your money worth disappears.

If you happen to didn’t do something with that money worth when you have been alive—guess what? The insurance coverage firm retains it! Your loved ones will get the demise profit, and the insurance coverage firm nabs your money worth account. (This is without doubt one of the worst components of money worth life insurance coverage and why we are going to all the time inform you to keep away from it.)

What Are the Forms of Entire Life Insurance coverage?

Entire life insurance coverage is available in all sizes and styles—and every kind is as dangerous as the subsequent. Listed below are a number of the several types of entire life insurance coverage:

These are the primary sorts, however there are much more particular varieties of entire life—like joint life insurance coverage that covers two folks. Or kids’s entire life insurance coverage, which is supposed to lock in a coverage early to your baby and be an funding for his or her future.

However each kind of entire life insurance coverage has the identical issues—they mix life insurance coverage with some sort of financial savings or funding account that comes with low returns and excessive charges. The consequence—you don’t get the life insurance coverage protection you actually need or construct the financial savings you anticipated.

How Can I Use My Entire Life Insurance coverage Money Worth?

Most individuals don’t wait till the coverage is at maturity to take out their entire life insurance coverage money worth. You’ll be able to faucet into it any time you need. However be warned: This isn’t like getting a paycheck or withdrawing cash from an ATM.

Whereas most entire life insurance policies will allow you to borrow towards them or cancel (aka give up) the coverage and declare no matter money worth you made, doing this isn’t pretty much as good of a deal because it appears.

Let’s take a look at the choices:

Taking Out a Mortgage In opposition to the Money Worth

If you happen to’ve constructed up some money worth, you possibly can take out a mortgage towards your coverage. Like every mortgage, you’ll need to pay curiosity as you pay it again, regardless that you’re borrowing towards your personal cash. How loopy is that?

And it will get worse—for those who don’t pay again the cash you borrow, your insurance coverage firm will take that quantity out of your demise profit. Plus, it’s not all the time greenback for greenback. Meaning your coverage will be diminished by greater than the precise money quantity you borrowed. Harsh!

Surrendering Your Coverage

You can too faucet into the money worth of an entire life coverage via a money give up or cancellation.

Right here’s how that works.

You inform the insurance coverage firm you wish to money out your entire life coverage, they usually ship you a proportion of the coverage’s money worth. How a lot cash you get again is dependent upon your explicit coverage, the insurance coverage firm charges, and the period of time you’ve had the coverage.

By now, you possibly can see that irrespective of the way you determine to faucet into the money worth of an entire life coverage, it’ll by no means work out in your favor. Your money worth will lose a whole lot of its price as a result of much less and fewer of your premiums have been invested over time, otherwise you’ll need to accept lower than the complete worth of the coverage you’ve been paying for. Both method, it’s not a good selection.

How A lot Is Entire Life Insurance coverage?

If you happen to’re questioning how a lot entire life prices, the brief reply is, it relies upon.

Entire life insurance coverage charges rely on a bunch of things. The highest ones are age, occupation, well being historical past and the quantity of your coverage. Altogether, these elements are how insurance coverage corporations work out what the percentages are of getting to pay out a demise profit—aka your threat profile.

For instance, let’s take a look at Ed: He’s in his early 50s, a heavy smoker and a stunt pilot. Ed applies for $100,000 of entire life insurance coverage.

Now let’s take a look at Brynna. She’s a 30-year-old nonsmoker who works as an workplace assistant. Brynna applies for a $50,000 entire life insurance coverage coverage.

Who might need a decrease premium—Ed or Brynna? If you happen to guessed Brynna, you’re completely appropriate! She’s youthful, more healthy, has a comparatively secure occupation, and is shopping for a coverage for half as a lot as Ed. And all that provides as much as much less threat for the insurance coverage firm.

What’s the Distinction Between Entire Life Insurance coverage and Time period Life Insurance coverage?

Time period life is totally different from entire life as a result of it’s simply life insurance coverage. In different phrases, time period life insurance coverage doesn’t faux to be an funding and life insurance coverage on the similar time. It additionally solely lasts for set variety of years—and that makes it less expensive.

Let’s see why entire life isn’t a sensible concept while you evaluate it to time period life . . .

You’ll pay the next premium with entire life insurance coverage.

There isn’t a money worth factor with time period life. So, the premiums for entire life are a lot greater than time period life premiums. And after we say greater premiums, we imply outrageously excessive. However why? For a money worth account with a low rate of interest? No thanks!

You’ll be able to make investments smarter with time period life insurance coverage.

Folks purchase entire life as a result of they assume they’re killing two birds with one stone. They get life insurance coverage and an funding. Whenever you actually give it some thought although, utilizing your insurance coverage as an funding makes no sense—particularly when there are higher funding choices on the market. You’ll be able to simply get extra to your cash by studying to take a position correctly. That is so essential—be very cautious of any kind of insurance coverage performing as an funding alternative.

Insurance coverage corporations make more cash on entire life insurance coverage.

Who actually advantages from entire life insurance coverage? The reality is the insurance coverage corporations and brokers who promote it are those profiting. They make a heck of much more cash on entire life insurance policies than they do with time period insurance policies, so which one do you assume they push extra?

Keep in mind, you’ll pay a a lot greater premium for a complete life coverage than for a time period life coverage. Insurance coverage corporations use that costly entire life premium to take a position your cash for their revenue. Don’t fall for it!

Get the Proper Kind of Life Insurance coverage

The money worth half of an entire life coverage can sound like deal. We get it—everybody wants to consider constructing their retirement fund. However a complete life coverage isn’t the way in which to do it. As a substitute, make investments 15% of your family revenue in good progress inventory mutual funds via tax-advantaged accounts, like a 401(okay) or Roth IRA. You’ll construct wealth quicker and be in a a lot stronger place when it’s time to retire.

Entire life insurance coverage—and the awful method it builds up money—simply can’t evaluate to the outcomes you get by investing your cash independently. Don’t depart investing to the insurance coverage firm.

To be taught extra about selecting the best kind of life insurance coverage for you and your loved ones, speak to a certified life insurance coverage skilled. For over 50 years, our trusted associates at Zander Insurance coverage have been serving to folks discover the very best coverage to guard their household. Or if you wish to do a fast DIY checkup on all your protection, take our 5-Minute Protection Checkup to see you probably have the precise insurance policies in place.

[ad_2]

Source link