[ad_1]

This text is the newest a part of the FT’s Monetary Literacy and Inclusion Marketing campaign

TikTok and Instagram are the final locations most older savers would hunt for monetary recommendation, however for younger individuals social media platforms are areas they’re more and more consulting for info.

“The genie is already out of the bottle: you’re not going to have the ability to cease individuals from posting on-line,” says Timi Merriman-Johnson, a 33-year-old content material creator, extensively often known as Mr MoneyJar. “That’s the place youthful persons are going to get monetary recommendation.”

Awaiting them is an ocean of cryptocurrency, high-frequency buying and selling and “meme” shares as influencers promote dangerous investments, pledging eye-watering returns. It’s a murky world the place regulators are working arduous to stop unscrupulous operators taking cash unfairly — and sometimes illegally — from younger individuals.

However navigating these uneven waters is a rising group of younger monetary professionals with a unique strategy from the rule-breaking scammers — they need to present easy steerage on topics similar to pensions, tax and balanced portfolios.

Beware impersonation scams

On-line impersonation is an enormous situation, raised by a number of well-liked IFAs interviewed by the FT. They highlighted the proliferation of faux accounts which dupe followers into sending cash for funding functions.

Emmanuel Asuquo, a 37-year-old IFA and content material creator, says he has been contacted by people who’ve fallen for scams involving somebody impersonating him, costing them thousand of kilos.

James Shackell considers Instagram merely “too scammy”, with pretend accounts a selected downside, however he provides that YouTube additionally has issues with bots.

TSB reported in Might that some 80 per cent of all buy, funding and impersonation fraud affecting its clients concerned scams by way of Meta-owned Fb, WhatsApp and Instagram.

It has tried to leverage findings to protest towards the federal government’s choice to scrap plans forcing expertise firms to compensate victims of on-line monetary scams.

Asuquo says he nonetheless prefers to make use of Instagram over different platforms as a consequence of its attain and the potential for partnerships. “Instagram was the primary platform after I began 5 years in the past because it’s actually good for manufacturers.”

Merriman-Johnson is amongst them, having constructed a following of 17,000 on Instagram with easy posts on financial savings and pensions. Now coaching to turn into an impartial monetary adviser (IFA), he and several other others hope to make use of their skilled expertise to rework the standard of monetary steerage obtainable on-line and make cash by way of partnerships with banks, charities and different companies.

Alongside regulators, they imagine they’ll make a distinction. The Monetary Conduct Authority in July introduced new pointers for monetary influencers, together with proposals that require firms to watch the output of influencers they pay to advertise merchandise.

“We see the house that’s inhabited by influencers as a key one for us to have interaction with,” says Lucy Castledine, director of client investments on the Monetary Conduct Authority. Whereas a whole lot of the regulators’ consideration is targeting the suspected rule-breakers, she says influencers play a distinguished function in how the FCA engages with youthful audiences.

The Monetary Occasions spoke with eight influencers, together with 4 who just lately pursued an IFA qualification, the first path to offering legally compliant monetary recommendation in Britain.

New varieties of content material

“Some individuals wish to be controversial,” says Kia Commodore, a 25-year-old content material creator who runs the monetary steerage web page Pennies to Kilos.

She began out on X, previously often known as Twitter, and YouTube earlier than specializing in Instagram the place her posts centre round shopping for a primary house and saving for retirement. Such themes, she says, had been ignored locally the place she grew up in a disadvantaged district of London. She says her ambition now’s to provide “jargon-free” content material rooted in “accuracy and worth”.

A number of months away from qualifying as an IFA, Commodore says formal coaching was an vital a part of legitimising her private model Pennies to Kilos. She earns an revenue by way of paid partnerships and talking engagements.

Commenting on the deceptive monetary promotion on-line, she says content material has turn into fast-paced and tough to verify. “On TikTok, for those who eat something on private finance you’re not seeing something in regards to the creator,” she says. “If you happen to’re consuming bursts you don’t have time to grasp an individual’s background.”

