[ad_1]

Phishing? Faux antivirus software program? “You’ve received” scams? It’s onerous to maintain up with the most recent web and telecom fraud schemes that thieves use to try to steal your hard-earned cash.

However the extra you understand, the higher you’ll be able to defend your self. So, let’s dig into the most recent scams, warning indicators, penalties, and—most significantly—steps you’ll be able to take to guard your self.

1. What Is Wire Fraud?

Wire fraud is when somebody makes use of telecommunications or the web to con somebody. It may be a telephone name, a fax, an e-mail, a textual content, radio, tv, social media messaging, or another type of airwave or cable communication. That features wi-fi communications too!

Okay, that explains the wire half. However what in regards to the fraud half?

Effectively, fraud covers a variety of scams thieves use to trick you—often to get your cash. Fraud may be dedicated by a single individual and even a complete firm and is punishable by jail time and/or fines. It may very well be something from dishonest a grandmother into emptying her financial savings account to stealing tens of millions of {dollars} from a gaggle of buyers.

2. A Temporary Historical past of Wire Fraud

Prepared for a brief journey down reminiscence lane? Right here we go . . .

Take our identity theft risk assessment.

It was that communications fraud was restricted to the phone and postal mail. Fraudsters would make a whole lot of telephone calls or ship out a whole lot of postcards to hook gullible targets.

These scammy telephone calls and postcards haven’t actually gone away, however when the web was born, it offered all new methods for thieves to trick individuals out of their cash. Now a fraudster’s work may be performed totally on-line with a couple of pretend pictures, made-up tales, or guarantees of everlasting monetary safety.

3. Examples of Wire Fraud

Listed here are some typical eventualities of wire fraud—be looking out for scams identical to these.

Nigerian Prince Rip-off

Let’s begin with one of many longest-running examples. The unique Nigerian Prince rip-off (aka the Nigerian letter rip-off and the 419 fraud) is a centuries-old swindle that’s been round for the reason that French Revolution. These old-school scammers despatched handwritten letters asking for monetary assist for a nonexistent nobleman who was falsely imprisoned.

The unique story may be lengthy forgotten, however the coronary heart of the rip-off lives on. At the moment’s fraudsters use emails, web sites and Fb profiles—as an alternative of handwritten postcards—to persuade trusting individuals to wire them cash or ship them their private data. Nigerian prince scams nonetheless rake in over $700,000 a yr.1

Professional tip: By no means—and we imply by no means, ever, ever—ship cash or give out your private data to strangers, regardless of how convincing they’re.

Telephone Swindles

Because it’s simpler to tear individuals off once you’re not face-to-face, a number of scammers nonetheless depend on the great ol’ landline (or cellphone) to search out their victims. Sadly, it’s largely aged individuals who fall prey to telephone swindles. Why? As a result of many senior residents aren’t savvy to the most recent scams.

The con often goes one thing like this: Suppose an aged girl named Donna will get a telephone name from somebody claiming to be a member of the native police division. The caller tells Donna her grandson has been arrested and she or he must ship $10,000 to bail him out of jail. With out hesitating, Donna drives to her financial institution and asks the teller to wire $10,000 from her financial savings account to the quantity the con man gave her.

Professional tip: All the time double-check the data strangers on the telephone let you know. On this case, if Donna had referred to as her grandson earlier than driving to the financial institution, she wouldn’t have misplaced $10,000.

Phishing Scams

Phishing is one other kind of wire fraud the place a scammer lies—often by e-mail—to get somebody’s private monetary data to both steal from them or promote their data to different scammers.

Right here’s an instance—this one’s referred to as model impersonation.

Think about somebody sends you an e-mail pretending they’re a UPS supply driver. They let you know somebody is attempting to ship you a package deal, however they want your deal with and bank card quantity to finish the supply.

Is that this a rip-off? Most probably, sure. Give it some thought. If somebody sends you a package deal, wouldn’t they already have your deal with? And the even larger purple flag: Why would the sender want your bank card quantity?

