[ad_1]

This text is an on-site model of our Vitality Supply publication. Join right here to get the publication despatched straight to your inbox each Tuesday and Thursday

Good morning from a baking sizzling Houston.

Temperatures listed below are anticipated to interrupt 100F (38C) within the coming days as a heatwave sweeps throughout the state. Texas’s energy grid operator Ercot has warned of report electrical energy demand as properties and workplaces crank up the air-con.

Hovering temperatures have gotten the norm in Texas. Energy demand within the state scaled new information 11 occasions final yr as local weather change bites in America’s vitality heartlands.

I will likely be relocating right here from New York full-time subsequent month, taking on as Houston correspondent following Justin’s departure. I’m looking for recommendations on all the pieces from oil patch drama to the place to get good brisket. Please get in contact: myles.mccormick@ft.com.

Talking of oil, the Worldwide Vitality Company stated yesterday that the world would hit peak demand earlier than the last decade is out, with consumption in transport sliding as quickly as 2026 as electrical autos achieve traction.

In right now’s publication Derek and Tom report from Shell’s huge day on Wall Road, the place the corporate’s prime brass sought to woo buyers with a pitch stressing “self-discipline”, returns and a extra “balanced” vitality transition strategy.

We even have an op-ed from veteran vitality dealer Adi Imsirovic of Surrey Clear Vitality, who hits out at Saudi “theatrics” in blaming speculators for oil value falls. In Knowledge Drill, Amanda charts the geographically uneven surge in world battery storage.

Thanks for studying. — Myles

Shell’s Sawan makes his pitch

Shell held its much-hyped investor day yesterday, with new chief government, Wael Sawan, delivering a sophisticated efficiency designed to spark enthusiasm for a supermajor that some buyers really feel has misplaced its manner in recent times.

The occasion’s location, a gilded room within the New York Inventory Alternate, was symbolic: the US stays friendlier to grease producers — one motive why a change of domicile to the nation was thought-about, and stays believable.

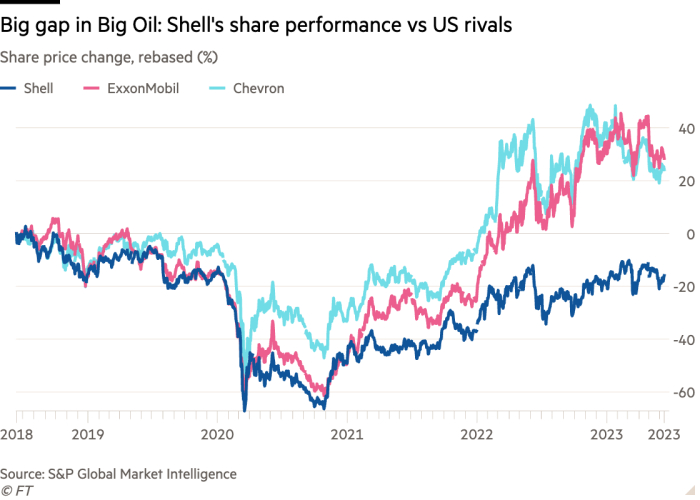

And if Sawan is to shut the large valuation hole with ExxonMobil and Chevron — the elephant within the room on Wall Road yesterday — he must win over American buyers. Listed here are some takeaways:

Shell will maintain pumping oil, however this was not an enormous pivot

Shell’s goal to chop oil output by 1-2 per cent per yr is gone, however solely as a result of — due to divestments — it has already met the goal. Now it intends to carry its high-margin oil output regular at about 1.4mn barrels a day till 2030.

It will launch a bunch of recent initiatives to ship 500,000 barrels of oil equal a day — “or extra” — stated Sawan, within the subsequent two years, however solely to offset declines elsewhere. This doesn’t embody its huge wager on Namibia, which is able to solely ship oil later within the decade at greatest.

Gasoline is a far larger progress space and LNG would be the star of the present. Shell will add a further 11mn tonnes every year of LNG capability by 2030. Meaning its owned and traded volumes mixed are anticipated to rise by as a lot as 30 per cent by the top of the last decade to virtually 80mn tonnes every year.

How low-carbon companies slot in stays to be seen. Shell says inexperienced initiatives might want to obtain returns of 6-8 per cent to justify funding, and a few might obtain 9-10 per cent. However that’s a far cry from the 25 per cent on supply from a few of its oil initiatives.

In the meantime, Sawan was adamant that Shell didn’t take pleasure in any “differentiated capabilities” that will justify a extra aggressive transfer into renewable era — a stance that may please the sort of US buyers which have flocked to ExxonMobil.

Sawan didn’t mince his phrases concerning the vitality transition

In a word-cloud of company buzzwords, “ruthless”, “disciplined”, “simplified” and “balanced” options prominently. “Scope 3”, not a lot.

The brand new catchphrase, in the meantime, is “extra worth, with much less emissions”, which sounds lots like Chevron’s “decrease carbon, increased returns”. And the rosy image of a straightforward vitality transition that company bosses boasted of some years in the past, earlier than Ukraine, was gone.

