[ad_1]

Obtain free Conflict in Ukraine updates

We’ll ship you a myFT Day by day Digest e mail rounding up the most recent Conflict in Ukraine information each morning.

Inflated transport prices are enabling Russian corporations to earn way more from crude oil gross sales to India than beforehand recognised, based on a Monetary Occasions evaluation which means that the costs might have raised greater than $1bn in a single quarter.

Russia has, till lately, appeared to conform on this route with western measures designed to curb its revenues which had been launched after its full-scale invasion of Ukraine final 12 months. Its oil producers have been promoting crude to India for beneath the $60-per-barrel worth cap.

However when freight prices are included, they and the merchants with whom they work have charged a lot larger sums.

An FT evaluation of ships working instantly from Russia’s Baltic ports to India means that this overcharging, mixed with charges earned from transport the oil on Russia-linked vessels, might have been value $1.2bn within the three months to July.

Benjamin Hilgenstock, a tutorial on the Kyiv Faculty of Economics, which has been learning evasion of the worth cap, stated: “Inflated transport prices are a significant concern as they successfully create a leak within the worth cap regime by which somebody, someplace can siphon off billions of {dollars}.”

James Cleverly, the UK’s international secretary, stated: “It comes as no shock that Putin is turning into more and more determined and dishonest in his makes an attempt to mitigate the worth cap’s affect — one thing that has been severely proscribing Russian revenues since its introduction. These aiding Russia’s makes an attempt to fund this unlawful warfare ought to know, the UK will proceed to behave alongside our companions to implement this measure.”

The worth cap imposed by the G7 is meant to maintain Russian oil flowing whereas squeezing revenues that might be used to fund the warfare. However the cap — which locations necessities on consumers, shipowners and insurers from taking part nations — doesn’t impose any restrict on freight prices.

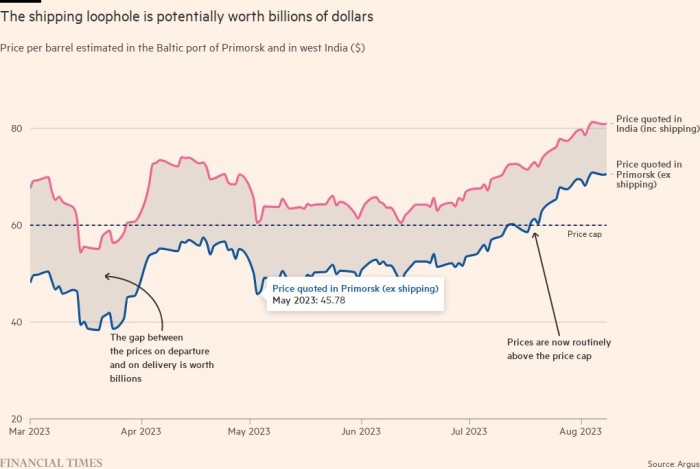

Customs data issued in Russia from December till the top of June point out that the common worth of crude oil shipped to India was round $50 per barrel in Russia’s Baltic ports. This stored the gross sales according to the cap, which applies to the so-called “free on board” (FOB) worth, or the price of the oil on the port of loading.

However Indian customs knowledge reveals that the costs really being paid in India after supply — the so-called “price, insurance coverage and freight” (CIF) worth — over the identical interval had amounted to $68. This was a marked low cost on world oil costs, which averaged round $79 per barrel over the interval, however implies an $18 per barrel rise in costs between the Baltic and India.

Figures from Argus, a pricing company, additionally level to a big unfold. Argus estimates that the common worth of Urals crude has been $14.90 per barrel larger in India than within the Baltic since knowledge began to be collected in February. That is in extra of Argus’s estimates of the particular worth of transport, which has averaged round $9 per barrel.

An official at an Indian state-owned oil firm which purchased a few of this oil informed the FT that Indian consumers had been shopping for inclusive of transport prices. The official stated that no negotiation was allowed over freight preparations or prices.

The surplus costs are subsequently prone to have been captured by the sellers of the oil. In line with Kpler, the information analytics firm, the oil producers Lukoil and Rosneft have made direct gross sales to Indian refineries. In different instances, the sale is managed by buying and selling corporations which have emerged previously 12 months with shut hyperlinks to a number of Russian oil corporations.