Some on-line content material fails to hold ample explanations of danger, in keeping with James Shackell, 33, a associate at Nova Wealth (beforehand Octopus Wealth) based mostly in London. “When individuals study crypto, they hear that they may get a 30 per cent yield,” he says, arguing that this leaves individuals pondering there are “free lunches”.

FT FLIC

Donate to the Monetary Literacy & Inclusion Marketing campaign right here

Shackell’s day job as a monetary planner is mixed together with his YouTube channel, which generates advert revenue and has round 84,000 subscribers, and consists of movies of him explaining index funds and retirement methods.

Whereas each have completely different audiences — Commodore skews in direction of these firstly of their financial savings journey, and Shackell leans extra in direction of an older demographic aged 55 and over — they each intention to supply sober steerage.

Content material creators are additionally diversifying. London-based Bola Sol, 31, says she has grown extra assured discussing property for instance, and has began creating podcasts. The monetary coach and private finance columnist says she has additionally began publishing a collection geared in direction of working-class younger individuals looking for a window into the lives of high-earning professionals.

A present Instagram collection entails asking people incomes six-figures sums about their budgeting and saving habits in addition to any monetary regrets they may have.

However Sol cautions different would-be influencers to not underestimate the calls for of posting monetary content material on-line, notably as guidelines imply posts ought to keep away from providing person-specific recommendation.

The FCA permits normal “steerage” however not focused “recommendation”. Sol says: “Such a content material creation is nuanced. I studied maths and finance, I’ve an consciousness of the foundations.”

John Somerville, head of studying on the London Institute of Banking and Finance, a supplier of IFA certification, says: “If creators aren’t educated sufficient, there’s a danger that anyone could also be put into some type of monetary misery.”

Coping with rogue influencers

For regulators, the guidance-orientated influencers are potential allies within the struggle towards scammers.

The FCA has partnered with 15 influencers to this point, together with Merriman-Johnson, and is in the midst of a five-year £11mn “InvestSmart” advertising and marketing marketing campaign. Aiming to dissuade dangerous funding behaviour, the regulator has revealed blogs and paid influencers to assist attain youthful audiences.

These strikes go hand in hand with elevated efforts to clamp down on rogue firms and their paid promoters.

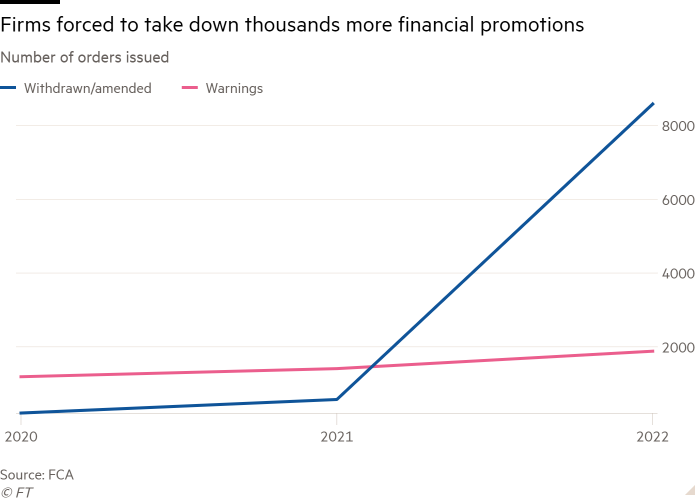

The regulator took motion towards an unnamed finfluencer final 12 months after they promoted “unauthorised merchants” to followers. It was considered one of greater than 8,500 circumstances during which the FCA intervened to power companies to amend or withdraw a on-line promotion final 12 months, up from 572 in 2021.

Castledine says the regulator is on monitor for the same whole this 12 months. The FCA took down 2,235 promotions within the first quarter of the 12 months. However regulators are nonetheless cautious of partnering with monetary influencers, even IFAs, as these creators can stray throughout recommendation/steerage boundaries.