Professional tip: By no means reply to suspicious emails. When you don’t know the sender, the sender’s e-mail deal with isn’t from the corporate they are saying they’re from, or the e-mail content material has spelling and/or grammar errors, it’s most likely a rip-off.

You Gained a Prize!

Any such wire fraud is named “you’ve received” scams. It’s actually onerous to withstand—who doesn’t wish to win one thing?

“You’ve received” scams often observe the identical sample: You get a card within the mail, or a telephone name, or an e-mail saying you received one thing huge. Possibly the scammer did their homework earlier than they contacted you and came upon you’ve at all times needed to go to Italy. Or perhaps they are saying you received a lottery or a sweepstakes.

Regardless of the prize, you get tremendous excited! However right here’s what occurs subsequent: The scammer claims that you must give them your bank card quantity or financial institution data to allow them to ship you your prize. You fall for it and some days later you verify your checking account, and as an alternative of discovering the money prize you anticipated, you discover an enormous chunk of your cash is gone!

Professional tip: Put the brakes in your pleasure about successful a prize and take note of the main points. You may’t win a contest you by no means entered. And bear in mind crucial rule: By no means give your bank card or banking data to anybody you don’t acknowledge. Ever! Even when they declare it’s your fortunate day.

4. Wire Fraud Penalty

Is wire fraud a federal crime? Sure, the feds take wire fraud very severely.

The explanation wire fraud is a federal crime in the US is as a result of it typically crosses state traces. Which means it may be investigated by the FBI or the Federal Commerce Fee (FTC).

Punishment for on-line scamming is harsh. We’re speaking as much as 20 years in jail and $250,000 in monetary penalties for people.2 Plus, every act of wire fraud may be charged as a separate offense. So, if a single scammer sends pretend emails to fifteen completely different individuals, they may very well be fined a whopping $3.75 million (15 x $250,000).

Wow!

When you spot a wire fraud rip-off, you’ll be able to report it by calling the Federal Commerce Fee at 1-877-382-4357 or logging on: http://www.ftc.gov/complaint.

Don’t Change into a Sufferer of Wire Fraud

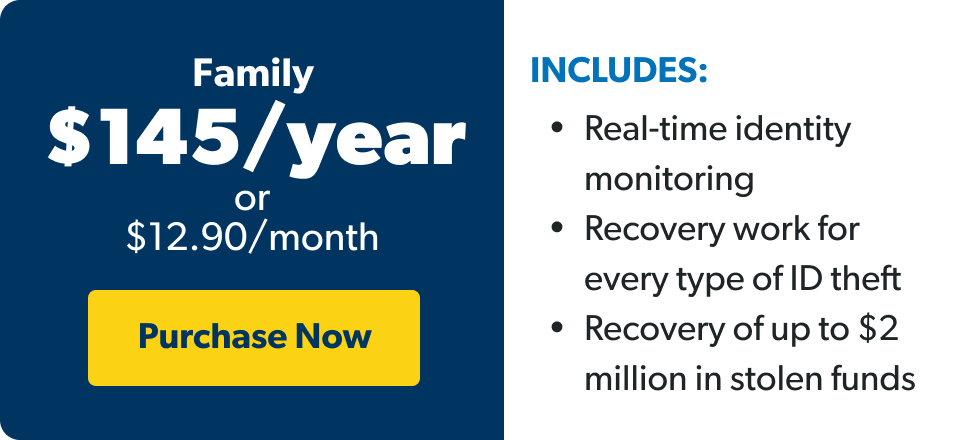

What’s the easiest way to guard your self in opposition to on-line scammers? We suggest working with RamseyTrusted supplier Zander Insurance coverage. They monitor your private data in actual time—so if one thing seems suspicious, they’ll let you understand instantly. And if the worst occurs, and your identification or cash is stolen, they’ll stick with you each step of the way in which to verify your world is right-side-up once more.

Get safety right now!

[ad_2]

Source link