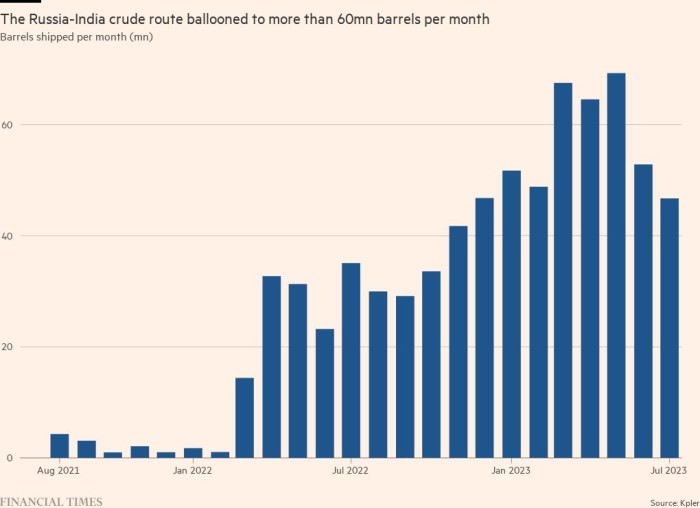

Kpler estimates that Russia shipped 108mn barrels from the Baltic to India from Could to July in 134 vessels, a time when the unfold between Argus costs averaged $17 per barrel, after taking account of the lag between departure and supply. At the moment, Argus estimates that business transport charges averaged $9 per barrel, suggesting that the overcharging could also be value round $800mn.

Hilgenstock stated: “If Russian oil corporations and merchants agree to those form of contractual situations, we now have to imagine {that a} portion of the unfold is being captured by Russia — whether or not or not Russia owns the tankers transferring the oil.”

Russia does have a hand within the tanker fleet. Of the 134 vessels recognized by Kpler as transferring Russian oil to India from Could to July, the FT has been capable of instantly hyperlink 23 of them to Russian entities through insurance coverage, possession or administration documentation.

Most of those are run by Solar Ship Administration, which has been positioned underneath sanctions by the UK and EU for being related to Sovcomflot, the large Russian state tanker fleet.

The FT has recognized an additional 26 “ghost” vessels which had been purchased by their present house owners for the reason that begin of the warfare. Their house owners are secret, hidden through shell corporations largely within the Marshall Islands and Liberia, however all have dramatically diverted on to the Russian oil routes since being purchased — and a few have beforehand been linked to Russia.

Within the three months to July, round 40 per cent of the oil shipped from the Baltic was carried by the Russia-connected fleet. The freight price estimates calculated by Argus suggest that this fleet might have earned greater than $350mn in income on the route over the quarter.

Including the $800mn by which charges had been inflated, which means that Russian entities might have covertly made a billion {dollars} extra in income over that interval than beforehand recognised.

India now accounts for round 1 / 4 of Russia’s crude and refined oil exports. Russia’s world oil exports amounted to $39bn in whole over these three months, based on the Worldwide Vitality Company.

Retaining the worth in its Baltic ports beneath the worth cap had allowed Russia to additionally use ships with western insurance coverage. Greater than half of the vessels on the route throughout that quarter had been G7-insured, with 46 of them run by Greek ship managers.

The variety of western vessels is dropping, nonetheless — a consequence of worldwide crude costs rallying 15 per cent previously month to close $85 a barrel. This has dragged Russian costs larger and nearer to the cap. Argus has assessed that common quoted costs in Primorsk, a significant Baltic port, rose above $60 final month.

This makes it tougher for western-linked corporations to shift the oil whereas nonetheless obeying the cap. Because of this, Greek-domiciled ship managers immediately began to go away the Russian crude market in July.

The Worldwide Vitality Company stated on Friday that Russia’s oil export revenues in July reached their highest stage for the reason that cap was launched, even with out together with inflated freight prices.

The upper costs can also deter consumers, nonetheless. An Indian oil official informed the FT that the low cost was now simply $2 to $10 a barrel.

“Indian imports might now decline, because the reductions aren’t as beneficiant,” stated Amrita Sen at Vitality Features. “Their banks are additionally getting anxious now there are indicators that the majority cargoes are buying and selling above the worth cap.”

[ad_2]

Source link