“I do watch some content material, and assume, ‘oh, you’re not nervous in regards to the FCA in any respect are you?’” says Sol. She provides that the accessibility of social media means new creators crop up regularly and produce content material that takes benefit of individuals. “Day buying and selling, cryptocurrency and pyramid schemes, these three I’m by no means fascinated by.”

Somerville says that IFAs should keep on high of authorized necessities, together with on-line, figuring out they danger monetary penalties and potential lack of licence for rule breaking.

Merriman-Johnson says IFA coaching means he can now cowl “the total spectrum” of subjects, together with taxes and pensions, in addition to debt, financial savings and funding.

“The coaching helped me when it comes to tax, pensions and financial savings,” says Francesca Henry, a just lately certified IFA, recognized on-line as MoneyFox. Having began out by detailing her journey chopping her personal bank card debt, she now produces content material starting from budgeting to insurance coverage.

Although certified IFAs are skilled to grasp regulatory frameworks, there may be nonetheless a danger that they breach monetary promotion guidelines, notably by handing out recommendation. “That’s the place it should fall foul of our monetary promotion guidelines and the place warnings and take down requests are available in,” Castledine says.

Thoughts the hole

Nevertheless, the necessity for recommendation is rising. FCA figures present that solely 8 per cent of the inhabitants — most of them over 45 — pay for monetary recommendation. This leaves a widening recommendation hole for thousands and thousands, particularly youthful individuals. The FCA is reviewing the recommendation/steerage boundary, together with proposals to streamline recommendation.

Sol says there’s no cause why correct on-line content material can not support younger individuals, notably because it’s free and accessible. “I’m not telling individuals the place to take a position, however they don’t even know learn how to get began,” she explains, including that she typically guides individuals to an IFA.

However regulated IFAs are typically older individuals who don’t at all times enchantment to younger savers. Fewer than 6 per cent are underneath 30, says the FCA.

Mike Barrett, a director at consultants The Lang Cat, says: “The sector is evolving very slowly, it’s a little bit extra consultant when it comes to age and gender, however it’s nonetheless dominated by older, extra established monetary planners.”

So for a lot of younger individuals, social media will stay the favoured first step for monetary steerage — regardless of the dangers that it typically entails.

Which platforms and providers make for one of the best content material?

Social media is a broad church providing a wide range of platforms with execs and cons for any impartial monetary adviser influencer.

James Shackell says YouTube and its capacity to accommodate long-form video permits him to clarify subjects intimately and discover a spread of situations, making his content material extra particular than on different platforms. “With 30-second movies, you’re by no means going to have the ability to give individuals the depth of knowledge they want.”

Platforms providing shorter content material are likely to have youthful audiences, with LinkedIn having a better common consumer age than, for instance, Instagram.

A number of influencers stated Instagram supplied a useful touchdown web page, enabling them to put up evergreen content material. Sol says she receives requests to put up sponsored content material on TikTok greater than different platforms. She says creators ought to guarantee any product they market aligns with their very own values.

“I dwell on Instagram, that’s the place I dedicate most of my time,” says Henry. “Individuals are extra more likely to attain out to you. They’ll hook up with you extra as an individual. With TikTok, you see them as and when.”

Most influencers juggle content material creation with a full-time job, that means working late evenings and weekends filming, modifying and posting.

Merriman-Johnson opts for Instagram, but additionally has a presence on TikTok and LinkedIn. The latter has turn into a helpful touchdown web page for IFAs normally, enabling them to succeed in working professionals, a standard buyer base.

He provides: “You’ll be able to put up on LinkedIn if you wish to share a stream of consciousness and for fast bits of textual content there’s Twitter [now known as X]. TikTok has the viral side and YouTube is a superb platform relying on how lengthy the content material lives on there.”

[ad_2]

Source link