“It’s crucial that we keep away from dismantling the present vitality system sooner than we’re in a position to construct the clear vitality system of the longer term,” Sawan stated.

As for the ruling from a Dutch court docket compelling Shell to chop emissions by 45 per cent by 2030, “it won’t make a distinction to the world” particularly if shoppers nonetheless wanted the fuels, leaving one other firm to supply them.

Shell appears to be like like a tasty cash-dispensing goal

Sawan’s pitch is to make his firm a “disciplined” money dispenser, with cuts to working and capital prices that may generate 10 per cent free money stream progress per share per yr via to the top of 2025 and permit for one more share buyback of a minimum of $5bn within the second half of the yr. It’s chunky stuff — though even with a bump up within the dividend within the second quarter, the payout stays decrease than earlier than the pandemic.

The large takeaway, nonetheless, could also be that as Shell touts a extra “balanced” strategy to the vitality transition — one which emphasises its LNG, buying and selling and deepwater prowess — it dangers changing into a juicy goal for an American supermajor. That will be one method to repair the valuation hole. (Derek Brower and Tom Wilson)

Opinion: Why Saudi Arabia is combating the oil market

Adi Imsirovic is a director of consultancy Surrey Clear Vitality

On June 5, Saudi Arabia, the de facto chief of the Opec cartel, introduced a big, unilateral reduce in oil manufacturing of 1mn barrels a day from July.

But crude costs barely budged. Yesterday, Brent crude, the worldwide benchmark, settled at $73.20 a barrel, down about 4 per cent since earlier than the Saudi intervention.

Why haven’t costs behaved like Saudi Arabia needed? As a result of the dominion is misunderstanding how costs are fashioned.

Prince Abdulaziz bin Salman, the Saudi vitality minister, believes oil costs are pushed by speculators, who drive them away from the basics of provide and demand.

I agree with the prince. Absolute oil costs are pushed by monetary market members, and never those that are buying and selling bodily barrels of oil.

However monetary gamers usually are not essentially speculators. Most of them are funds, investing in a large portfolio of property by which oil might play a comparatively minor function, often as a hedge in opposition to inflation. Even when a few of these funds had been speculating, they might be basing their choices on anticipated market fundamentals sooner or later sooner or later.

Market drivers

This yr, the first issue figuring out value has been the probability of a recession, pushed mainly by central banks’ willpower to maintain elevating rates of interest to chill inflation.

Latest analysis factors to a couple different monetary drivers of the oil market volatility: world and US financial coverage uncertainty, geopolitical threat, US financial coverage uncertainty and fairness market volatility.

In different phrases, monetary gamers, key drivers of oil costs, have had each proper to be bearish in latest months. Even when they had been speculating, they might have been rational to remain brief.

Certainly, neither the near-term fundamentals which might be usually adopted by the bodily oil gamers, nor the longer term anticipated fundamentals adopted by the monetary gamers have been notably bullish.

In an surroundings of excessive rates of interest, holding oil is pricey and dangerous. So, it’s not shocking that many gamers went brief, lowering demand for oil contracts.

Saudi motivation

What then ought to we make of Saudi Arabia’s newest choice to chop output?

For a while, Opec has been shedding credibility and Opec+ has been shedding relevance. The group’s choice in April to chop 1.66mn b/d didn’t halt the slide in oil costs, simply as an earlier reduce introduced final October had failed. But regardless of the continued drift decrease, the one significant (however inadequate) manufacturing reduce Opec+ may muster got here from Saudi Arabia. It too didn’t cease additional value falls.

Russia, the one producer within the “plus” a part of the alliance value mentioning, has been combating a struggle in Ukraine, and is determined to maintain the oil revenues flowing — making Moscow not possible to tackle any voluntary cuts.

This lack of management over the market is a motive for a lot irritation throughout the prime brass of the cartel.

The one hope for the Saudis is a robust pick-up in demand later within the yr. This may occasionally properly occur, however the theatrics of blaming the speculators usually are not useful.

At greatest, they verify the troublesome place that Opec leaders are in; and at worst, they expose a basic lack of information of what’s shaping the value of the world’s most essential commodity. (Adi Imsirovic)

Knowledge Drill

Annual battery storage installations will surpass 400GWh globally by 2030, a tenfold improve from final yr’s capability additions, in accordance with Rystad Vitality.

Falling costs and new insurance policies are driving this progress, with US battery capability anticipated to rise 27 per cent by 2030 due to the landmark Inflation Discount Act.

China, which is able to proceed to guide in battery storage installations, the US and Europe will collectively account for 85 per cent of annual world installations in 2030, leaving creating markets far behind — an end result that would sluggish decarbonisation efforts. (Amanda Chu)

Energy Factors

Vitality Supply is written and edited by Derek Brower, Myles McCormick, Amanda Chu and Emily Goldberg. Attain us at vitality.supply@ft.com and comply with us on Twitter at @FTEnergy. Compensate for previous editions of the publication right here.

Beneficial newsletters for you

Ethical Cash — Our unmissable publication on socially accountable enterprise, sustainable finance and extra. Join right here

The Local weather Graphic: Defined — Understanding a very powerful local weather information of the week. Join right here

[ad_2]

Source link